Utah Self-Employed Groundskeeper Services Contract

Description

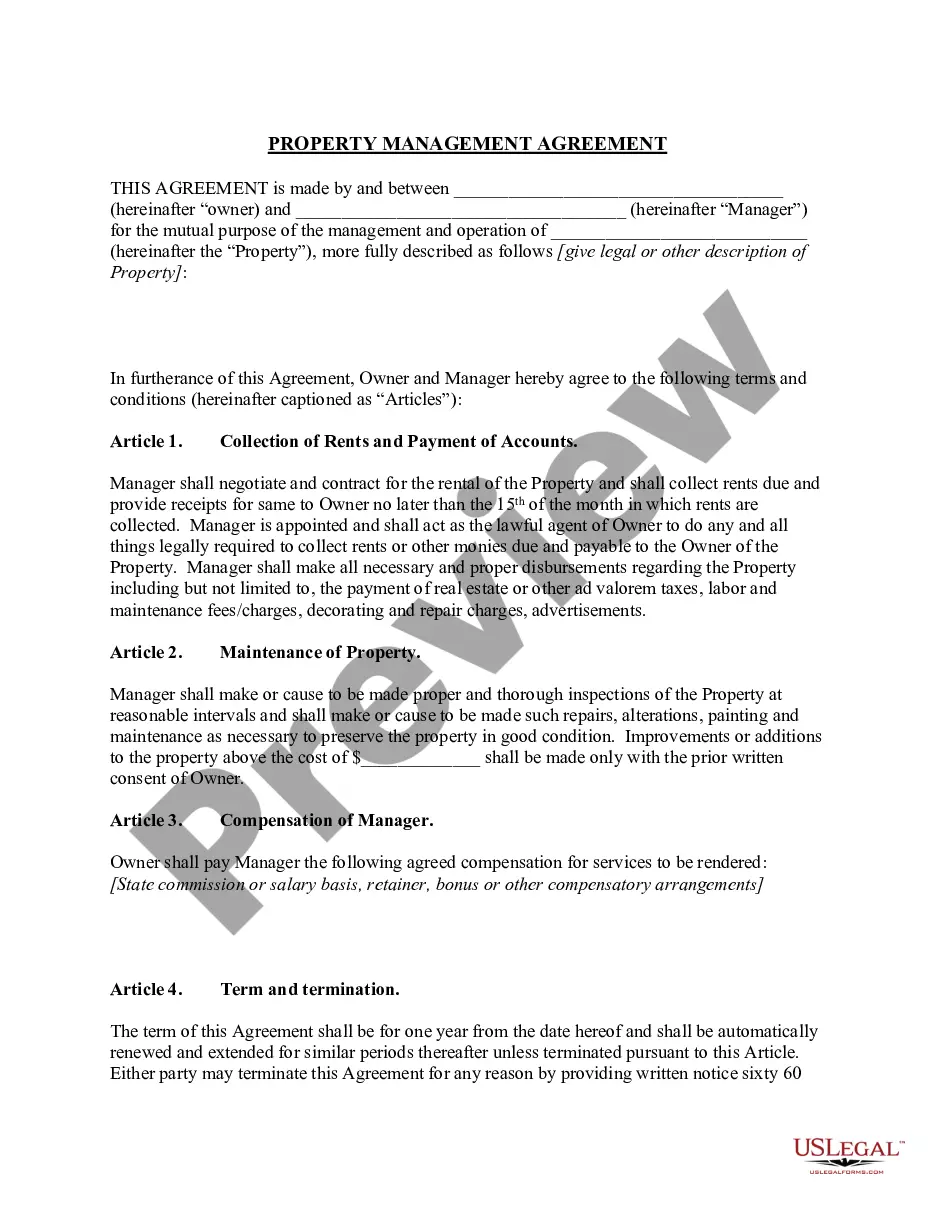

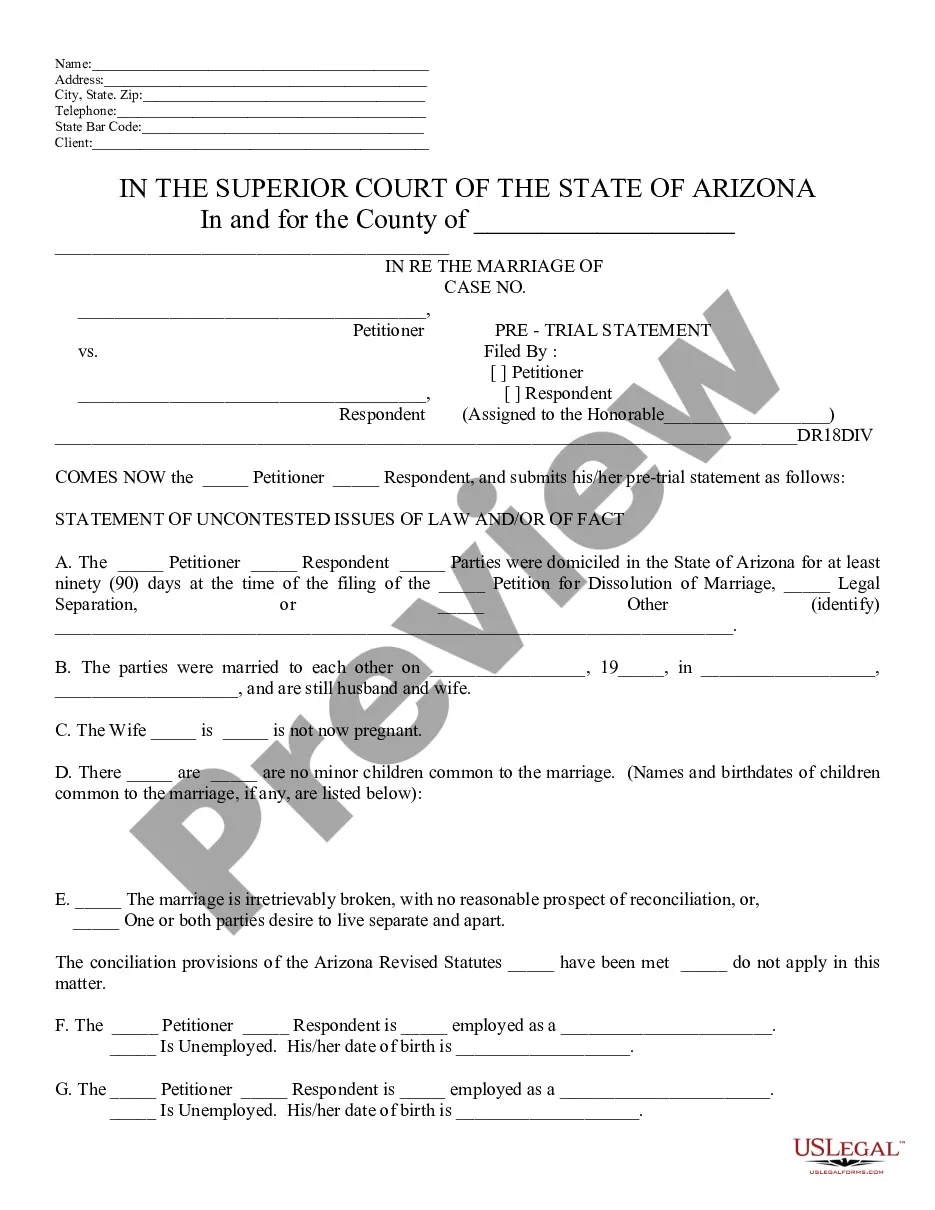

How to fill out Self-Employed Groundskeeper Services Contract?

If you desire to be thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest collection of legal forms that are accessible online.

Take advantage of the website's straightforward and convenient search feature to locate the documents you need.

Various templates for commercial and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Utah Self-Employed Groundskeeper Services Contract. Every legal document format you buy is yours forever. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Complete and obtain, and print the Utah Self-Employed Groundskeeper Services Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Utah Self-Employed Groundskeeper Services Contract in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click the Download button to obtain the Utah Self-Employed Groundskeeper Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form format.

Form popularity

FAQ

When writing a contract agreement for services, start by clearly defining the parties involved and the services to be provided. Include details such as payment terms, service duration, and cancellation policies. A well-structured Utah Self-Employed Groundskeeper Services Contract will ensure both parties understand their responsibilities and can help prevent disputes. You can find templates on platforms like uslegalforms that simplify this process.

To quote lawn maintenance effectively, first assess the size of the property and the specific services required. You should consider factors such as the type of grass, frequency of mowing, and any additional services like fertilization or weed control. By gathering these details, you can create a clear and accurate estimate for your client. Additionally, using a Utah Self-Employed Groundskeeper Services Contract will help formalize the agreement and outline the scope of work.

To write a contract for lawn service, start by detailing the services you will provide, such as mowing, edging, and weed control. Specify payment terms, service frequency, and duration. Utilizing the Utah Self-Employed Groundskeeper Services Contract template can streamline this process and ensure you cover all essential legal elements, protecting both you and your clients.

The 1/3 rule for lawns states that you should never cut more than one-third of the grass height during any single mowing. This practice encourages healthier growth and helps maintain a lush lawn. Implementing this rule can be part of the services outlined in your Utah Self-Employed Groundskeeper Services Contract to reassure clients about your professional standards.

In Utah, you can perform minor landscaping tasks without a contractor license, but there are limits based on project value and complexity. Generally, if your work does not exceed a certain dollar amount and does not involve specialized services, you may operate without a license. Always refer to local regulations, and ensure you have a clear agreement like the Utah Self-Employed Groundskeeper Services Contract to protect your interests.

Yes, independent contractors in Utah may need a business license depending on the nature of their work. For landscaping services, if you exceed a certain income threshold or provide specific services, obtaining a license is advisable. To support your business, consider utilizing the Utah Self-Employed Groundskeeper Services Contract to outline your services clearly.

To write a simple service agreement, begin by stating the parties involved and the services offered. Clearly define the payment terms, deadlines, and any responsibilities of both parties. A straightforward approach can be found in the Utah Self-Employed Groundskeeper Services Contract template, which provides a solid foundation for your agreement.

In Utah, you can start a landscaping business without a specific license for certain services. However, if you plan to perform more extensive work, such as hardscaping or irrigation installation, you may need a contractor's license. It's important to review local regulations to ensure compliance and consider using the Utah Self-Employed Groundskeeper Services Contract for clarity in your agreements.

To create a lawn service contract, start by outlining the services you will provide, such as mowing, trimming, and fertilization. Include details like payment terms, service frequency, and duration of the contract. Using a template like the Utah Self-Employed Groundskeeper Services Contract can simplify this process and ensure you cover all necessary legal aspects.

Yes, operating as an independent contractor usually requires a business license. This is particularly important when providing services, like those covered in a Utah Self-Employed Groundskeeper Services Contract. A business license helps ensure that you meet local regulations and standards, protecting you and your clients. You can find useful information on obtaining a business license through resources like US Legal Forms.