Utah Cosmetologist Agreement - Self-Employed Independent Contractor

Description

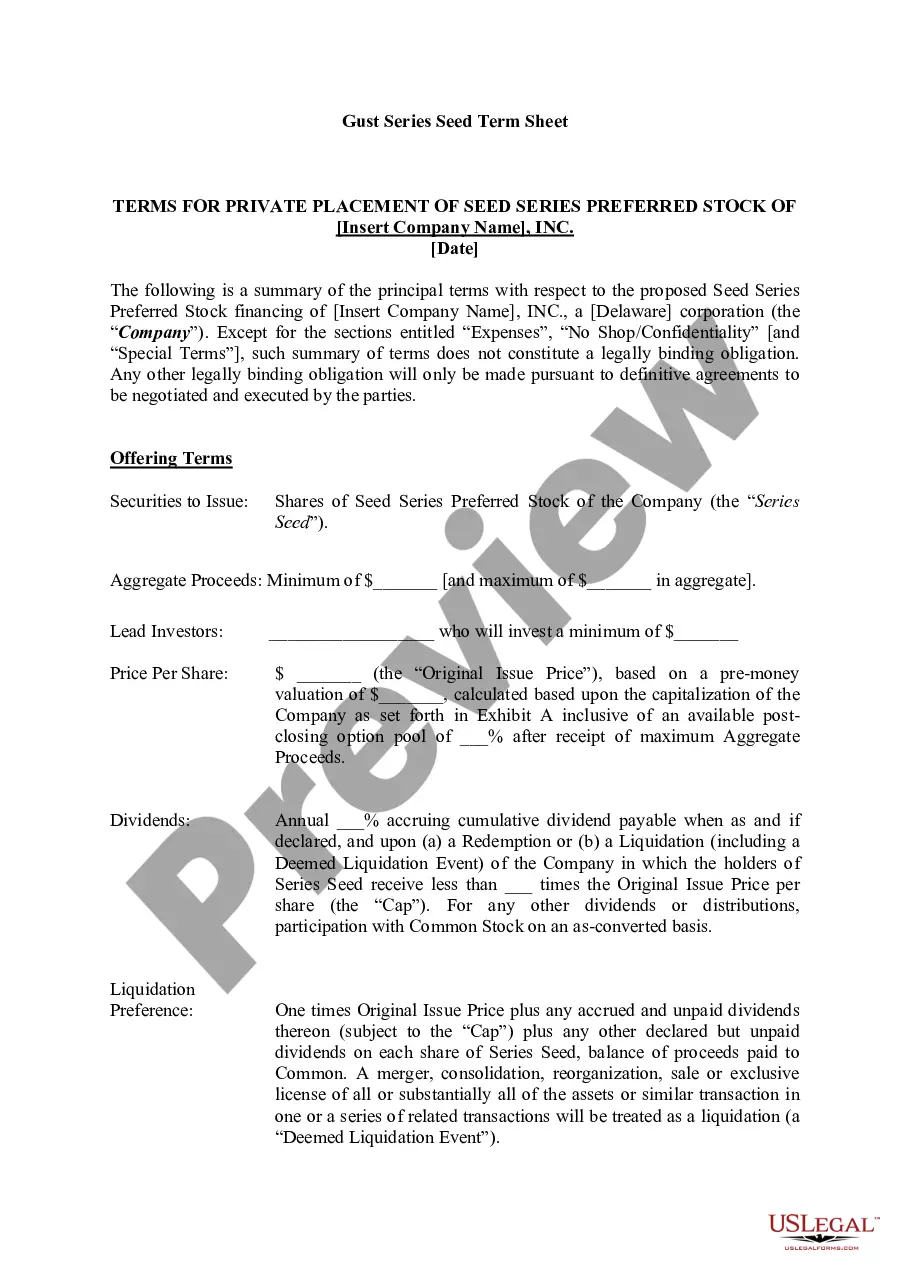

How to fill out Cosmetologist Agreement - Self-Employed Independent Contractor?

Selecting the optimal legal document web template can be a challenge. Of course, there are numerous web templates accessible online, but how can you obtain the legal form you need? Take advantage of the US Legal Forms website. The service provides a vast array of web templates, including the Utah Cosmetologist Agreement - Self-Employed Independent Contractor, suitable for business and personal purposes. All templates are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Utah Cosmetologist Agreement - Self-Employed Independent Contractor. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to acquire another copy of the document you need.

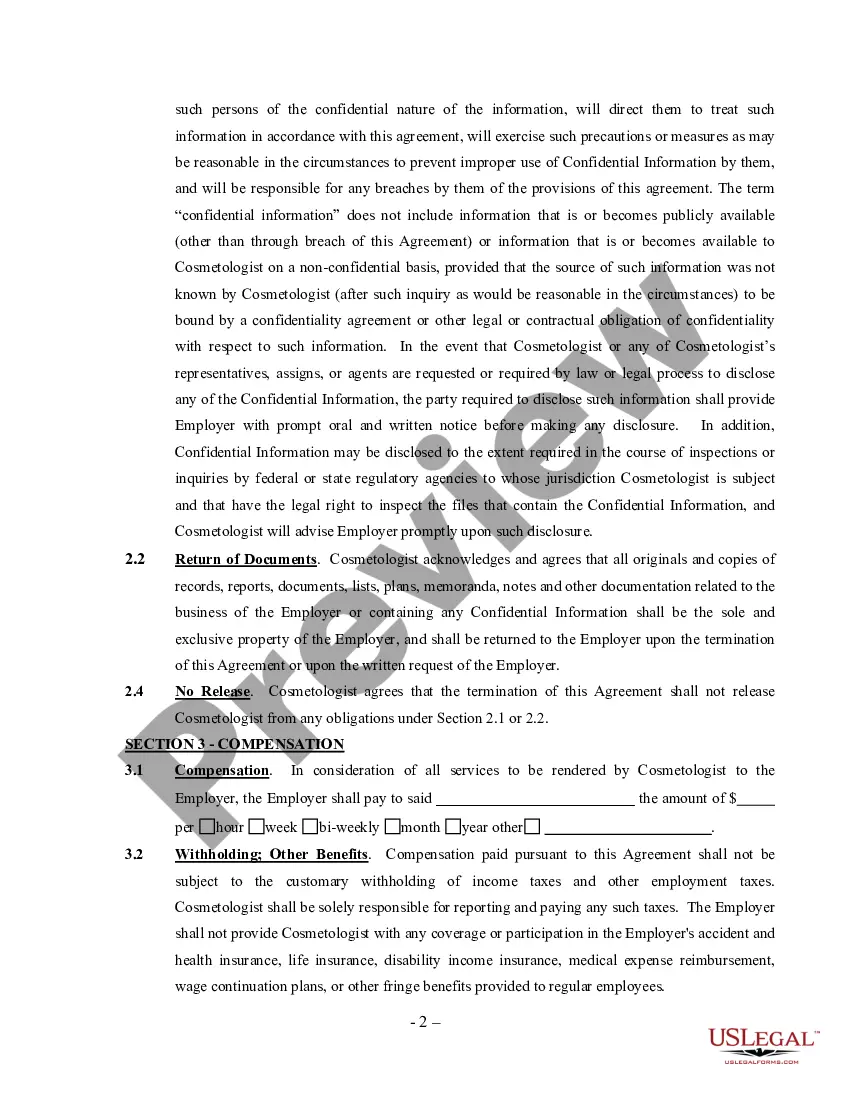

If you are a new user of US Legal Forms, here are simple instructions you should follow: First, ensure you have selected the correct form for your area/region. You can review the form using the Preview button and examine the form description to confirm this is suitable for you. If the form does not fulfill your requirements, use the Search box to find the appropriate form. Once you are confident the form is suitable, click the Buy now button to purchase the form. Choose the payment plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Utah Cosmetologist Agreement - Self-Employed Independent Contractor.

Maximize your legal documentation experience with US Legal Forms by following these guidelines.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted documents that comply with state requirements.

- Access a wide selection of legal templates tailored to both business and personal use.

- Benefit from expert-verified forms that meet legal standards.

- Enjoy a user-friendly interface for easy navigation and document retrieval.

- Make informed choices with comprehensive form descriptions and previews.

Form popularity

FAQ

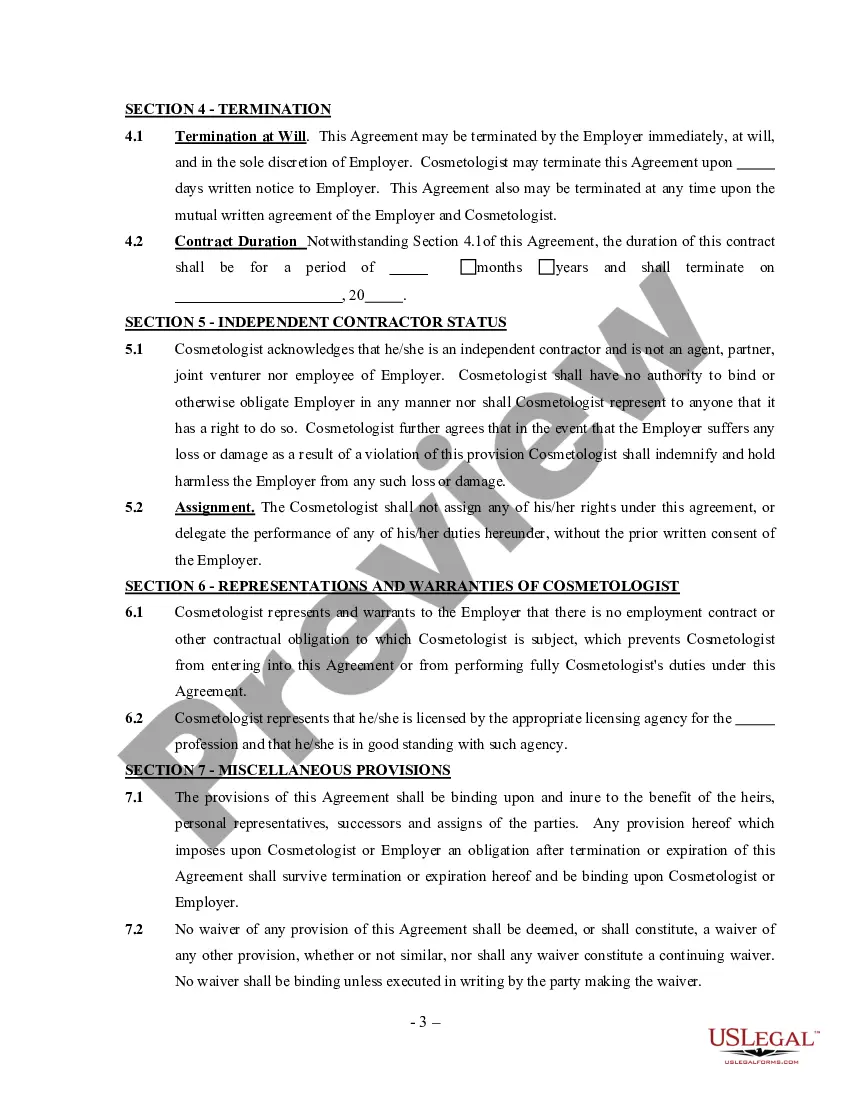

To create an effective Utah Cosmetologist Agreement - Self-Employed Independent Contractor, start by clearly defining the roles and responsibilities of both parties involved. Next, outline payment terms, including rates and schedules, to ensure transparency. Make sure to include details about the duration of the agreement and any termination clauses. Using a platform like US Legal Forms can simplify this process, providing ready-made templates that ensure your agreement meets legal standards.

An independent contractor in cosmetology is a skilled professional who provides services to clients without being an employee of a salon or spa. They operate their own business, manage their schedule, and are responsible for their own taxes. A Utah Cosmetologist Agreement - Self-Employed Independent Contractor outlines the terms and conditions of this work relationship, giving you the freedom to create your own cosmetology brand.

While you generally do not need formal business registration as an independent contractor in Utah, it can offer benefits such as liability protection. Registering your business helps establish credibility with clients and provides a clear business identity. Consider the advantages when operating under a Utah Cosmetologist Agreement - Self-Employed Independent Contractor.

In Utah, the amount of work you can perform without a contractor license varies based on the type of work. For independent contractors in cosmetology, many services do not require a license, as long as they follow the state guidelines. Always ensure your operations align with a Utah Cosmetologist Agreement - Self-Employed Independent Contractor to avoid any legal issues.

Yes, an independent contractor is considered self-employed. This means you handle your own taxes, business expenses, and income generation. By signing a Utah Cosmetologist Agreement - Self-Employed Independent Contractor, you take full ownership of your professional path, allowing you to thrive in the beauty industry.

Typically, an independent contractor does not require a state business license in Utah. However, depending on your specific services and location, different permits or licenses may be necessary. Always check the local laws to meet the requirements when working under a Utah Cosmetologist Agreement - Self-Employed Independent Contractor.

In Utah, you generally do not need a business license solely for being an independent contractor. However, specific local regulations may apply, especially in the cosmetology industry. It's important to review any city or county requirements to ensure compliance while engaging in a Utah Cosmetologist Agreement - Self-Employed Independent Contractor.

Yes, an independent contractor operates as a business entity for tax purposes. When you enter into a Utah Cosmetologist Agreement - Self-Employed Independent Contractor, you take on the responsibility of managing your own business operations. This means you can set your rates, manage customer relations, and make decisions that affect your income.

Filling out an independent contractor form involves gathering all relevant information about the contractor, including their legal name, contact details, and tax identification number. Make sure to explicitly outline the services they will provide under the Utah Cosmetologist Agreement - Self-Employed Independent Contractor terms. Review the form for accuracy and ensure both parties sign it to formalize the agreement. Using resources from uslegalforms can provide guidance on completing these forms correctly.

To write an independent contractor agreement, first, clearly define the services you expect the contractor to provide. Include details such as payment terms, deadlines, and any specific responsibilities. It’s important to ensure that the agreement outlines the nature of the work relationship, emphasizing the Utah Cosmetologist Agreement - Self-Employed Independent Contractor framework. You can also utilize platforms like uslegalforms to access templates that simplify the drafting process and ensure you cover all necessary aspects.