Utah Shoring Services Contract - Self-Employed

Description

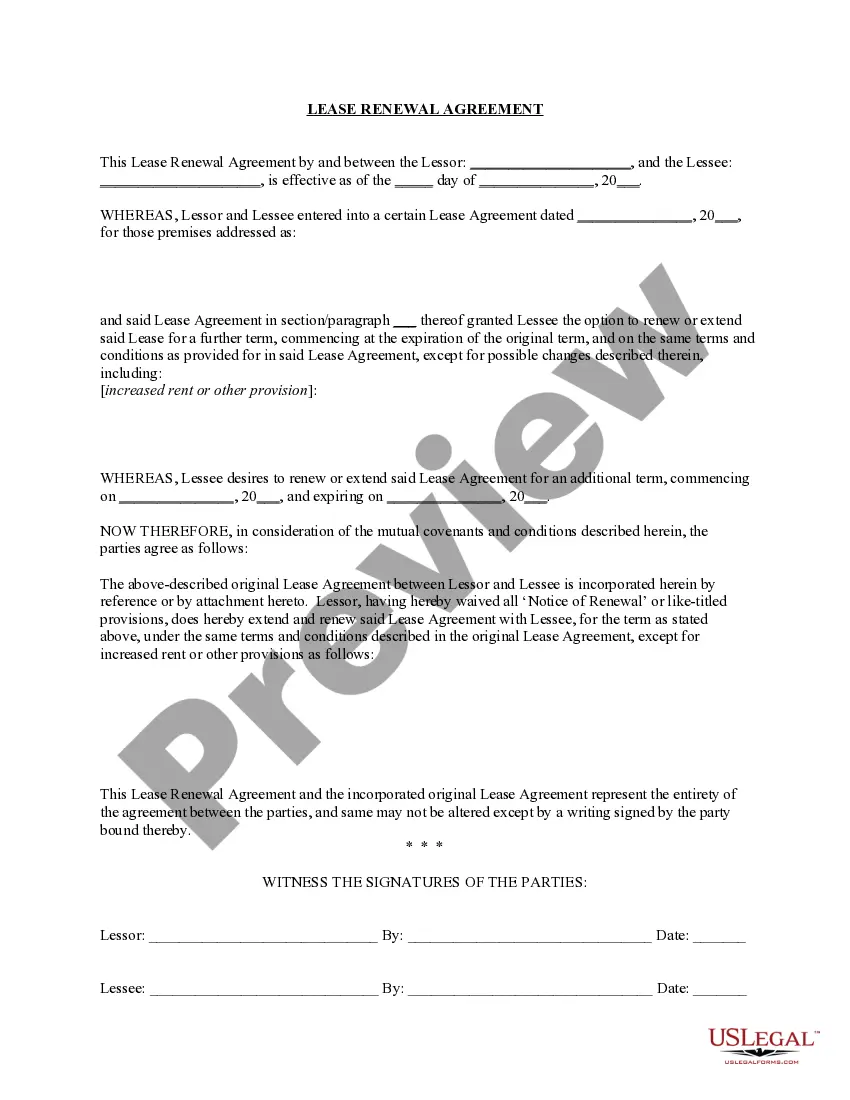

How to fill out Shoring Services Contract - Self-Employed?

If you intend to finalize, retrieve, or create legal document templates, utilize US Legal Forms, the premier array of legal forms available online.

Employ the site’s user-friendly and straightforward search to acquire the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have identified the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Utah Shoring Services Contract - Self-Employed in just a few clicks.

- If you are an existing US Legal Forms client, Log Into your account and click the Obtain button to access the Utah Shoring Services Contract - Self-Employed.

- You may also retrieve forms you previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, adhere to the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s details. Remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

As an independent contractor in Utah, possessing a business license is necessary. This requirement ensures that you comply with legal standards when entering into a Utah Shoring Services Contract - Self-Employed. A valid license enhances your reputation and shows clients that you operate legally and responsibly.

In Utah, you can perform limited tasks without a contractor license, but this varies based on the type of work. Generally, small projects may not require a contractor license, but for work associated with a Utah Shoring Services Contract - Self-Employed, a license is often mandatory. Always check current regulations to avoid penalties.

You can issue a 1099 form to someone without a business license, but it may create complications. It's advisable to hire individuals who have the necessary credentials, such as those involved in a Utah Shoring Services Contract - Self-Employed. Ensuring a proper business license adds legitimacy and reduces potential legal risks.

In Utah, independent contractors must obtain a business license to operate legally. When entering into a Utah Shoring Services Contract - Self-Employed, having a business license illustrates your commitment to professionalism and compliance. This requirement helps protect you and your clients throughout your projects.

Yes, registering as an independent contractor in Utah is essential for legal and tax purposes. This registration allows you to operate under the framework of a Utah Shoring Services Contract - Self-Employed. Moreover, it facilitates proper reporting and enhances your ability to secure contracts with reputable clients.

Yes, subcontractors in Utah typically require a license depending on the scope of work. If your project involves specialized tasks, such as those found in a Utah Shoring Services Contract - Self-Employed, having a license may be crucial. It's best to confirm specific licensing requirements with the state's licensing authority.

To become a subcontractor in Utah, you must register your business, obtain the necessary permits, and provide proof of relevant experience. Signing a Utah Shoring Services Contract - Self-Employed often requires showcasing your skills and project history to potential clients. Additionally, you'll need to adhere to all local and state regulations.

In Utah, individuals engaged in business activities must obtain a business license. This requirement applies to various professions, including those entering into a Utah Shoring Services Contract - Self-Employed. A valid business license ensures compliance with state regulations and builds credibility with clients.

You do not need to have an LLC to operate as a contractor under the Utah Shoring Services Contract - Self-Employed. Many independent contractors work as sole proprietors, but forming an LLC can offer liability protection and tax benefits. It can help you separate your personal and business assets, making it easier to manage risks. Consider consulting legal resources or using USLegalForms to understand your options better.

Creating an independent contractor contract for your Utah Shoring Services Contract - Self-Employed requires careful planning. Begin by clearly outlining the scope of work, payment terms, and deadlines. Include clauses for confidentiality and termination to protect both parties. You can simplify this process by using platforms like USLegalForms, which provide customizable templates designed for Utah shoring services.