Utah Simple Agreement for Future Equity

Description

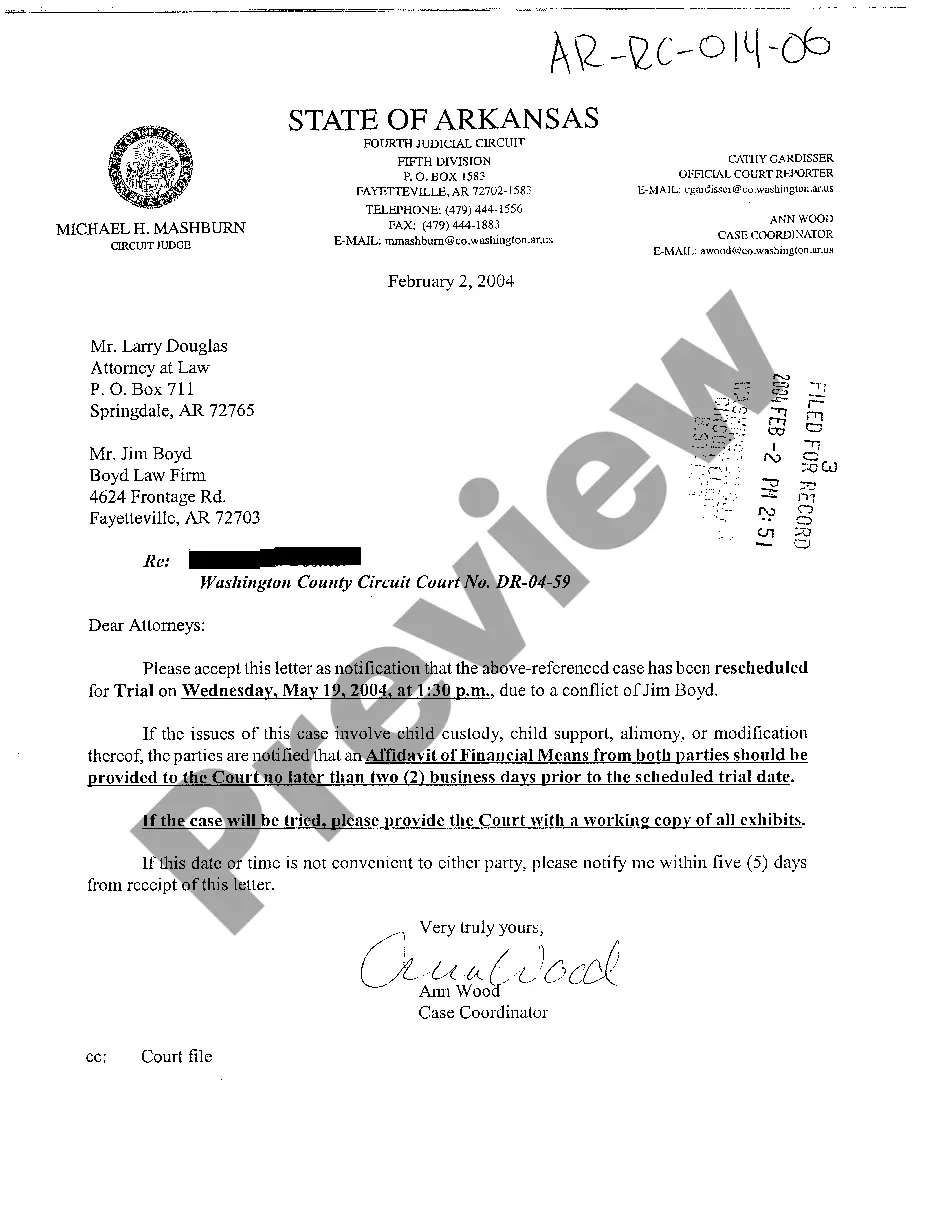

How to fill out Simple Agreement For Future Equity?

US Legal Forms - one of the biggest libraries of lawful types in the United States - provides a wide array of lawful file templates you can obtain or print out. Utilizing the site, you can find 1000s of types for enterprise and individual functions, sorted by classes, suggests, or key phrases.You can find the most up-to-date versions of types just like the Utah Simple Agreement for Future Equity in seconds.

If you already possess a subscription, log in and obtain Utah Simple Agreement for Future Equity in the US Legal Forms local library. The Obtain option will show up on each and every kind you see. You gain access to all in the past saved types from the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, here are easy instructions to get you started:

- Ensure you have chosen the right kind for your personal area/area. Click on the Review option to review the form`s content material. Look at the kind description to actually have chosen the correct kind.

- In case the kind does not suit your demands, take advantage of the Look for discipline at the top of the display screen to discover the one who does.

- Should you be happy with the shape, verify your choice by clicking on the Buy now option. Then, choose the pricing plan you like and supply your references to register for an accounts.

- Method the financial transaction. Use your credit card or PayPal accounts to accomplish the financial transaction.

- Select the file format and obtain the shape in your device.

- Make alterations. Fill up, edit and print out and indicator the saved Utah Simple Agreement for Future Equity.

Every single design you included with your money lacks an expiration date which is your own property for a long time. So, if you wish to obtain or print out an additional duplicate, just check out the My Forms area and click on on the kind you will need.

Obtain access to the Utah Simple Agreement for Future Equity with US Legal Forms, one of the most comprehensive local library of lawful file templates. Use 1000s of skilled and condition-certain templates that meet your business or individual demands and demands.

Form popularity

FAQ

A simple agreement for future equity (SAFE) is a contract between an investor and a company that provides rights to the venture capital investor for equity down the road. Interested clients need to know that, concerning taxes, this relatively new and quick form of raising venture capital is not simple, advisors say.

While debt is taxed once, equity funding is taxed twice: once at the business level, and once at the shareholder level through dividend and capital gains taxes. Successfully classifying funding as debt as opposed to equity produces tax advantages for the corporation.

SAFEs are generally considered taxable at the time of the triggering event, when the SAFE converts into equity (i.e. stock in the company).

Cons: SAFE investors assume most, if not all, of the risk, in that there is no guarantee of any equity ownership in the company. ... A SAFE holder is not entitled to any company assets in the event of a liquidation.

SAFTs typically provide that the intended tax treatment of the SAFT is as a forward contract. If this treatment is respected, then taxation of the purchase amount should be deferred until delivery of the s to the SAFT holder.

A simple agreement for future equity delays valuation of a company until it has more performance data on which to base a valuation. At the same time, it promises an investor the right to buy future equity when a valuation is made. A SAFE can be converted into preferred stock in the future.

Calculation ing to the Discount Rate The total shares are calculated ing to the SAFE money invested divided by the share price in the next round, multiplied by the discount rate. If we take our example above, if during the next financing round, the company raises money ing to a share price of $10.