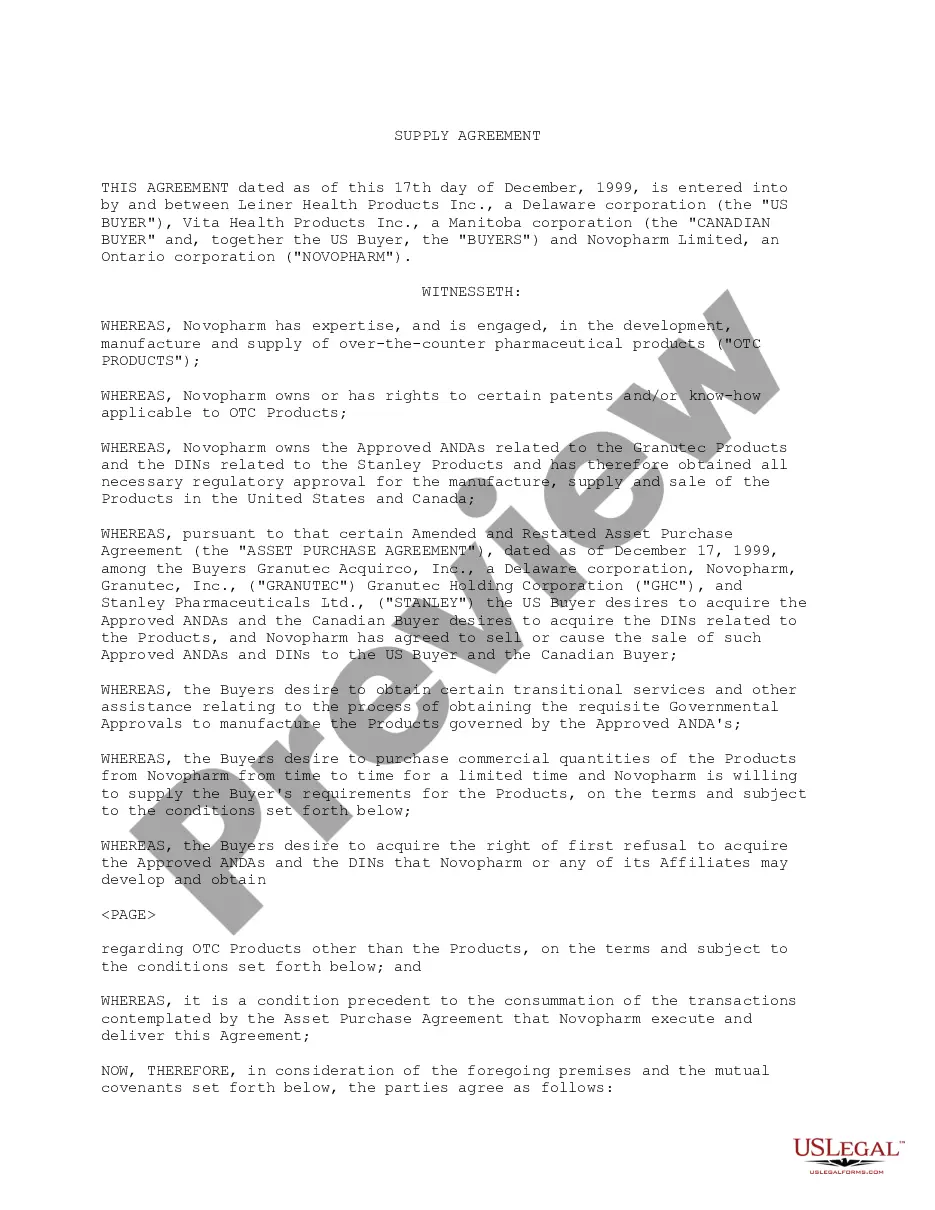

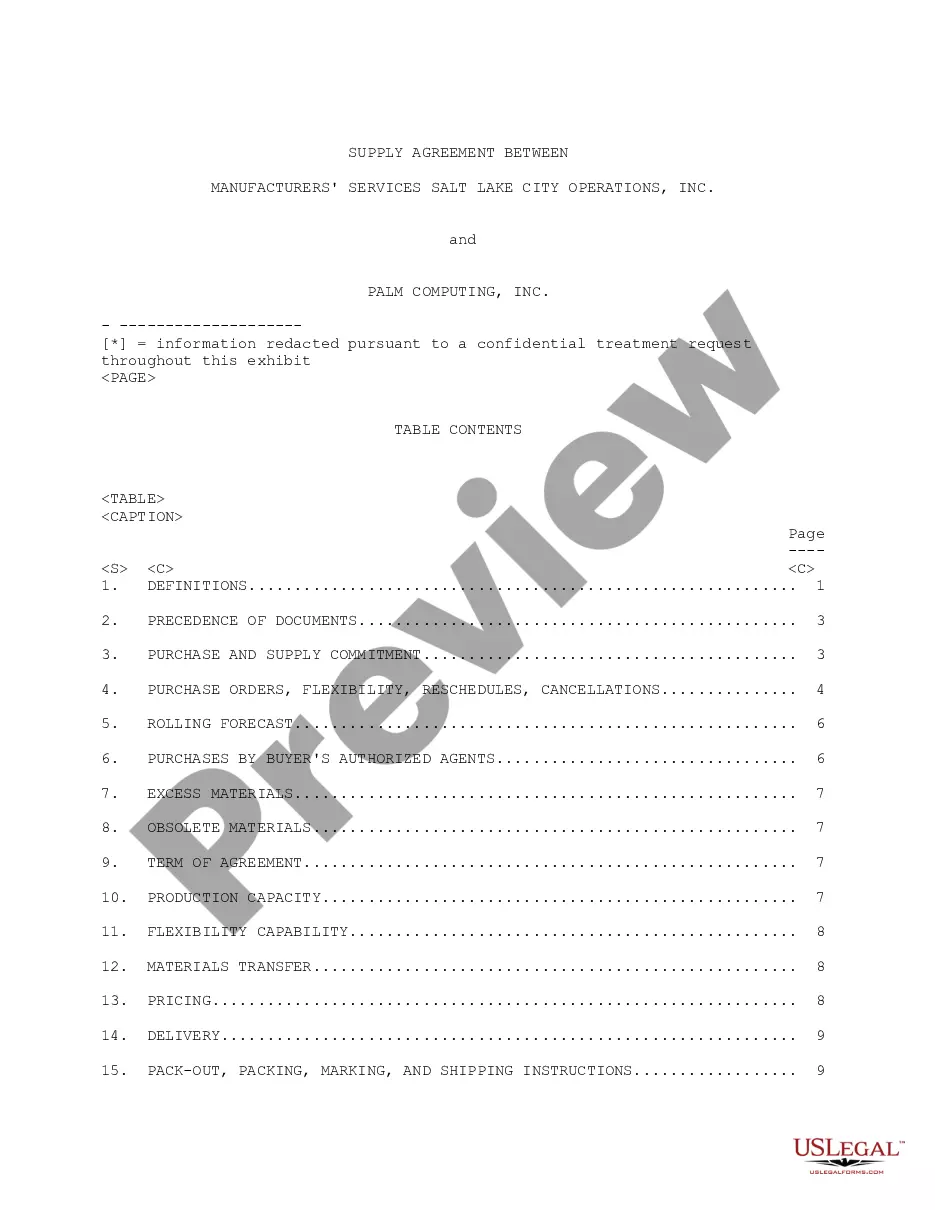

Utah Round Supply Agreement

Description

How to fill out Round Supply Agreement?

If you want to complete, acquire, or printing legitimate document themes, use US Legal Forms, the biggest collection of legitimate kinds, that can be found on the Internet. Utilize the site`s basic and hassle-free research to discover the files you will need. Different themes for organization and individual reasons are sorted by types and says, or keywords. Use US Legal Forms to discover the Utah Round Supply Agreement with a handful of click throughs.

In case you are presently a US Legal Forms consumer, log in for your accounts and click the Acquire option to have the Utah Round Supply Agreement. Also you can gain access to kinds you earlier acquired inside the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the shape for your proper metropolis/land.

- Step 2. Make use of the Preview option to check out the form`s information. Don`t overlook to read through the outline.

- Step 3. In case you are unsatisfied with the kind, take advantage of the Research discipline towards the top of the display screen to find other types from the legitimate kind design.

- Step 4. After you have identified the shape you will need, click on the Get now option. Pick the prices plan you prefer and include your credentials to sign up for an accounts.

- Step 5. Process the financial transaction. You may use your credit card or PayPal accounts to finish the financial transaction.

- Step 6. Select the structure from the legitimate kind and acquire it in your system.

- Step 7. Complete, edit and printing or indication the Utah Round Supply Agreement.

Each and every legitimate document design you buy is yours for a long time. You have acces to each and every kind you acquired in your acccount. Click the My Forms segment and select a kind to printing or acquire yet again.

Remain competitive and acquire, and printing the Utah Round Supply Agreement with US Legal Forms. There are thousands of specialist and state-certain kinds you may use for the organization or individual demands.

Form popularity

FAQ

As an LLC member in Utah, you'll pay both federal and state personal income tax, along with the federal self-employment tax of 15.3%. Utah collects personal income tax at a flat rate of 4.85%. Other taxes that may apply to your Utah LLC include the state's 6.1% sales tax, industry-specific taxes, and employer taxes.

A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal income tax purposes.

In Utah partnerships are generally taxed as pass-through entities, meaning the profit and losses from the businesses pass directly into the partners' personal incomes. Utah does require a yearly partnership return from each partnership within the state.

Utah is an origin-based state. This means you're responsible for applying the sales tax rate determined by the ship-from address on all taxable sales. Event sales are taxed based on the location of the event.

When and where the return must be filed. A return must be filed with the Utah State Tax Commission, 210 N 1950 W, SLC, UT 84134-0270 on or before the 15th day of the fourth month following the close of the fiscal year or by April 15th for a calendar year business.

File your Utah taxes at tap.utah.gov. If filing on paper, mail your return to the address on page 1. TC-40 page 3, TC-40A, TC-40B, TC-40S, and TC-40W (all that apply). An explanation for any equitable adjustment entered on TC-40A, Part 2, code 79.

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or.

The partnership must provide a Utah Schedule K-1 to each partner showing the amount of Utah withholding paid on be- half of the partner. This withholding tax is then claimed as a credit by the partner on the partner's Utah income tax return.