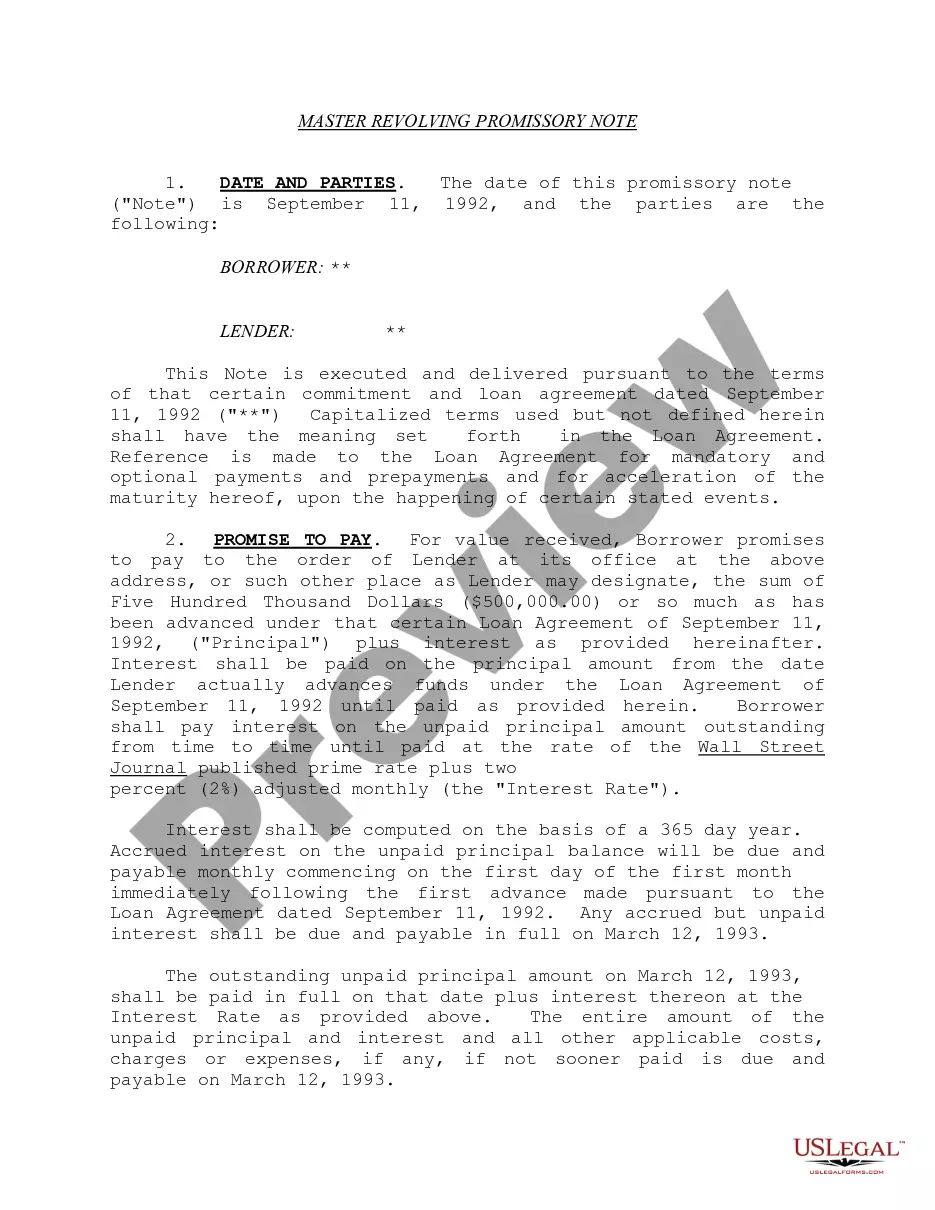

Utah Servicing Agreement

Description

How to fill out Servicing Agreement?

Discovering the right lawful file web template could be a have difficulties. Needless to say, there are a lot of themes accessible on the Internet, but how will you find the lawful form you require? Utilize the US Legal Forms web site. The assistance provides thousands of themes, for example the Utah Servicing Agreement, that you can use for business and personal requires. Each of the kinds are checked out by specialists and meet up with state and federal demands.

In case you are currently signed up, log in to the account and click on the Download switch to get the Utah Servicing Agreement. Make use of account to appear with the lawful kinds you possess purchased previously. Proceed to the My Forms tab of your account and get one more duplicate in the file you require.

In case you are a new end user of US Legal Forms, here are basic instructions that you should comply with:

- Initially, make sure you have chosen the correct form for your personal metropolis/area. You are able to look through the shape while using Review switch and look at the shape explanation to make sure it is the best for you.

- If the form fails to meet up with your expectations, take advantage of the Seach industry to get the right form.

- Once you are sure that the shape is acceptable, click the Acquire now switch to get the form.

- Choose the pricing program you desire and enter in the necessary information and facts. Design your account and pay money for the transaction with your PayPal account or Visa or Mastercard.

- Select the document formatting and down load the lawful file web template to the gadget.

- Comprehensive, modify and print and sign the acquired Utah Servicing Agreement.

US Legal Forms will be the most significant collection of lawful kinds in which you can find numerous file themes. Utilize the company to down load skillfully-made files that comply with status demands.