Utah Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc.

Description

How to fill out Stock Option And Long Term Incentive Plan Of Golf Technology Holding, Inc.?

Have you been within a position that you need paperwork for either organization or personal reasons just about every working day? There are a lot of legitimate record layouts available online, but finding kinds you can depend on is not straightforward. US Legal Forms delivers 1000s of form layouts, such as the Utah Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc., which are created in order to meet federal and state requirements.

If you are presently acquainted with US Legal Forms web site and possess a free account, merely log in. Following that, you may obtain the Utah Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. design.

If you do not provide an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the form you need and make sure it is to the appropriate town/state.

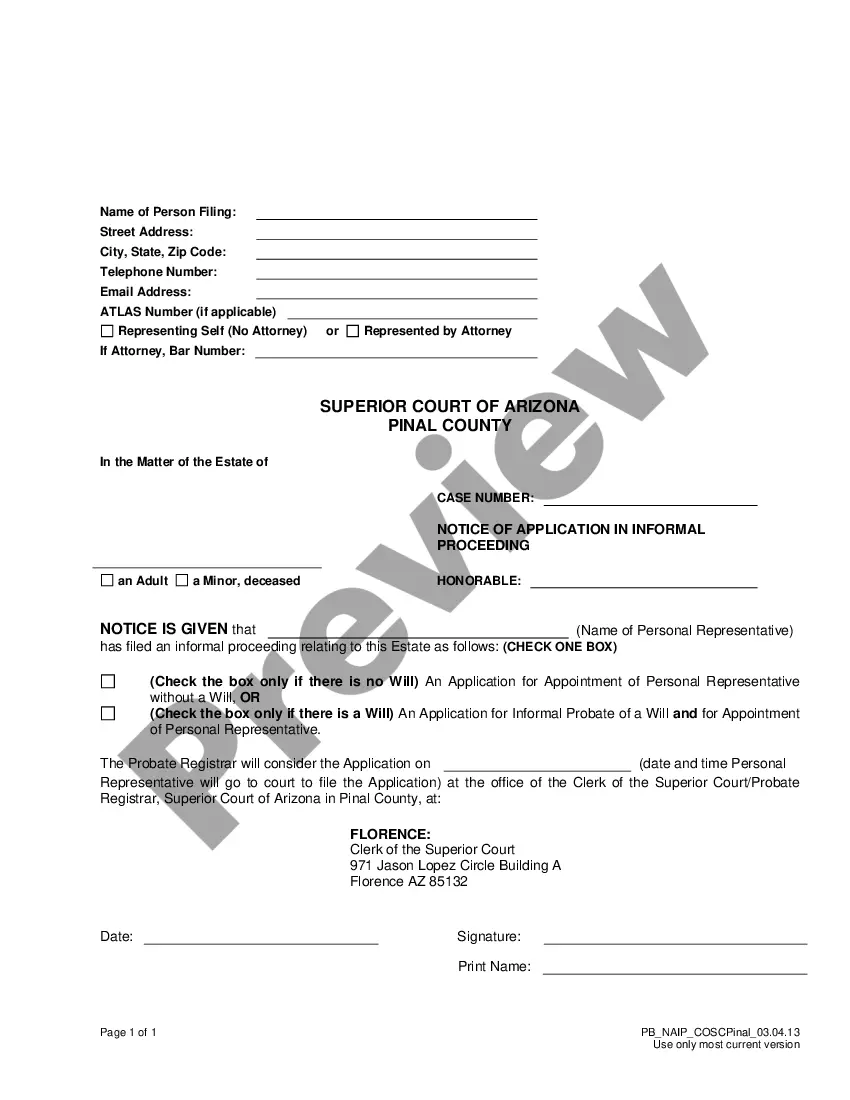

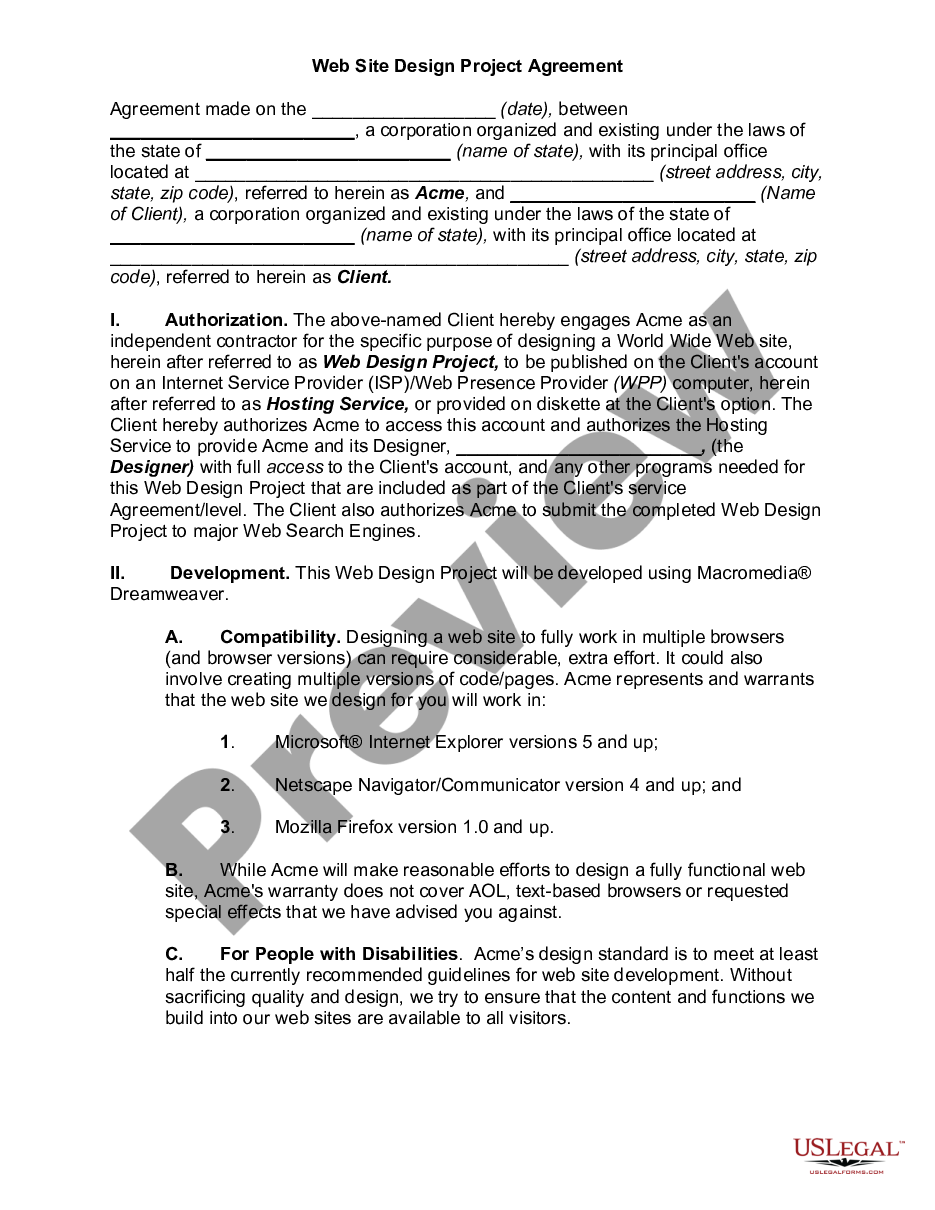

- Use the Review button to analyze the shape.

- See the outline to ensure that you have selected the appropriate form.

- When the form is not what you`re looking for, use the Research industry to obtain the form that meets your requirements and requirements.

- Whenever you get the appropriate form, click Acquire now.

- Choose the prices strategy you would like, fill out the required information and facts to make your bank account, and pay money for the transaction with your PayPal or charge card.

- Decide on a practical paper format and obtain your duplicate.

Discover each of the record layouts you have bought in the My Forms food selection. You can aquire a additional duplicate of Utah Stock Option and Long Term Incentive Plan of Golf Technology Holding, Inc. any time, if possible. Just select the necessary form to obtain or print out the record design.

Use US Legal Forms, one of the most considerable variety of legitimate forms, to save lots of time and prevent faults. The services delivers appropriately created legitimate record layouts that you can use for a selection of reasons. Create a free account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs. bonds, the kinds of vehicles you're using, and so forth.

Understanding Long-Term Incentive Plan (LTIP) Long-term incentives are earned based on the achievement of goals over a longer period of time. The goals may be based on stock price or business performance. It's important to take a holistic approach to compensation ? if it's short- or long-term, cash vs.

The basic idea behind a LTIP is that participants receive share options or shares if they satisfy certain performance criteria over time. Sometimes, the LTIP participants have to invest a proportion of salary or cash bonus towards the acquisition of shares.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.

This can help to create a sense of shared ownership and alignment amongst all employees, not just the highest earners. Another key difference between LTIPs and EMI options is the vesting period. LTIPs typically have longer vesting periods than EMI options, which can range from three to five years or longer.

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.