Utah Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005

Description

How to fill out Current Expenditures Of Individual Debtors - Schedule J - Form 6J - Post 2005?

Choosing the right legitimate document design might be a have difficulties. Of course, there are plenty of web templates available on the Internet, but how will you obtain the legitimate develop you require? Make use of the US Legal Forms web site. The assistance offers 1000s of web templates, like the Utah Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005, which you can use for enterprise and personal requires. All of the kinds are checked out by experts and meet federal and state requirements.

Should you be currently authorized, log in in your bank account and click on the Download key to get the Utah Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005. Use your bank account to check from the legitimate kinds you possess bought formerly. Proceed to the My Forms tab of your own bank account and get yet another backup of the document you require.

Should you be a whole new user of US Legal Forms, allow me to share straightforward recommendations that you should adhere to:

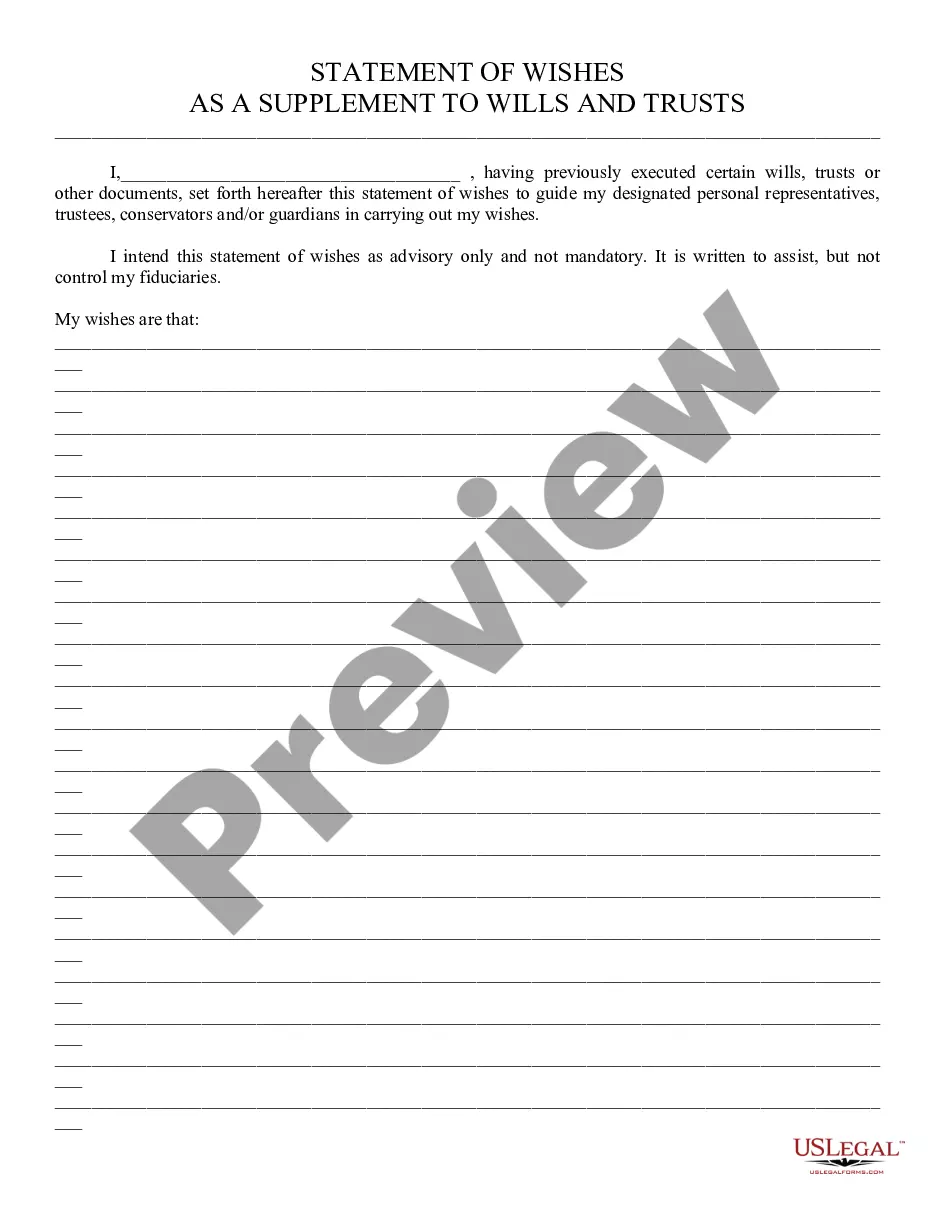

- Very first, make sure you have selected the proper develop to your town/area. It is possible to check out the shape utilizing the Preview key and study the shape explanation to guarantee it is the best for you.

- In case the develop fails to meet your requirements, use the Seach area to find the proper develop.

- Once you are certain that the shape is proper, click on the Buy now key to get the develop.

- Choose the rates plan you desire and enter the necessary information and facts. Make your bank account and pay money for the order with your PayPal bank account or Visa or Mastercard.

- Choose the document structure and download the legitimate document design in your product.

- Comprehensive, revise and print and indicator the acquired Utah Current Expenditures of Individual Debtors - Schedule J - Form 6J - Post 2005.

US Legal Forms will be the largest collection of legitimate kinds that you can discover a variety of document web templates. Make use of the service to download professionally-created documents that adhere to status requirements.

Form popularity

FAQ

Schedule J-2: Expenses for Separate Household of Debtor 2 (individuals)

Some of the monthly expenses that are listed on your Schedule J include your rent or mortgage payments, upkeep expenses on your home, utilities, food, gas, telephone, water, car maintenance, childcare, clothing, laundry, and vehicle maintenance. Basically, the money you spend just to live each month is listed here.

Schedule J: Your Expenses (Official Form 106J) provides an estimate of the monthly expenses, as of the date you file for bankruptcy, for you, your dependents, and the other people in your household whose income is included on Schedule I: Your Income (Official Form 106I).

Schedule J and its instructions guide you through calculation of tax on your current year elected farm income as well as the three base years to calculate your averaged income.

Schedule J helps the bankruptcy trustee determine your disposable income, which is the amount of money you have left over each month after paying your necessary expenses.