Utah Farm Lease or Rental - Cash

Description

How to fill out Farm Lease Or Rental - Cash?

If you have to total, acquire, or printing authorized papers themes, use US Legal Forms, the largest selection of authorized forms, that can be found on the Internet. Take advantage of the site`s basic and handy look for to obtain the files you will need. Different themes for business and personal uses are sorted by types and says, or keywords. Use US Legal Forms to obtain the Utah Farm Lease or Rental - Cash in a number of mouse clicks.

In case you are previously a US Legal Forms client, log in to the profile and then click the Obtain option to find the Utah Farm Lease or Rental - Cash. You can also accessibility forms you previously saved within the My Forms tab of the profile.

If you work with US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape to the proper town/region.

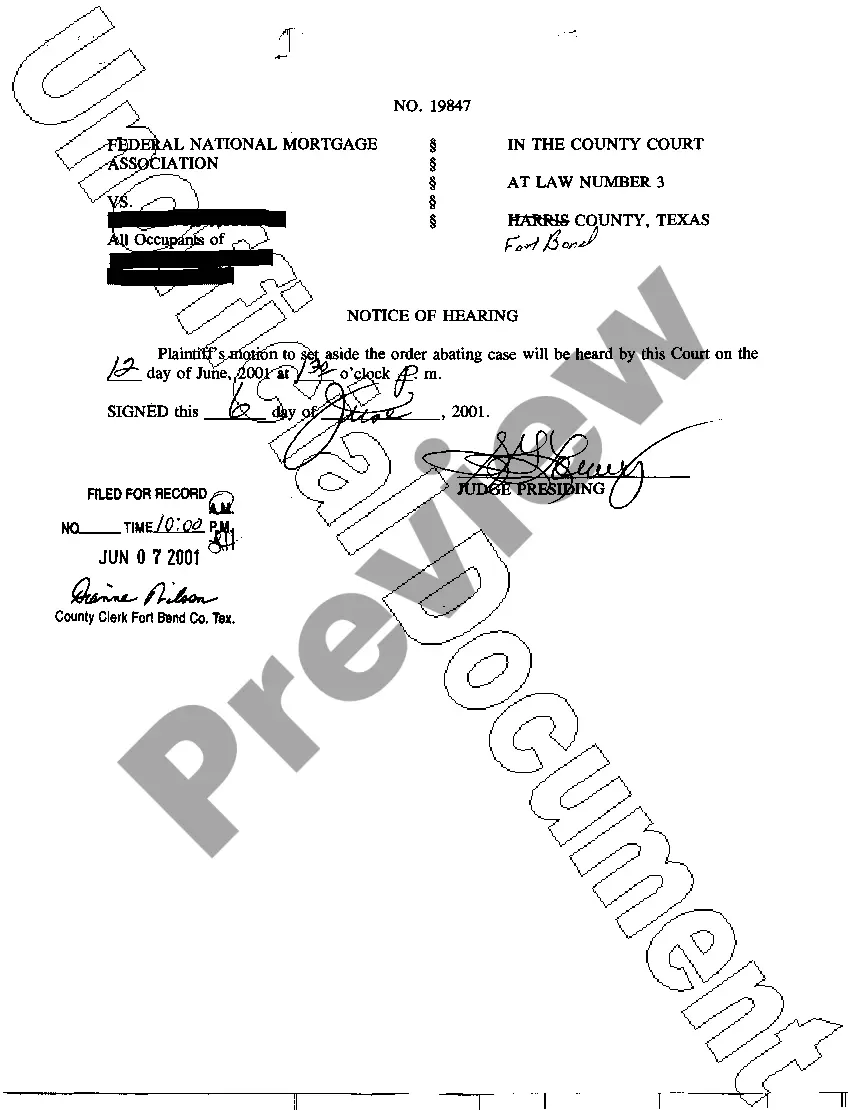

- Step 2. Utilize the Preview option to look through the form`s information. Never forget to see the explanation.

- Step 3. In case you are not happy with all the form, make use of the Search discipline towards the top of the display screen to get other versions of the authorized form format.

- Step 4. Upon having found the shape you will need, go through the Purchase now option. Choose the prices program you like and add your accreditations to sign up for an profile.

- Step 5. Process the transaction. You can use your charge card or PayPal profile to complete the transaction.

- Step 6. Find the formatting of the authorized form and acquire it on your own product.

- Step 7. Comprehensive, edit and printing or indication the Utah Farm Lease or Rental - Cash.

Every single authorized papers format you get is yours for a long time. You have acces to every single form you saved within your acccount. Go through the My Forms area and decide on a form to printing or acquire once more.

Remain competitive and acquire, and printing the Utah Farm Lease or Rental - Cash with US Legal Forms. There are millions of skilled and status-particular forms you can utilize to your business or personal requirements.

Form popularity

FAQ

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

Passive income comes from real estate, investments and rental activities. Land rent is not earned income, but passive income except where specific exceptions apply.

Farm income can include any amount earned by cultivating, operating, or managing a farm for gain or profit, either as owner or tenant.1 The definition of a farm for the purposes of reporting farm income can include a wide range of businesses.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

The reasoning is simple: farmland is a good investment because it's a limited resource (there's only so much land in the US and the number of undeveloped acres keeps shrinking) and it's in high-demand, given food production is so essential.

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be. The crop-sharing lease is usually workable only in strictly cash-crop farming.

Rental income is typically considered passive income and exempt from self-employment tax, however, if an individual land owner materially participates in the farming operations, either through crop share arrangements, or actual production of the commodities or the management of production, that material

When it comes to rental real estate activities, all rental income is generally categorized as passive income, no matter how much you participate. So, even if you materially participate in running your rental properties, you still can't deduct those losses against other nonpassive income.

Passive Investments in Farming and Timberland Real assets, like income-producing agriculture, provide a hedge against inflation, and are an attractive investment for a diversified portfolio.