Utah Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

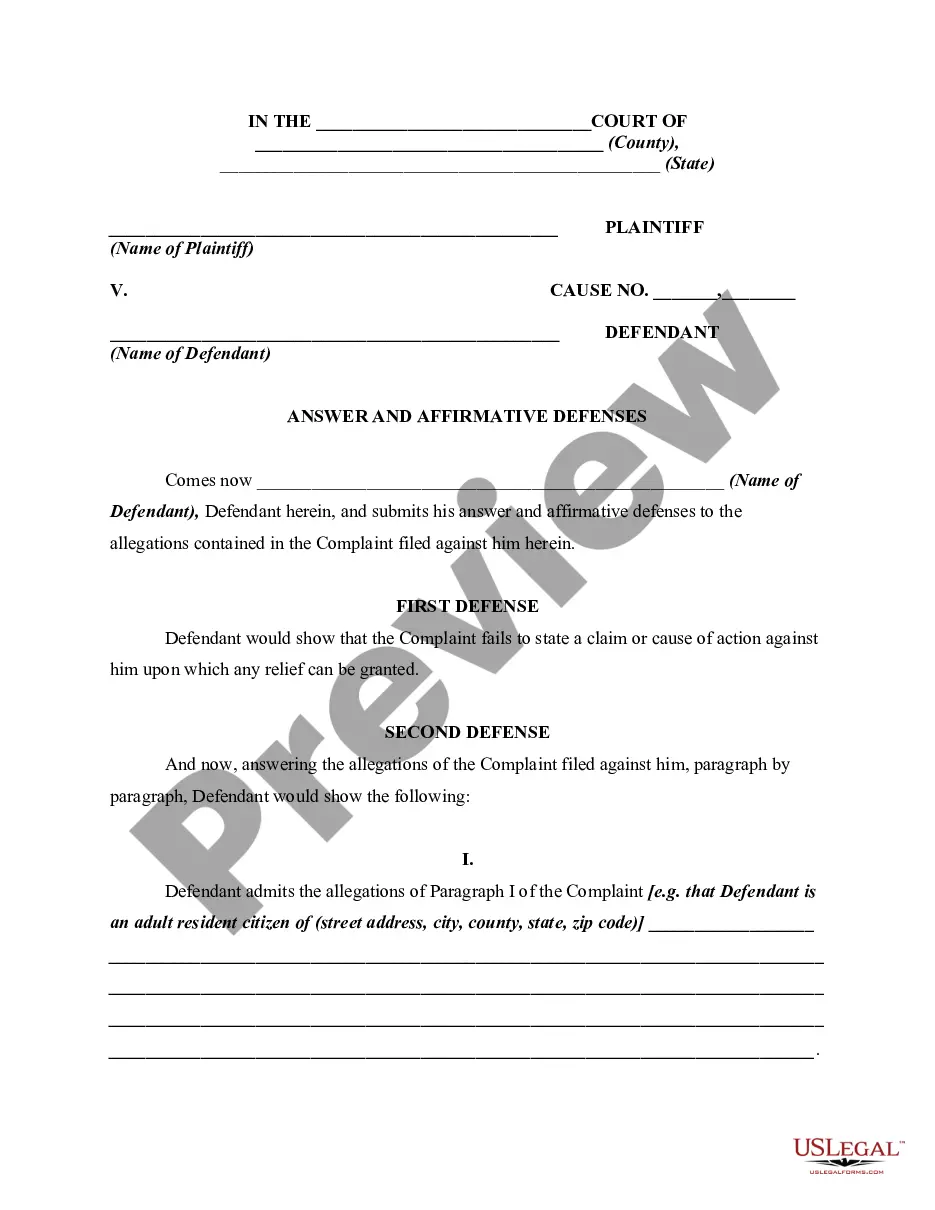

How to fill out Personal Guaranty Of Another Person's Agreement To Pay Consultant?

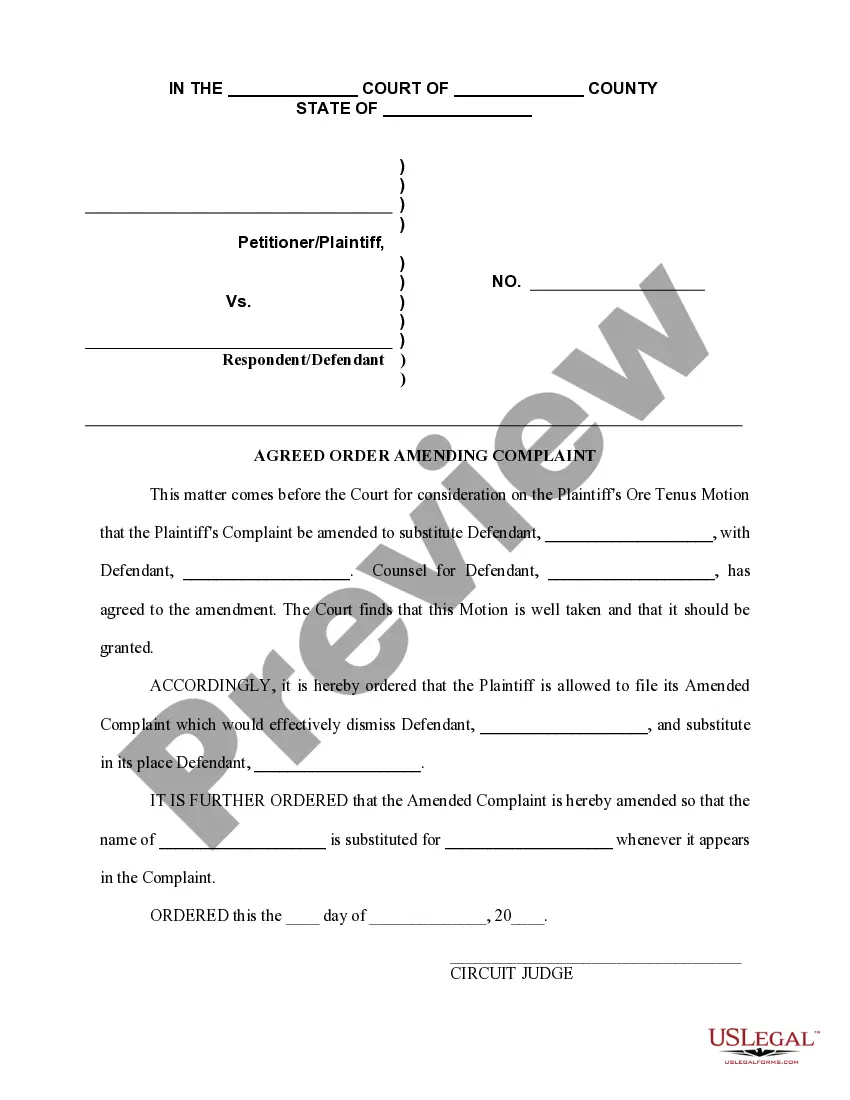

US Legal Forms - one of the largest collections of legal templates in the United States - provides a diverse selection of legal document templates that you can download or create.

By utilizing the website, you can access thousands of forms for professional and personal purposes, organized by categories, states, or keywords. You can find the most up-to-date versions of forms, such as the Utah Personal Guaranty of Another Person's Agreement to Pay Consultant, within moments.

If you are already registered, Log In and download the Utah Personal Guaranty of Another Person's Agreement to Pay Consultant from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents tab of your account.

Select the file format and download the form to your device.

Make adjustments. Complete, modify, and print and sign the downloaded Utah Personal Guaranty of Another Person's Agreement to Pay Consultant.

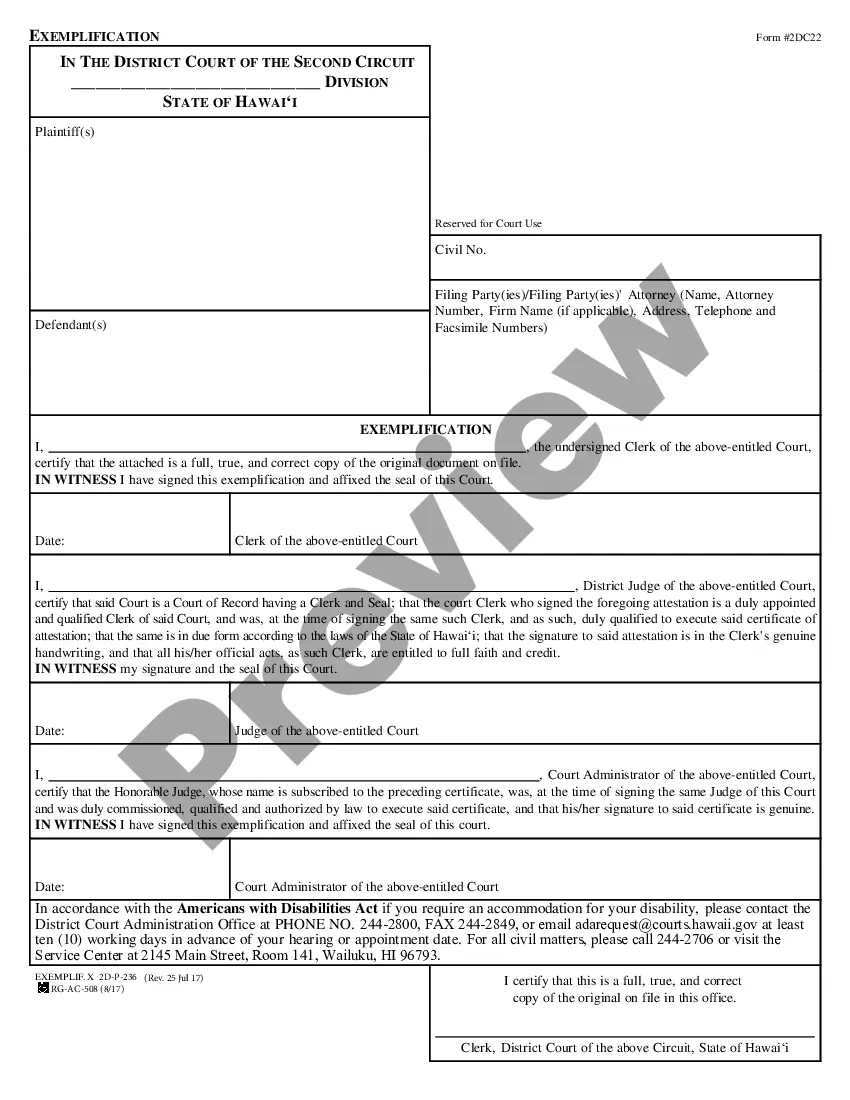

- Ensure you have selected the appropriate form for your area/state. Click the Review button to assess the form's content.

- Read the form description to ensure you have chosen the correct document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking on the Purchase now button.

- Then, choose the pricing plan you prefer and enter your credentials to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Form popularity

FAQ

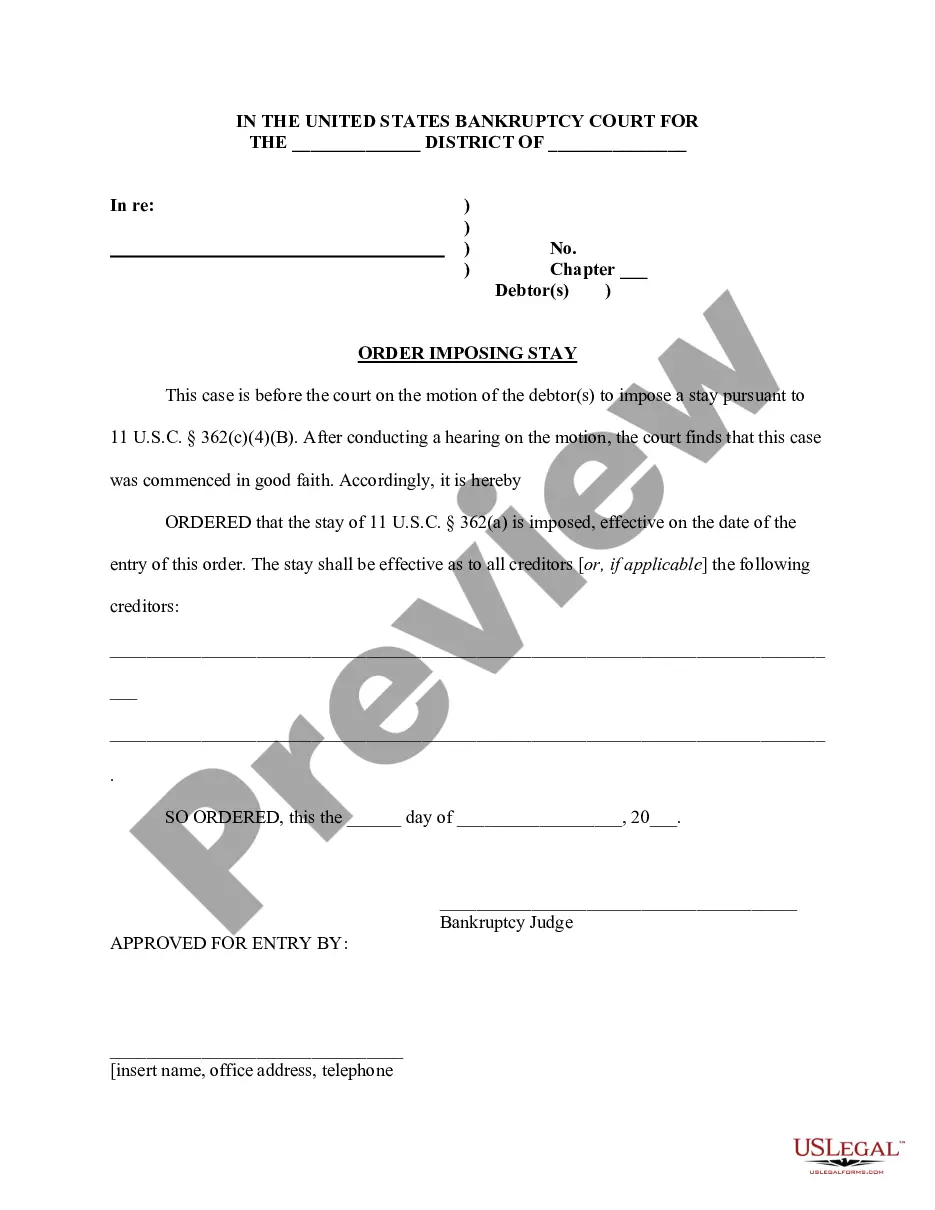

A personal guarantee can be enforced the same way as any debt. If the business owner does not pay, the creditor can bring a lawsuit to receive a judgment and levy the owner's personal assets to cover the debt. The exact terms of a personal guarantee specify a creditor's options under the guarantee.

The term personal guarantee refers to an individual's legal promise to repay credit issued to a business for which they serve as an executive or partner. Providing a personal guarantee means that if the business becomes unable to repay the debt, the individual assumes personal responsibility for the balance.

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

To reduce their credit risk, lenders will often seek security over some assets of the borrower in the case of your business, that's you. Signing a Personal Guarantee means that if your business becomes unable to repay a debt to the lender, you're personally responsible.

A loan personal guarantee is a document that allows an individual, known as the guarantor, to be responsible for loaned money if it is not paid back by the borrower.

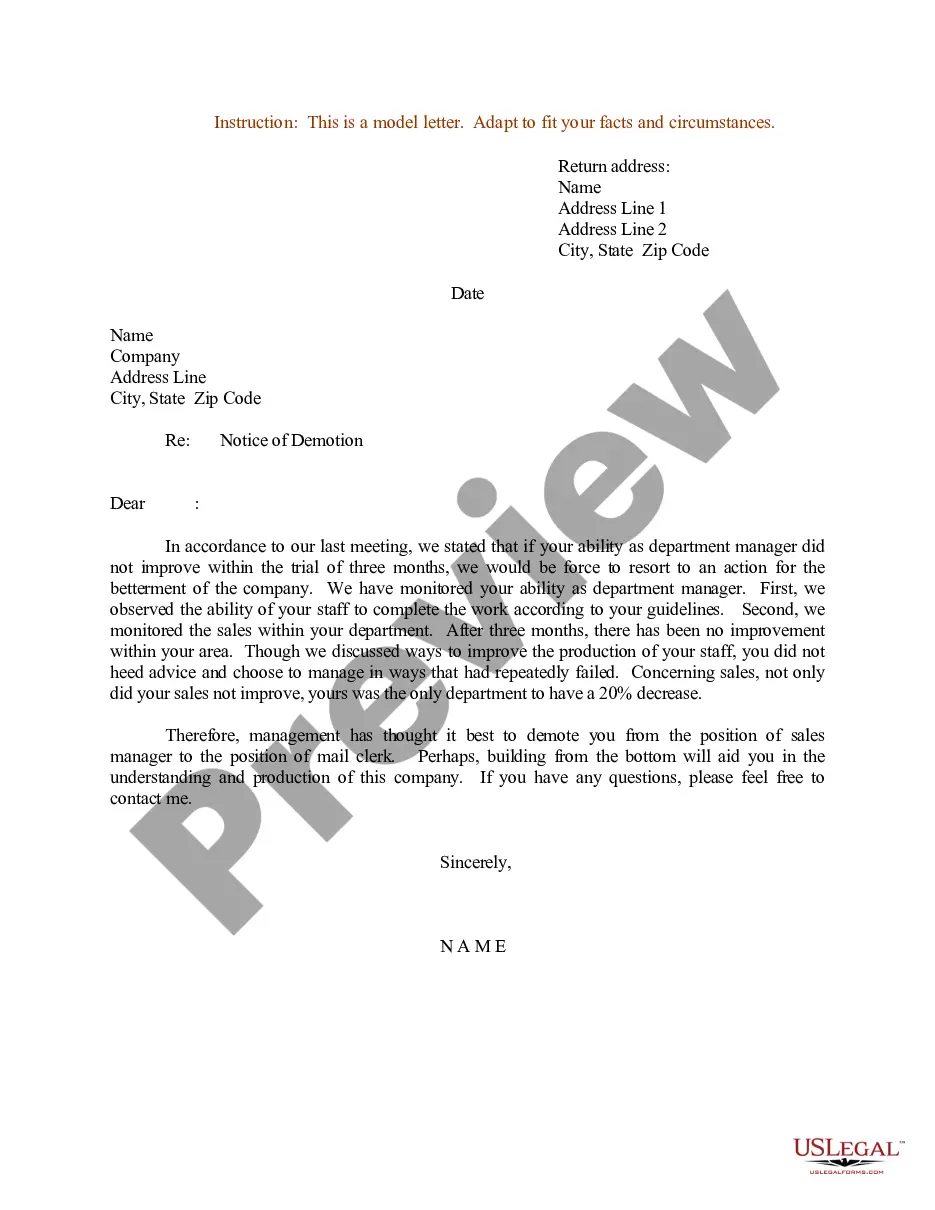

How to Write a Personal Guarantee?Information About the Parties.Information About the Loan.Subject of the Guarantee.Terms and Conditions.Contact Information.Signatures.Witness.

Most importantly, to be enforceable, a personal guaranty must meet certain criteria. A personal guaranty must be in writing and it must be signed by the guarantor in the guarantor's personal capacity. Though seemingly obvious, this important issue cannot be overlooked.

According to the Restatement, a party may enforce a guaranty under one of three theories: A promise to be surety for the performance of a contractual obligation, made to the obligee, is binding if: The promise is in writing and signed by the promisor and recites a purported consideration; or.

Corporate credit cards. Instead, by using a credit that are issued to an individual are another example of a personal guarantee. The individual or employee is responsible for the debt that the organization takes on and the overall spending on the credit card. Here, the cardholder takes the role of a guarantor.