Utah Credit Memo Request Form

Description

How to fill out Credit Memo Request Form?

Finding the appropriate legitimate document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you locate the authentic type you require.

Utilize the US Legal Forms website.

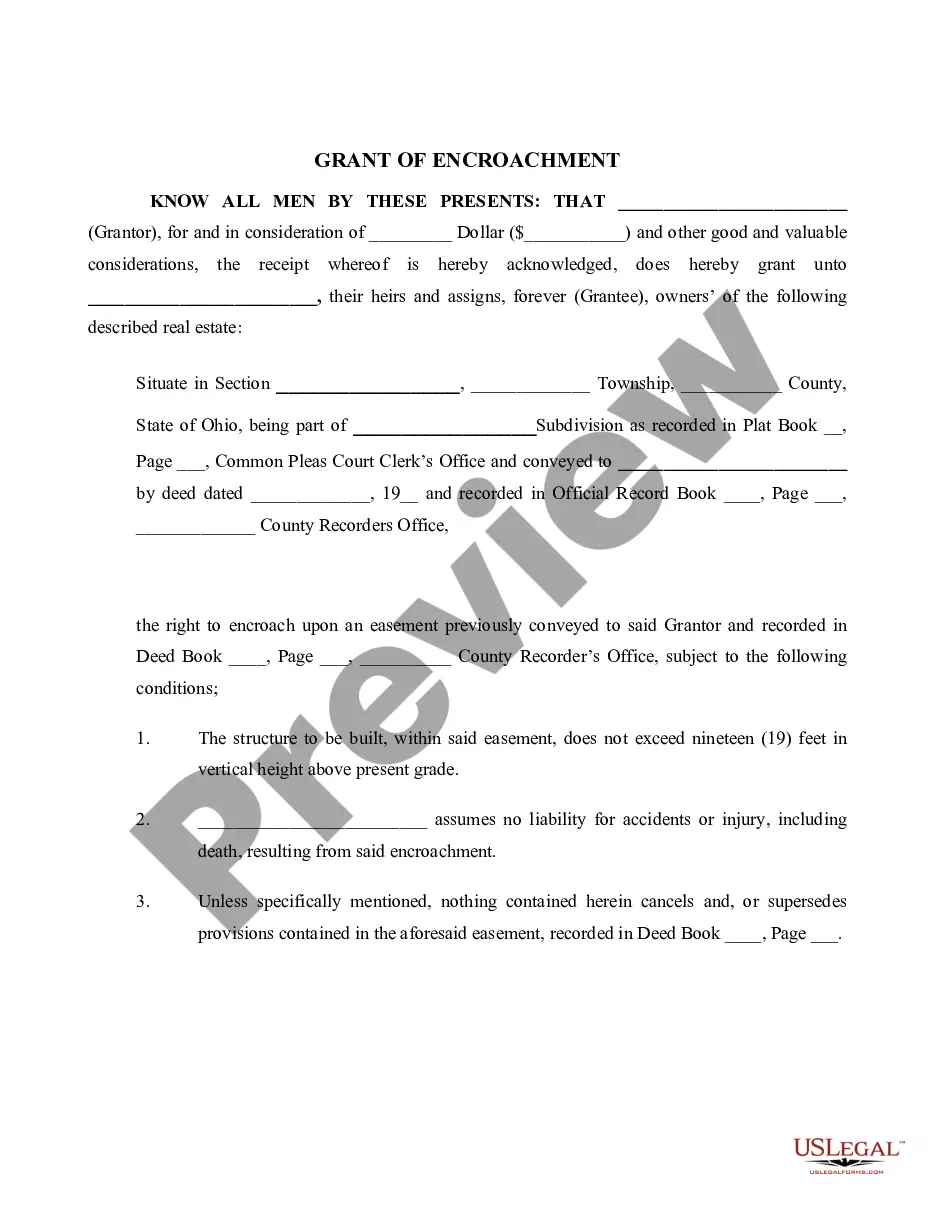

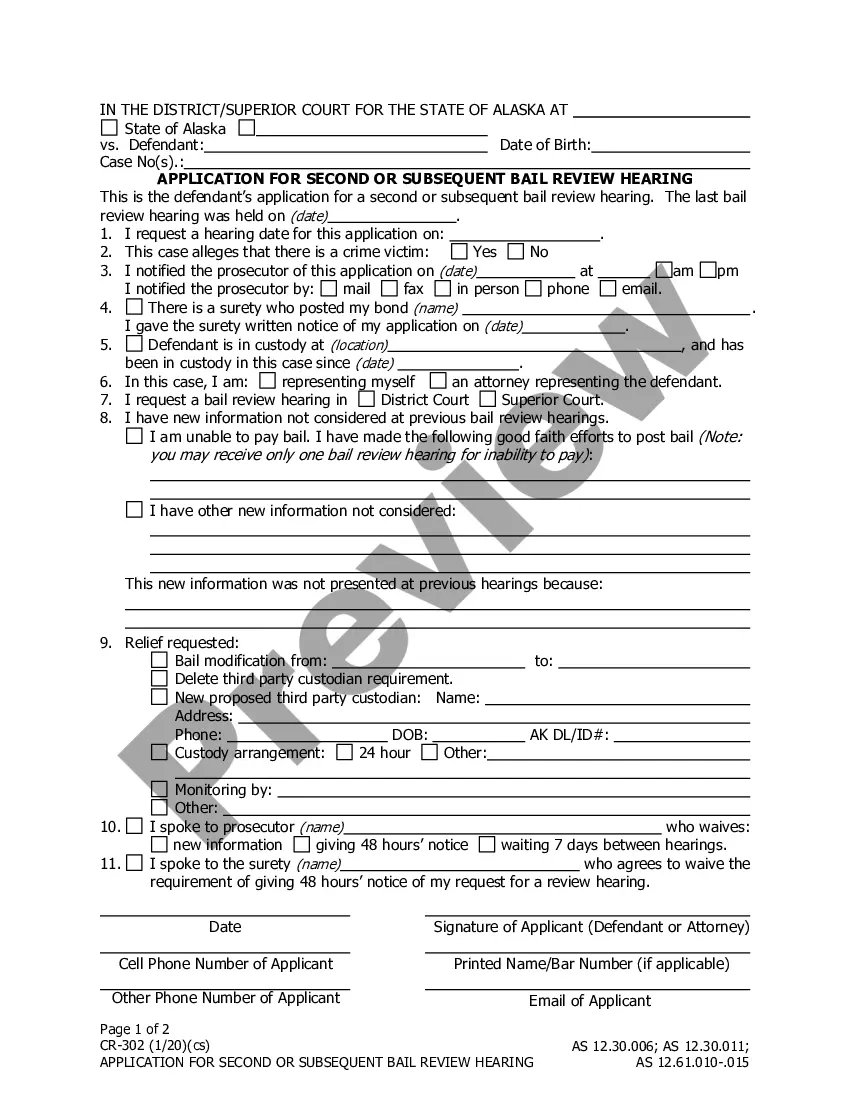

Firstly, ensure you have selected the correct form for your locality. You can review the form using the Review button and read the form description to verify it is the right one for you.

- The service offers thousands of templates, including the Utah Credit Memo Request Form, suitable for business and personal purposes.

- All forms are reviewed by experts and comply with state and federal standards.

- If you are already a member, Log In to your account and click the Obtain button to download the Utah Credit Memo Request Form.

- You can use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

Form popularity

FAQ

TC-675R, Statement of Utah Tax Withheld on Mineral Production.

The upper-tier partnership must provide a Utah Schedule K-1 showing the amount of Utah withholding tax paid on behalf of the lower-tier partnership. The lower-tier partnership must report this with- holding tax on form TC-250 and then allocate it to its partners, who will claim the withholding tax on their returns.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

If you are a Utah partnership, a Utah S corporation, or a Utah fiduciary, and you received a TC-675R or a Utah Schedule K-1 with a credit for Utah tax withheld on mineral production, the credit must be distributed on the Utah Schedule K-1 you send to your partners, shareholders, or beneficiaries.

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or. want a refund of any income tax overpaid.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records we may ask you to provide the documents at a later time.

Utah Withholding Account IDYou can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms.If you're unsure, contact the agency at (801) 297-2200.

The upper-tier partnership must provide a Utah Schedule K-1 showing the amount of Utah withholding tax paid on behalf of the lower-tier partnership. The lower-tier partnership must report this with- holding tax on form TC-250 and then allocate it to its partners, who will claim the withholding tax on their returns.

Form TC-941E is an Annual Employer Reconciliation report used to report wages and withholding tax returns for employees.