Utah Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

On the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Utah Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets within seconds.

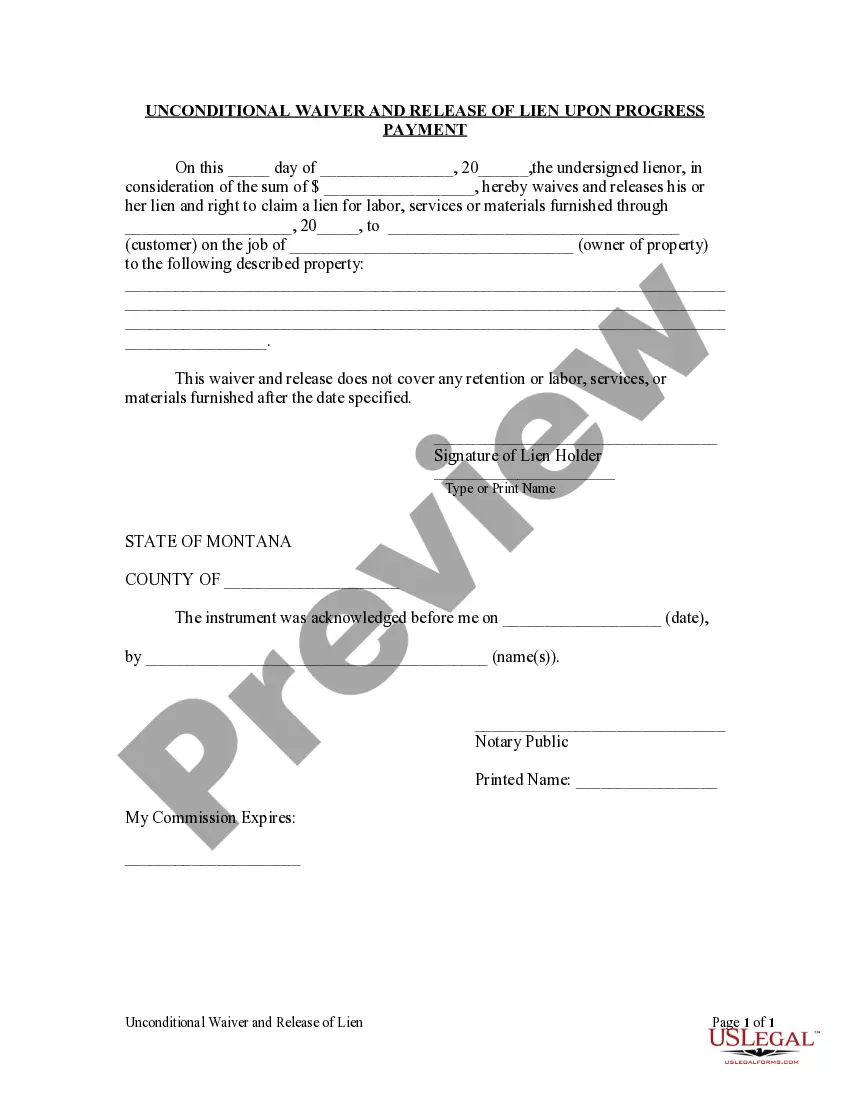

Review the Review button to inspect the content of the form. Read the form description to ensure you have chosen the correct form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you have a membership, Log In to download the Utah Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets from your US Legal Forms library.

- The Download button will be displayed on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple guidelines to help you get started.

- Ensure you have selected the correct form for your region/state.

Form popularity

FAQ

Yes, typically, when a partnership is dissolved, the assets are liquidated to settle debts and distribute remaining equity to the partners. The exact method of liquidation and distribution can depend on the partnership agreement. A Utah Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets can help clarify the distribution process.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

File a Dissolution Form. You'll need to file a dissolution of partnership form with the state your business is based in to formally announce the end of the partnership. Doing so makes it clear that you are no longer in a partnership or liable for its debts; it's a good protective measure to take.

Any remaining assets are then divided among the remaining partners in accordance with their respective share of partnership profits. Under the RUPA, creditors are paid first, including any partners who are also creditors.

In the dissolution process, any partner may dissolve the partnership at any time by providing a notice of dissolution. The partnership is then required to wind up its business activities and distribute its assets.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.