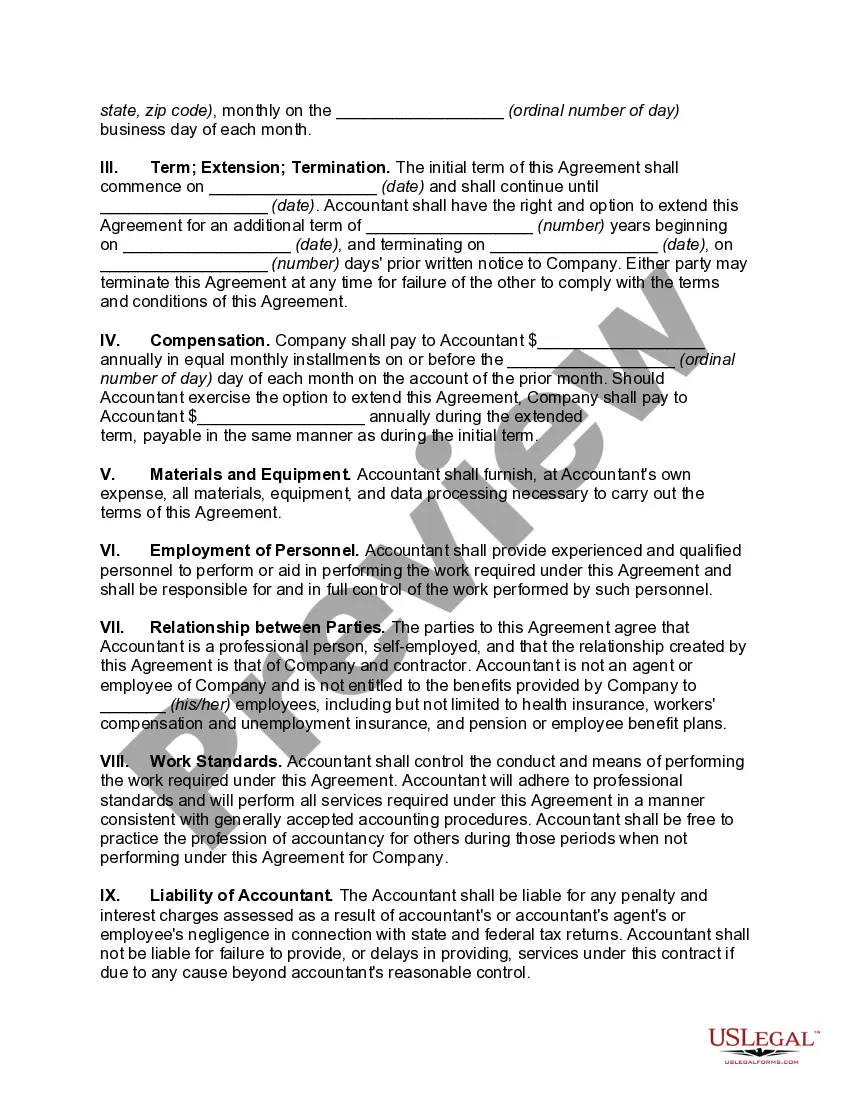

Utah Independent Contractor Agreement for Accountant and Bookkeeper

Description

How to fill out Independent Contractor Agreement For Accountant And Bookkeeper?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Utah Independent Contractor Agreement for Accountant and Bookkeeper in just moments.

If you have an account, Log In and download the Utah Independent Contractor Agreement for Accountant and Bookkeeper from the US Legal Forms library. The Download button will be available on every form you view. You can access all the previously acquired forms within the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the file format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Utah Independent Contractor Agreement for Accountant and Bookkeeper. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you want. Access the Utah Independent Contractor Agreement for Accountant and Bookkeeper with US Legal Forms, one of the most extensive libraries of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you get started.

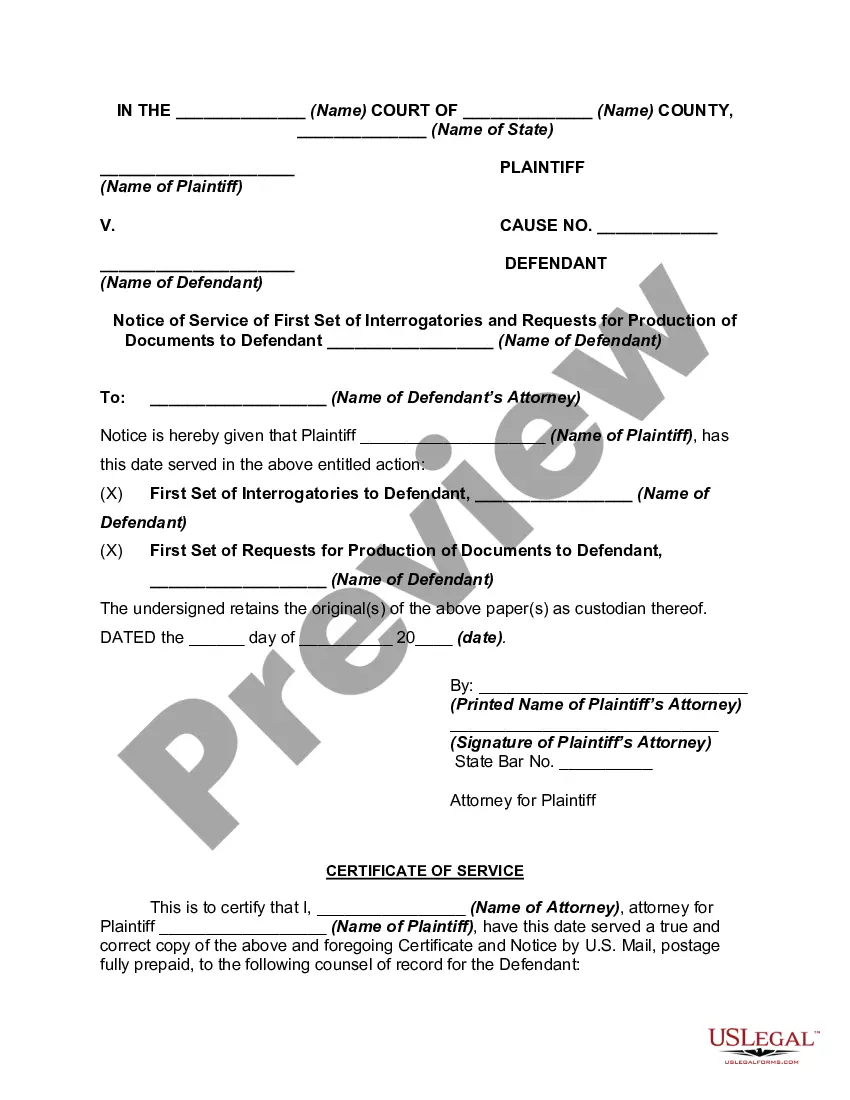

- Make sure you have selected the correct form for your area/county. Click the Preview button to review the form's contents.

- Check the form summary to ensure that you have picked the correct version.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the payment method you prefer and provide your credentials to register for an account.

Form popularity

FAQ

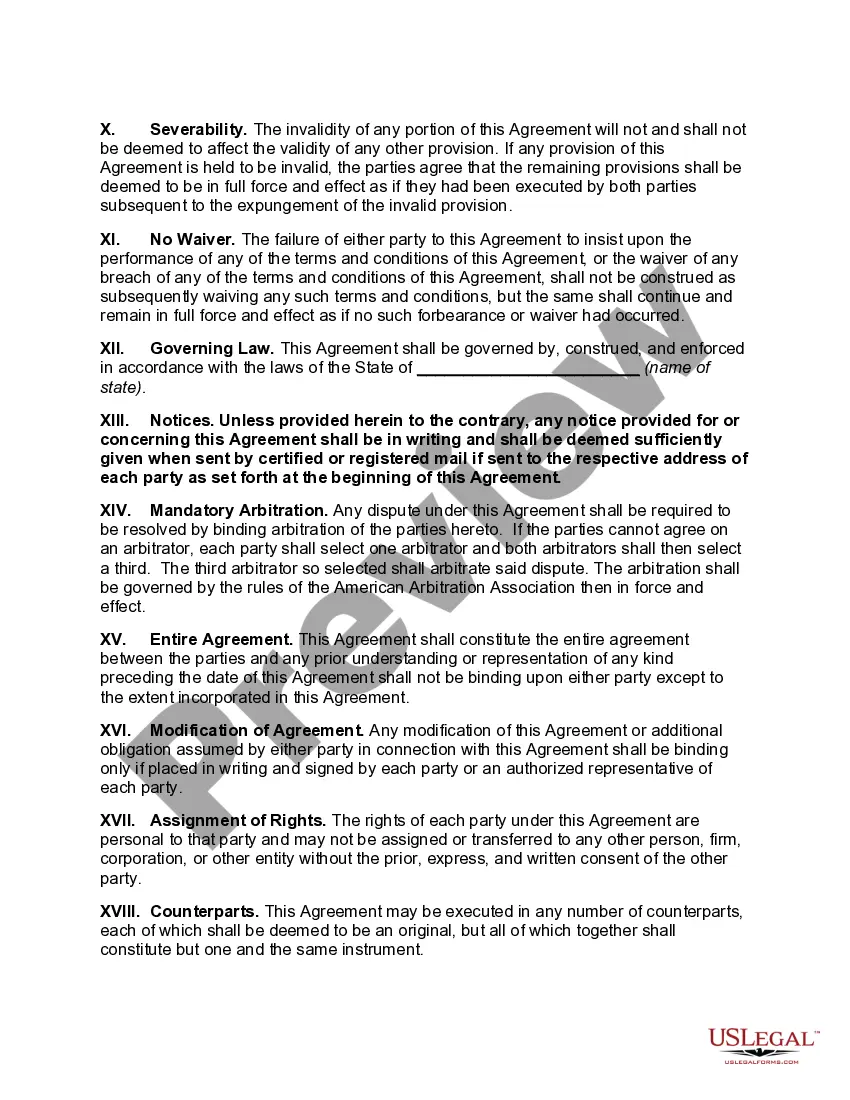

Writing an independent contractor agreement involves detailing the services to be provided, payment conditions, and both parties' responsibilities. Ensure your language is clear and includes clauses on termination and dispute resolution. By utilizing a Utah Independent Contractor Agreement for Accountant and Bookkeeper template, you can streamline the process and cover all crucial aspects.

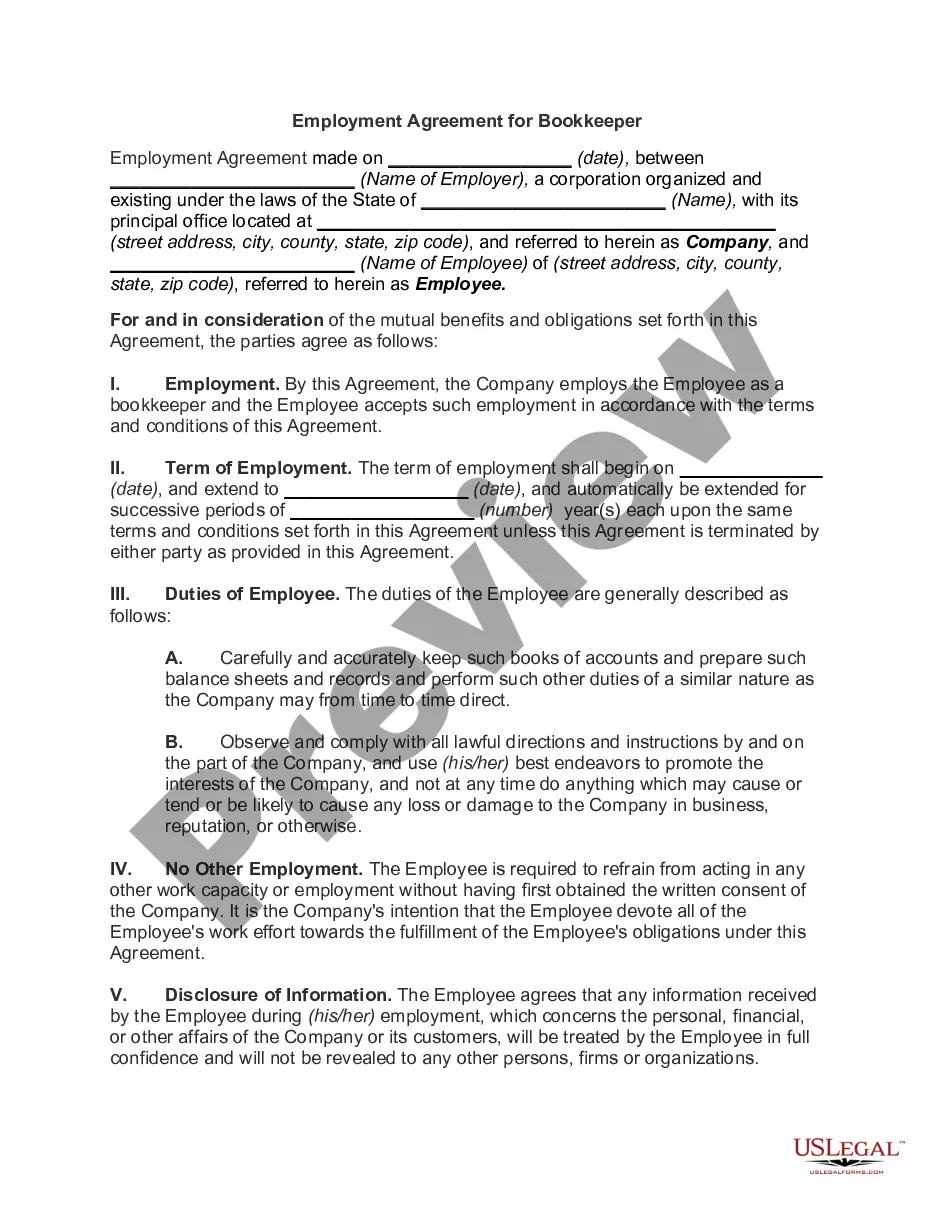

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

Payroll software automates a large majority of your payroll program, and can calculate wages and taxes, and some even will turn in taxes for you. Doing payroll by hand is the most time-consuming and requires someone learning how to do payroll, and that person is called a bookkeeper.