Utah Jury Instruction - Conspiracy To Defraud United States

Description

How to fill out Jury Instruction - Conspiracy To Defraud United States?

Finding the right legitimate document template can be quite a have difficulties. Needless to say, there are tons of templates available on the Internet, but how would you find the legitimate form you need? Utilize the US Legal Forms site. The support provides thousands of templates, such as the Utah Jury Instruction - Conspiracy To Defraud United States, which you can use for business and private needs. Each of the varieties are examined by specialists and satisfy federal and state needs.

Should you be previously registered, log in for your bank account and click the Download key to find the Utah Jury Instruction - Conspiracy To Defraud United States. Utilize your bank account to check through the legitimate varieties you possess acquired in the past. Visit the My Forms tab of the bank account and acquire another duplicate from the document you need.

Should you be a new end user of US Legal Forms, listed below are simple guidelines so that you can adhere to:

- First, make sure you have chosen the appropriate form for your town/area. It is possible to check out the shape utilizing the Preview key and study the shape information to make certain it will be the right one for you.

- In the event the form is not going to satisfy your preferences, take advantage of the Seach area to obtain the proper form.

- When you are certain that the shape is proper, click the Get now key to find the form.

- Select the rates strategy you need and type in the required information and facts. Create your bank account and pay for the order making use of your PayPal bank account or bank card.

- Choose the document format and down load the legitimate document template for your product.

- Comprehensive, change and print out and signal the obtained Utah Jury Instruction - Conspiracy To Defraud United States.

US Legal Forms is definitely the greatest local library of legitimate varieties that you can find different document templates. Utilize the service to down load professionally-created paperwork that adhere to express needs.

Form popularity

FAQ

What is the Statute of Limitations for False Statements? The statute of limitations is five years, from the time the statement was made or submitted.

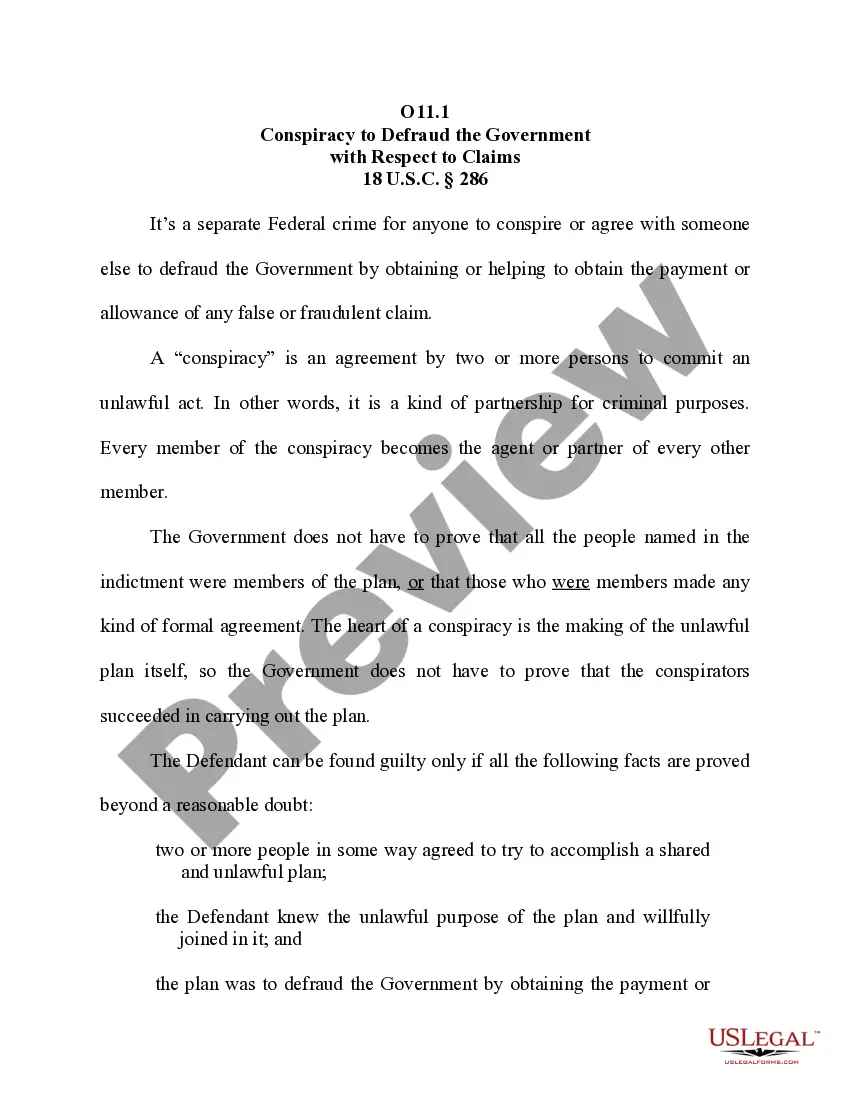

Whoever enters into any agreement, combination, or conspiracy to defraud the United States, or any department or agency thereof, by obtaining or aiding to obtain the payment or allowance of any false, fictitious or fraudulent claim, shall be fined under this title or imprisoned not more than ten years, or both.

You must decide whether the conspiracy charged in the indictment existed, and, if it did, who at least some of its members were. If you find that the conspiracy charged did not exist, then you must return a not guilty verdict, even though you may find that some other conspiracy existed.

Section 371 conspiracies are subject to the general five-year statute of limitations for non-capital federal offenses set forth in 18 U.S.C. § 3282. This five-year statute of limitations also applies to conspiracies under other federal statutes unless those statutes contain their own limitations periods.

§ 371 affect the government in at least one of three ways: (1) They cheat the government out of money or property; (2) They interfere or obstruct legitimate Government activity; or (3) They make wrongful use of a governmental instrumentality." The "intent required for a conspiracy to defraud the government is that the ...

The general conspiracy statute, 18 U.S.C. § 371, creates an offense "[i]f two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose. (emphasis added).

[An overt act is any act knowingly committed by one or more of the conspirators in an effort to accomplish some purpose of the conspiracy. Only one overt act has to be proven.

Whoever enters into any agreement, combination, or conspiracy to defraud the United States, or any department or agency thereof, by obtaining or aiding to obtain the payment or allowance of any false, fictitious or fraudulent claim, shall be fined under this title or imprisoned not more than ten years, or both.