Utah Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

Are you presently in a situation where you need documents for both business or personal purposes on a daily basis.

There is a wide selection of official document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms provides an extensive collection of form templates, such as the Utah Document Organizer and Retention, designed to comply with federal and state regulations.

When you find the appropriate form, click Acquire now.

Select the pricing plan you prefer, submit the necessary information to create your account, and complete your purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Utah Document Organizer and Retention template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/state.

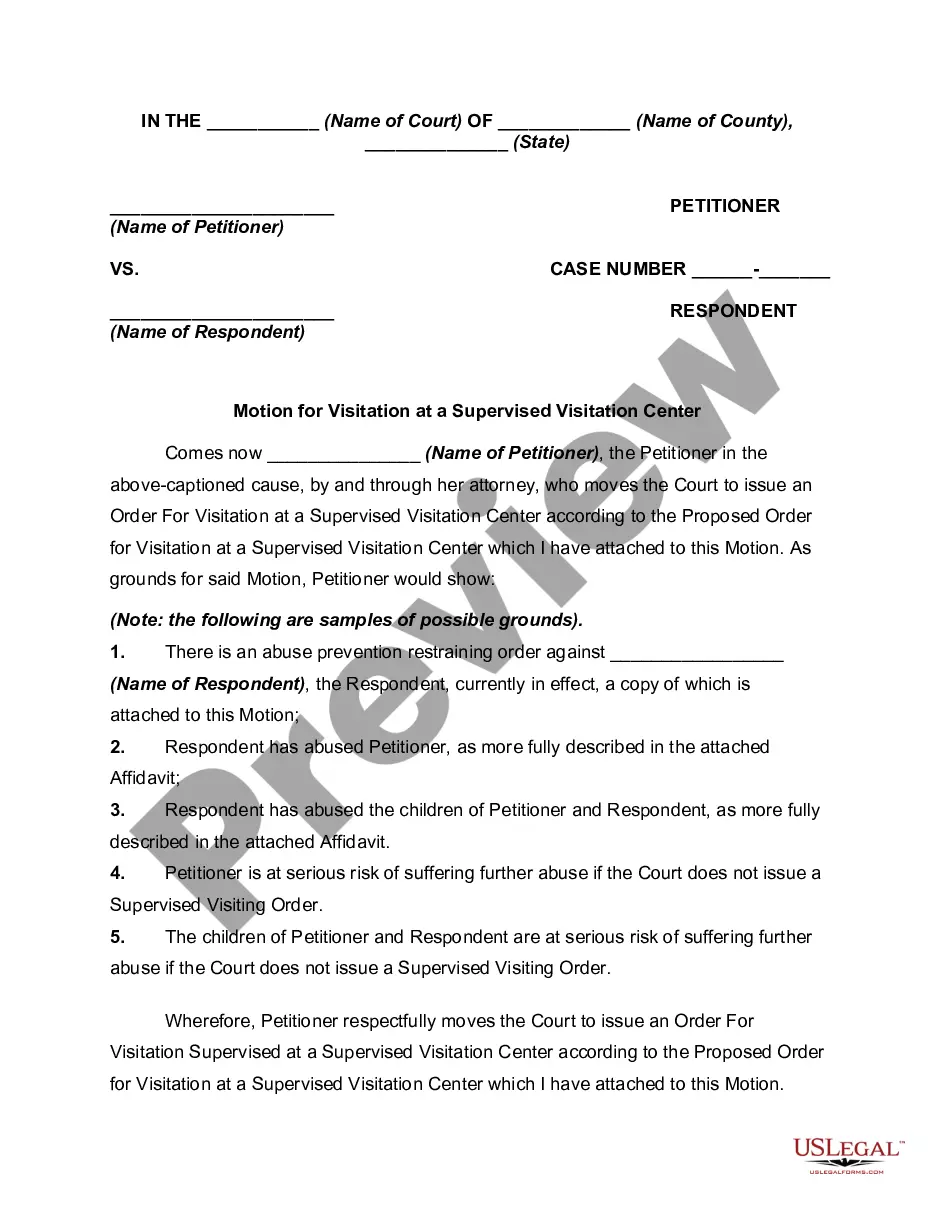

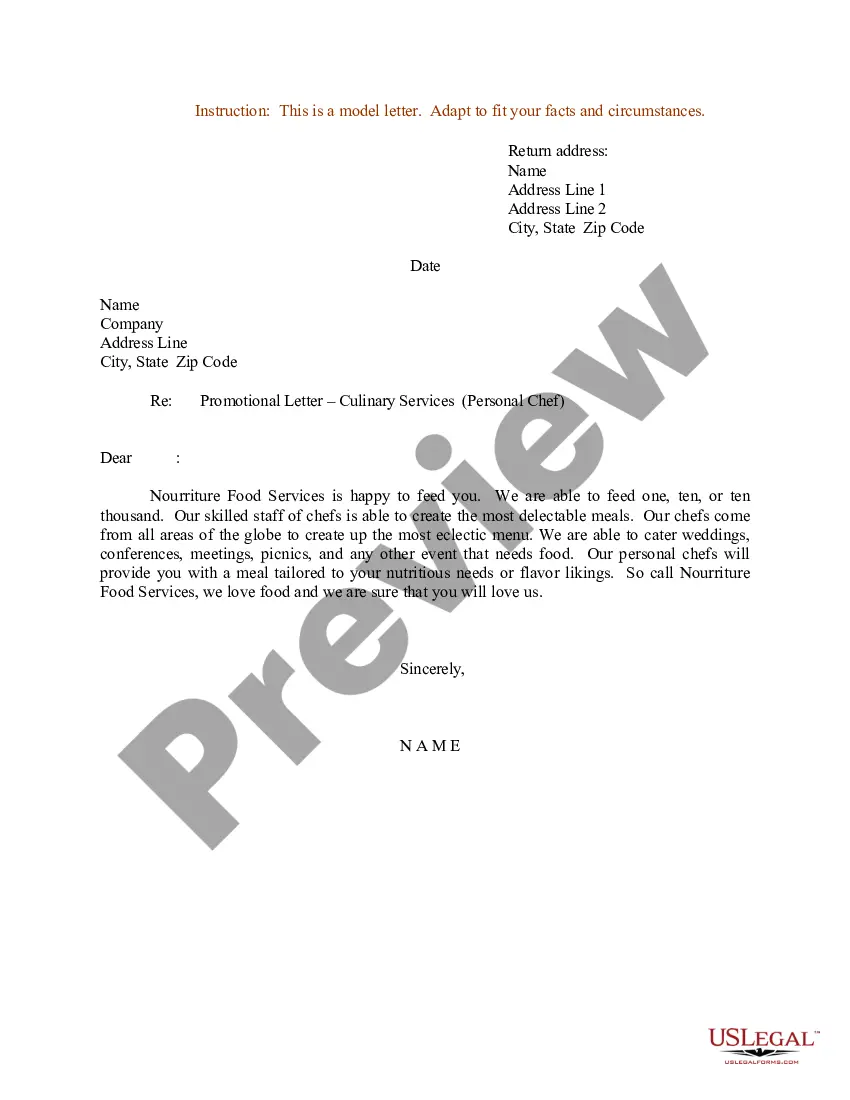

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

As a result, you should keep personal data, performance appraisals and employment contracts for six years after an employee leaves. Don't forget, a former employeeor anyone you hold data onmight issue you with a Subject Access Request (SAR) to see what data you have on them.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever. If you're unsure what to keep and what to shred, your accountant, lawyer and state record-keeping agency may provide guidance.

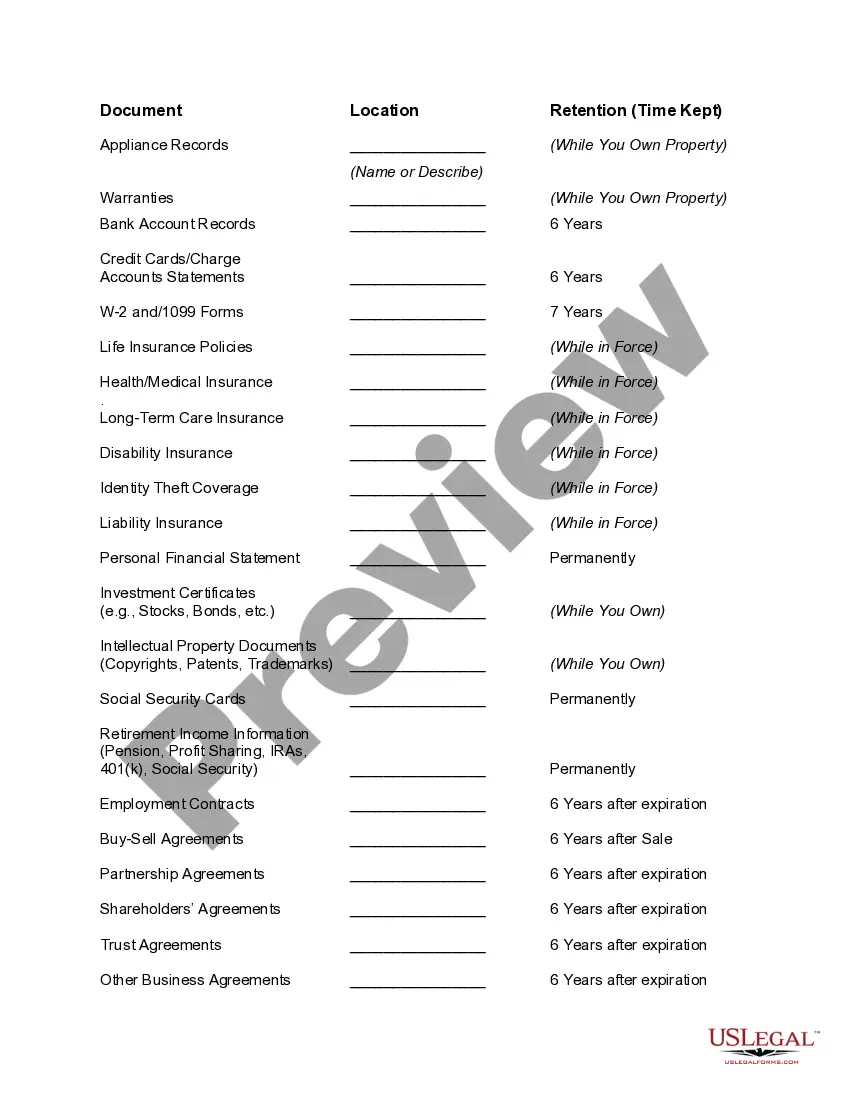

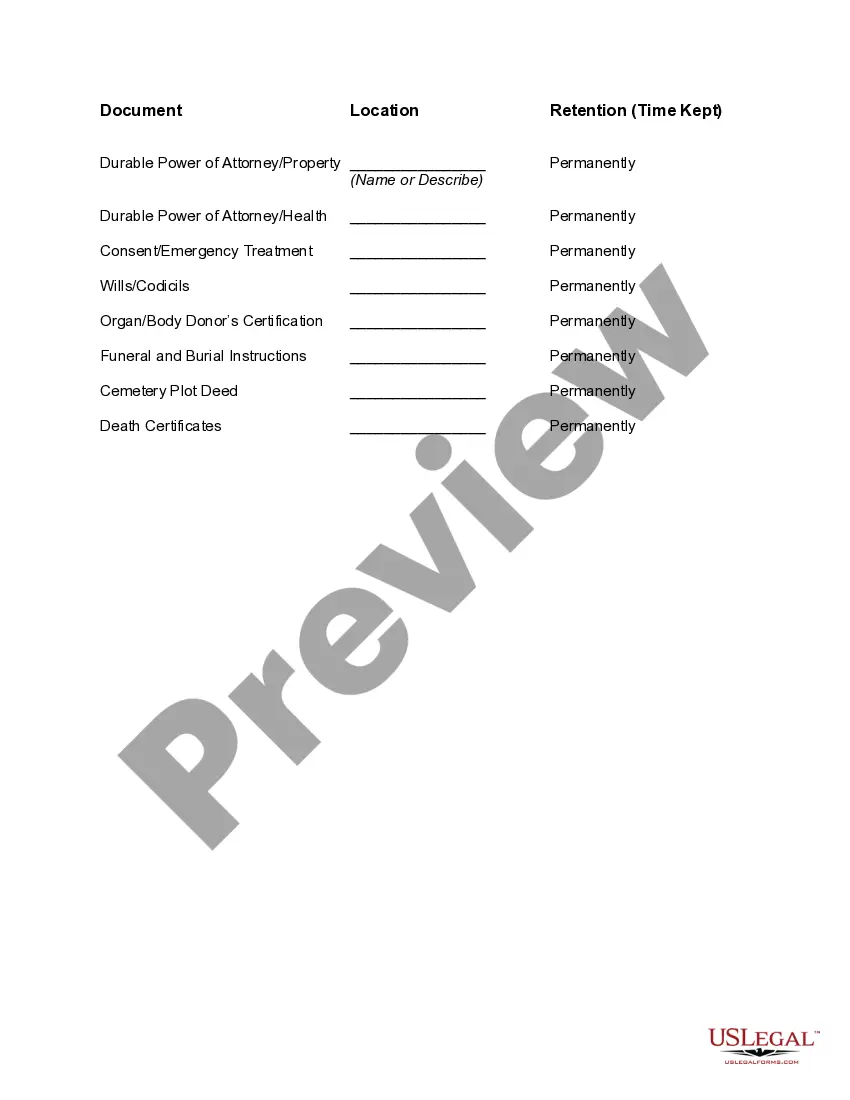

The records retention schedule captures all of the types of records created and used by a company in the course of its business and indicates how long these records are required to be retained.

A document retention plan is a policy that provides for the systematic review, retention and destruction of documents.

How long should I keep employee personnel files? You should keep an employee's personnel files for six years after the employee has left your organisation. The reason for this is that up until six years has passed, the former employee may sue you for breach of contract in the county court.

A record retention schedule is a list of records maintained by all or part of an organization together with the period of time that each record or group of records is to be kept.

A document retention policy is a company policy, which establishes the customary practice and guidelines regarding the retention and maintenance of company records, and sets forth a schedule for the destruction of certain documents received or created during the course of business.

Retention policies help to manage many risks including lost or stolen information, excessive backlog of paper files, loss of time and space while internally managing records and lack of organization system for records, making them hard to find, just to name a few.

Employment records We recommend retaining most of these records for the duration of an employee's employment plus three years. The reason for this recommendation is due to the various recordkeeping requirements and statutes of limitations applicable to state and federal employment laws.

For example, if financial records have a retention period of five years, and the records were created during the 1995-1996 fiscal year (July 1, 1995 - June 30, 1996), the five-year retention period begins on July 1, 1996 and ends five years later on July 1, 2001.