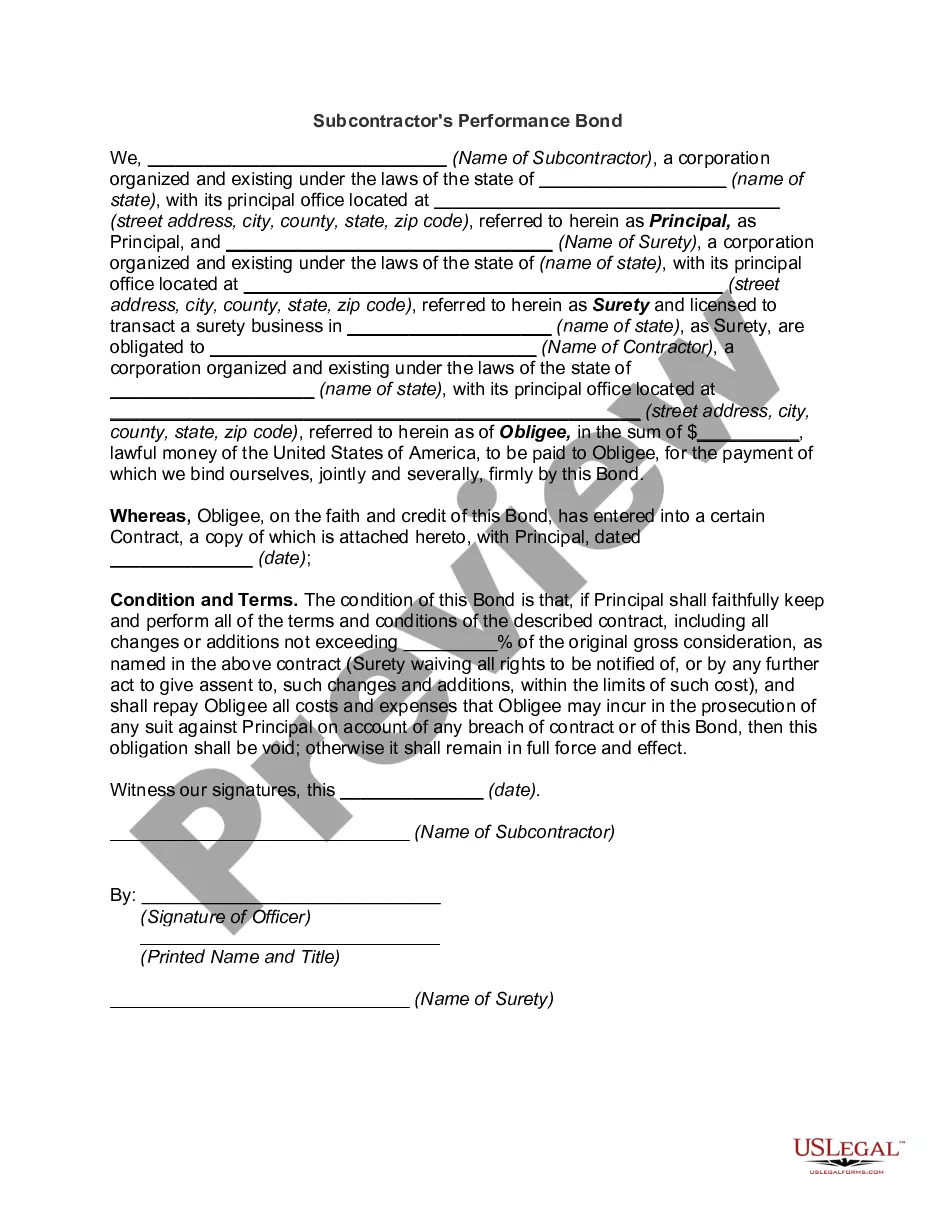

Utah Performance Bond

Description

How to fill out Performance Bond?

US Legal Forms - one of many greatest libraries of authorized kinds in the United States - gives a wide array of authorized file web templates you may download or printing. While using website, you can find a large number of kinds for company and person uses, sorted by types, says, or keywords and phrases.You can get the most up-to-date variations of kinds just like the Utah Performance Bond within minutes.

If you already have a registration, log in and download Utah Performance Bond through the US Legal Forms library. The Acquire switch can look on every single develop you look at. You have access to all in the past delivered electronically kinds from the My Forms tab of your bank account.

In order to use US Legal Forms the very first time, allow me to share simple guidelines to help you began:

- Make sure you have selected the right develop for your city/region. Click the Review switch to review the form`s content. See the develop information to ensure that you have chosen the correct develop.

- In the event the develop does not suit your specifications, make use of the Look for industry near the top of the display screen to discover the one that does.

- When you are pleased with the shape, validate your selection by clicking the Get now switch. Then, pick the prices program you like and supply your references to register to have an bank account.

- Procedure the deal. Make use of your credit card or PayPal bank account to accomplish the deal.

- Pick the structure and download the shape on your own system.

- Make adjustments. Fill out, revise and printing and indicator the delivered electronically Utah Performance Bond.

Every single design you put into your money does not have an expiry time which is yours forever. So, if you would like download or printing an additional backup, just proceed to the My Forms segment and click on around the develop you will need.

Gain access to the Utah Performance Bond with US Legal Forms, one of the most comprehensive library of authorized file web templates. Use a large number of specialist and state-particular web templates that fulfill your organization or person needs and specifications.

Form popularity

FAQ

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

Surety bonds also come with the following cons for contractors: A bonded contractor must pay for the bond and will also be responsible for paying valid bond claims. A lapse in a bond can result in a license suspension or the invalidation of a contract. Required renewals can add ongoing expenses.

One key difference between performance bonds and surety bonds is the scope of their coverage. Performance bonds only cover a specific project, while surety bonds can cover multiple projects or ongoing business activities. Another difference is the party responsible for paying the bond premium.

Advance Payment Bond v's Performance Bond An APB will protect the Employer against goods or services yet to be supplied while a PB will provide compensation in the event of the Contractors failure to perform and complete his obligations under the Contract.

Distinction in Practice If accessoriness is evident, it is a surety bond. In the absence of accessoriness, a guarantee has been agreed. In contrast to a surety, the guarantor may not raise any objections or defenses based on another debt obligation.

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.

A performance bond issued by a financial institution guarantees the fulfillment of a contract. If the U.S. exporter fails to "perform" as agreed, the buyer is compensated. A bid bond - often required in a bid selection process - guarantees the foreign buyer that the U.S. exporter will execute the contract if selected.

Performance bonds are a subset of contract bonds and guarantee that a contractor will fulfill the terms of the contract. If they fail to do so, the Surety company is responsible for completing the contract obligations, either by securing a new contractor to complete the job or by financial compensation.