Utah Loan Agreement for Car

Description

How to fill out Loan Agreement For Car?

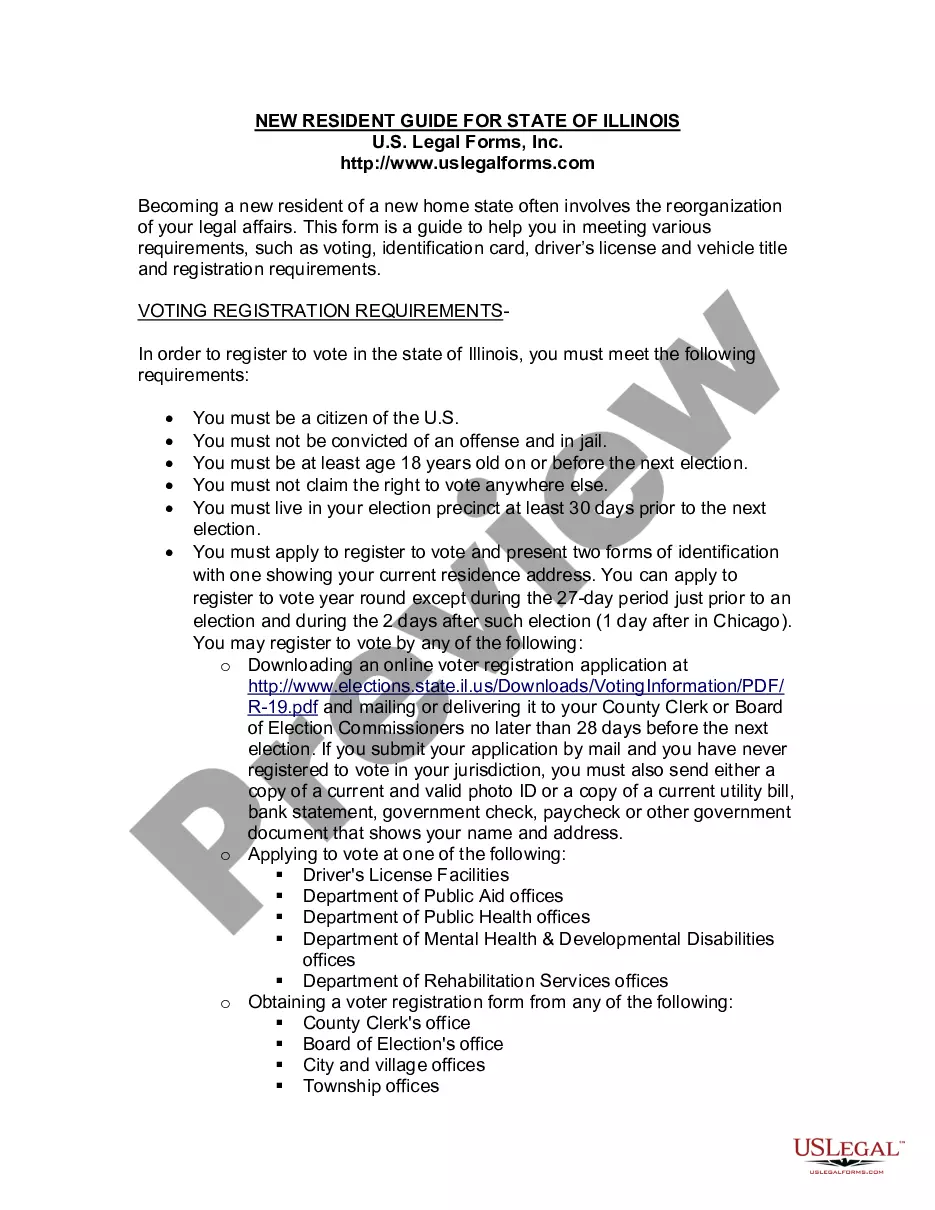

If you want to comprehensive, down load, or print out authorized record themes, use US Legal Forms, the greatest variety of authorized forms, which can be found online. Utilize the site`s simple and hassle-free search to discover the paperwork you require. Numerous themes for organization and personal functions are categorized by types and says, or keywords and phrases. Use US Legal Forms to discover the Utah Loan Agreement for Car with a couple of mouse clicks.

When you are previously a US Legal Forms buyer, log in for your accounts and click the Download switch to find the Utah Loan Agreement for Car. You can even entry forms you formerly downloaded in the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the correct metropolis/region.

- Step 2. Utilize the Review choice to look through the form`s articles. Don`t forget to learn the explanation.

- Step 3. When you are unhappy using the kind, use the Lookup industry towards the top of the display screen to get other types in the authorized kind web template.

- Step 4. Upon having identified the shape you require, select the Purchase now switch. Opt for the pricing program you choose and add your accreditations to sign up for the accounts.

- Step 5. Method the financial transaction. You can utilize your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the formatting in the authorized kind and down load it on your own system.

- Step 7. Total, modify and print out or indication the Utah Loan Agreement for Car.

Every authorized record web template you acquire is your own eternally. You have acces to each and every kind you downloaded with your acccount. Select the My Forms segment and select a kind to print out or down load once again.

Contend and down load, and print out the Utah Loan Agreement for Car with US Legal Forms. There are thousands of expert and condition-specific forms you can use to your organization or personal requires.

Form popularity

FAQ

What is the Average Car Loan Length? The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is a bit higher than in previous decades.

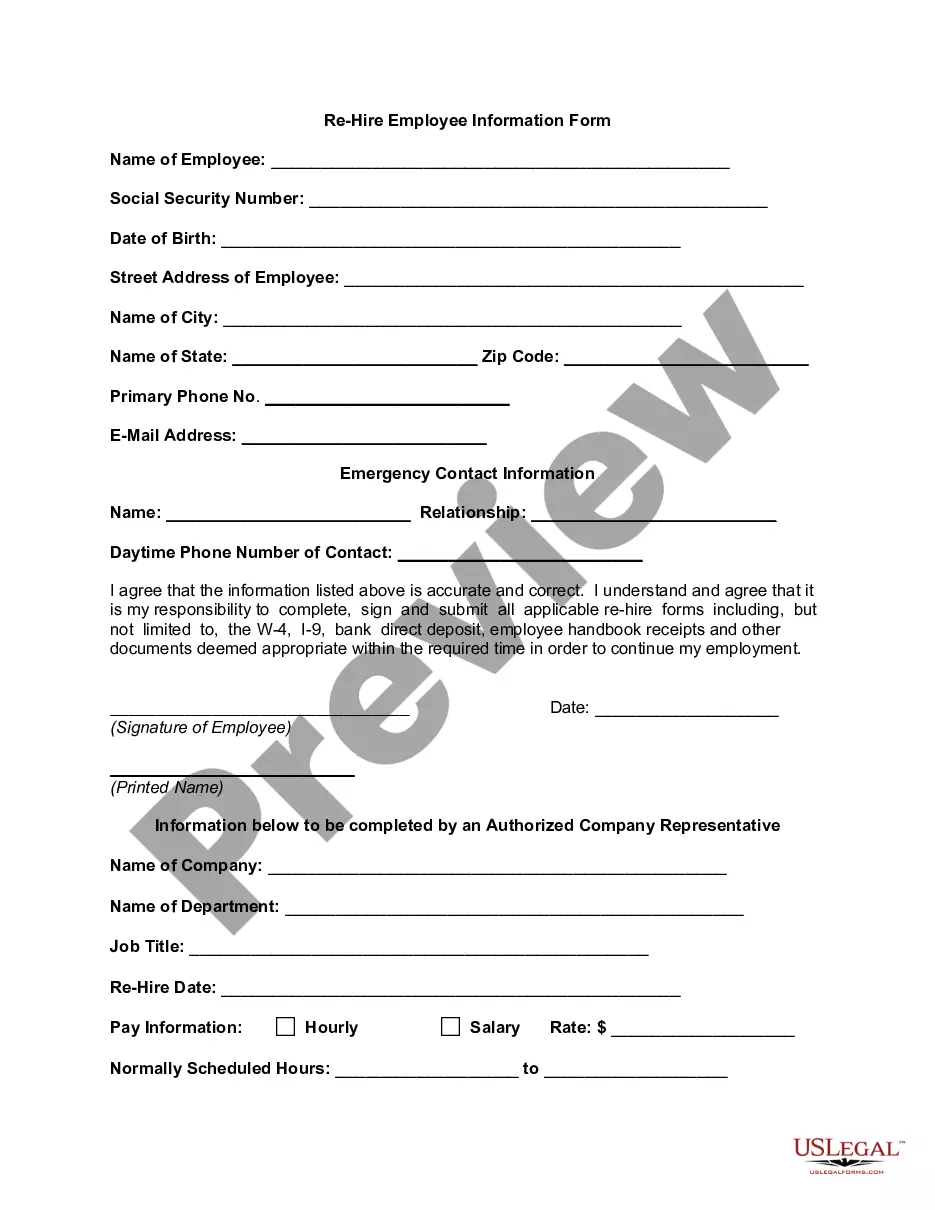

An auto loan agreement is a contract used to secure a loan by a buyer of a motor vehicle. The agreement establishes the names of the borrower and lender, the amount ($) that was borrowed, the length of the loan, how much the borrower needs to pay on a monthly basis, and other important terms.

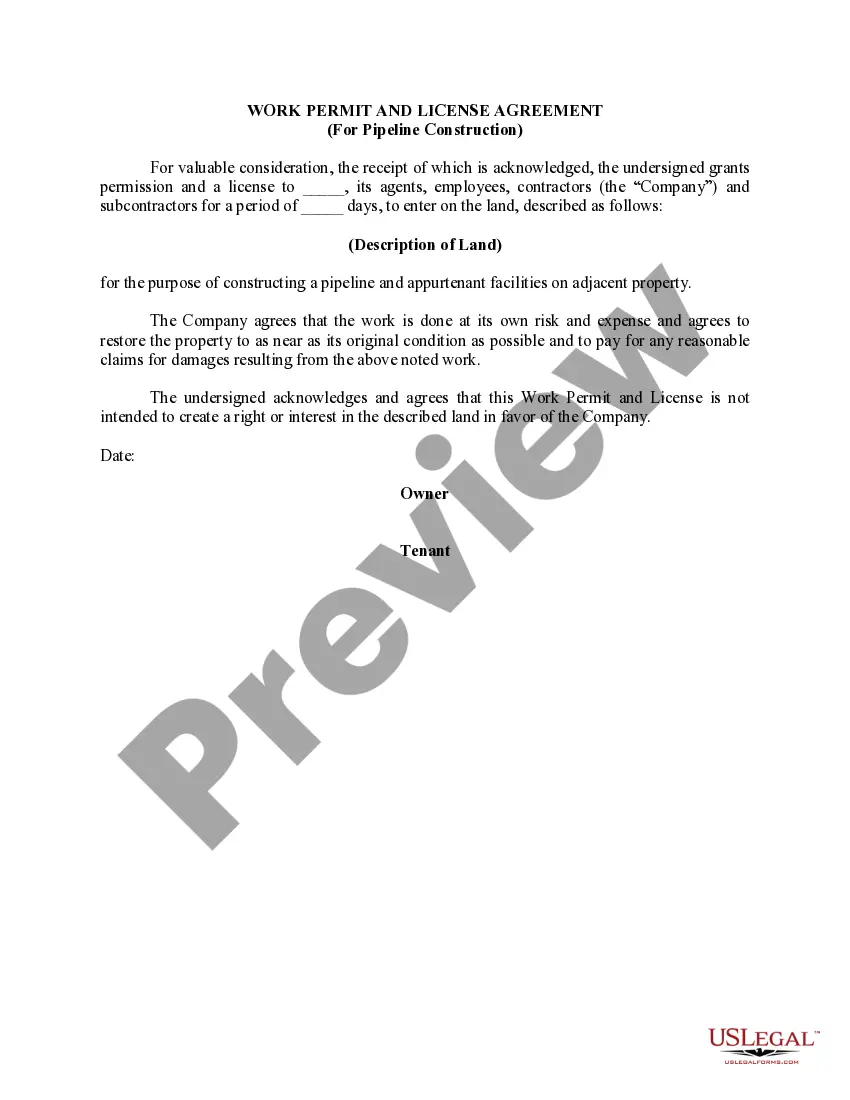

Dealers make money off in-house financing because they mark up your offered rate.

You and a dealer enter into a contract where you buy a vehicle and agree to pay, over a period of time, the amount financed plus a finance charge.

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates.

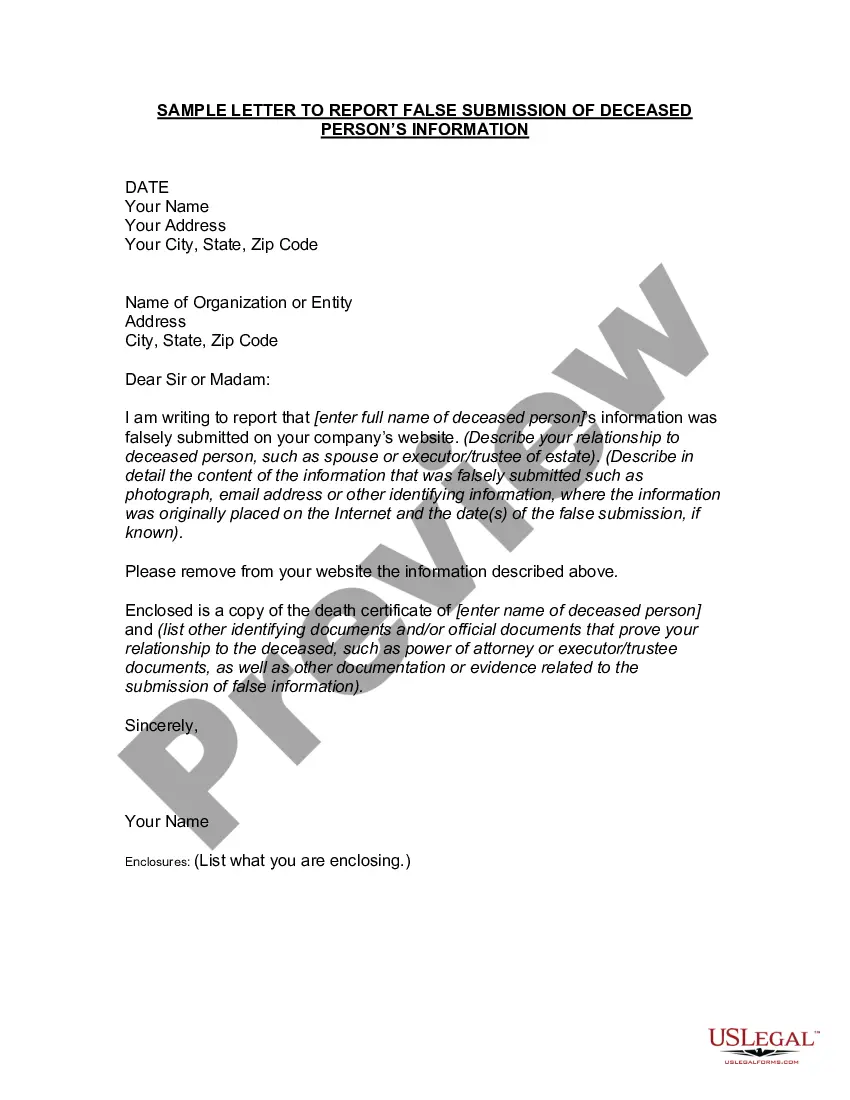

5 options to get out of a loan you can't afford Renegotiate the loan. You can reach out to your lender and negotiate a new payment plan. ... Sell the vehicle. Another strategy is to sell the car with the lien. ... Voluntary repossession. ... Refinance your loan. ... Pay off the car loan.

All agreements come with a 14-day car finance cooling-off period, which means you have a legal right to withdraw from the arrangement or cancel it within the first 14 days of signing the contract. To cancel your credit agreement within the 14-day cooling-off period, you need to contact the lender directly.

Car Promissory Note With a ca promissory note, a borrower promises to make payments on a car loan in exchange for a vehicle. The borrower typically makes even payments throughout the car loan term but often makes an initial lmp sum down payment.