Utah Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

You can spend time on the internet trying to locate the legal document template that aligns with the state and federal regulations you require.

US Legal Forms provides a vast array of legal forms reviewed by experts.

It is easy to obtain or create the Utah Agreement to Incorporate as an S Corp and as a Small Business Corporation with Eligibility for Section 1244 Stock from their service.

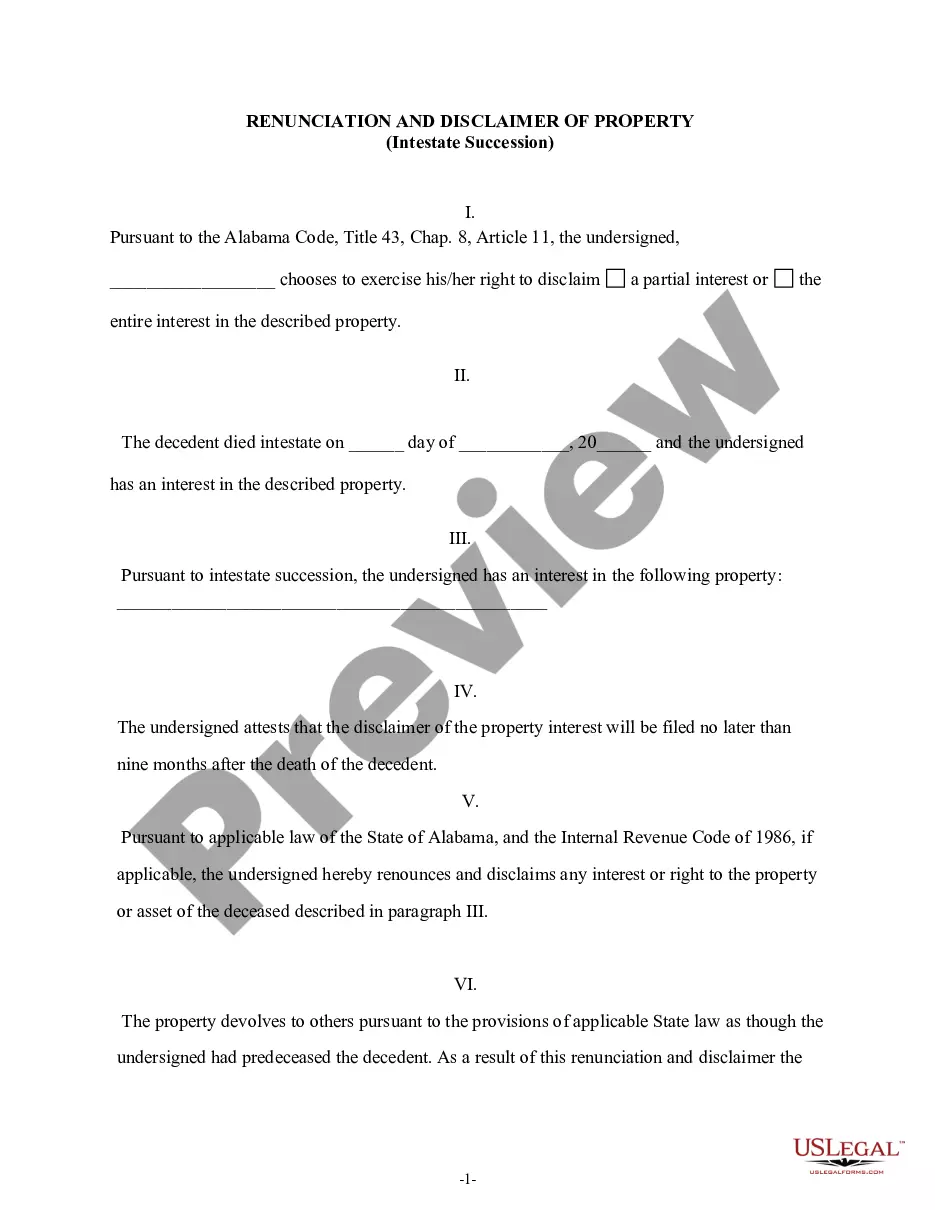

If available, use the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, create, or sign the Utah Agreement to Incorporate as an S Corp and as a Small Business Corporation with Eligibility for Section 1244 Stock.

- Every legal document template you acquire is yours permanently.

- To access another copy of a purchased form, go to the My documents tab and then click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to make sure you have chosen the appropriate form.

Form popularity

FAQ

An S corporation's structure also protects business owners' personal assets from any corporate liability and passes through income, usually in the form of dividends, to avoid double corporate and personal taxation. S corporations help companies establish credibility as a corporation since they have more oversight.

There are several advantages to becoming a corporation, including the limited personal liability, easy transfer of ownership, business continuity, better access to capital and (depending on the corporation structure) occasional tax benefits.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

An ordinary loss from the sale or worthlessness of Section 1244 stock is reported on Form 4797, and if the total loss exceeds the maximum amount that can be treated as an ordinary loss for the year, the transaction should also be reported on Form 8949.

Utah recognizes the federal S election and Utah S corporations are not required to pay the state's franchise tax. However, an individual S corporation shareholder will owe tax on his or her share of the company's income. Example: For the 2018 tax year, your S corporation had net income of $500,000.

1244(b)). Any loss in excess of the limit is a capital loss, subject to the capital loss rules. Thus, if the potential loss exceeds the $50,000 (or $100,000) limit, the stock should be disposed of in more than one year to maximize the ordinary loss treatment.

You can start an S corporation (S corp) in Utah by forming a limited liability company (LLC) or a corporation, and then electing S corp status from the IRS when you apply for your EIN. An S corp is an IRS tax classification, not a business structure. The S corp status is used to reduce a business's tax burden.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

For small businesses, an S Corp offers tax advantages and liability protection while preserving ownership flexibility. This allows business profits to pass through to the shareholders' personal tax returns meaning that entrepreneurs are protected from the double taxation C Corp owners incur.