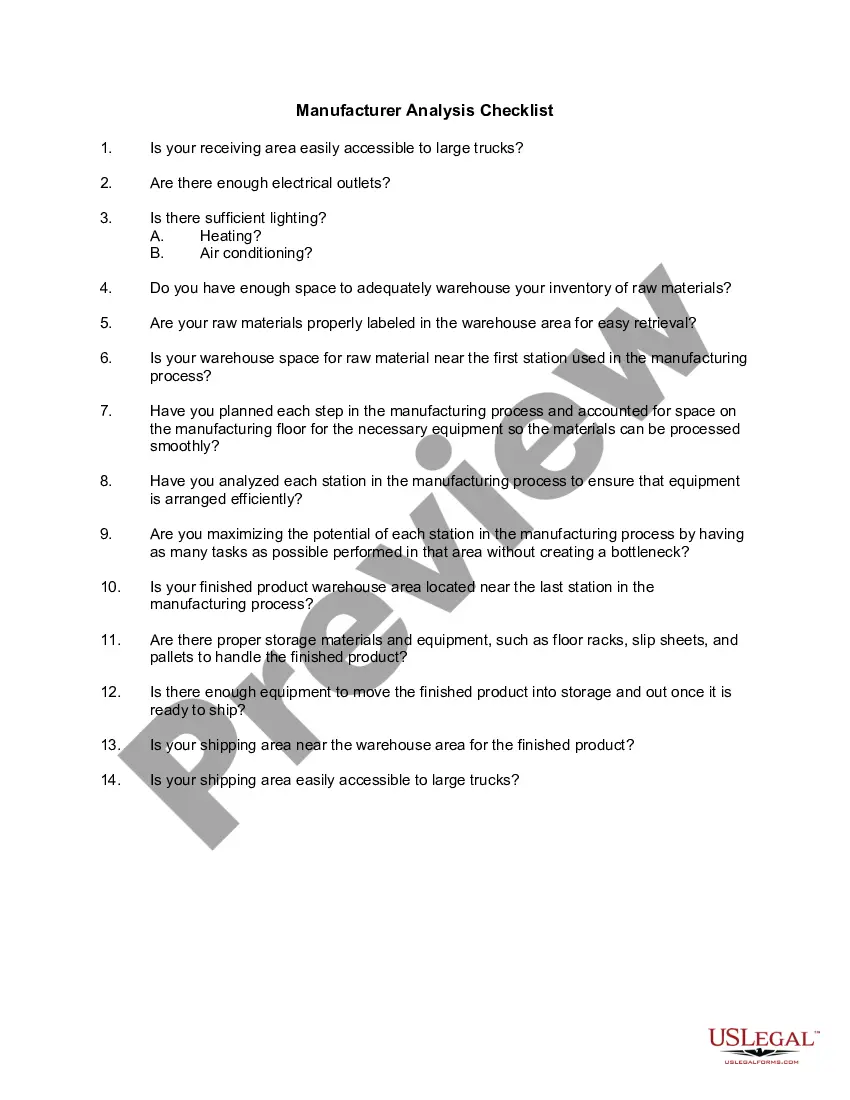

Utah Manufacturer Analysis Checklist

Description

How to fill out Manufacturer Analysis Checklist?

You might spend hours online exploring the legal template that meets the state and federal requirements you necessitate.

US Legal Forms offers thousands of legal templates that are reviewed by professionals.

You can download or print the Utah Manufacturer Evaluation Checklist from the service.

If available, utilize the Review button to browse the template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Utah Manufacturer Evaluation Checklist.

- Each legal template you acquire is yours permanently.

- To get another version of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct template for your county/region of preference.

- Examine the form details to ensure you have selected the right document.

Form popularity

FAQ

To mail the Utah TC 65 form, send it to the address specified on the form, which is typically the Utah State Tax Commission. Ensure you check the latest mailing address on the official website in case of changes. To avoid mistakes, refer to the Utah Manufacturer Analysis Checklist for guidance on what to include when sending your TC 65.

For filing an S Corporation in Utah, you will need to complete the Articles of Incorporation and obtain an EIN. You should also prepare any necessary state tax forms and ensure you meet eligibility requirements. Using the Utah Manufacturer Analysis Checklist can help you navigate these requirements and file everything correctly.

You can file the Utah TC 65 form at the Utah State Tax Commission either online or through the mail. If filing online, use the TAP system for convenience. Remember to consult the Utah Manufacturer Analysis Checklist to confirm that you are submitting all required information and attachments with your TC 65.

Filing withholding tax in Utah requires you to first register your business with the Utah State Tax Commission. After that, you can file your withholding tax returns electronically through the Utah Taxpayer Access Point (TAP). The Utah Manufacturer Analysis Checklist can guide you through the necessary steps to ensure compliance and timely submission.

To file the Utah annual report, visit the Utah Department of Commerce's website and access the online filing portal. You will need basic information about your LLC or corporation, such as its name, address, and ownership details. Utilize the Utah Manufacturer Analysis Checklist to streamline this process and confirm you include all necessary information.

To file taxes for an LLC in Utah, you need to gather essential documents such as your LLC's EIN and income records. You'll also need to fill out the appropriate tax forms, including the Utah LLC tax return form. The Utah Manufacturer Analysis Checklist can help you ensure you cover all required filings and payments accurately.