Utah Sales Commission Policy

Description

How to fill out Sales Commission Policy?

If you're looking to total, obtain, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you obtain is your property indefinitely. You will have access to all forms you have downloaded in your account. Click the My documents section to select a form to print or download again.

Collaborate and obtain, and print the Utah Sales Commission Policy with US Legal Forms. There is a wide array of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to retrieve the Utah Sales Commission Policy in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the Utah Sales Commission Policy.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the correct form for your specific city/state.

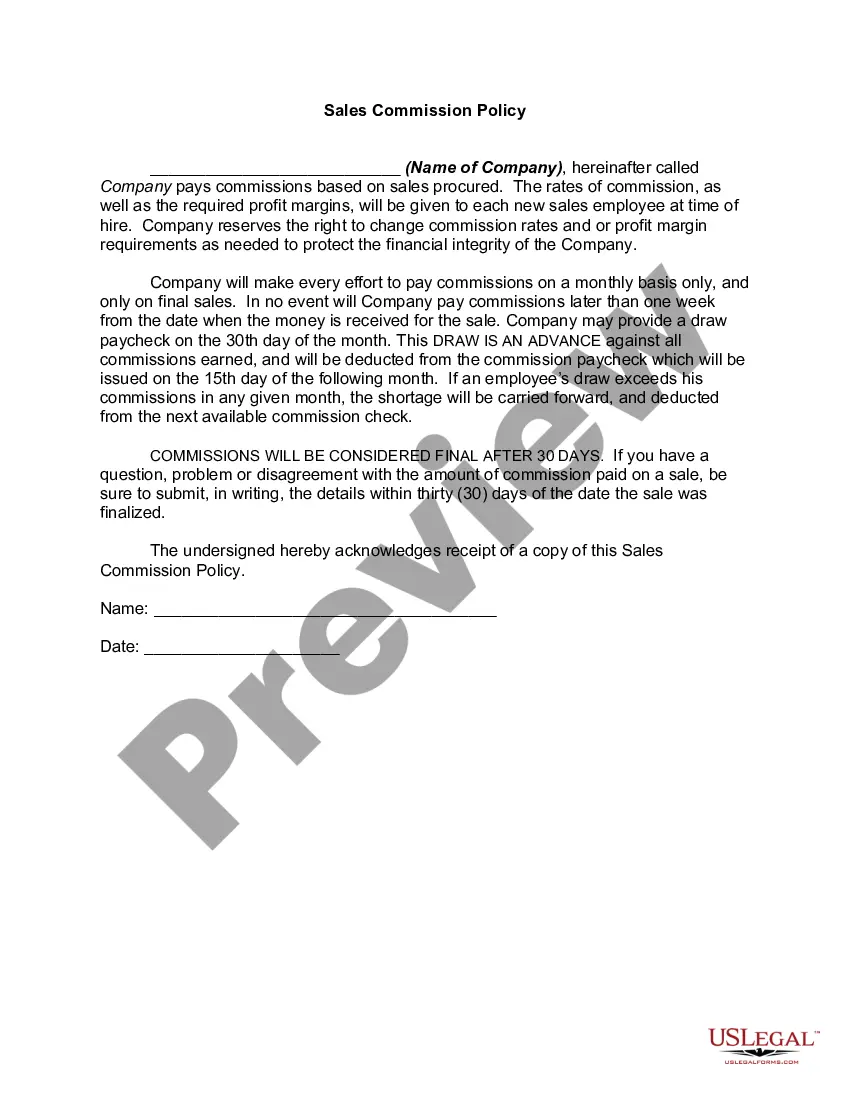

- Step 2. Use the Preview button to review the form's details. Be sure to check the information.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions in the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose your preferred pricing plan and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Utah Sales Commission Policy.

Form popularity

FAQ

To register for the Utah State Tax Commission, visit their official website and access the registration section. You will need to provide details about your business, including ownership structure and contact information. This step is essential to ensure you are compliant with tax regulations, particularly those outlined in the Utah Sales Commission Policy, enabling you to operate your business smoothly.

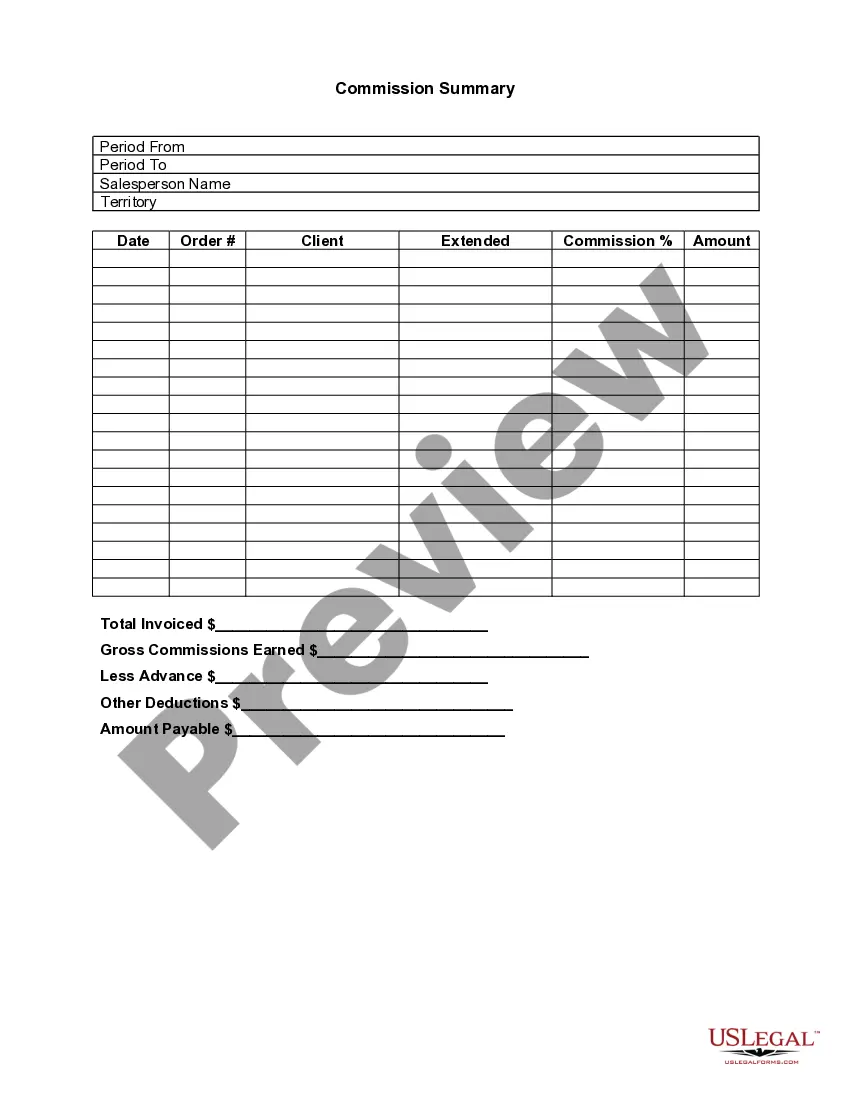

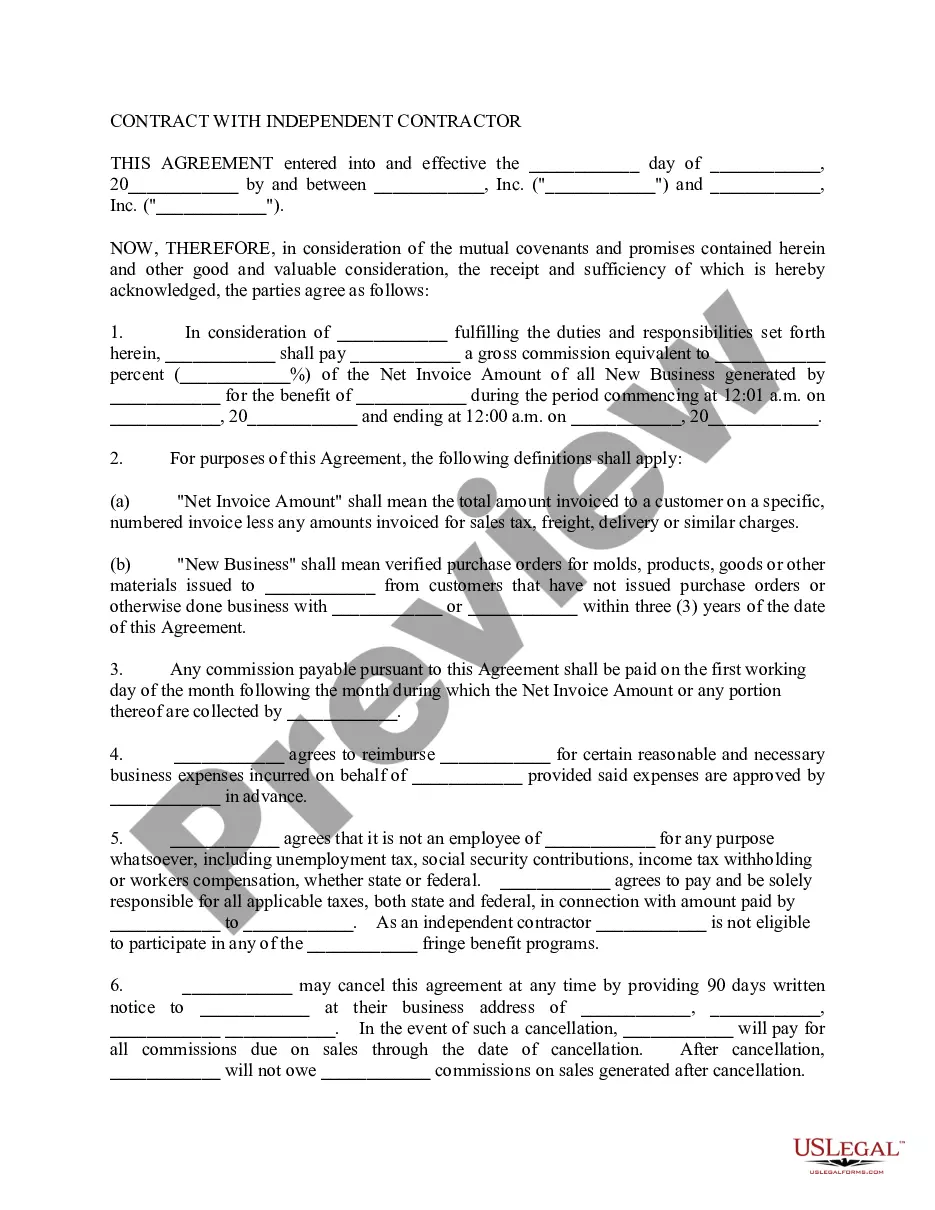

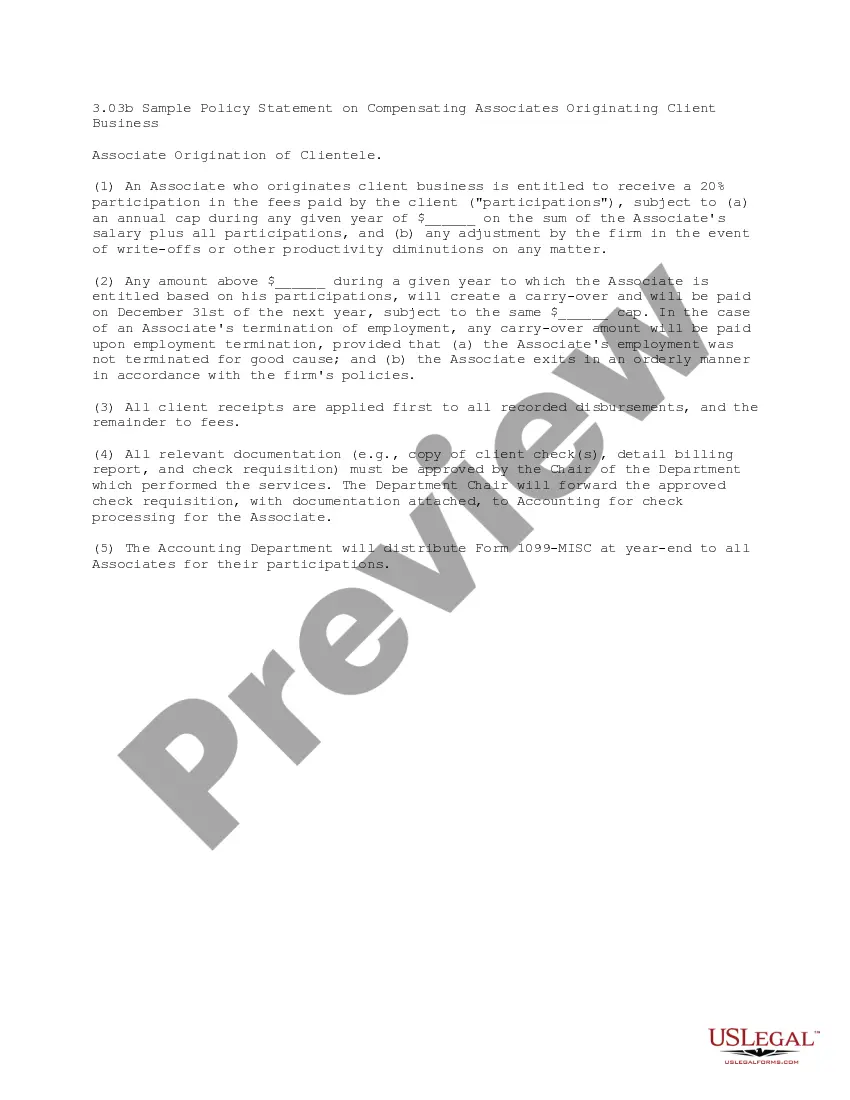

The sales commission policy outlines how sales representatives are compensated for their sales activities within a business. In Utah, this policy must comply with state regulations and tax requirements. Adhering to the Utah Sales Commission Policy not only helps maintain ethical standards but also builds trust between employers and employees regarding compensation.

To register for Utah state income tax withholding, you must complete the necessary registration form through the Utah State Tax Commission’s website. This form requires information about your business and the employees you plan to withhold taxes from. Proper registration is crucial to align with the Utah Sales Commission Policy and ensures you fulfill your payroll tax responsibilities correctly.

The Utah State Tax Commission administers tax laws for the state, managing various taxes, including sales tax, income tax, and property tax. They ensure compliance and fairness in the tax system, providing guidance on policies like the Utah Sales Commission Policy. By understanding their role, you can better navigate the tax obligations associated with operating a business in Utah.

Registering with the Utah State Tax Commission involves filling out the appropriate forms available on their website. Ensure you provide accurate information regarding your business structure and taxes. This registration is vital, especially if you wish to stay compliant with the Utah Sales Commission Policy, as it helps you manage your sales tax obligations effectively.

To obtain a Utah state tax ID number, you need to apply through the Utah State Tax Commission. This process can typically be completed online and requires your business information, including the type of business entity and contact details. Once your application is processed, you will receive your tax ID number, which is crucial for complying with the Utah Sales Commission Policy and for carrying out business transactions.

No, a sales tax permit and a tax-exempt certificate serve different purposes in Utah. A sales tax permit allows a seller to collect tax on sales, while a tax-exempt certificate enables qualifying buyers to avoid paying sales tax on certain purchases. Understanding this distinction is vital for complying with the Utah Sales Commission Policy.

To avoid sales tax on car purchases in Utah, you may explore exemptions available for eligible vehicles, including those used for certain business purposes. Additionally, understanding the proper documentation and tax exemption certificate requirements is crucial. Review the Utah Sales Commission Policy for comprehensive guidelines to make informed decisions.

Eligibility for a tax exemption certificate in Utah generally includes nonprofit organizations, government agencies, and certain educational or religious entities. Each category has specific guidelines that you must meet. You can check with the Utah State Tax Commission for more details to ensure compliance with the Utah Sales Commission Policy.

You might receive a letter from the Utah State Tax Commission regarding issues like audit notifications, tax adjustments, or updates to your tax status. Such communications aim to inform you about possible discrepancies or required actions related to your tax responsibilities. Staying informed through these updates helps you comply with the Utah Sales Commission Policy.