Utah Invoice Template for Chef

Description

How to fill out Invoice Template For Chef?

You may devote numerous hours online searching for the legal document template that fulfills the state and federal requirements you seek.

US Legal Forms offers countless legal forms that have been reviewed by experts.

You can download or print the Utah Invoice Template for Chef from our service.

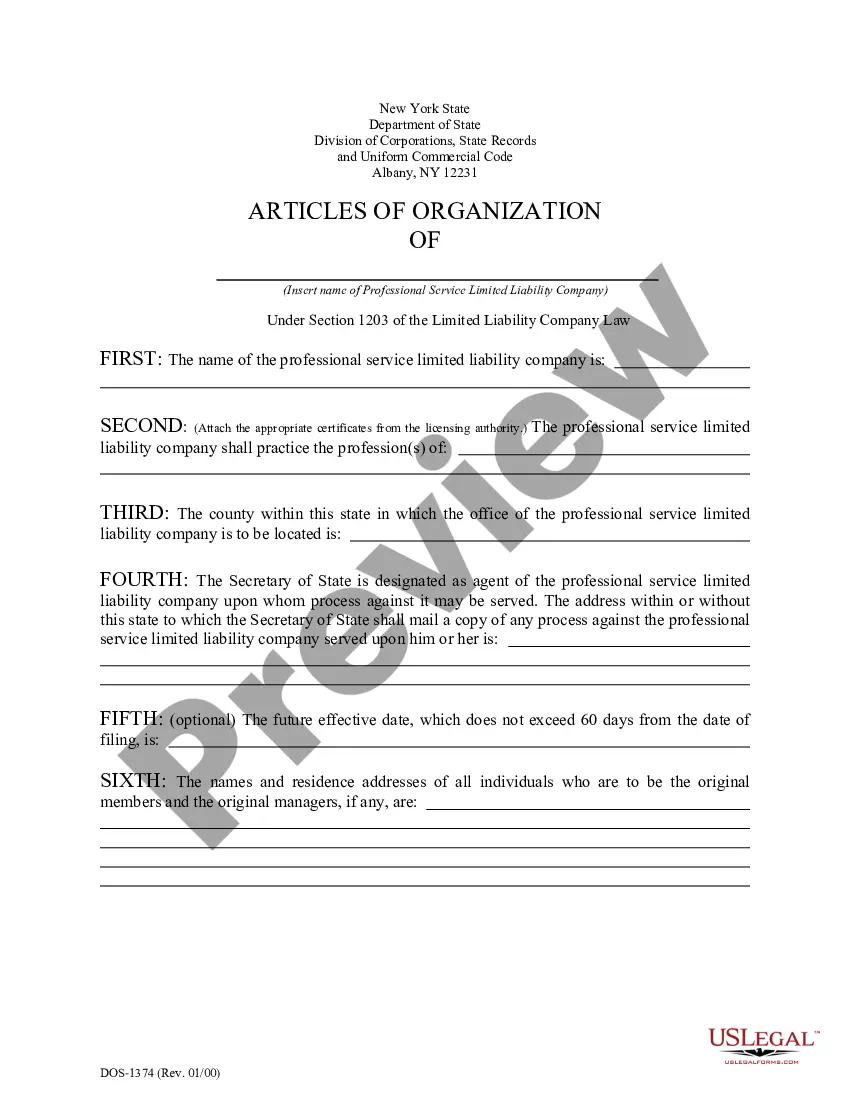

If available, utilize the Review button to browse the document template as well.

- If you possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Utah Invoice Template for Chef.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Review the form description to make sure you have selected the right one.

Form popularity

FAQ

Utah does not impose a tax on services, which includes various professional services. This absence allows chefs and other service providers to offer their expertise without additional taxation burdens on their customers. Leveraging a Utah Invoice Template for Chef can help service providers clearly outline their charges, making it easier to manage finances and attract clients.

Each state has its rules regarding sales tax, but several states do not impose sales tax on groceries. States like Maryland and Massachusetts provide this exemption, making them favorable for food businesses. If you are considering expanding your culinary services to other states, remember to adjust your Utah Invoice Template for Chef accordingly, reflecting local tax regulations for each state.

The TC 75 form in Utah serves as a vehicle registration application, relevant for those who need to register or title a vehicle. While this form may not directly tie into your culinary business, understanding the importance of proper documentation can enhance your professional image. When using a Utah Invoice Template for Chef, maintaining accurate records simplifies financial tracking and helps with such administrative tasks.

The sales tax in Utah generally stands at 4.85%. However, additional local taxes can increase this rate, depending on the specific area. If you are using a Utah Invoice Template for Chef, it is important to calculate the correct sales tax based on your location to ensure compliance. Having accurate sales tax details in your invoices helps build trust with your clients.

To write a food invoice, begin with your business and customer information at the top. Clearly describe the food items or services provided and their prices. Ensure to include any taxes and the total amount due. Using a Utah Invoice Template for Chef helps to maintain consistency and ensures you don’t overlook any details.

Writing a simple invoice involves including basic information such as your business name, the client’s name, and the services rendered. List each service with its corresponding amount, and clearly state the total due. For convenience, a Utah Invoice Template for Chef can be your go-to tool, allowing you to focus on your culinary creations while it handles the paperwork.

To fill out a service invoice sample, start by entering your business name, logo, and contact details at the top. Then, list the services provided with descriptions, quantities, and prices. Don’t forget to add payment instructions. By using a Utah Invoice Template for Chef, you can easily replicate this format and ensure all necessary information is included.

Filling out a contractor's invoice involves detailing your services, materials used, and the associated costs. Begin with your contact information followed by the client’s details. Ensure that you specify payment terms and any relevant dates. A Utah Invoice Template for Chef can assist you by guiding you through the required sections for clarity and efficiency.

Filling out an invoice template requires you to personalize it with your business and client information. Ensure to accurately describe the services, list the rates, and include the invoice number. If you choose a Utah Invoice Template for Chef, it streamlines this process by providing a predefined structure, making it easier to fill out.

The best wording for an invoice combines clarity and professionalism. Use phrases like 'Invoice for Services Rendered' or 'Payment Due' with specific details about the services. Incorporate your payment terms and a thank-you note at the bottom. Utilizing a Utah Invoice Template for Chef helps you include all necessary components while maintaining professionalism.