Utah Assignment and Bill of Sale of Equipment and Machinery

Description

How to fill out Assignment And Bill Of Sale Of Equipment And Machinery?

If you intend to total, obtain, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you've found the form you need, click the Download now button. Choose the payment plan you prefer and input your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Utah Assignment and Bill of Sale of Equipment and Machinery in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to obtain the Utah Assignment and Bill of Sale of Equipment and Machinery.

- You can also access forms you previously saved from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

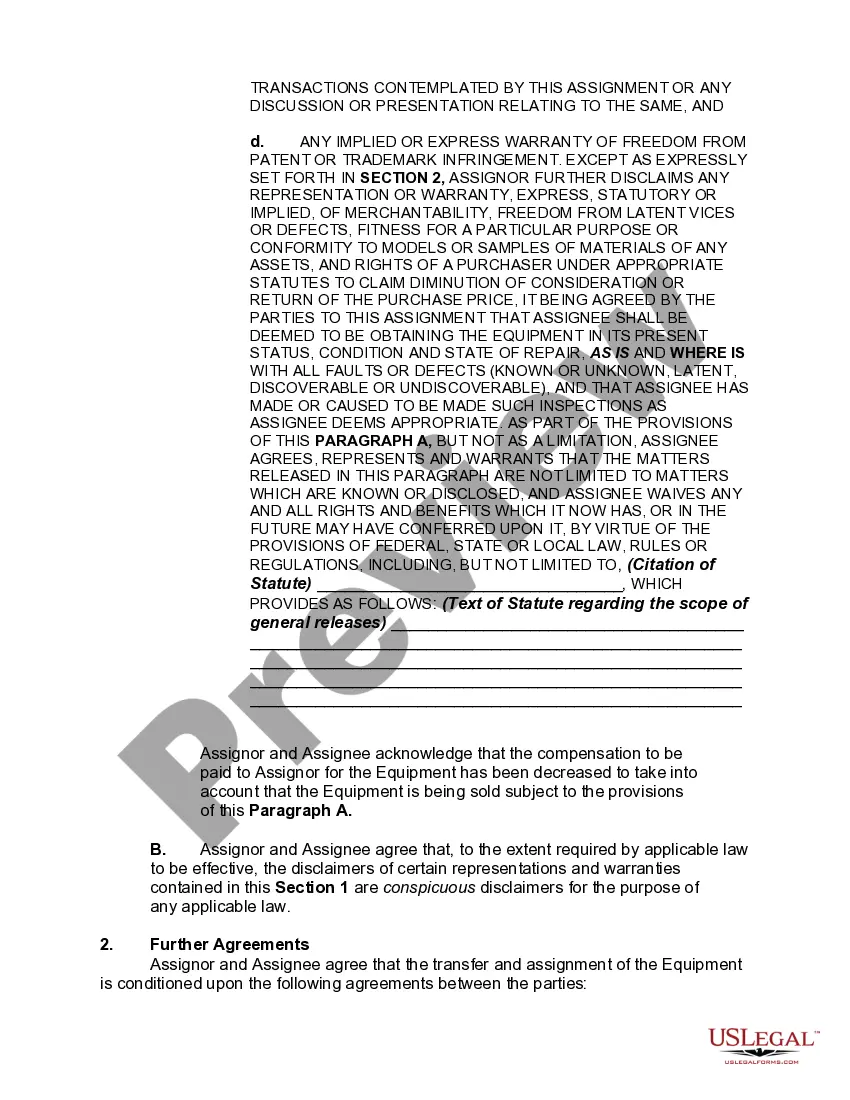

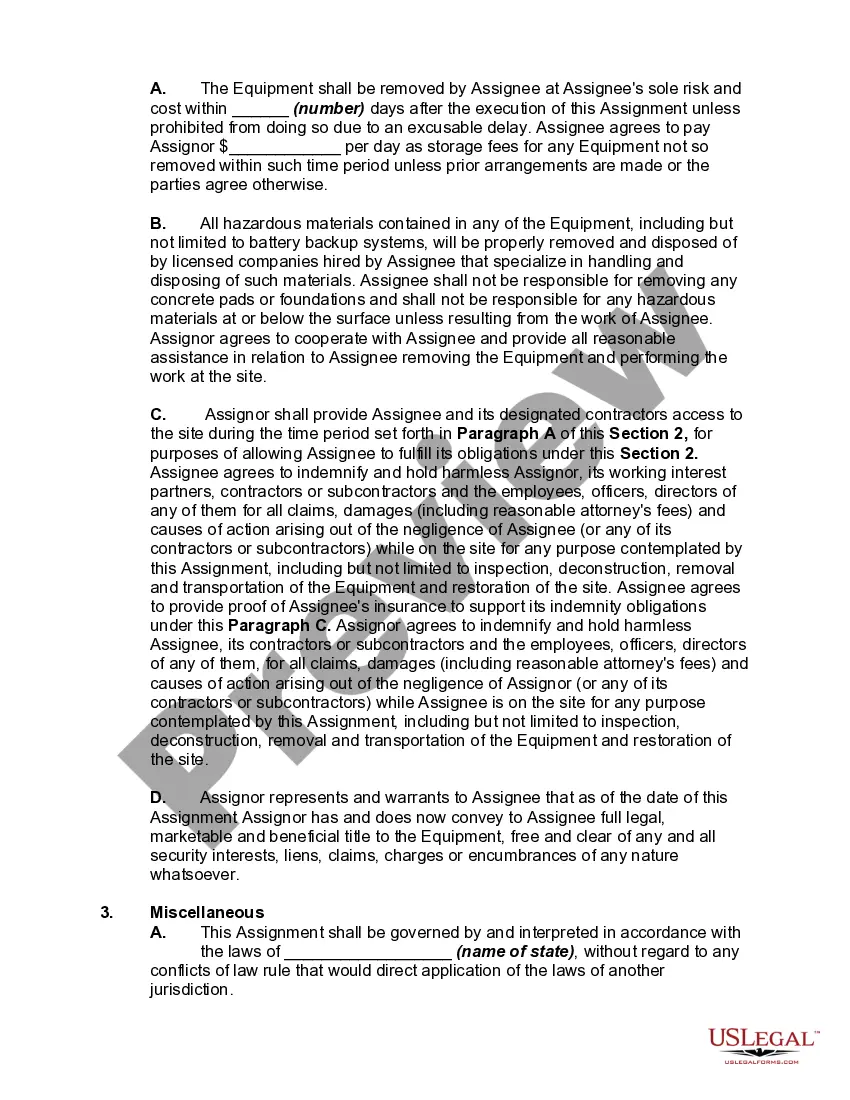

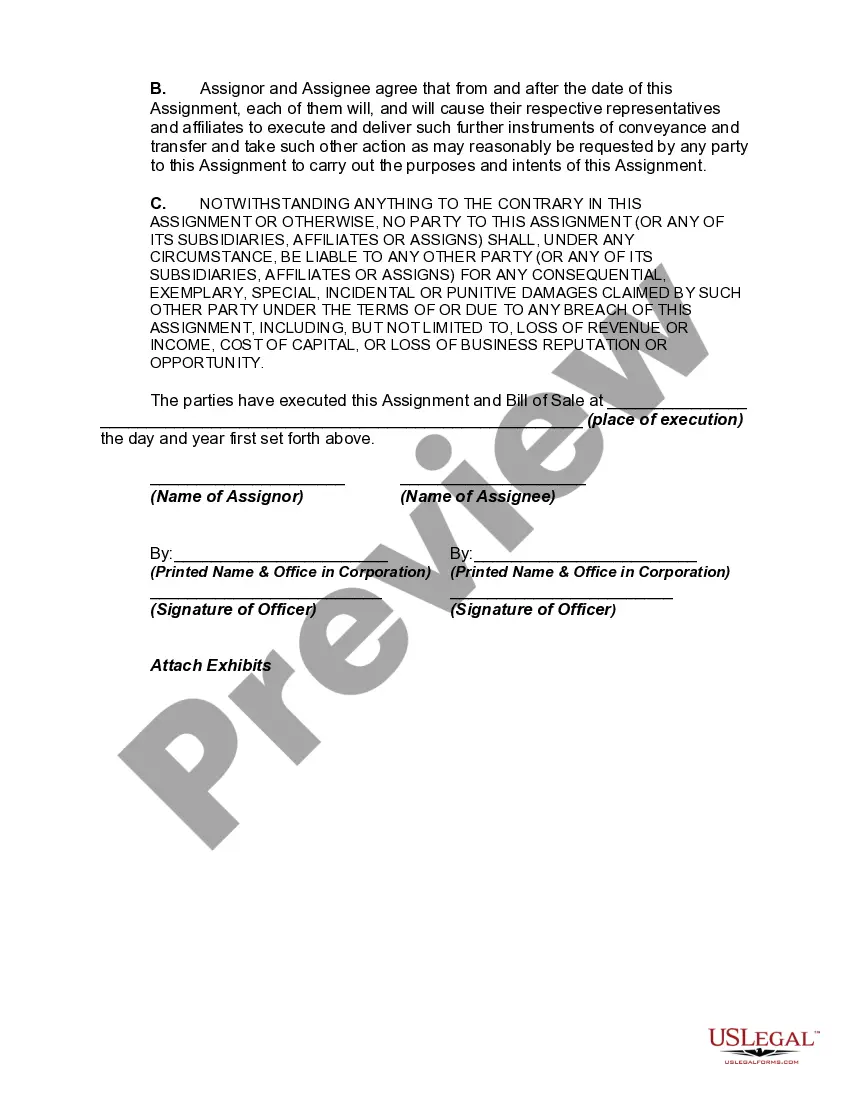

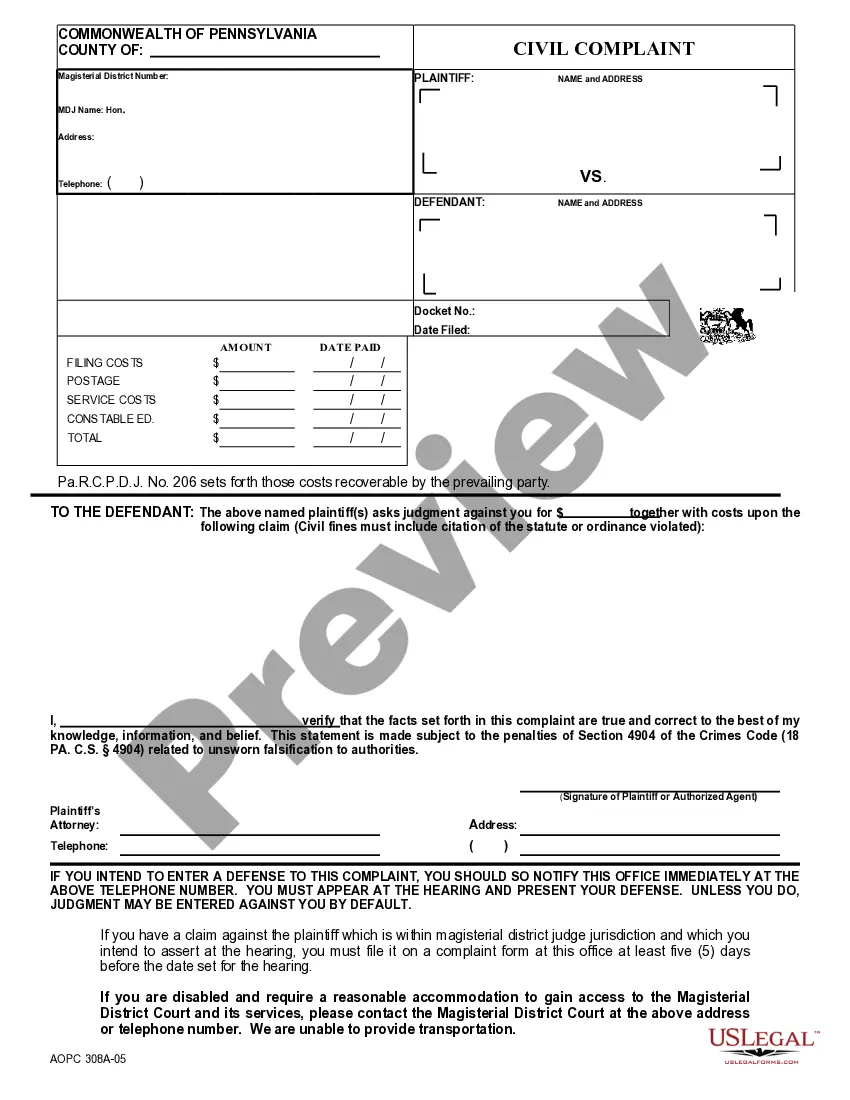

- Step 2. Use the Preview option to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To file taxes for an LLC in Utah, you will need your LLC's federal Employer Identification Number (EIN), financial statements, and any relevant documentation regarding sales, including any Utah Assignment and Bill of Sale of Equipment and Machinery. Prepare these documents ahead of time to streamline the filing process and ensure compliance with state regulations.

Yes, a handwritten bill of sale is legal in Utah as long as it includes all the necessary elements, such as the buyer's and seller's information, a description of the sold item, and signatures. However, for added security and clarity, it is recommended to use a structured form, like the Utah Assignment and Bill of Sale of Equipment and Machinery available through USLegalForms.

Utah operates as a destination state for sales tax purposes, meaning the tax is based on where the buyer uses the equipment or machinery. This affects your sales tax collection when you sell in Utah. Always remember to incorporate this into your sales strategy, especially when drafting a Utah Assignment and Bill of Sale of Equipment and Machinery.

Filling out a Utah title when selling equipment or machinery requires you to provide details like the vehicle identification number (VIN), odometer reading, and seller's signature. Ensure that the buyer's information also appears clearly. After completing the title, it is wise to create a Utah Assignment and Bill of Sale of Equipment and Machinery as a formal record of the transaction.

To file Utah sales tax online, you need to visit the Utah State Tax Commission's website. Create an account if you haven't already, then follow the prompts to enter your business information and sales details. Ensure you have all relevant documents, including any Utah Assignment and Bill of Sale of Equipment and Machinery related to equipment sales, ready for reference.

The primary difference between an assignment and a bill of sale lies in their purpose. An assignment transfers rights or interests in an item, while a bill of sale is a document that serves as proof of the sale transaction. For equipment and machinery in Utah, understanding these distinctions can help you choose the right documentation for your needs.

Whether or not to notarize your bill of sale is up to you and the specifics of your transaction. Notarizing adds a layer of trust and can help prevent future disputes. Think about the value of the equipment and machinery involved, as this may influence your decision.

An agreement of sale also does not need to be notarized in Utah. Similar to a bill of sale, notarization may help establish credibility. For transactions involving the Utah Assignment and Bill of Sale of Equipment and Machinery, notarization can support compliance with any local laws and regulations.

No, a bill of sale does not need to be notarized in Utah. While notarization is not a requirement, it can add an extra layer of trust to your transaction. If the equipment or machinery value is substantial, consider getting the bill of sale notarized to protect both parties.

Filling out a Utah bill of sale involves several steps. Start by including the date, names, and addresses of both the buyer and seller. Clearly describe the equipment or machinery being sold, including its condition. Finally, ensure both parties sign the document to make it official. You can use platforms like uslegalforms to access templates that simplify this process.