Utah General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can buy or print. By using the website, you can access thousands of documents for business and personal purposes, categorized by type, state, or keywords.

You can obtain the latest versions of documents such as the Utah General Form of Factoring Agreement - Assignment of Accounts Receivable in just minutes.

If you are registered, Log In and download the Utah General Form of Factoring Agreement - Assignment of Accounts Receivable from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the payment. Use a Visa or MasterCard or PayPal account to process the payment.

Retrieve the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Utah General Form of Factoring Agreement - Assignment of Accounts Receivable. Each template you add to your account has no expiration date and belongs to you indefinitely. Therefore, to download or print another copy, simply navigate to the My documents section and click on the document you wish.

- Ensure you have selected the correct document for your city/state.

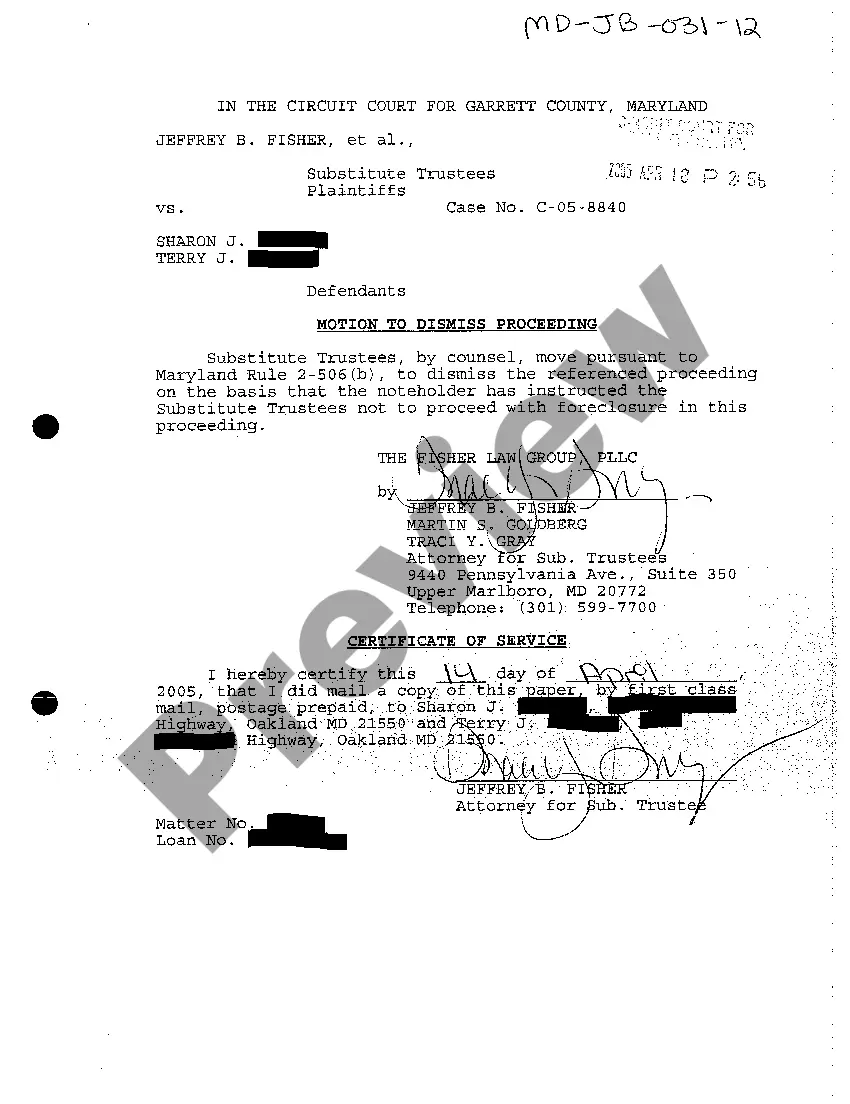

- Click on the Preview button to review the document's content.

- Examine the document summary to confirm you have chosen the correct form.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Download now button.

- Then, select your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

An assignment of accounts receivable typically allows the original company to retain some control over collections, while factoring often involves a complete transfer of rights to the third party. Utilizing the Utah General Form of Factoring Agreement - Assignment of Accounts Receivable can help delineate the specific rights and obligations inherent in either process.

A Notice of Assignment (NoA) is a document sent to your customers, informing them that their payment should be directed to the factoring company instead of your business. This process ensures transparency and reduces confusion regarding payment responsibilities. Incorporating a NoA in your Utah General Form of Factoring Agreement - Assignment of Accounts Receivable is essential for a smooth transition.

To factor accounts receivable, start by selling your outstanding invoices to a factoring company. The company then provides you with an upfront payment for these invoices, usually around 70% to 90% of their total value. Using a Utah General Form of Factoring Agreement - Assignment of Accounts Receivable simplifies this process, making it easier to manage your finances.

The factoring rate for accounts receivable varies based on several factors, including the industry, the client's financial health, and the factoring company. Typically, rates can range from 1% to 5% of the invoice amount. Understanding your options is crucial when choosing a Utah General Form of Factoring Agreement - Assignment of Accounts Receivable.

Factoring is the sale of receivables, whereas invoice discounting ("assignment of accounts receivable" in American accounting) is a borrowing that involves the use of the accounts receivable assets as collateral for the loan.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.

For example, if you sell $100,000 worth of accounts receivables and get a 90 percent advance, you will receive $90,000. The accounts receivable factoring company holds the remaining 10-percent or $10,000 as security until the payment of the invoice or invoices have been received.

How to Factor InvoicesYour business invoices a customer and sends a copy to the factoring company.The factor then funds your business with an advance typically between 70% to 90% of the invoice amount.Your business gets the remaining invoice amount, minus a small fee, once the customer pays the invoice.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

Note: $20,000 factor fee is considered interest expense because the company obtained cash flow earlier than it would have if it waited for the receivables to be collected.