This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Petition to Determine Distribution Rights of the Assets of a Decedent

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

US Legal Forms - one of many biggest libraries of authorized types in the USA - gives a wide range of authorized record web templates you may down load or print. Utilizing the internet site, you can find a large number of types for company and person reasons, sorted by classes, claims, or keywords.You can get the latest types of types just like the Utah Petition to Determine Distribution Rights of the Assets of a Decedent in seconds.

If you already have a monthly subscription, log in and down load Utah Petition to Determine Distribution Rights of the Assets of a Decedent from the US Legal Forms collection. The Download option will show up on each type you see. You have access to all previously downloaded types inside the My Forms tab of your own profile.

In order to use US Legal Forms the first time, allow me to share basic instructions to obtain started out:

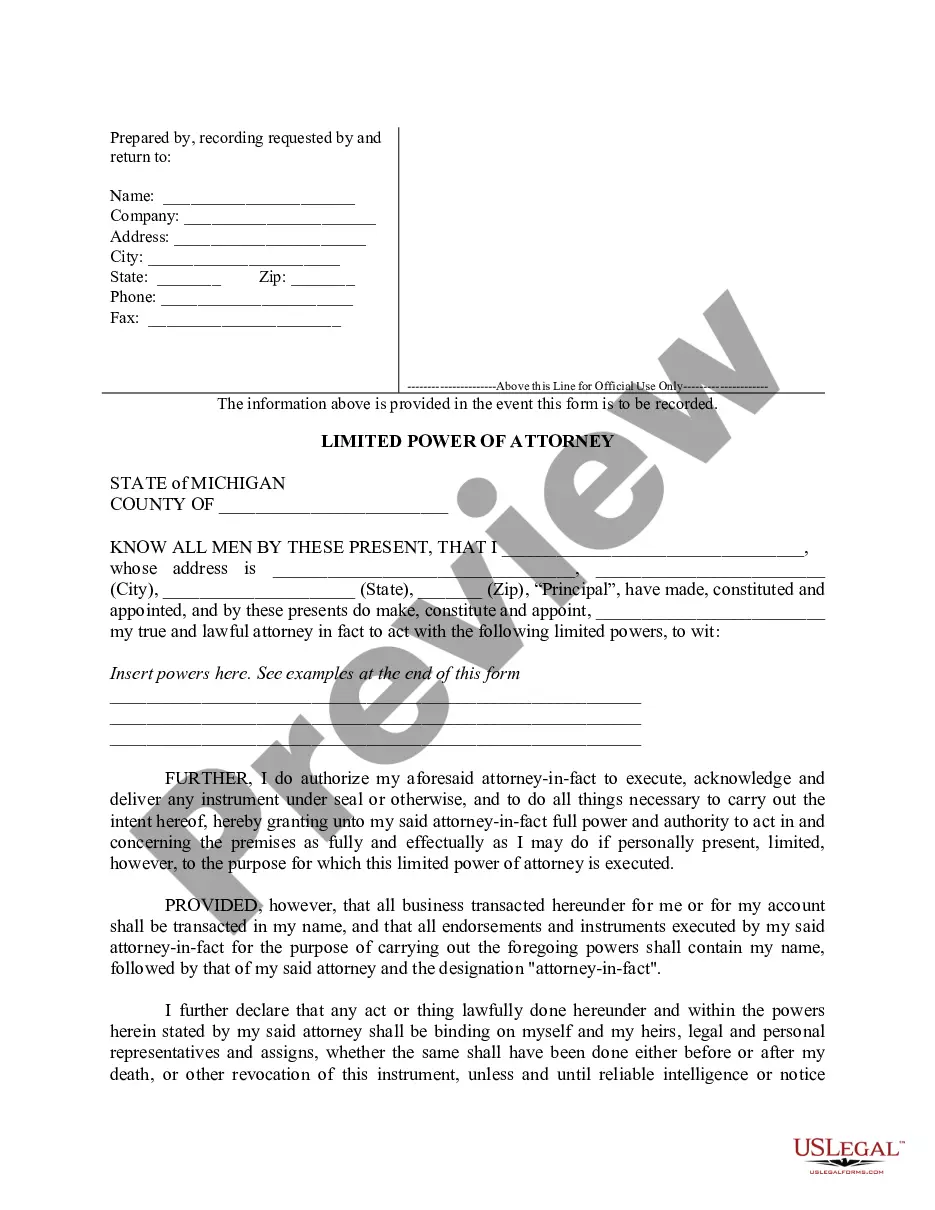

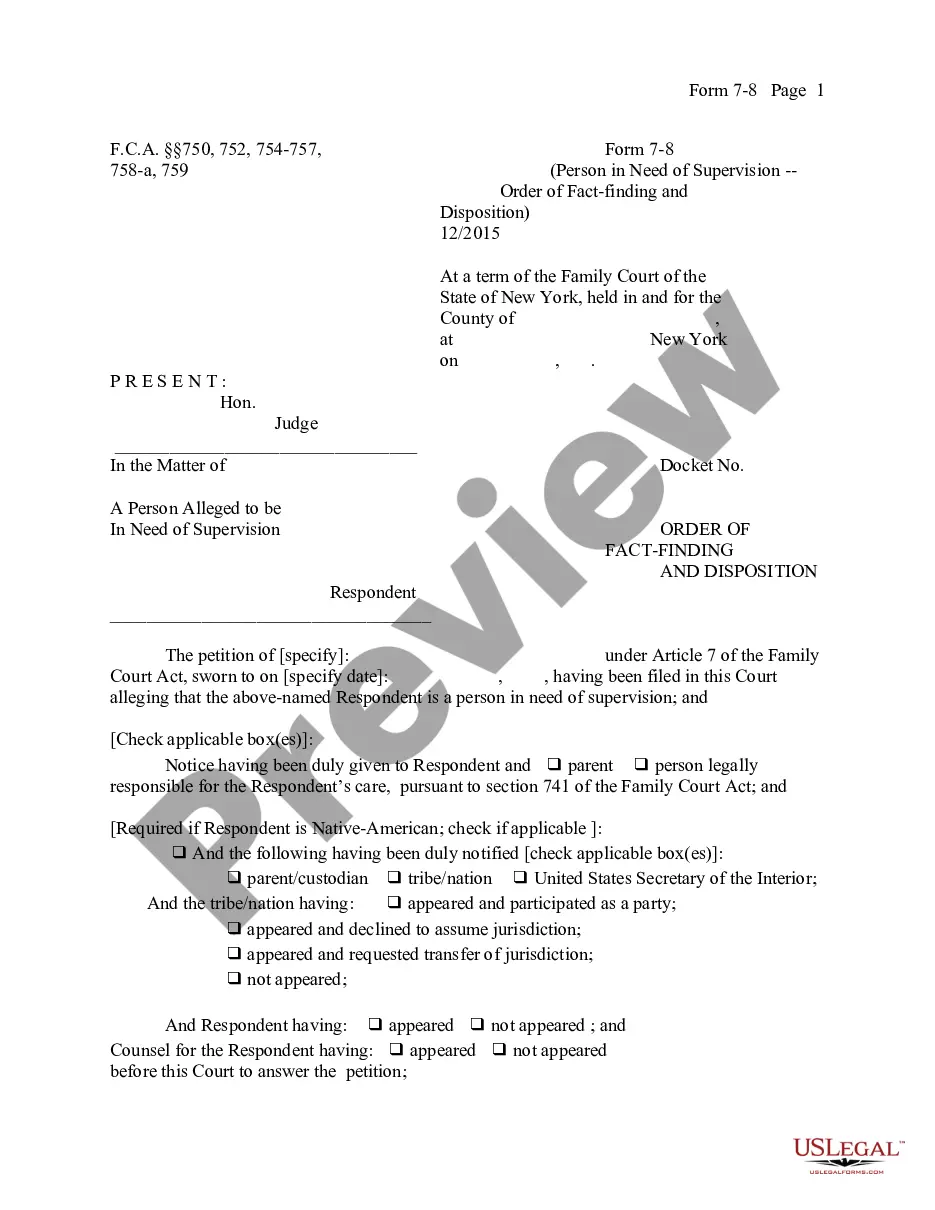

- Be sure you have chosen the right type for the area/state. Select the Preview option to review the form`s articles. Read the type information to ensure that you have chosen the correct type.

- When the type doesn`t match your requirements, make use of the Search field on top of the monitor to find the one which does.

- If you are pleased with the form, validate your choice by visiting the Buy now option. Then, opt for the costs plan you want and give your credentials to register for the profile.

- Approach the purchase. Utilize your bank card or PayPal profile to finish the purchase.

- Select the structure and down load the form in your device.

- Make modifications. Fill out, modify and print and signal the downloaded Utah Petition to Determine Distribution Rights of the Assets of a Decedent .

Each format you included in your account lacks an expiration date and is also your own property eternally. So, if you wish to down load or print yet another copy, just visit the My Forms portion and click around the type you require.

Gain access to the Utah Petition to Determine Distribution Rights of the Assets of a Decedent with US Legal Forms, probably the most comprehensive collection of authorized record web templates. Use a large number of specialist and state-distinct web templates that meet up with your business or person demands and requirements.

Form popularity

FAQ

A will is a legal document that sets forth your wishes regarding the distribution of your property and the care of any minor children. If you die without a will, those wishes may not be carried out.

If the decedent passes property to beneficiaries through contract, the assets will be passed along outside of the formal probate process. If the decedent died with a will, property will be distributed in ance with the will's directions. If the decedent set up a trust, trust property will be distributed that way.

A distribution is the delivery of cash or an asset to a given heir. After resolving debts and paying any taxes due, the executor should distribute the remaining estate to the heirs in ance with the instructions in the will (or as dictated by the court).

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The basic role of the probate court judge is to assure that the deceased person's creditors are paid, and that any remaining assets are distributed to the proper beneficiaries.

Common sources of information about asset existence include: The will. A list the decedent prepared in advance. The decedent's lawyer or tax accountant.