Utah Agreement to Compromise Debt by Returning Secured Property

Description

How to fill out Agreement To Compromise Debt By Returning Secured Property?

Are you currently in a position where you frequently require documents for both business or personal purposes? There are many legal document templates accessible online, but finding reliable ones isn’t easy.

US Legal Forms provides a multitude of form templates, including the Utah Agreement to Compromise Debt by Returning Secured Property, which are designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess your account, simply Log In. Then, you can download the Utah Agreement to Compromise Debt by Returning Secured Property template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Utah Agreement to Compromise Debt by Returning Secured Property at any time if needed. Just select the desired form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/state.

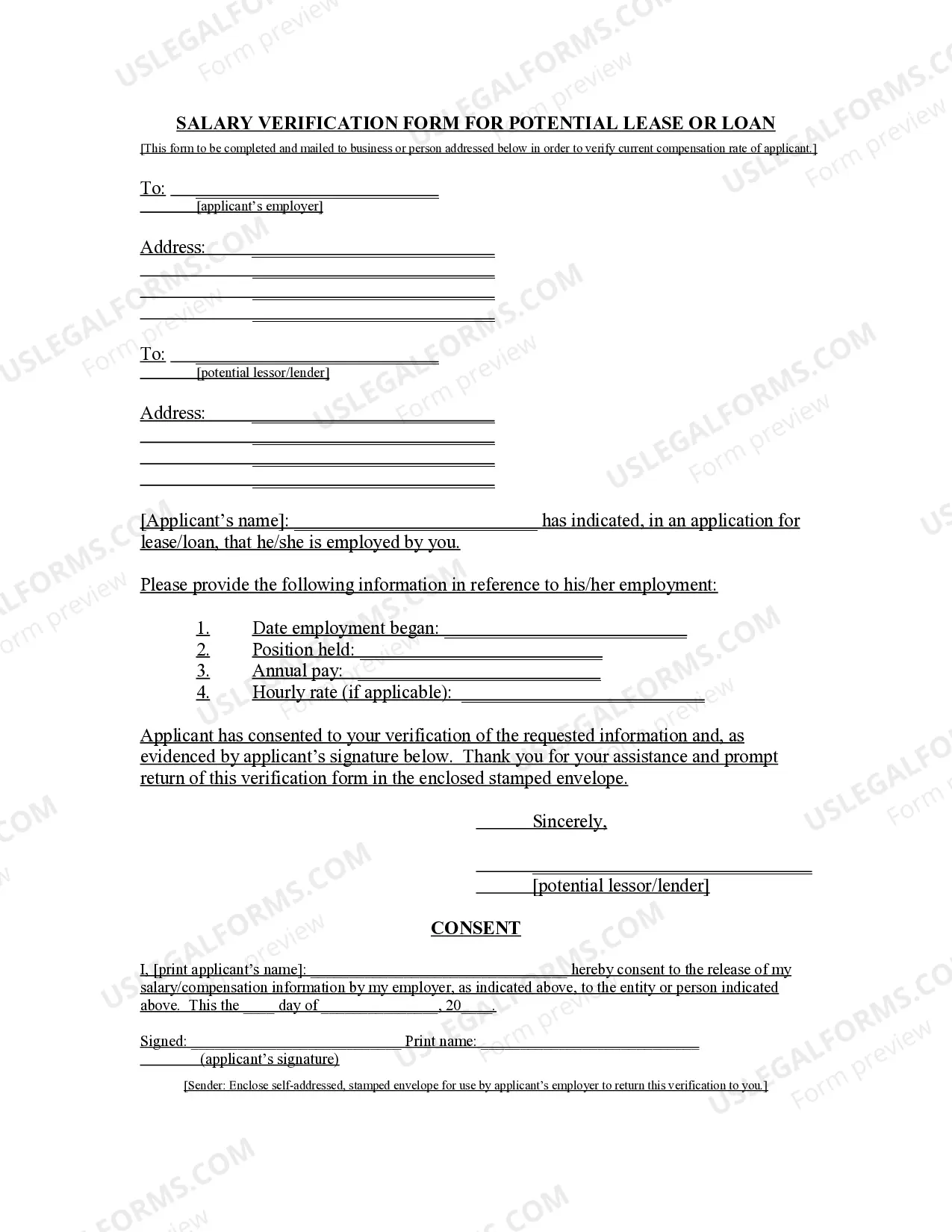

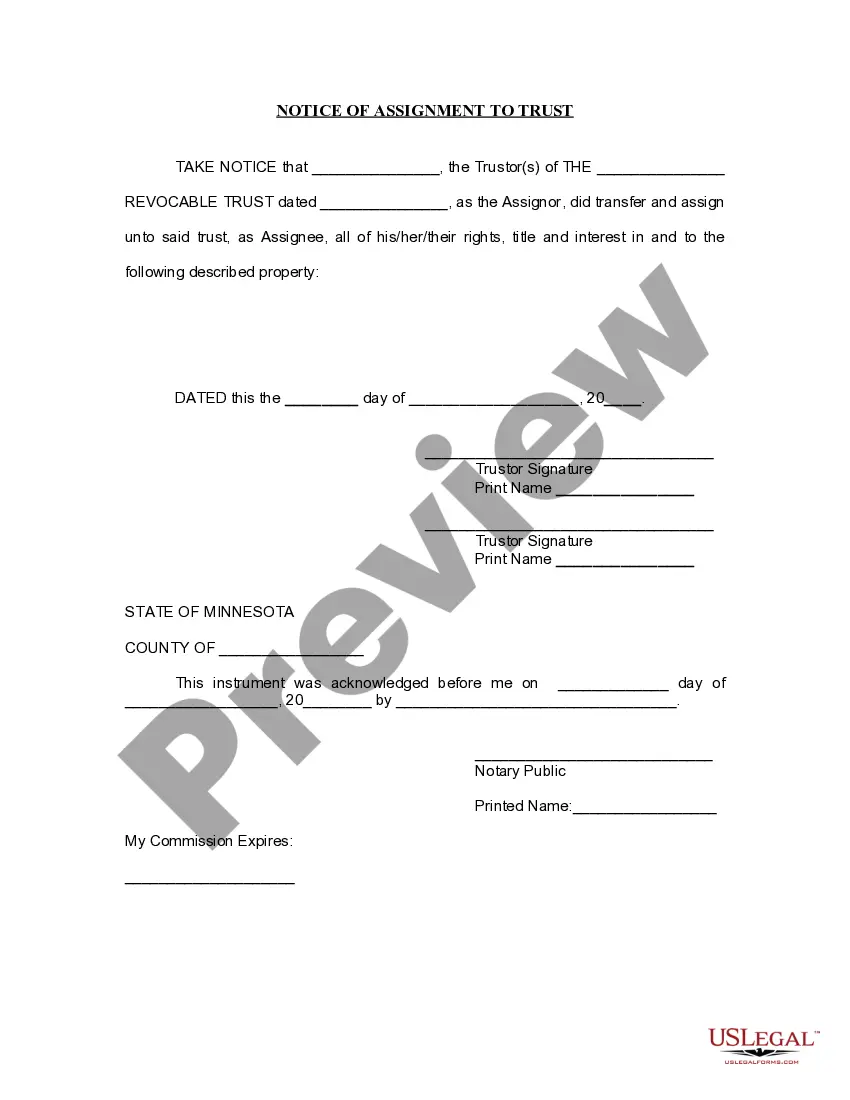

- Utilize the Preview button to review the form.

- Check the summary to confirm that you have selected the appropriate form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and specifications.

- Once you have the correct form, click Buy now.

- Select the pricing plan you want, enter the required information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

One downside to an offer in compromise, especially regarding the IRS, is that it can impact your credit score. Furthermore, the IRS may require you to disclose detailed financial information, which can be intrusive. Although the Utah Agreement to Compromise Debt by Returning Secured Property can alleviate some debts, it is essential to weigh the benefits against potential long-term consequences.

Receiving a letter from the Utah state tax commission can indicate a number of things regarding your tax situation. The letter may pertain to outstanding debts or questions about your tax filings. It's essential to read the letter carefully and respond promptly to avoid complications, especially if you are considering options like the Utah Agreement to Compromise Debt by Returning Secured Property.

The timeline for an offer in compromise, particularly with the Utah Agreement to Compromise Debt by Returning Secured Property, can vary. Generally, you might expect a response within six to twelve months. However, delays can occur, especially if additional documentation is required. It’s important to be patient and follow up with the tax authority if needed.

In Utah, the penalty for reckless driving can include fines, points on your driving record, and even possible jail time depending on the severity of the offense. While this may seem unrelated to the Utah Agreement to Compromise Debt by Returning Secured Property, any incurred legal issues can impact your financial situation. Maintaining good standing with your driving record is essential in preserving your overall financial health, thus helping you avoid unnecessary complications.

Section 25 5 of the Utah Code establishes the rules governing debt settlements and compromises, including those pertaining to the Utah Agreement to Compromise Debt by Returning Secured Property. This section details how debtors and creditors can legally manage debt obligations, allowing financial resolutions without court involvement. Understanding these rules can facilitate smoother negotiations and outcome resolutions in debt management.

Utah Code 57 1 38 addresses the rights and responsibilities of lienholders concerning the property they secure. This code can play a significant role in the context of the Utah Agreement to Compromise Debt by Returning Secured Property, as it outlines the legal standing of creditors and the steps they must take in debt resolution processes. Familiarity with this code can offer critical insights into lien disputes and property transfers.

In Utah, substitution of trustee refers to the process of replacing the original trustee in a trust deed, a critical step in the context of the Utah Agreement to Compromise Debt by Returning Secured Property. Full reconveyance occurs when a mortgage is satisfied, releasing the lien on the property. Both concepts are vital for property owners to understand when dealing with secured debts and are often part of the negotiation process with creditors.

Section 25 5 4 of the Utah Code pertains to the Utah Agreement to Compromise Debt by Returning Secured Property. This section outlines the legal framework governing how debtors can settle their debts through the return of secured property rather than monetary payment. It helps individuals avoid foreclosure by allowing them to reach a mutual agreement with creditors. Understanding this section can empower you to make informed choices regarding debt management.

When settling a debt, you might consider offering a percentage between 30% and 70% of the total amount owed, depending on your financial situation. It’s wise to base your offer on what you can afford, reflecting your commitment to resolve the matter. Utilizing the Utah Agreement to Compromise Debt by Returning Secured Property may also guide your negotiations, allowing you to protect essential assets.

Writing a debt settlement agreement requires you to detail the debt amount, the settlement offer, and any necessary dates for payments. Clearly outline the terms and conditions, including any provisions related to the Utah Agreement to Compromise Debt by Returning Secured Property. This agreement should be signed by all parties to ensure that everyone is in agreement and accountable.