Utah Assignment of Property in Attached Schedule

Description

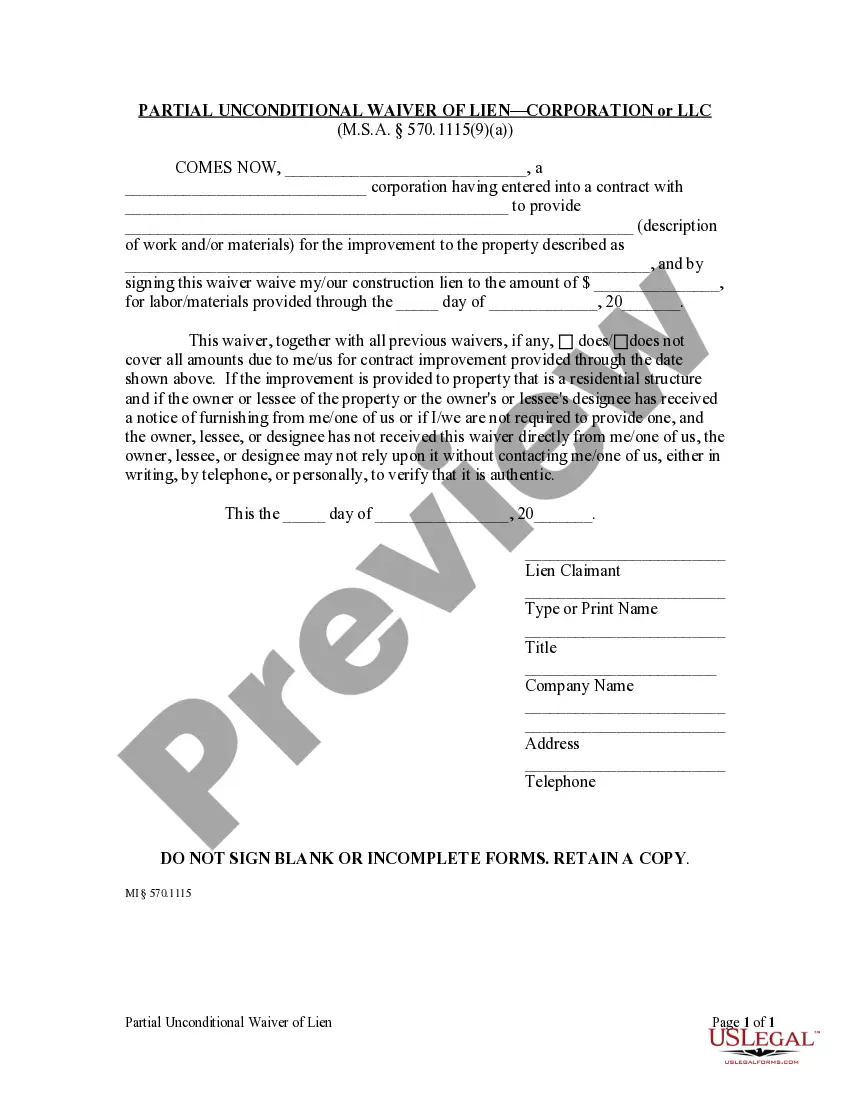

How to fill out Assignment Of Property In Attached Schedule?

If you desire to finalize, obtain, or print legal form templates, utilize US Legal Forms, the most extensive repository of legal forms available on the web.

Take advantage of the website’s straightforward and smooth search feature to find the documents you require.

An assortment of templates for commercial and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you want, click the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Utah Assignment of Property in Attached Schedule with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click on the Download button to obtain the Utah Assignment of Property in Attached Schedule.

- You can also access forms you have previously acquired under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to browse through the form's details. Be sure to read the information thoroughly.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find alternative versions of the legal form template.

Form popularity

FAQ

Utah does not impose a Personal Tangible Property (PTE) tax on residents. Instead, individuals and businesses are tasked with reporting their property in the Utah Assignment of Property in Attached Schedule. This approach simplifies the reporting process, making it clear for asset owners how to disclose their holdings correctly. If you have questions about navigating property assignment in Utah, US Legal Forms provides the resources you need to ensure compliance.

To file Form TC 41, the Utah Amended Income Tax Return, you'll need to send it to the Utah State Tax Commission. Ensure to follow the latest guidelines on the correct mailing address, which can change. For individuals involved in property management, understanding this filing can be pertinent when considering aspects of the Utah Assignment of Property in Attached Schedule.

In Utah, the minimum taxable limit for individuals generally aligns with federal standards but can vary depending on different deductions and exemptions. This means understanding your taxable income fully is vital for compliance. If you have queries on how this relates to your property assignments, the Utah Assignment of Property in Attached Schedule could play a role in your tax strategy.

For entities filing Form TC 20, the minimum tax liability is generally based on taxable income and can vary widely. However, businesses should account for a minimum tax obligation alongside other operational costs. If you're managing property-related taxes, understanding the implications of the Utah Assignment of Property in Attached Schedule is essential.

Utah has a flat state income tax rate, which means the minimum state tax rate is currently fixed at 4.85%. This rate applies uniformly to various income brackets, simplifying the calculation process for taxpayers. The implications of your income regarding the Utah Assignment of Property in Attached Schedule should be carefully reviewed to optimize your tax strategy.

You must file Form TC 65, the Nonresident Tax Return, with the Utah State Tax Commission. This form handles taxes for individuals or entities who earn income in Utah but reside elsewhere. Using uslegalforms can simplify filing and ensure your Utah Assignment of Property in Attached Schedule meets state requirements.

In Utah, property tax exemptions for seniors typically apply to individuals aged 66 and older, provided they meet certain income criteria. This can significantly ease financial burdens for elderly homeowners. If you're considering how exemptions relate to the Utah Assignment of Property in Attached Schedule, consult with a tax professional for tailored advice.

Utah does not impose a franchise tax as part of its business tax structure. Instead, businesses may be liable for a corporation tax, which is based on a percentage of the property's income. Utilizing resources like uslegalforms can provide clarity on how costs related to Utah Assignment of Property in Attached Schedule could impact your tax obligations.

In Utah, the threshold for paying sales tax varies based on your business activities. Generally, if you have gross sales over $100,000 in the state, you will be required to collect and remit sales tax. Keep in mind that understanding how to handle sales tax correctly is crucial for compliance, especially when dealing with any Utah Assignment of Property in Attached Schedule.

In Utah, there are no specific laws that limit how much a landlord can raise rent, unless a lease agreement stipulates otherwise. This means landlords have the freedom to decide on rent increases, but they should notify tenants within a reasonable timeframe. Consulting resources such as USLegalForms can guide you through the specifics of rent increases, ensuring you remain compliant while utilizing the Utah Assignment of Property in Attached Schedule effectively.