Utah Sample Letter to Include Article Relating to Tax Sales

Description

How to fill out Sample Letter To Include Article Relating To Tax Sales?

Have you found yourself in a situation where you require documents for both business or personal purposes almost every day.

There is an abundance of legal document templates accessible online, but locating versions you can trust is not easy.

US Legal Forms offers thousands of form templates, such as the Utah Sample Letter to Include Article Relating to Tax Sales, which are crafted to comply with federal and state regulations.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Utah Sample Letter to Include Article Relating to Tax Sales template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/county.

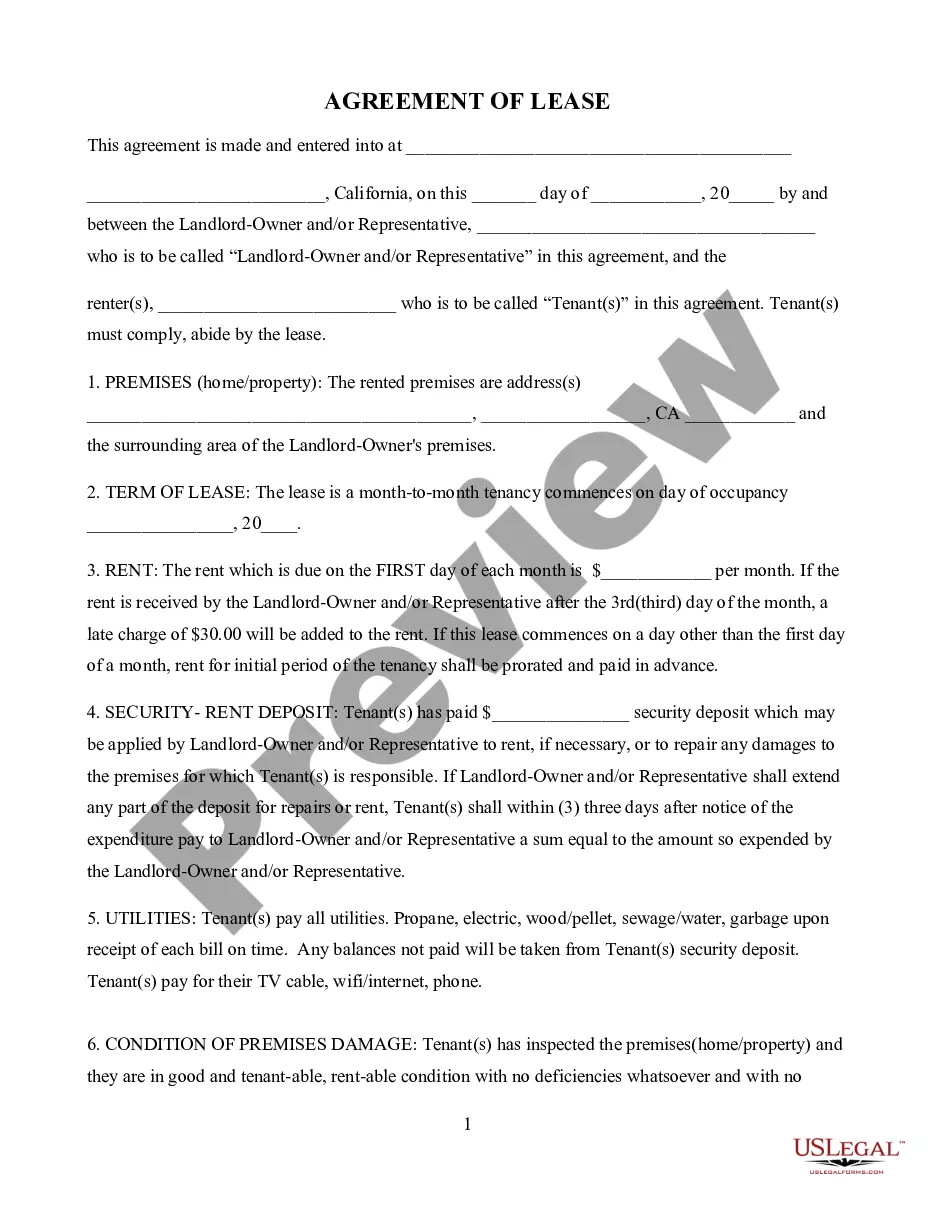

- Utilize the Preview feature to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search bar to find the form that suits your needs.

- Once you have obtained the right form, click Get now.

Form popularity

FAQ

The state uses a flat tax rate of 4.95% for all income levels and the sales tax rate is 4.85%.

If you need to change or amend an accepted Utah State Income Tax Return for the current or previous Tax Year you need to complete Form TC-40. Form TC-40 is a Form used for the Tax Return and Tax Amendment. You can prepare a current tax year Utah Tax Amendment on eFile.com, however you can not submit it electronically.

Find Your Utah Tax ID Numbers and Rates You can find your Withholding Account ID on any mail you have received from the State Tax Commission, or or any previously filed tax forms. If you're unsure, contact the agency at (801) 297-2200.

TC-62S, Sales and Use Tax Return for Single Place of Business ? For Printing.

TC-69, Utah State Business and Tax Registration.

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records ? we may ask you to provide the documents at a later time.

SEPARATE AND RETURN ONLY THE BOTTOM COUPON WITH PAYMENT. KEEP TOP PORTION FOR YOUR RECORDS. Use payment coupon TC-559 to make the following corporate/partnership tax payments: 1) Estimated tax payments 2) Extension payments 3) Return payments Mark the circle on the coupon that shows the type of payment you are making.

?SALT tax? means a state income tax payment made by a PTE on behalf of a Final PTET on voluntary taxable income. ?Voluntary taxable income? means PTE income that is attributed to a Final PTET who is a Utah resident individual or PTE income derived from Utah sources that is attributed to a nonresident individual.