Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements

Description

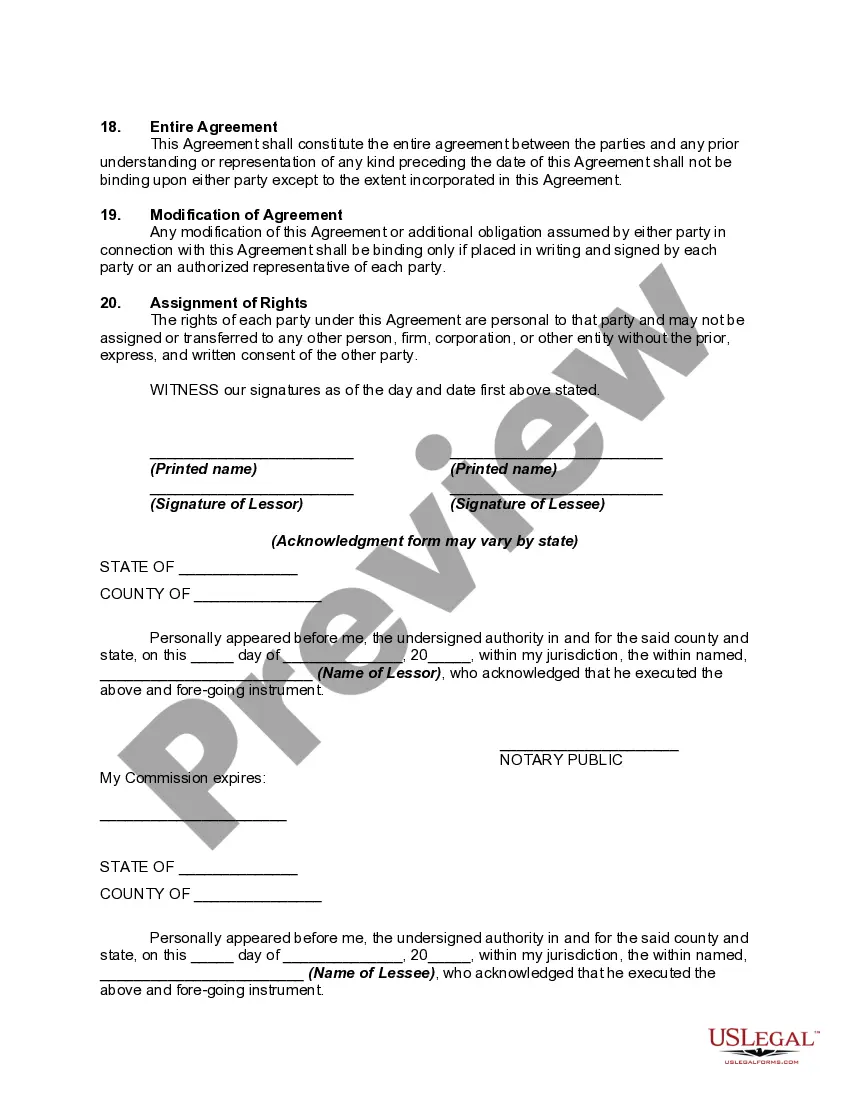

How to fill out Farm Lease Or Rental With Right To Make Improvements And Receive Reimbursements?

US Legal Forms - one of the top libraries of legal documents in the United States - provides an extensive variety of legal form templates that can be downloaded or printed.

Through the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements in just a few minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Upon satisfaction with the form, confirm your selection by clicking the Buy now button. Then, select your preferred payment plan and provide your details to create an account.

- If you hold a monthly membership, Log In and download the Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to assist you in getting started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the form's content.

Form popularity

FAQ

A farm lease is a contract that outlines the terms under which farmland is rented out for farming operations. A Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements specifically provides additional benefits, allowing farmers to make improvements and receive reimbursements for their investments. Such a lease helps in establishing clear expectations for both the tenant and the landlord, fostering a successful and sustainable farming environment. Utilizing a trusted platform like uslegalforms can simplify the process of creating effective lease agreements that cover all essential aspects.

An on-farm lease is a legal agreement between a landowner and a farmer, allowing the farmer to use the land for agricultural purposes. In the context of a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, farmers can make necessary modifications to the land to optimize farming operations. This type of lease not only secures rights for the land but also allows for improvements, ensuring a better return for both parties involved. Overall, it encourages collaboration between landowners and farmers.

Leasing farmland, particularly under a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, can be a wise financial move. This arrangement not only allows you to use the land for your farming needs but also provides a potential for reimbursements on improvements you make. Thus, it minimizes your upfront costs while letting you enhance the property’s value. Many investors find this strategy beneficial as it often leads to increased agricultural productivity.

The Right to Farm Act in Utah is designed to protect farmers from nuisance lawsuits related to agricultural activities. It encourages the preservation of farming in rural areas, thereby supporting local agriculture. If you are considering a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, this act safeguards your right to farm without fear of legal challenges.

The Utah Farmland Assessment Act allows qualifying landowners to have their farmland assessed based on its agricultural value rather than its market value. This can significantly lower property taxes for farmers. If you have a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, this act can enhance your profitability by reducing your tax burden.

The Farmland Protection Policy Act aims to protect the nation's agricultural resources. This legislation helps ensure that farmland remains available for agricultural production and prevents urban sprawl. If you are engaged in a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, this law supports your commitment to sustainable farming practices.

Building a house on greenbelt land in Utah is generally not permitted, as this land is designated for agricultural purposes. However, local zoning laws and regulations can vary, so you should check with your local authorities. If you are considering a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, understanding these regulations is crucial for your investment plans.

You can report farm rental income using Schedule E on your tax return. You should include expenses associated with the rental to accurately reflect your taxable income. If you are utilizing a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, keep thorough records to ensure you claim all possible deductions.

Farm rent is generally not considered earned income; it is categorized as passive income. However, this distinction can affect your overall tax liability, especially if you have a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements. Understanding the nuances of your income will help you in your tax planning.

Form 4835 is a tax form used to report farm rental income and expenses. Specifically, it is for reporting income from leasing your farm to tenants who operate it. If you earn income from a Utah Farm Lease or Rental with Right to Make Improvements and Receive Reimbursements, this form helps you accurately report that income to the IRS.