Utah Rejection of Goods

Description

How to fill out Rejection Of Goods?

Finding the appropriate legal document template can be challenging.

There are numerous templates accessible online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Utah Rejection of Goods, suitable for business and personal use. Each of the forms is vetted by experts and meets federal and state regulations.

Once you confirm that the form is correct, click the Buy Now button to obtain the form. Select the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Utah Rejection of Goods. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain well-crafted documents that adhere to state standards.

- If you are already registered, sign in to your account and click the Download button to retrieve the Utah Rejection of Goods.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

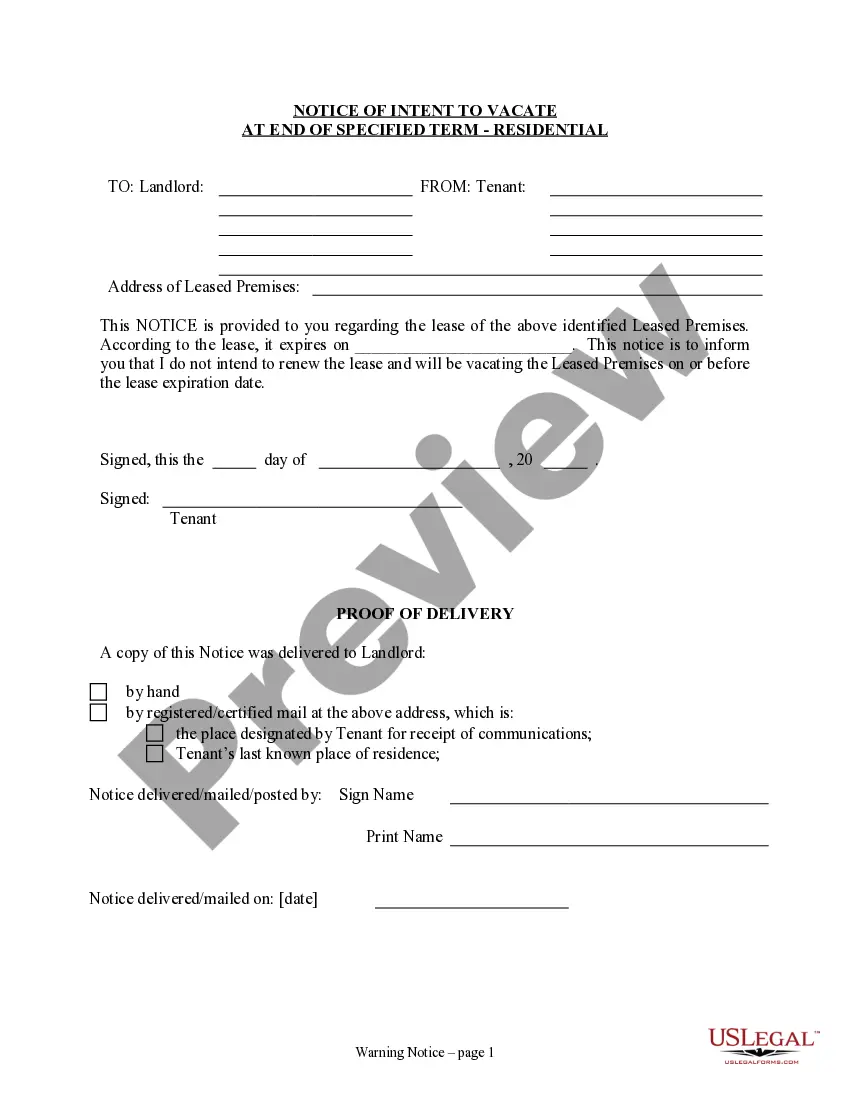

- First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and review the form description to ensure it meets your needs.

- If the form does not satisfy your requirements, utilize the Search box to locate the right form.

Form popularity

FAQ

Yes, there is a statute of limitations for taxes owed in Utah, typically lasting for three years. If the state asserts fraud, this period may extend beyond three years. Understanding this limitation can help you plan your financial strategies. Knowledge of Utah Rejection of Goods can also provide insight into managing these obligations responsibly.

Yes, Utah sales tax can be recoverable under certain circumstances. If you have overpaid or were not responsible for the tax, you can file for a refund. Familiarizing yourself with the process is crucial, and having the right forms can help. This process can intersect with matters concerning Utah Rejection of Goods, impacting your overall strategy.

In Utah, the statute of limitations on sales tax is generally three years from the date the tax return was due. This window can be extended if the state finds evidence of fraud. Staying informed about your rights regarding sales tax can save you from unforeseen issues. This ties into understanding concepts such as Utah Rejection of Goods.

Reporting an unlicensed business in Utah involves contacting the Utah Division of Occupational and Professional Licensing. You can provide details through their online platform or by calling their office. Documenting your interactions and experiences can strengthen your report. Keep in mind how Utah Rejection of Goods might relate to the business practices of unlicensed companies.

If you wish to file a complaint against a property management company in Utah, start by gathering all your documentation related to the issue. You can submit your complaint to the Utah Division of Real Estate online. Utilizing services like US Legal Forms can simplify your paperwork and ensure compliance. Knowledge of Utah Rejection of Goods can be helpful in your case.

To file an anonymous complaint about a business in Utah, you can use online forms provided by state agencies. Make sure to include relevant details without revealing your identity. Additionally, consulting platforms like US Legal Forms can guide you through the complaint process efficiently. Understanding Utah Rejection of Goods can also add context to your complaint.

A state can typically go back three years to assess and collect taxes owed. In cases of fraud or willful neglect, the time frame might extend indefinitely. It's essential to maintain accurate tax records to protect yourself from unexpected claims. Considering Utah Rejection of Goods can improve your understanding of this issue.

In Utah, a sales and use tax audit can generally go back three years. However, if the state suspects fraud or substantial underreporting, it may extend beyond this period. Managing your sales records carefully can help you avoid complications. Understanding the implications of Utah Rejection of Goods also plays a role in these audits.