Utah Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

If you want to be thorough, obtain, or print official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Utilize the site’s user-friendly and efficient search feature to find the documents you need.

Various templates for business and personal uses are organized by categories and titles, or keywords.

Step 4. Once you have found the form you require, click on the Acquire now option. Choose your preferred payment plan and enter your details to register for the account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Utah Revocable Trust for Asset Protection in just a few clicks.

- If you are already a customer of US Legal Forms, sign in to your account and click on the Obtain button to access the Utah Revocable Trust for Asset Protection.

- You can also retrieve forms you've previously accessed from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

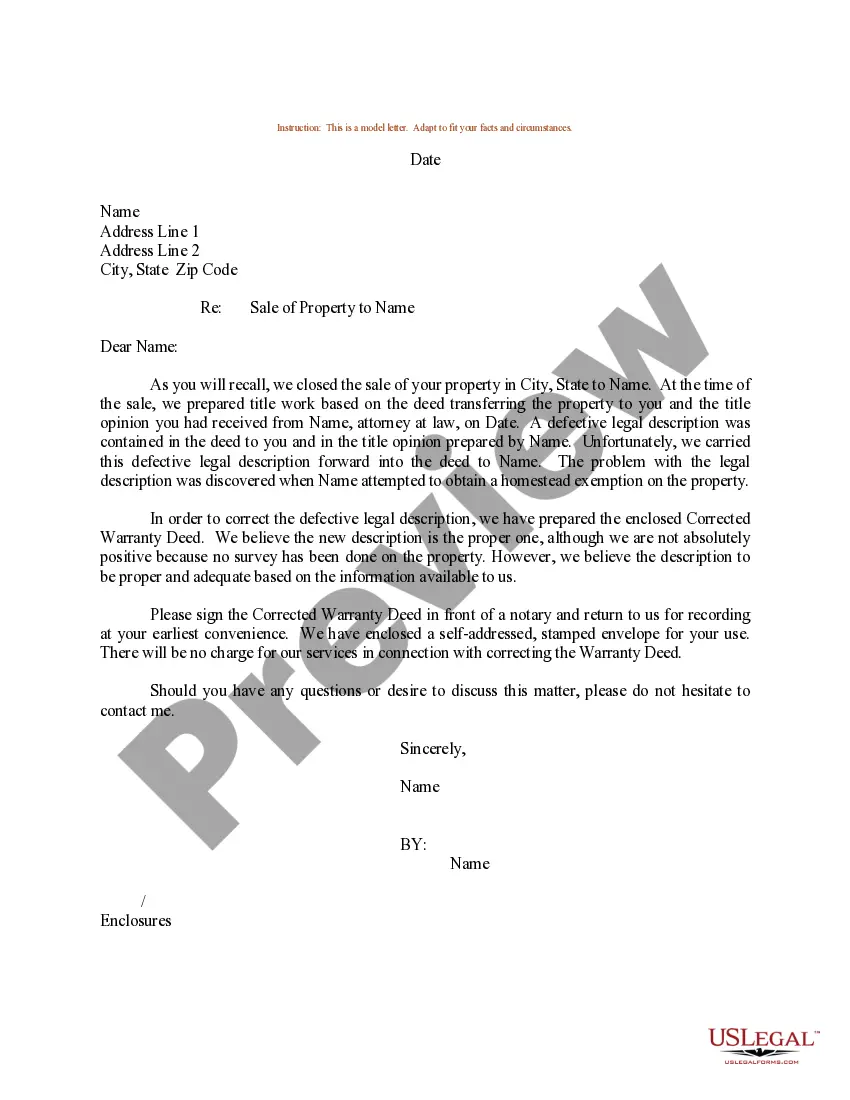

- Step 2. Utilize the Preview option to view the form’s content. Remember to read the overview.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Putting assets in a trust can be a wise decision for your parents, especially if they seek to manage their estate effectively. A Utah Revocable Trust for Asset Protection allows them to retain control over their assets while simplifying the transfer process after their passing. It's essential to discuss this option with them and guide them to seek legal advice for a thorough understanding of their choices.

One of the biggest mistakes parents make is not funding the trust properly. Establishing a Utah Revocable Trust for Asset Protection is only beneficial if you transfer assets into it. Parents often overlook this step and end up with an empty trust, which defeats its purpose. Always confirm that your trust is funded with the appropriate assets for it to be effective.

Family trusts, like a Utah Revocable Trust for Asset Protection, can sometimes lead to family disputes over the management and distribution of assets. Miscommunication about roles and expectations can create tension among family members. It's crucial to have clear plans and open discussions to avoid misunderstandings that can affect family relationships.

The major disadvantage of a trust, including a Utah Revocable Trust for Asset Protection, is that it does not provide complete protection from creditors. While it helps with estate management, it may be vulnerable depending on your financial situation. Additionally, trusts may involve setup and ongoing maintenance costs, which can add complexity to your financial planning.

A revocable trust can provide some level of asset protection, but it is essential to understand its limitations. By moving your assets into a Utah Revocable Trust for Asset Protection, you can control and manage your property during your lifetime. However, creditors may still have access to these assets under certain circumstances. For robust protection, consider combining it with other legal strategies.

Yes, you can create your own trust in Utah. With the right resources and guidance, you can set up a Utah Revocable Trust for Asset Protection to suit your needs. However, it is important to ensure that you follow all legal requirements to avoid issues later on. Consider using platforms like US Legal Forms that can provide templates and guidance to help you through the process.

To write an asset protection trust in Utah, you should begin by determining your specific needs and goals. Next, consult with a qualified estate planning attorney who understands the intricacies of a Utah Revocable Trust for Asset Protection. They can help you draft the trust document to ensure it meets state requirements and aligns with your financial objectives. Utilizing platforms like USLegalForms can simplify this process, providing templates and guidance for creating a trust that secures your assets effectively.

The Utah Code provides a framework for creating trusts, including the Utah Revocable Trust for Asset Protection. This type of trust allows individuals to manage their assets while safeguarding them from potential creditors. It is essential to understand that the specific sections of the Utah Code relating to asset protection can provide valuable guidelines. You can simplify the process by using platforms like US Legal Forms, which offer easy access to the necessary documents and information.

For those seeking robust asset protection, a Utah irrevocable trust is often recommended over a revocable trust. Unlike revocable trusts, irrevocable trusts transfer ownership, providing a stronger shield from creditors. However, assess your needs carefully, as this can limit your control over the assets. USLegalForms can guide you in choosing the right type of trust to meet your unique asset protection goals.

While a Utah revocable trust for asset protection helps with the management and distribution of your assets, it offers limited protection from creditors. The trust can control how and when your assets are distributed, but since you retain control, creditors may still reach these assets. To enhance protection, it may be wise to explore additional estate planning strategies alongside your trust.