Utah Revocable Trust for Estate Planning

Description

How to fill out Revocable Trust For Estate Planning?

You might spend hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal templates that are reviewed by experts.

It is easy to download or print the Utah Revocable Trust for Estate Planning from the platform.

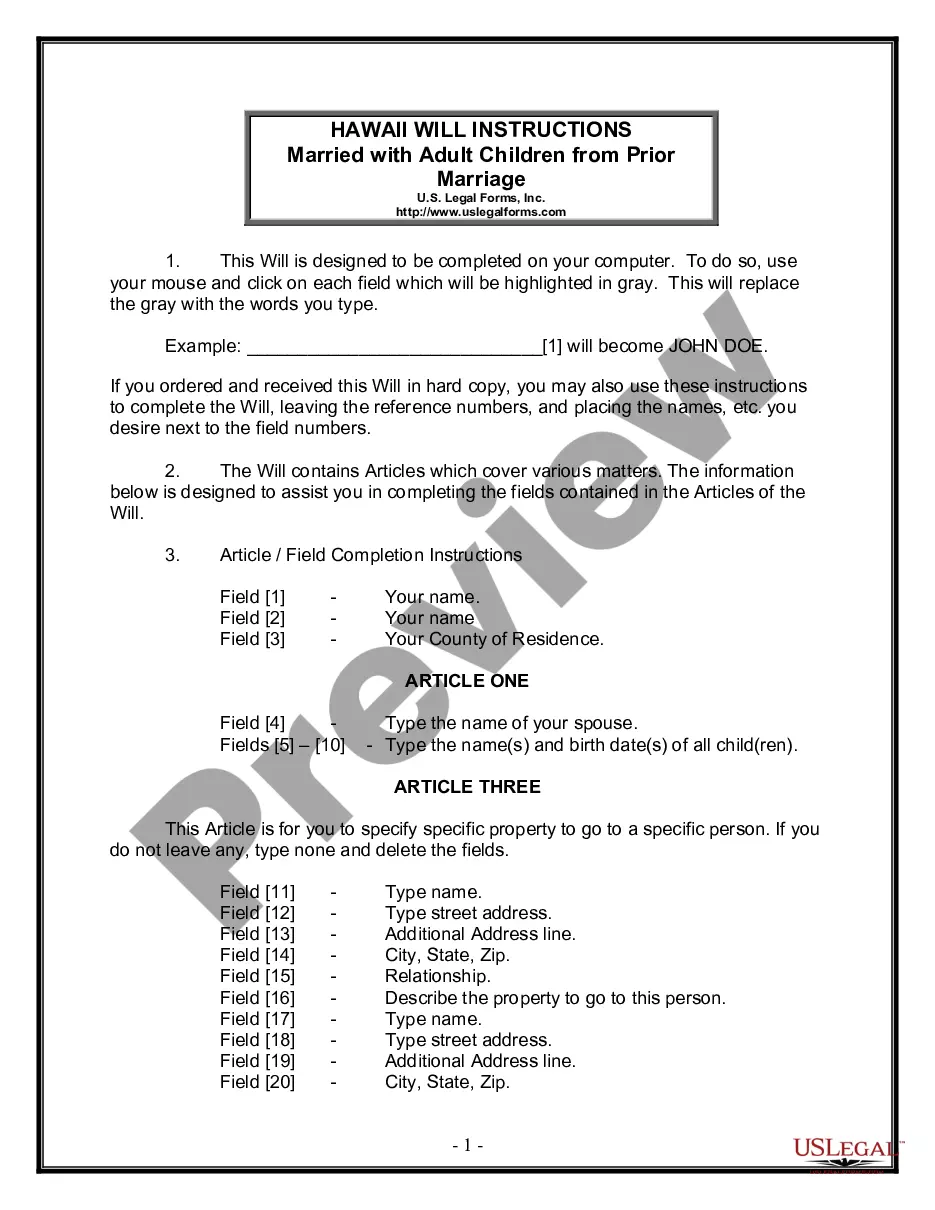

If available, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can complete, modify, print, or sign the Utah Revocable Trust for Estate Planning.

- Every legal document template you receive is yours permanently.

- To get an additional copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your preference.

- Read the form description to confirm you have chosen the right form.

Form popularity

FAQ

Transferring your property into a trust in Utah involves a few straightforward steps. Start by drafting your Utah Revocable Trust for Estate Planning document, which outlines how you wish to manage your assets. Next, you will need to execute a deed that transfers ownership of the property from your name to the trust’s name. Finally, ensure you record this deed with the local county recorder to complete the transfer process and maintain clear legal title to your property.

A Utah Revocable Trust for Estate Planning is often the best choice for your house. This trust allows you to maintain control over your property while providing smooth transfer upon your death. It helps avoid probate and keeps your property within your family's reach without unnecessary delays. Establishing this trust may involve legal documentation, which resources like uslegalforms can help you efficiently manage.

To avoid probate in Utah, create a Utah Revocable Trust for Estate Planning. By transferring your assets into the trust, they bypass probate and go directly to your beneficiaries after your death. This process can significantly save time and court fees, reducing the stress on your loved ones. Uslegalforms can provide the right documentation to ensure your trust is set up correctly for this purpose.

A Utah Revocable Trust for Estate Planning offers significant security concerning your assets while you are alive. While you maintain control over the trust, it protects your assets from risks such as probate and public scrutiny upon your death. However, it is essential to understand that because it is revocable, it does not provide creditor protection during your lifetime. It is advisable to combine it with other strategies for comprehensive estate security.

Yes, you can create your own trust in Utah using online resources or legal forms. However, it is wise to ensure that the trust fulfills all legal requirements to be valid. Using platforms like uslegalforms simplifies the process, guiding you through necessary legal language and formats. Creating a DIY Utah Revocable Trust for Estate Planning can be efficient, yet consulting with a professional may enhance its effectiveness.

The greatest advantage of a Utah Revocable Trust for Estate Planning is flexibility. You can modify or revoke it at any point during your lifetime, allowing you to respond to changes in your circumstances or wishes. Additionally, it helps your beneficiaries avoid the lengthy probate process, ensuring they receive their inheritance more quickly. This adaptability makes it a popular choice for many individuals.

A revocable trust, including a Utah Revocable Trust for Estate Planning, does not provide direct tax benefits during your lifetime. However, it allows for more straightforward tax management for your heirs once you pass. The assets in the trust typically avoid probate, which can lead to significant savings in fees and taxes for your estate. Therefore, while the tax benefits are not immediate, they become apparent during the estate settlement process.

Yes, a Utah Revocable Trust for Estate Planning transitions to an irrevocable trust upon your death. This means you can no longer alter the trust's terms after you pass. It becomes a stable entity that ensures your assets are distributed according to your wishes. This feature provides peace of mind as it solidifies your estate plans.

In the UK, a significant mistake parents often make when setting up a trust fund is failing to align the trust's purpose with their long-term family goals. Lack of clarity can lead to conflict or mismanagement down the line. Additionally, parents sometimes neglect to regularly review and update their trust documents as family situations change. Even though this question pertains to the UK, understanding effective practices from using a Utah Revocable Trust for Estate Planning can provide valuable insights for estate planning.

To designate a trust as a beneficiary, ensure that you clearly identify the trust in your legal documents. This includes specifying the trust's legal name and date of establishment. You must also provide any necessary documentation to the financial institution where your assets are held. By using a Utah Revocable Trust for Estate Planning, you can streamline this process, ensuring a smooth transition of assets upon your passing.