Utah Owner Financing Contract for Home

Description

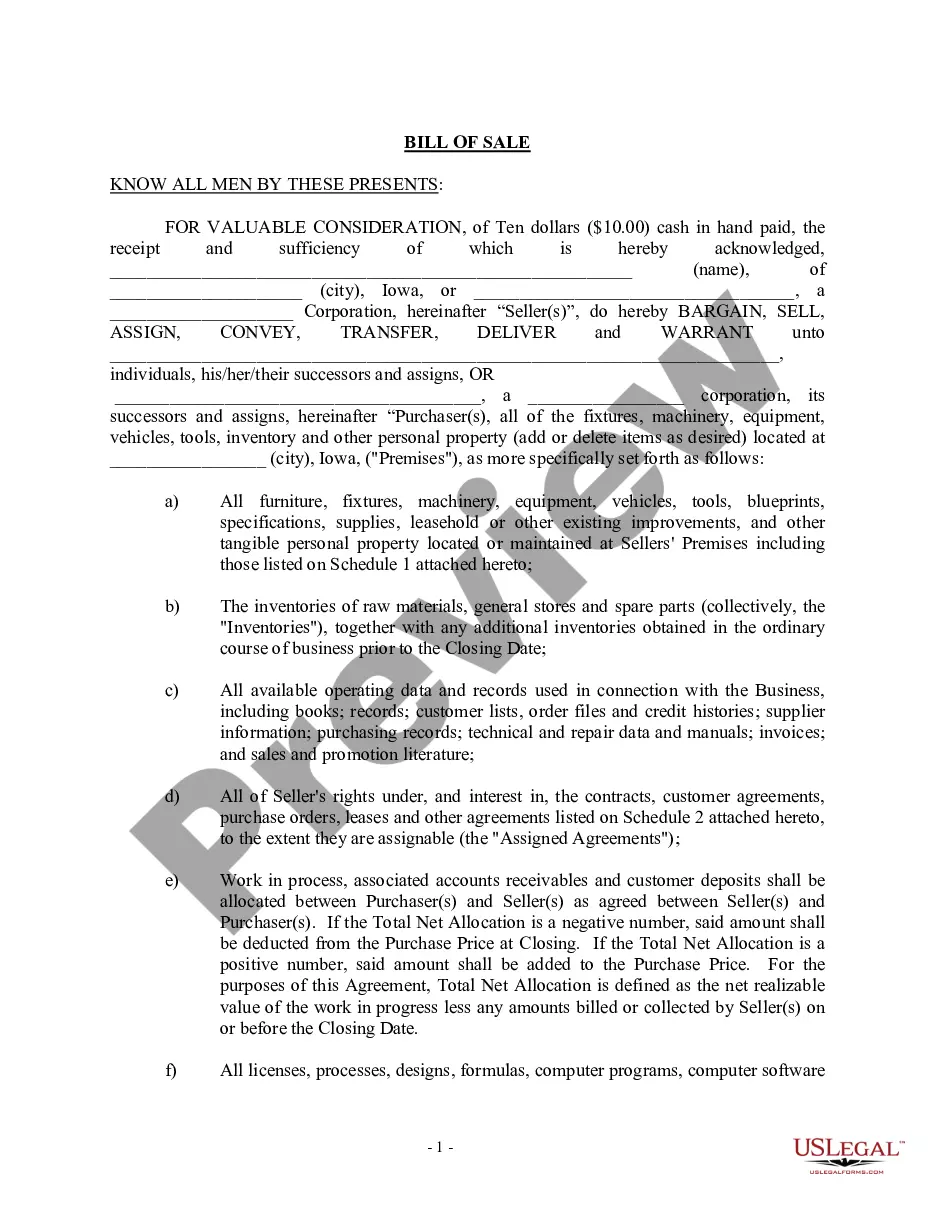

How to fill out Owner Financing Contract For Home?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, sorted by categories, states, or keywords. You can find the latest versions of documents like the Utah Owner Financing Contract for Home in just a few minutes.

If you already have a monthly subscription, Log In and download the Utah Owner Financing Contract for Home from the US Legal Forms library. The Download button will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Select the file format and download the form to your device.

Make edits. Fill out, modify, print and sign the downloaded Utah Owner Financing Contract for Home. Each template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just navigate to the My documents area and click on the form you wish.

- Ensure you have selected the correct form for your city/county. Click the Review button to examine the form's details.

- Check the form description to confirm that you have selected the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to sign up for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

An owner financing offer might involve a seller proposing that the buyer pays a certain percentage as a down payment, followed by monthly payments. For instance, a seller could offer a home for $250,000 with a $25,000 down payment and a remaining balance financed over five years. This scenario can be structured through a Utah Owner Financing Contract for Home for clarity and protection.

Owner-financed homes can be a great option for some buyers, especially those who may not qualify for traditional financing. This method can offer greater flexibility in terms and potentially lower closing costs. However, buyers should carefully consider their financial situation and obligations before proceeding. A clear and thorough Utah Owner Financing Contract for Home can help ensure a beneficial arrangement for all parties.

Typical terms for owner financing can include interest rates, repayment schedules, and down payment amounts. Most contracts outline a set repayment period ranging from a few years to several decades. By negotiating these terms, buyers can often find a payment plan that fits their financial situation. A well-drafted Utah Owner Financing Contract for Home can help ensure all terms are transparent and agreed upon.

When reporting a seller-financed mortgage, you need to disclose the transaction to the IRS along with your income tax return. Lenders often provide a 1098 Form to document the mortgage interest received. Additionally, it's important to keep thorough records concerning the Utah Owner Financing Contract for Home, as this information supports your tax filings. Consider consulting a tax professional for tailored advice.

Here are three main ways to structure a seller-financed deal:Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar.Draft a Contract for Deed.Create a Lease-purchase Agreement.

Here are three main ways to structure a seller-financed deal:Use a Promissory Note and Mortgage or Deed of Trust. If you're familiar with traditional mortgages, this model will sound familiar.Draft a Contract for Deed.Create a Lease-purchase Agreement.

Most owner-financing deals are short term. A typical arrangement is to amortize the loan over 30 years (which keeps the monthly payments low), with a final balloon payment due after only five or 10 years.

Unlike a bank mortgage, seller financing typically involves few or no closing costs or and may not require an appraisal. Sellers are often more flexible than a bank in the amount of down payment. Also, the seller-financing process is much faster, often settling within a week.

Key Takeaways. Owner financing can be a good option for buyers who don't qualify for a traditional mortgage. For sellers, owner financing provides a faster way to close because buyers can skip the lengthy mortgage process.

While there is no real "standard" amount of earnest money required, the amount submitted with an offer can have a strong affect on the offer's strength. In Park City Utah, it is typical to see the earnest money at about 1-2% of the purchase price for the property.