Utah Liquidation Agreement regarding Debtor's Collateral in Satisfaction of Indebtedness

Description

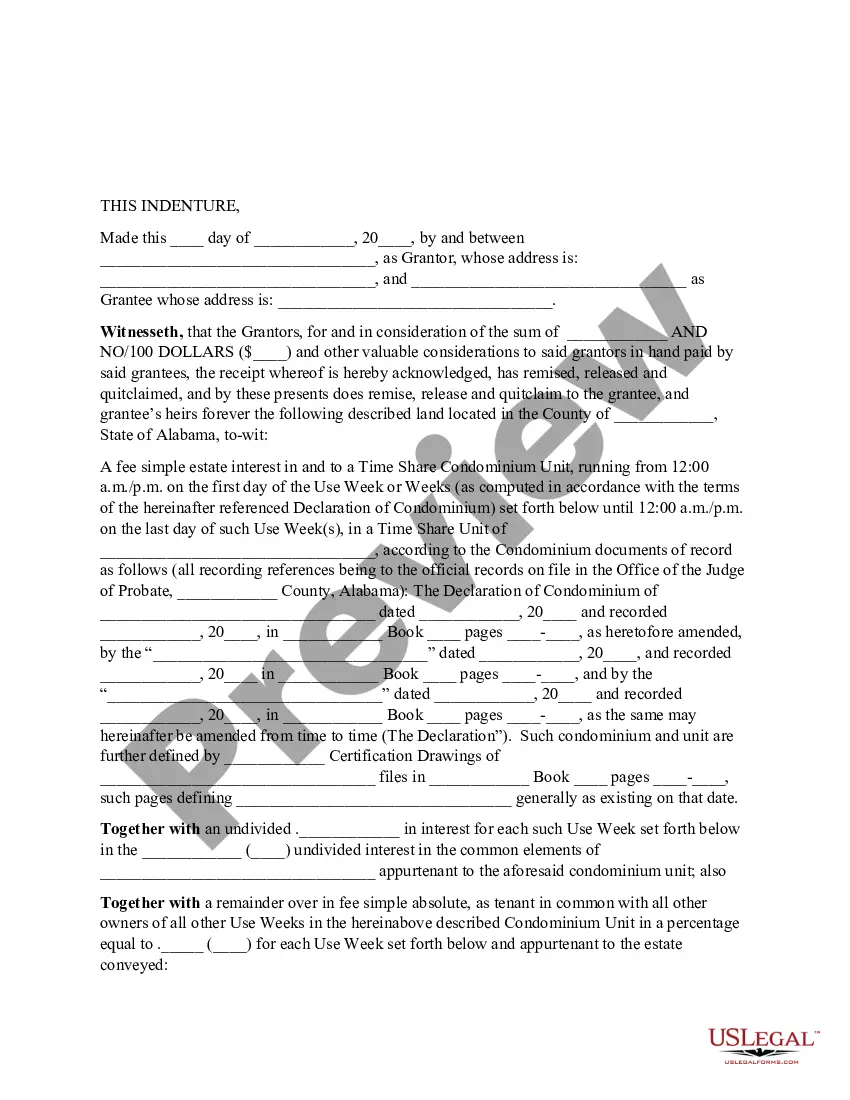

How to fill out Liquidation Agreement Regarding Debtor's Collateral In Satisfaction Of Indebtedness?

Selecting the appropriate legal document web template can be somewhat challenging. Obviously, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The service offers thousands of templates, such as the Utah Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Debt, which can be utilized for both business and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to obtain the Utah Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Debt. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents tab of your account and retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and examine the form summary to confirm it is suitable for you. If the form does not fulfill your needs, utilize the Search field to find the right form. When you are confident that the form is appropriate, click the Get now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Utah Liquidation Agreement concerning Debtor's Collateral in Satisfaction of Debt. US Legal Forms is indeed the largest repository of legal forms where you can explore a variety of document templates. Use the service to download professionally crafted papers that adhere to state regulations.

Form popularity

FAQ

A security agreement must contain a description of the collateral that reasonably identifies it. "all the debtor's assets" does not reasonably identifies the collateral. A creditor who has a security interest in the debtor's collateral is a secured party.

Ing to UCC Section 9-504, a financ- ing statement ?sufficiently indicates the collateral that it covers? if the financing statement provides (1) a description of the collateral pursuant to UCC Section 9-108, or (2) a generic description of all assets or all personal property of the debtor if the description of ...

It does not matter whether the agreement is between individuals or companies. A security agreement must contain a description of the collateral that reasonably identifies it; "all the debtor's assets" does not reasonably identify the collateral.

It follows the proposal-and-objection model found in former Section 9-505: The debtor consents if the secured party sends a proposal to the debtor and does not receive an objection within 20 days.

At a minimum, a valid security agreement consists of a description of the collateral, a statement of the intention of providing security interest, and signatures from all parties involved. Most security agreements, however, go beyond these basic requirements.

Collateral can include business-related items such as inventory, business furniture, accounts receivable, or some business savings accounts. If a borrower defaults, the security agreement allows the lender to collect the borrower's collateral and either sell it or hold onto it until the loan is repaid.