Utah Authorization for Lien and Sale for Nonpayment of Repair and / or Parts Charges - Car or Automobile

Description

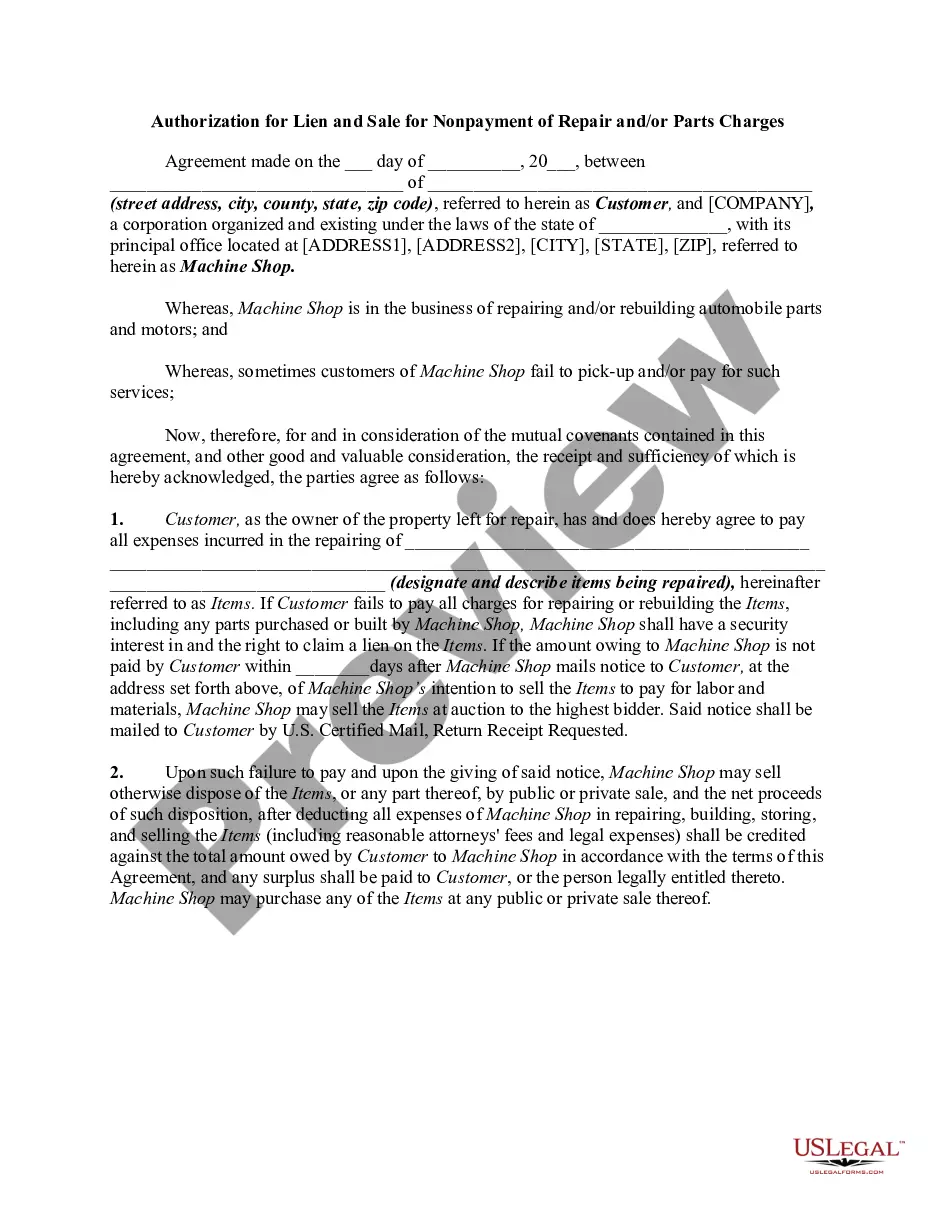

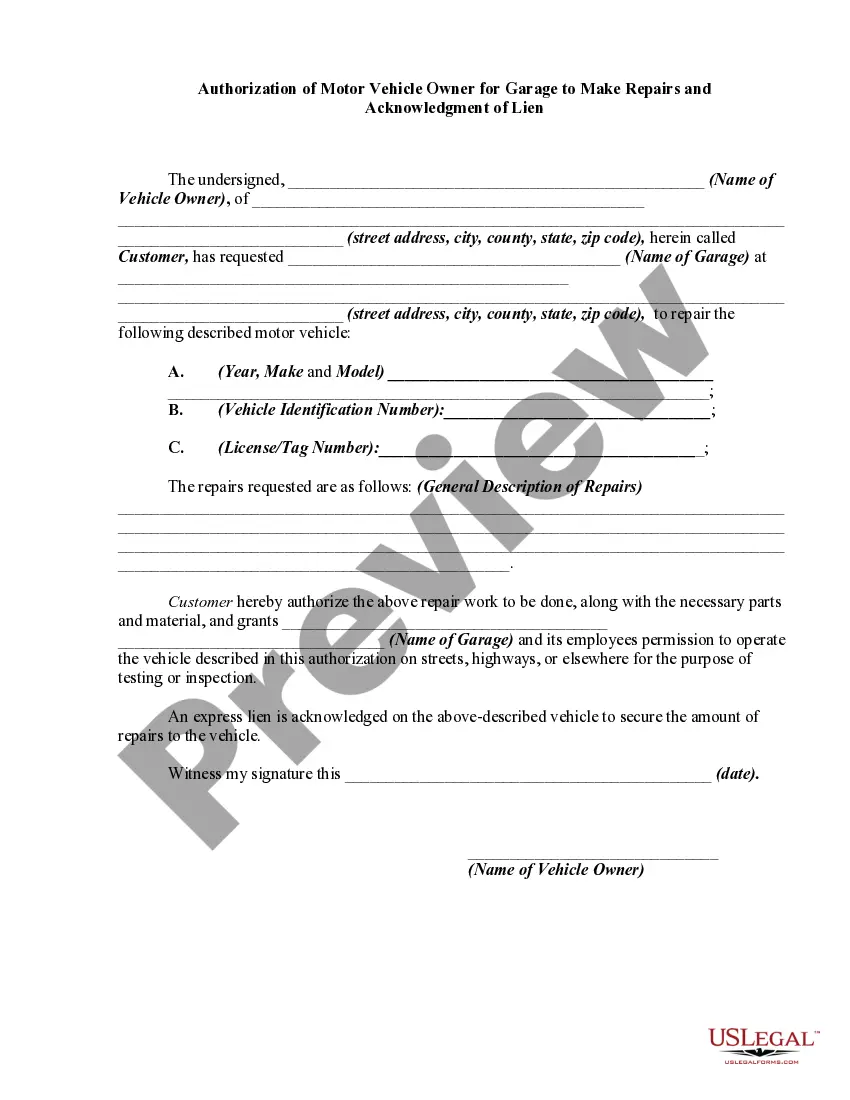

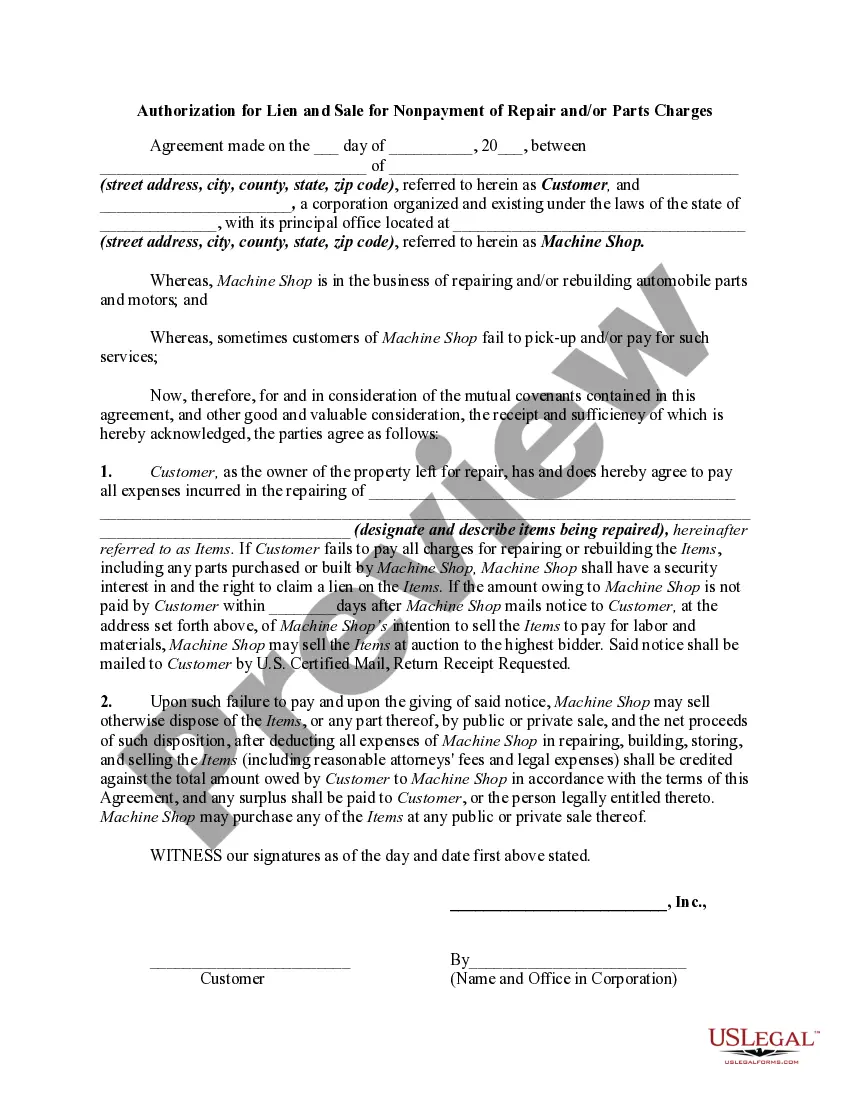

The following form creates a lien on automobile parts and motors for charges incurred by the Machine Shop for its services and charges in repairing and/or rebuilding the items. Upon failure by Customer to pay all charges for repairing or rebuilding the items, Machine Shop may sell the items by public or private sale, and the net proceeds of such disposition, after deducting all expenses of Machine Shop, shall be credited against the total amount owed by Customer to Machine Shop.. Machine Shop may purchase any of the items at any public or private sale by simply bidding its debt and expenses. No money need change hands, but a record should be kept detailing the date of the sale, the amount paid and the items sold and purchased.

How to fill out Authorization For Lien And Sale For Nonpayment Of Repair And / Or Parts Charges - Car Or Automobile?

Are you in the position the place you need to have paperwork for both organization or personal purposes just about every day time? There are plenty of authorized papers layouts accessible on the Internet, but locating ones you can depend on is not easy. US Legal Forms gives thousands of kind layouts, just like the Utah Authorization for Lien and Sale for Nonpayment of Repair and / or Parts Charges - Car or Automobile, which can be composed to fulfill federal and state demands.

In case you are currently informed about US Legal Forms web site and possess a merchant account, simply log in. Next, you can acquire the Utah Authorization for Lien and Sale for Nonpayment of Repair and / or Parts Charges - Car or Automobile design.

Unless you have an account and need to start using US Legal Forms, adopt these measures:

- Find the kind you require and make sure it is for that right area/area.

- Take advantage of the Preview option to analyze the shape.

- Read the outline to ensure that you have chosen the appropriate kind.

- In the event the kind is not what you`re trying to find, utilize the Research discipline to get the kind that suits you and demands.

- If you find the right kind, click Purchase now.

- Choose the prices strategy you desire, complete the desired information to create your account, and pay money for the order making use of your PayPal or bank card.

- Select a handy document format and acquire your copy.

Locate each of the papers layouts you possess bought in the My Forms menus. You can obtain a further copy of Utah Authorization for Lien and Sale for Nonpayment of Repair and / or Parts Charges - Car or Automobile at any time, if possible. Just click on the required kind to acquire or print out the papers design.

Use US Legal Forms, one of the most extensive collection of authorized kinds, to save efforts and stay away from mistakes. The service gives professionally manufactured authorized papers layouts which can be used for a variety of purposes. Create a merchant account on US Legal Forms and begin generating your life a little easier.

Form popularity

FAQ

Where do I file and record my Utah Mechanics Lien? Utah mechanic lien claims are documents recorded with the county recorder office. For your mechanic's lien to be valid, you must record it in the county where the job is physically located. Each county havs their own unique rules and requirements.

Any person furnishing labor, service, equipment, or material for which a mechanics lien or payment bond claim may be made shall provide preliminary notice to the SCR within 20 after starting work. Preliminary notices must be filed within 20 days after furnishing labor, services, material and/or equipment.

For more information about liens, contact the Tax Commission at 801-297-7703 or 1-800-662-4335 ext. 7703. This website is provided for general guidance only. It does not contain all tax and motor vehicle laws or rules.

A "wrongful" lien is a lien that is not authorized by: state or federal statute. a state court order, or. an authorizing document signed by the owner of the real property.

Definitions. the person against whom a recorded nonconsensual common law document purports to reflect or establish a claim or obligation.

A judgment lien in Utah will remain attached to the debtor's property (even if the property changes hands) for eight years.

File A Lien In addition to initiating the action to enforce the lien claim, the lien claimant must also record a lis pendens with the county recorder in the county where the lien was recorded. Preliminary notice must be filed within 20 days from commencement of work or delivery of materials.

38-9-203 Civil liability for recording wrongful lien -- Damages. (1) A lien claimant who records or causes a wrongful lien to be recorded in the office of the county recorder against real property is liable to a record interest holder for any actual damages proximately caused by the wrongful lien.