Utah Lease of Machinery for use in Manufacturing

Description

How to fill out Lease Of Machinery For Use In Manufacturing?

If you require to obtain, secure, or generate official document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Employ the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are sorted by categories and indicates, or terms and phrases. Utilize US Legal Forms to secure the Utah Lease of Machinery for utilization in Manufacturing in a few clicks.

Each legal document format you obtain is yours permanently. You will have access to every form you downloaded in your account.

Choose the My documents section and select a form to print or download again. Complete and download, and print the Utah Lease of Machinery for use in Manufacturing with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to retrieve the Utah Lease of Machinery for use in Manufacturing.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

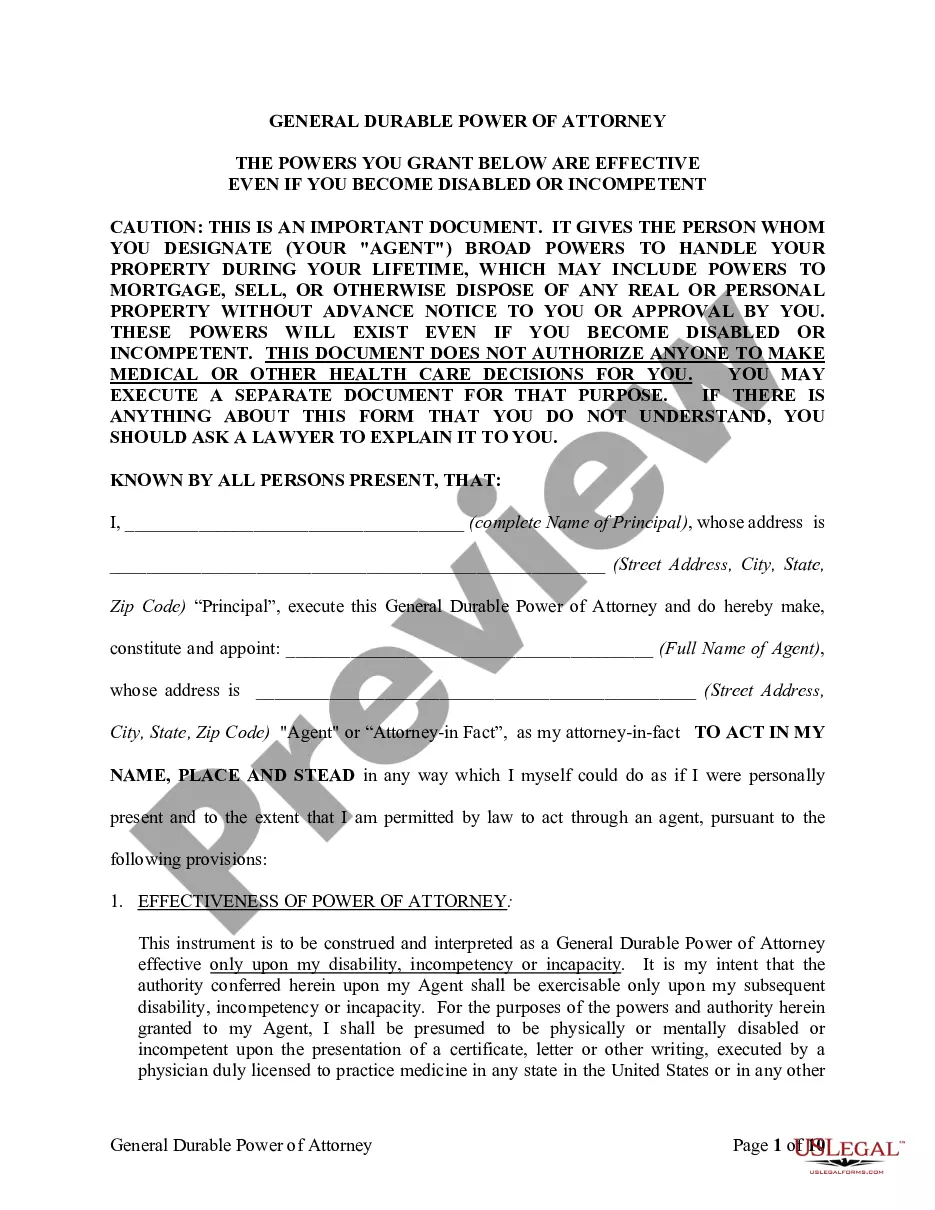

- Step 2. Use the Preview option to review the form’s content. Remember to read the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other alternatives in the legal form format.

- Step 4. Once you've located the form you need, select the Get now option. Choose your pricing plan and provide your information to register for an account.

- Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Utah Lease of Machinery for use in Manufacturing.

Form popularity

FAQ

Utah's occupancy tax varies by location, often ranging from 3% to over 13% of the rental amount. This tax applies to accommodations like hotels and vacation rentals but does not typically affect the Utah Lease of Machinery for use in Manufacturing. Understanding these taxes can help businesses budget better and avoid surprises. For more specific details, consider consulting with local authorities or utilize uslegalforms for tailored assistance.

In Utah, regular rental transactions generally do not incur sales tax. However, specific leases, such as the Utah Lease of Machinery for use in Manufacturing, may have different tax implications. It is important to review your lease agreements carefully and consult with a tax professional. This ensures that your lease complies with state regulations and minimizes unexpected costs.

Certain items are exempt from sales tax in Utah, including machinery and raw materials used in manufacturing. This exemption is beneficial for businesses engaged in the Utah Lease of Machinery for use in Manufacturing, as it allows them to invest more in their operations rather than paying sales tax. Knowing these exemptions can help you make informed decisions for your business activities in Utah.

In Utah, most clothing is not subject to sales tax, which creates an opportunity for savings for consumers and businesses alike. This tax exemption can be particularly advantageous for manufacturers that lease machinery, such as when equipping employees with the necessary attire for production. Understanding these details helps you navigate the financial aspects of operating within Utah's market effectively.

Utah does not impose a state-level tax on personal property or a state income tax. This absence of a personal property tax benefits businesses, such as those involved in the Utah Lease of Machinery for use in Manufacturing. Consequently, leasing machinery can lead to significant savings, making it a favorable option for manufacturers looking to invest in equipment without incurring additional tax burdens.

To set up an equipment lease, start by identifying the machinery you need and the duration you require it. Then, explore options for a Utah Lease of Machinery for use in Manufacturing, comparing terms from various providers. After selecting a provider, finalizing your lease involves negotiating terms, reviewing contracts, and ensuring compliance with all stipulations.

Leasing a machine typically starts with selecting the equipment you need and negotiating lease terms. In a Utah Lease of Machinery for use in Manufacturing, you would discuss the lease duration, payment schedule, and maintenance responsibilities. Once you agree, you sign a lease agreement and begin using the machinery per the established rules.

An equipment lease can be classified as an operating lease or a capital lease, depending on the terms. A typical Utah Lease of Machinery for use in Manufacturing may function as an operating lease, where payments cover usage without transferring ownership. Thus, it's vital to understand the specific lease agreement to determine its classification.

Leasing equipment, including a Utah Lease of Machinery for use in Manufacturing, can have disadvantages. You may face long-term costs that exceed buying outright, and you often do not build equity in the machinery. Additionally, you may encounter limitations on use or modifications, which can impact operations.

To obtain a Utah resale certificate, businesses must apply through the Utah State Tax Commission, providing necessary details about their operations. This certificate is vital when engaging in a Utah Lease of Machinery for use in Manufacturing, as it allows you to make tax-exempt purchases for resale. Ensure you fulfill all requirements to streamline the application process.