Utah Bill of Sale for a Coin Collection

Description

How to fill out Bill Of Sale For A Coin Collection?

Are you currently in a role where you frequently require documentation for either business or personal reasons.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a wide variety of form templates, including the Utah Bill of Sale for a Coin Collection, designed to meet state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have acquired in the My documents menu. You can obtain another version of the Utah Bill of Sale for a Coin Collection at any time if needed. Simply click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Utah Bill of Sale for a Coin Collection template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you require and ensure it corresponds to your specific locality/region.

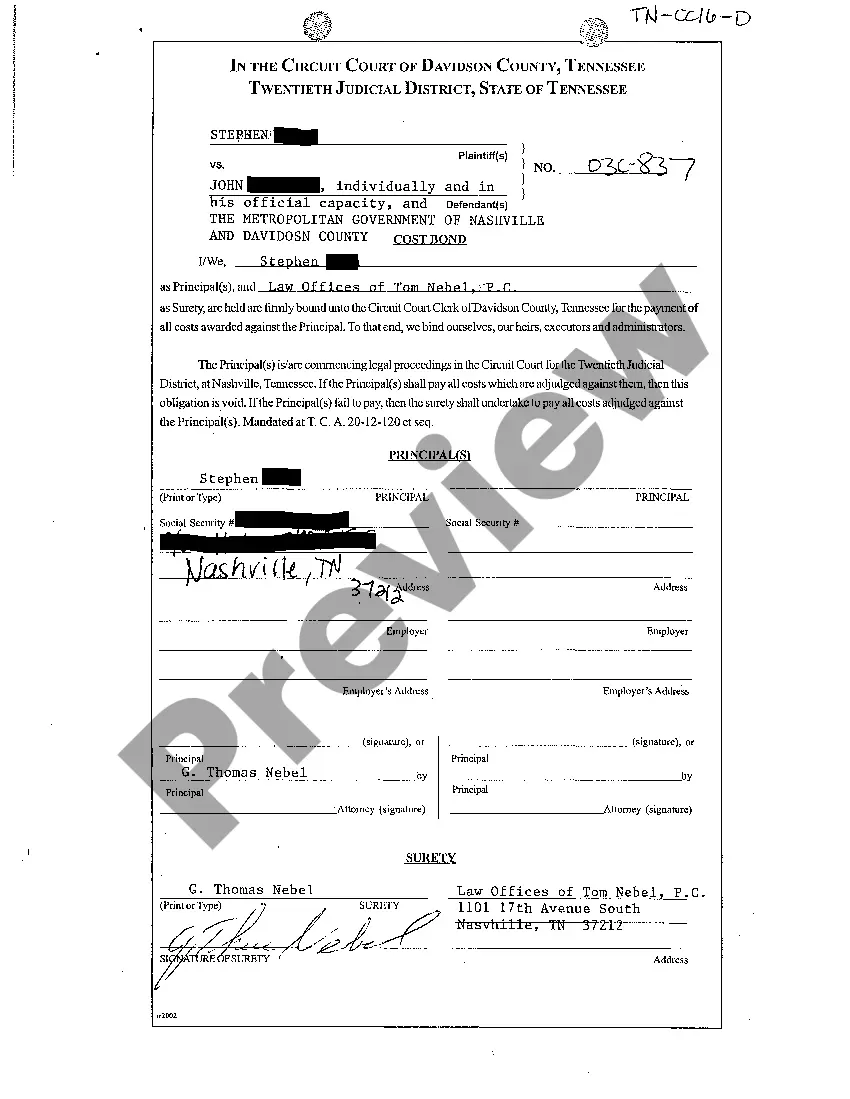

- Make use of the Preview button to review the document.

- Examine the description to confirm that you have selected the correct form.

- If the form is not what you’re looking for, use the Research field to find the form that suits your needs and criteria.

- Upon finding the appropriate form, click Purchase now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and settle the payment using your PayPal or credit card.

Form popularity

FAQ

To make a homemade bill of sale, begin by gathering all necessary information such as the names and contact details of both parties, a clear description of the item being sold, and the transaction amount. For a Utah Bill of Sale for a Coin Collection, include details about the coins, their condition, and payment method. After drafting the document, ensure both parties sign it and consider notarizing it for added protection. Resources like uslegalforms can provide guidance on drafting your bill of sale.

Yes, a handwritten bill of sale can be notarized. Notarization provides additional security and verifies the identities of both the buyer and seller, which can be crucial for transactions involving a Utah Bill of Sale for a Coin Collection. To get your document notarized, bring the signed bill of sale to a notary public who will witness the signing and provide a notary seal. This step can enhance the credibility of your transaction.

To create a bill of sale for your coin collection, start by clearly stating the names and contact information of both the buyer and seller. Detail the items being sold, including specific descriptions of each coin, and include the sale date. It is important to sign and date the document to make it legally binding. Utilizing a Utah Bill of Sale for a Coin Collection simplifies this task and provides a reliable format for completing your transaction.

When selling a coin collection in Utah, you need to ensure that the title reflects the accurate details of the items sold. Start by entering the buyer's name, address, and the date of the sale. You should also provide the description of the coin collection, including any unique identifiers or certifications. Using a Utah Bill of Sale for a Coin Collection can help streamline the process and ensure all information is recorded correctly.

Whether or not to notarize your bill of sale is a personal decision. Many choose to notarize a Utah Bill of Sale for a Coin Collection for peace of mind and legal protection. If you decide to proceed with notarization, make sure all parties are present during the signing. For seamless document preparation, uslegalforms can help you create a notarized form quickly.

In Utah, a bill of sale does not need to be notarized to be valid. While notarization can enhance the credibility of a Utah Bill of Sale for a Coin Collection, it is not mandatory. You should focus on including all necessary details, such as a description of the coin collection and the transaction date. Consider using uslegalforms to create a well-structured document.

An agreement of sale does not necessarily need notarization in Utah. However, notarizing a Utah Bill of Sale for a Coin Collection can provide proof of identity and verify the signing process. This can be beneficial in the event of disputes or complications. Always ensure that all parties understand their rights and obligations within the agreement.

Yes, you can create a Utah Bill of Sale for a Coin Collection without a notary. While notarization is not legally required in Utah for a bill of sale, having one can add an extra layer of authenticity. If you prefer a simple transaction, just make sure all parties involved keep a signed copy of the document. If you need assistance in drafting one, consider using platforms like uslegalforms for clarity.

Yes, coin sales are generally reported to the IRS if the seller profits from the transaction. When you sell coins for a gain, you're required to report that income, as it falls under capital gains tax regulations. Utilizing a Utah Bill of Sale for a Coin Collection can provide a comprehensive record of your sales, making it easier to report your earnings. Always keep detailed records to ensure transparency during tax season.

Yes, if you sell collectibles, including coins, for a profit, you generally must report that income on your tax return. The IRS considers profits from collectibles as capital gains, which can impact your overall tax obligations. Keeping thorough records, including a Utah Bill of Sale for a Coin Collection, ensures you have the necessary documentation for reporting purposes. It's advisable to track your sales to remain compliant with tax regulations.