Utah Demand for Collateral by Creditor

Description

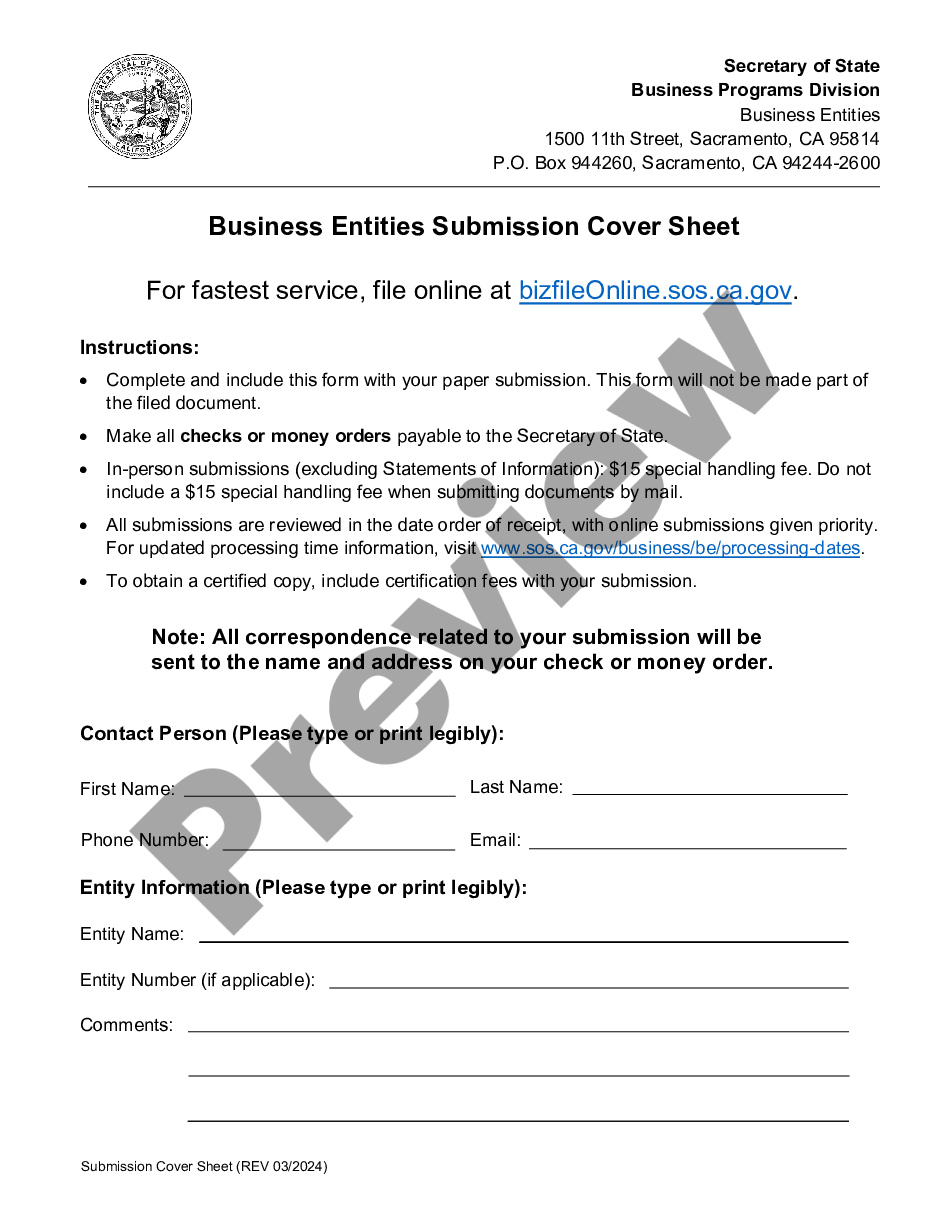

How to fill out Demand For Collateral By Creditor?

It is feasible to allocate time on the web seeking the valid document format that meets the federal and state requirements you need.

US Legal Forms offers numerous valid forms that are assessed by specialists.

You can conveniently acquire or print the Utah Demand for Collateral by Creditor through our service.

If available, use the Review option to examine the document format as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the Utah Demand for Collateral by Creditor.

- Each valid document format you receive is yours permanently.

- To get another copy of a purchased form, head to the My documents section and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/city of your choice.

- Review the form outline to confirm that you have selected the appropriate form.

Form popularity

FAQ

The time required for a UCC filing typically ranges from a few days to several weeks, depending on the specific circumstances and the jurisdiction. When you submit a filing related to the Utah Demand for Collateral by Creditor, it is important to ensure all paperwork is correctly completed to avoid delays. Utilizing U.S. Legal Forms can streamline this process for you, ensuring you have the right documents ready and filed accurately. By doing so, you can expedite your filing and focus on securing the collateral you need.

Utah Code 70C 2 102 outlines the specific obligations of creditors regarding consumer credit agreements. It emphasizes the necessity for clear communication of terms, including interest rates and repayment structures. Understanding these obligations is essential for both parties involved in a financial agreement, especially when addressing demands for collateral by creditors. Consulting legal resources can greatly enhance your understanding in these situations.

The Utah Code 70A 9a 203 focuses on the filing and effectiveness of financing statements in secured transactions. This section is important for creditors to know as it addresses how to properly secure their interests in collateral. A well-documented financing statement can prevent disputes and ensures that demands for collateral by creditors are legally valid. Turning to platforms such as US Legal Forms can help clarify this process.

Utah Code 70C 2 101 discusses the definitions related to consumer credit and financial agreements in Utah. This part of the code helps to clarify terms and conditions that are pivotal for understanding your rights as a borrower or creditor. Grasping these definitions is essential, especially when dealing with demands for collateral by creditors. Resources like US Legal Forms can provide essential insights into these definitions.

Utah Code 70C 3 101 outlines the general provisions about consumer credit transactions in the state. This section provides guidelines that aim to protect consumers while ensuring creditors adhere to fair lending practices. Understanding this code is crucial for both creditors and consumers involved in financial agreements, particularly concerning demands for collateral. Legal platforms like US Legal Forms offer comprehensive explanations for navigating these regulations.

The maximum interest rate allowed in Utah is primarily governed by state laws and specific agreements between parties. Generally, the cap is set at 10% for most loans unless otherwise agreed upon. For creditors issuing demands for collateral, it is vital to understand these limits to ensure compliance and protect against legal repercussions. Consulting legal resources can aid in understanding these rates better.

Section 70C 7 106 of the Utah Code addresses the legal requirements for the procedures related to a demand for collateral by creditors. This section lays out the obligations that creditors must follow to ensure compliance with state laws. Understanding this section can help both creditors and borrowers navigate the complexities of securing loans and demands for collateral. Utilizing resources like US Legal Forms can provide clarity in these situations.

In Utah, the sentence for aggravated kidnapping can vary significantly based on the specifics of the case. Typically, it can result in a minimum of 1 year to life in prison. Additionally, aggravated kidnapping may involve substantial fines. Individuals facing such charges should consider seeking legal guidance to navigate their options effectively.

To become a secured party, a creditor must create a security agreement with the debtor. This agreement must outline the terms of the secured debt and include a description of the collateral. Once established, the creditor can take further actions, such as sending a Utah Demand for Collateral by Creditor, to enforce their rights should defaults occur.

To perfect a security interest in an account receivable, creditors generally need to file a financing statement or UCC-1 form with the appropriate state department. This formal filing establishes the creditor's priority claim over the receivables in the event of a default. By effectively employing a Utah Demand for Collateral by Creditor, creditors can protect their interests in account receivables.