Utah Bill of Sale of Mobile Home with or without Existing Lien

Description

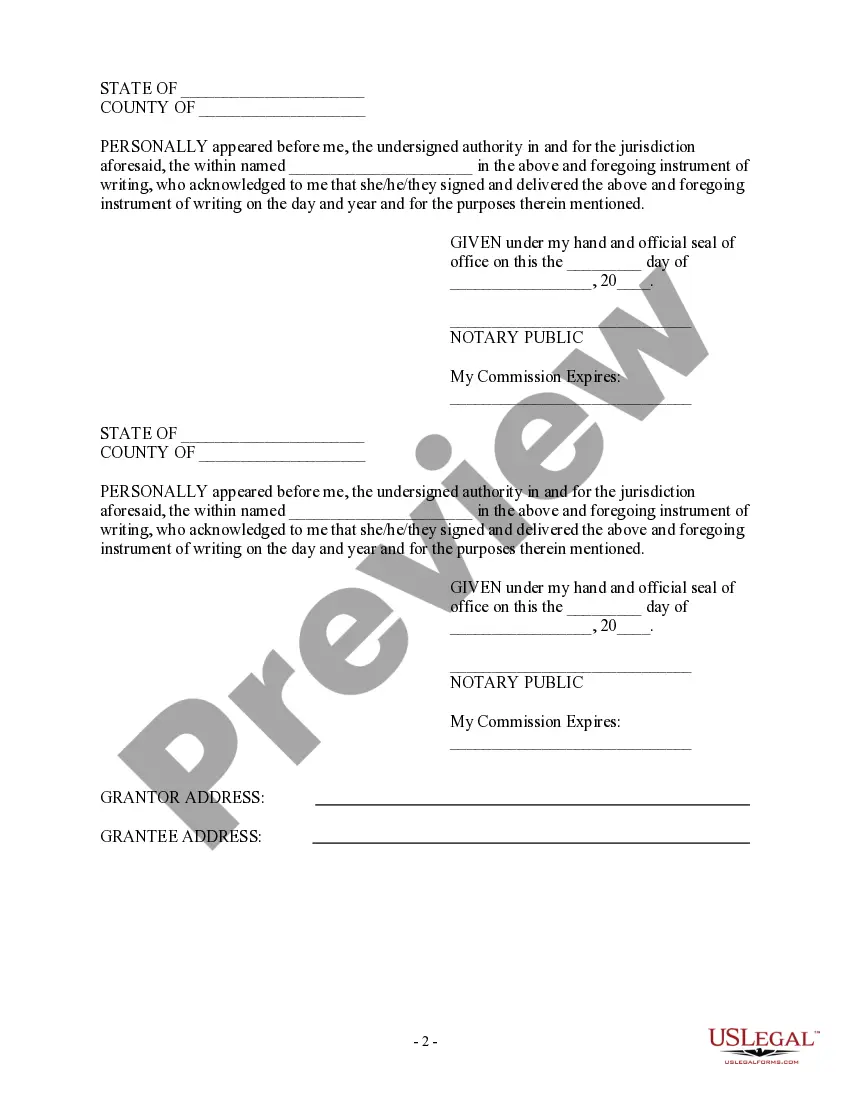

How to fill out Bill Of Sale Of Mobile Home With Or Without Existing Lien?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most current versions of forms such as the Utah Bill of Sale of Mobile Home with or without Existing Lien in just moments.

If you possess a registration, Log In to obtain the Utah Bill of Sale of Mobile Home with or without Existing Lien from the US Legal Forms library. The Download button will appear on every form you view. You can access all of your previously saved forms in the My documents section of your account.

Proceed with the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, and print and sign the saved Utah Bill of Sale of Mobile Home with or without Existing Lien.

Every document you add to your account has no expiration date and is yours to keep indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Utah Bill of Sale of Mobile Home with or without Existing Lien through US Legal Forms, the most extensive collection of legal document templates available. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to view the content of the form.

- Check the form description to confirm you have chosen the correct one.

- If the form does not fulfill your requirements, use the Search field at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Yes, the name on the bill of sale should match the name on the title to avoid any legal issues. Consistency in names helps establish clear ownership transfer and reduces the risk of disputes. If you need assistance drafting a proper bill of sale, uslegalforms provides templates designed for a Utah Bill of Sale of Mobile Home with or without Existing Lien.

A bill of sale is not the same as a title but serves as a crucial step in the ownership transfer process. The bill of sale acts as proof of the transaction, while the title officially documents ownership. To avoid confusion, always ensure that the bill of sale accompanies the title transfer, particularly when dealing with a Utah Bill of Sale of Mobile Home with or without Existing Lien.

Yes, a handwritten bill of sale can be acceptable as long as it includes all necessary details about the mobile home and the transaction. Make sure both parties sign the document to solidify the agreement. However, to simplify the process, consider using a template from uslegalforms that complies with regulations regarding a Utah Bill of Sale of Mobile Home with or without Existing Lien.

A mobile home title is often referred to as a certificate of title. This document serves as proof of ownership for the mobile home and contains important details like the owner's name and the mobile home's identification number. When transferring ownership, having a proper bill of sale that corresponds to the title is essential. This is vital when dealing with a Utah Bill of Sale of Mobile Home with or without Existing Lien.

To create a homemade bill of sale, first gather essential details about the mobile home, including its make, model, year, and identification number. Next, write down the buyer's and seller's names, addresses, and signatures. Finally, add the date of the transaction and note any existing liens. With the right information, you can draft a valid Utah Bill of Sale of Mobile Home with or without Existing Lien that protects both parties.

To transfer a trailer title in Utah, you need to submit the signed title along with a completed bill of sale to the DMV. This document is essential because it provides the necessary details of the sale to both parties and confirms the transaction. You can simplify this process by using a Utah Bill of Sale of Mobile Home with or without Existing Lien template from uslegalforms, ensuring all required information is included.

Yes, you can transfer a title online in Utah through the official DMV website. The process allows for convenience and efficiency when handling mobile home transactions. To ensure compliance, it is crucial to have the correct documentation, including the Utah Bill of Sale of Mobile Home with or without Existing Lien, ready for submission during the online title transfer.

In Utah, a mobile home can be considered real property if it meets certain criteria, such as being permanently affixed to the land. This classification affects the way the property can be sold and taxed. It's important for buyers and sellers to understand this distinction, especially when drafting the Utah Bill of Sale of Mobile Home with or without Existing Lien to reflect the status correctly.

Yes, you need a bill of sale when selling or buying a trailer in Utah. This document serves as proof of the transaction and includes valuable information about the trailer and the parties involved. Moreover, having a comprehensive bill of sale ensures a smoother transfer process. Using a Utah Bill of Sale of Mobile Home with or without Existing Lien template can streamline this for you.

Yes, a handwritten bill of sale is legal in Utah. However, to be effective, it should include all necessary details such as the buyer's and seller's information, the mobile home description, and any existing liens. This makes the document an essential part of the process when transferring ownership. If you are unsure about the specifics, consider utilizing the Utah Bill of Sale of Mobile Home with or without Existing Lien template from uslegalforms for accuracy.