This agreement allows one lien holder to subordinate its deed of trust to the lien of another lien holder. For valuable consideration, a particular deed of trust will at all times be prior and superior to the subordinate lien.

Utah Subordination Agreement of Deed of Trust

Description

How to fill out Subordination Agreement Of Deed Of Trust?

You can devote hours on-line attempting to find the authorized papers web template that fits the federal and state requirements you require. US Legal Forms gives a large number of authorized forms which can be reviewed by experts. You can actually acquire or printing the Utah Subordination Agreement of Deed of Trust from the service.

If you currently have a US Legal Forms accounts, you can log in and click on the Down load option. After that, you can full, edit, printing, or indicator the Utah Subordination Agreement of Deed of Trust. Each authorized papers web template you purchase is your own permanently. To obtain another version of the acquired develop, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website the first time, follow the basic directions listed below:

- Initial, ensure that you have chosen the right papers web template for the county/area of your choosing. See the develop outline to ensure you have selected the correct develop. If offered, make use of the Preview option to check throughout the papers web template at the same time.

- If you want to locate another edition of the develop, make use of the Lookup area to find the web template that meets your requirements and requirements.

- After you have discovered the web template you would like, click Purchase now to carry on.

- Pick the prices strategy you would like, enter your references, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal accounts to purchase the authorized develop.

- Pick the structure of the papers and acquire it to the gadget.

- Make adjustments to the papers if needed. You can full, edit and indicator and printing Utah Subordination Agreement of Deed of Trust.

Down load and printing a large number of papers web templates making use of the US Legal Forms site, that offers the biggest collection of authorized forms. Use specialist and express-particular web templates to handle your business or person needs.

Form popularity

FAQ

Yes, you do record a subordination agreement to make it official and publicly accessible. This action not only protects the rights of the lenders but also informs potential buyers or other creditors about existing liens on the property. When you engage in a Utah Subordination Agreement of Deed of Trust, recording the agreement is essential for ensuring that all parties are aware of the lien hierarchy.

In most cases, it is advisable to record a subordination agreement to protect the interests of all parties involved. Recording the agreement ensures that it becomes part of the public record, which can prevent future claims against the property. For a Utah Subordination Agreement of Deed of Trust, recording is a crucial step in maintaining transparency and safeguarding your rights.

Yes, a subordination agreement typically needs to be notarized to ensure its legal validity. Notarization provides an additional layer of protection and verifies the identities of the parties involved. When dealing with a Utah Subordination Agreement of Deed of Trust, having the document notarized is an important step to prevent disputes and ensure its enforceability.

The subordination clause in a trust deed specifies that the lender agrees to allow a secondary lien to have priority over their existing lien. This clause is crucial in a Utah Subordination Agreement of Deed of Trust as it facilitates the process of securing new loans. By including this clause, the original lender remains flexible while enabling property owners to access additional funding when needed.

A subordinate lien deed of trust is a legal document that establishes a secondary lien on a property. This type of deed of trust ranks below the primary mortgage in terms of repayment priority. In the context of a Utah Subordination Agreement of Deed of Trust, it allows the secondary lender to take a lower position in the hierarchy of claims against the property, which can be beneficial for refinancing or obtaining additional financing.

Who Benefits from a Subordination Clause? A subordination clause is meant to protect the interests of the primary lender. A primary mortgage usually covers the cost of purchasing the home; however, if there is a secondary mortgage, the clause ensures that the primary lender retains the number one priority.

It is an arrangement that alters the lien position. Without a subordination clause, loans take chronological priority which means that a deed of trust recorded first will be considered senior to all deeds of trusts recorded after.

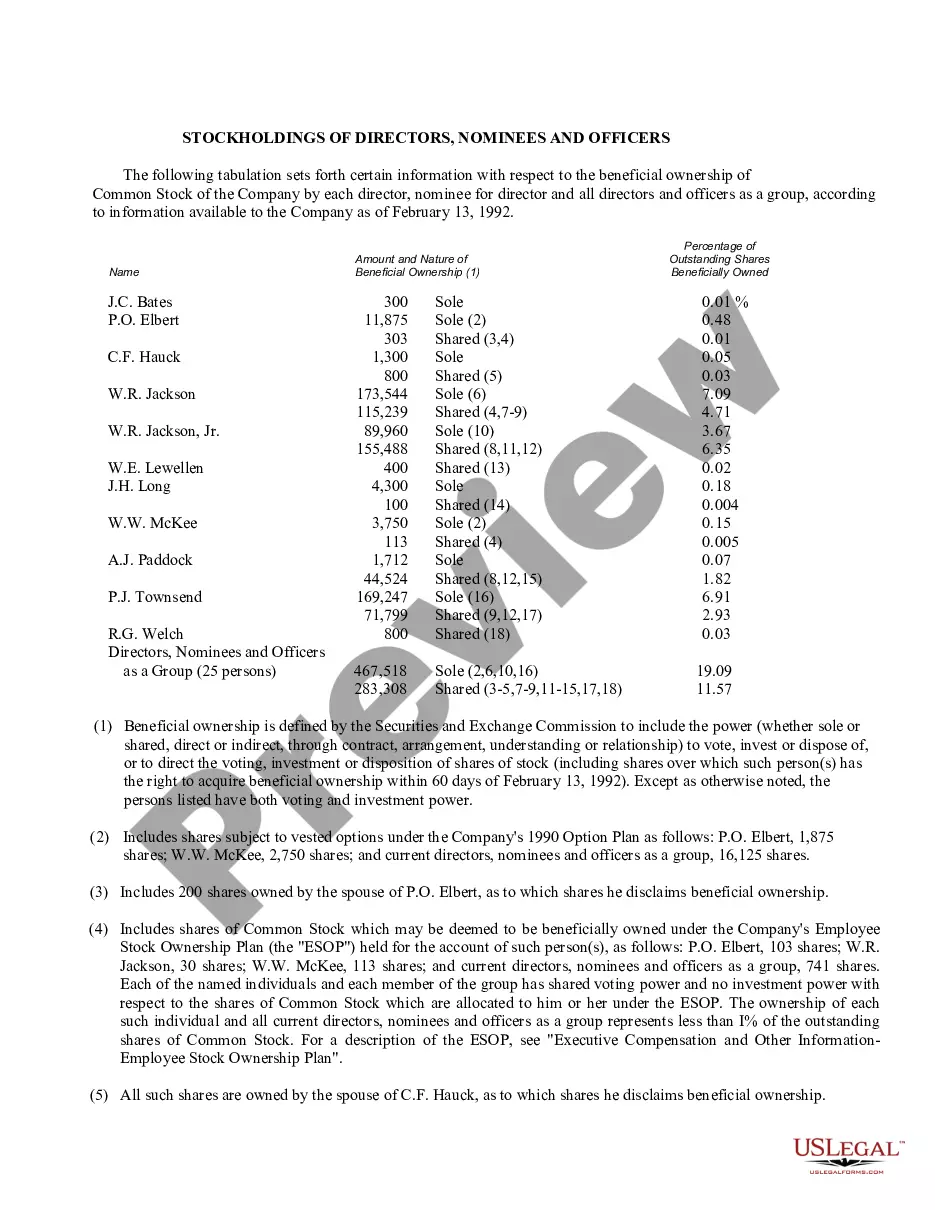

The Subordinated Lender hereby agrees that all Subordinated Obligations (as defined below) and all of his right, title and interest in and to the Subordinated Obligations shall be subordinate and junior in right of payment to the Senior Lender Loan and all rights of Senior Lender in respect of the Senior Lender Loan, ...

A subordination clause is where a first and second mortgage will switch places. In other words, the first becomes a second, a second becomes a first. Subordination means to take a lesser position, so someone in the first position would agree to subordinate and become a second lien holder.

An agreement by which one encumbrance (for example, a mortgage) is made subject (junior) to another encumbrance. To "subordinate" is to "make subject to," or to make of lower priority. A Subordination Agreement is a legal document that establishes the priority of liens or claims against a specific asset.