This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Utah Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

Locating the appropriate legal document format may pose a challenge. Naturally, there are numerous online templates accessible on the web, but how can you acquire the legitimate type you require? Utilize the US Legal Forms platform. The service provides thousands of templates, including the Utah Application for Certificate of Discharge of IRS Lien, which you can use for business and personal purposes. All of the documents are verified by experts and comply with state and federal regulations.

If you are currently a registered user, Log In to your account and click the Acquire button to obtain the Utah Application for Certificate of Discharge of IRS Lien. Use your account to browse through the legal documents you have purchased previously. Visit the My documents section of your account to download another copy of the file you need.

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the appropriate form for your city/state. You can review the document using the Review button and check the form details to confirm it is the correct one for you. If the form does not fulfill your requirements, utilize the Search field to find the right form. Once you are certain the form is accurate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document to your device. Finally, complete, modify, print, and sign the acquired Utah Application for Certificate of Discharge of IRS Lien.

- US Legal Forms is the leading repository of legal documents where you can find a variety of file templates.

- Utilize the service to obtain professionally crafted paperwork that complies with state regulations.

- Ensure the document is suitable for your needs.

- Follow the steps carefully to avoid any issues.

- Keep your account details secure.

- Contact customer support if you encounter any problems.

Form popularity

FAQ

To release a mechanics lien in Utah, you must file a document with the county recorder where the lien was initially filed. This document typically needs to include a statement that the lien has been satisfied. Be sure to follow the specific guidelines set by Utah law to avoid any complications. Platforms like US Legal Forms can help you prepare and file the necessary documents efficiently.

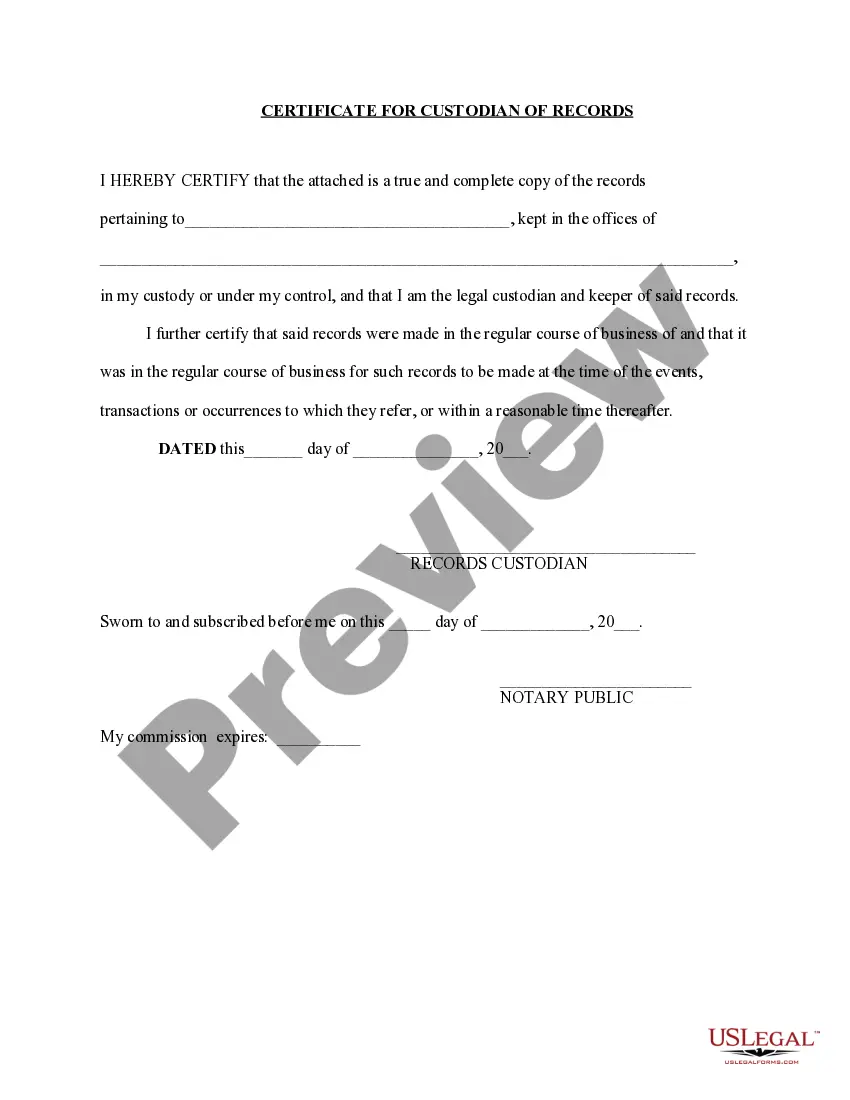

Applying for a certificate of discharge from a federal tax lien involves submitting Form 12277 to the IRS. This form allows you to request the discharge of a lien on specific property. When completing your application, provide all required information to expedite the process. For assistance, consider using US Legal Forms to navigate the Utah Application for Certificate of Discharge of IRS Lien effectively.

To remove a lien from your property in Utah, you need to follow specific steps. First, determine the type of lien and gather relevant documentation. You can then file a Utah Application for Certificate of Discharge of IRS Lien if the lien is federal. Utilizing platforms like US Legal Forms can simplify the application process, ensuring you complete all necessary forms accurately.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

When you pay off your full tax balance or when the IRS runs out of time to collect the balance, the IRS will automatically release your tax lien. This removes the lien from your property. If the lien isn't automatically released, you can write to the IRS to request the release certificate.

Once a lien arises, the IRS generally can't release it until you've paid the tax, penalties, interest, and recording fees in full or until the IRS is no longer legally able to collect the tax.

Help Resources. Centralized Lien Operation ? To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

Self-Releasing Liens A federal tax lien usually releases automatically 10 years after a tax is assessed if the statutory period for collection has not been extended and the IRS does not extend the effect of the Notice of Federal Tax Lien by refiling it.

Completing Form 14135 Your personal information: Be sure to enter the information as it appears on the Notice of Federal Tax Lien. Your representative's information (attach Form 2848, Power of Attorney) Information about your lender or finance company. A description and appraisal of the property.