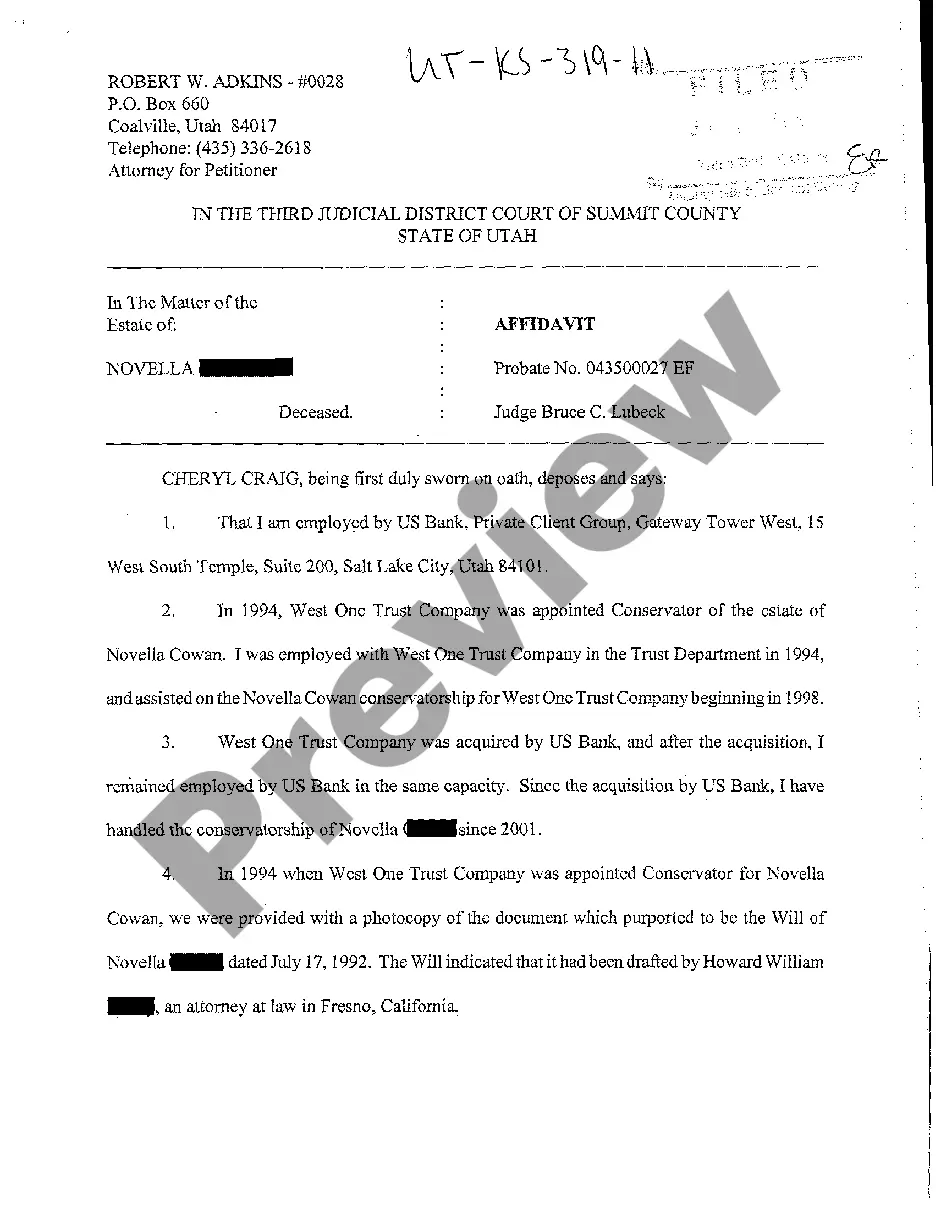

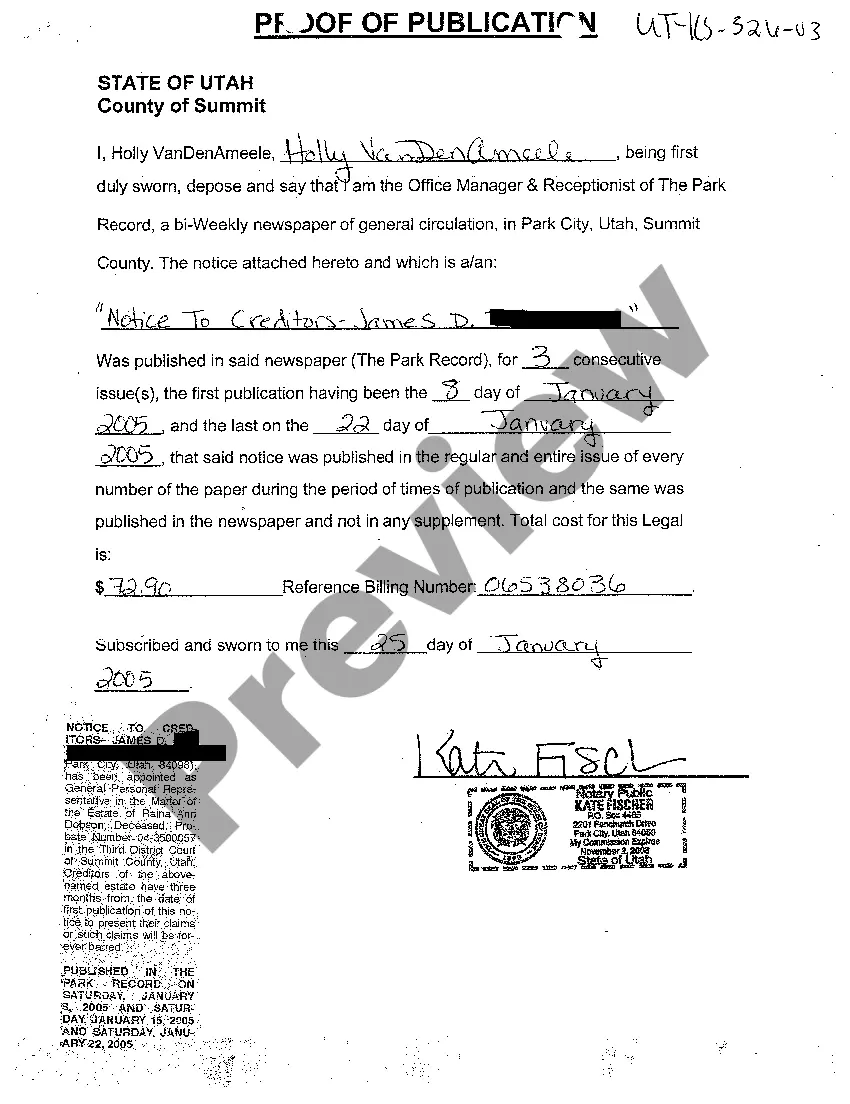

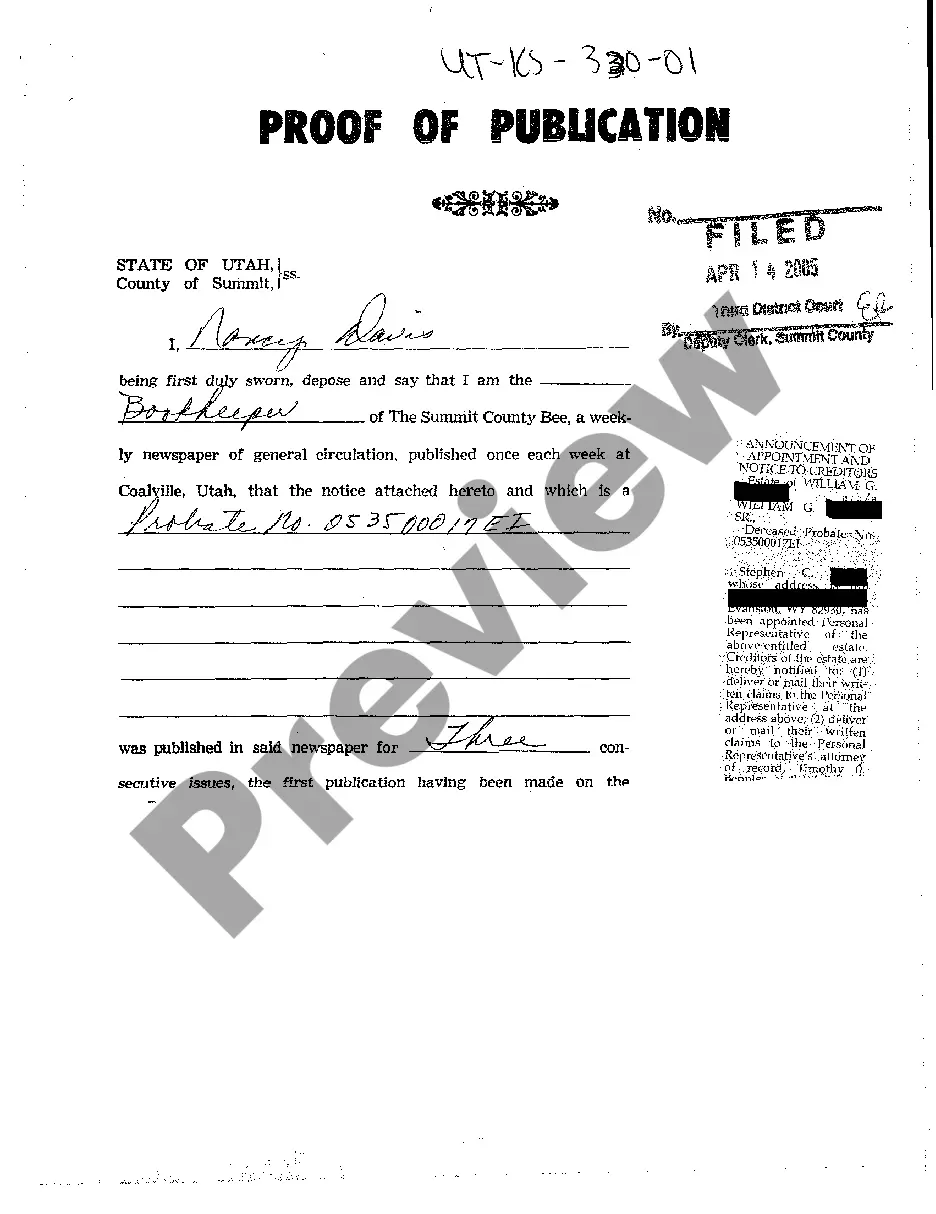

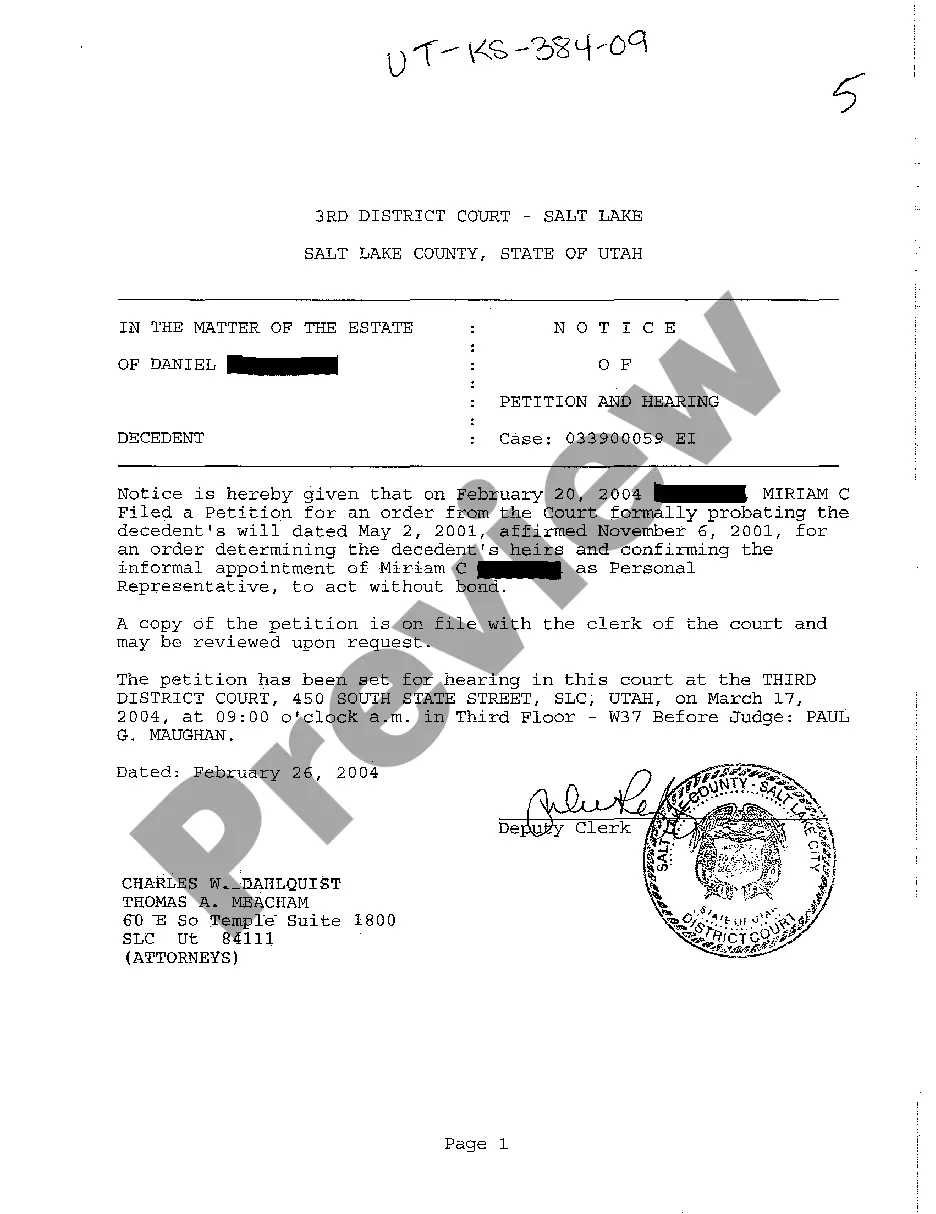

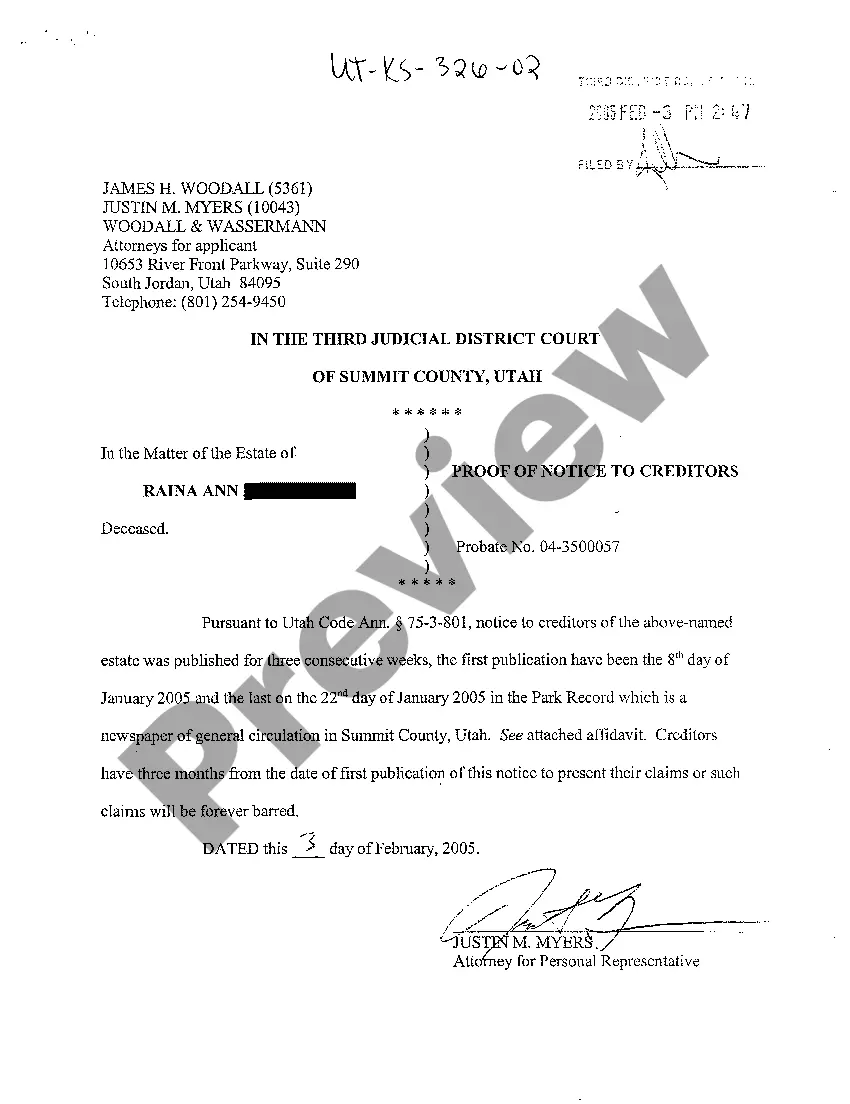

Utah Proof of Notice to Creditors

Description

How to fill out Utah Proof Of Notice To Creditors?

Among hundreds of paid and free examples which you find on the net, you can't be certain about their accuracy. For example, who made them or if they’re competent enough to deal with what you require these to. Keep relaxed and utilize US Legal Forms! Locate Utah Proof of Notice to Creditors templates created by skilled legal representatives and avoid the expensive and time-consuming process of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access your previously downloaded files in the My Forms menu.

If you are making use of our service the first time, follow the instructions below to get your Utah Proof of Notice to Creditors fast:

- Make sure that the file you discover applies in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template using the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and paid for your subscription, you may use your Utah Proof of Notice to Creditors as often as you need or for as long as it remains valid in your state. Revise it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A notice to creditors refers to a public notice that is addressed to potential creditors and debtors of an estate of a deceased individual. The notice is published by the estate executor in local and national newspapers with a national circulation for several weeks, depending on the estate laws of the state.

Even in the most routine probates, the law requires a minimum four-month wait after the Notice to Creditors has been issued before any action can be taken to distribute or close the estate.

A creditor is an entity (person or institution) that extends credit by giving another entity permission to borrow money intended to be repaid in the future.People who loan money to friends or family are personal creditors.

Dear {Name}, This letter is to inform you that {Name} has passed away and to request that a formal death notice be added to {his/her} file in your accounts. {Name}'s full name was {Full Name}. At the time of death, {his/her} residence was {Address}, {City} in {County} County, {State}.

Creditors have one year after death to collect on debts owed by the decedent. For example, if the decedent owed $10,000.00 on a credit card, the card-holder must file a claim within a year of death, or the debt will become uncollectable.

However, once the three nationwide credit bureaus Equifax, Experian and TransUnion are notified someone has died, their credit reports are sealed and a death notice is placed on them. That notification can happen one of two ways from the executor of the person's estate or from the Social Security Administration.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

Timespan for Creditors to Make Claim For unsecured debts, the time limit ranges from 3-6 months in most states. State laws require executors to post notice of the death, either in a newspaper or directly to known creditors to give them a chance to file a claim. No claims are accepted after the time frame has expired.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.