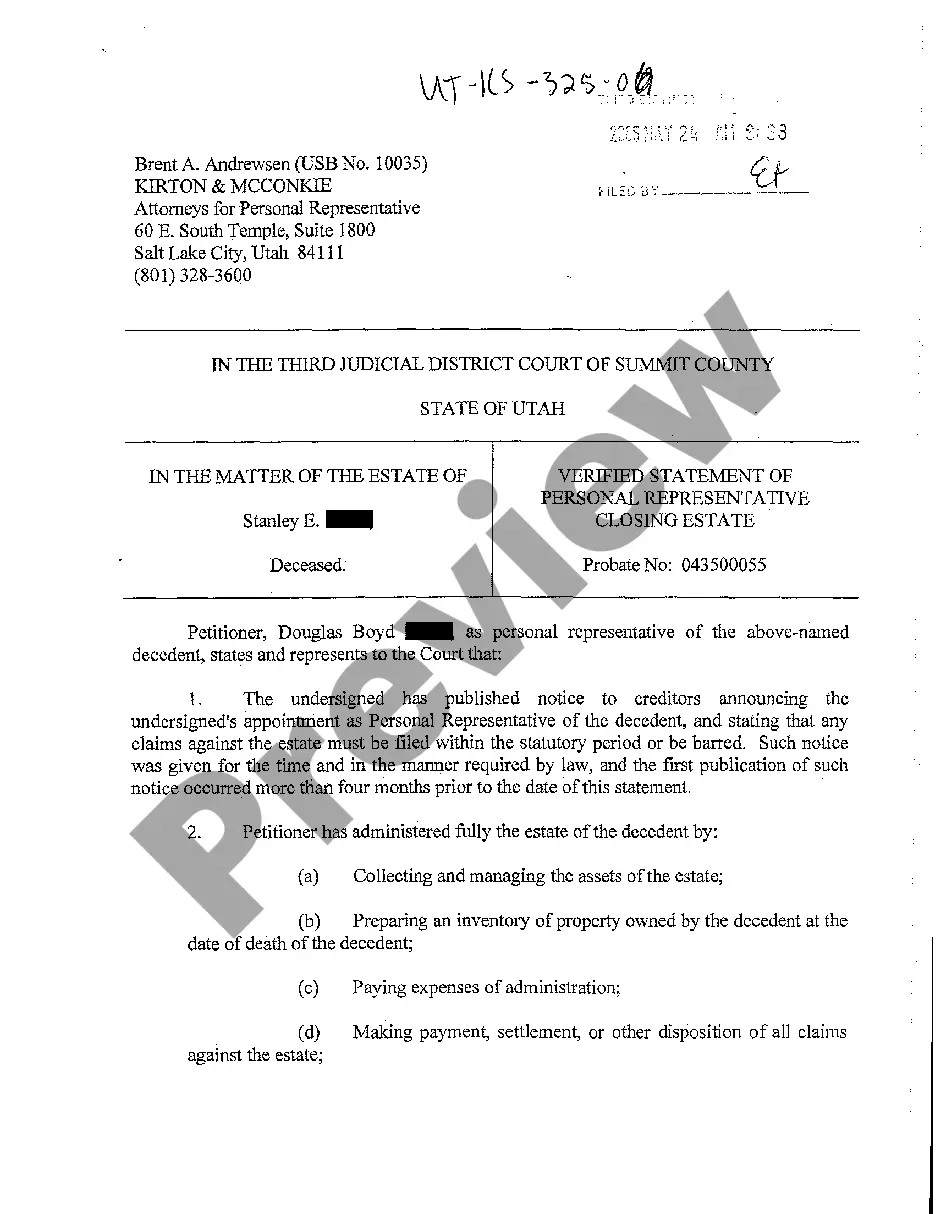

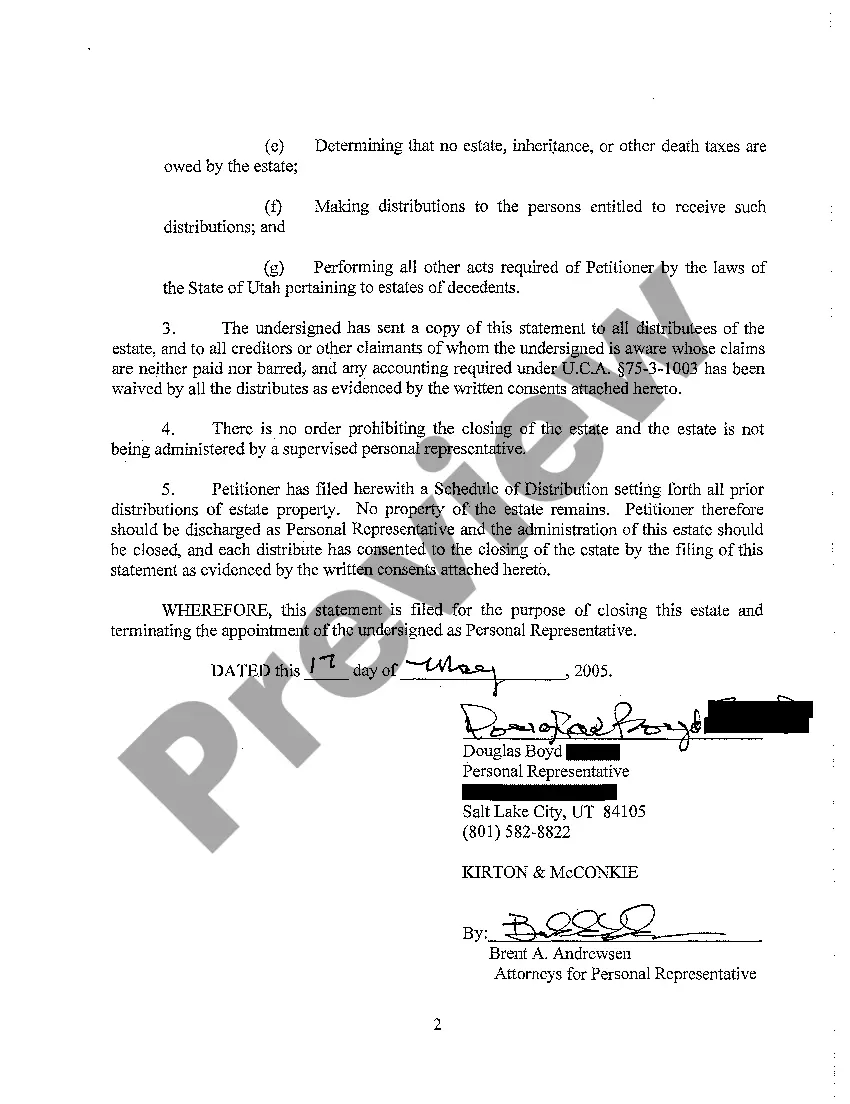

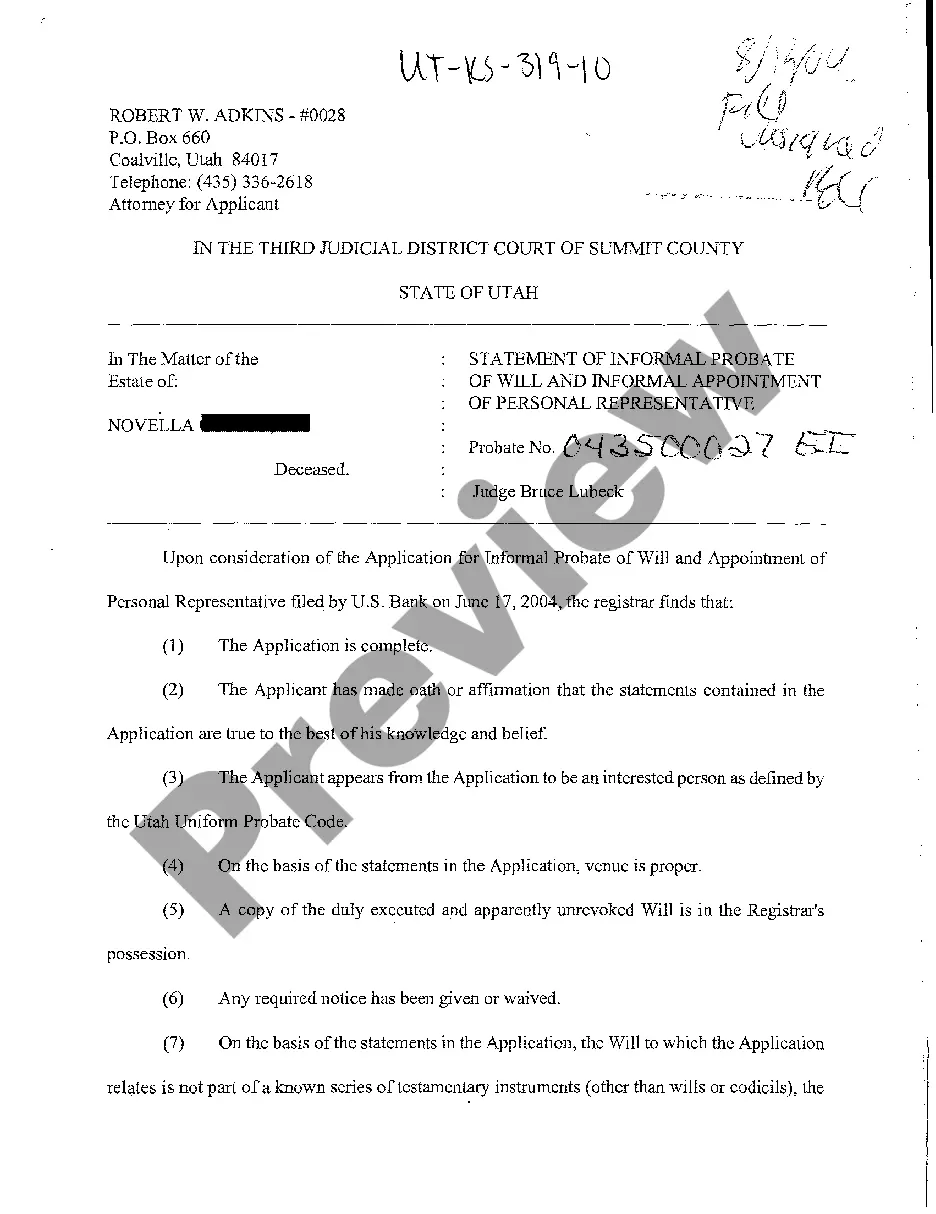

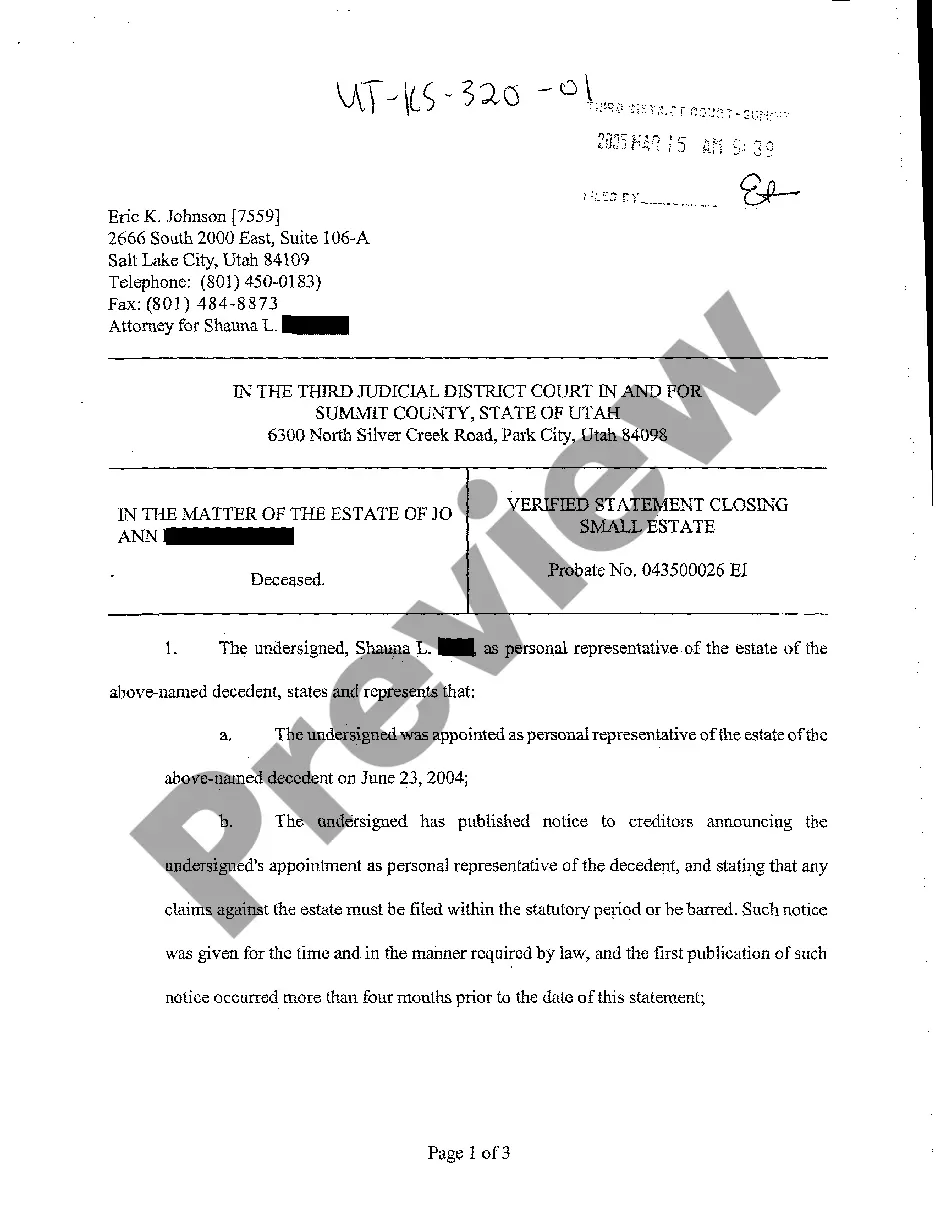

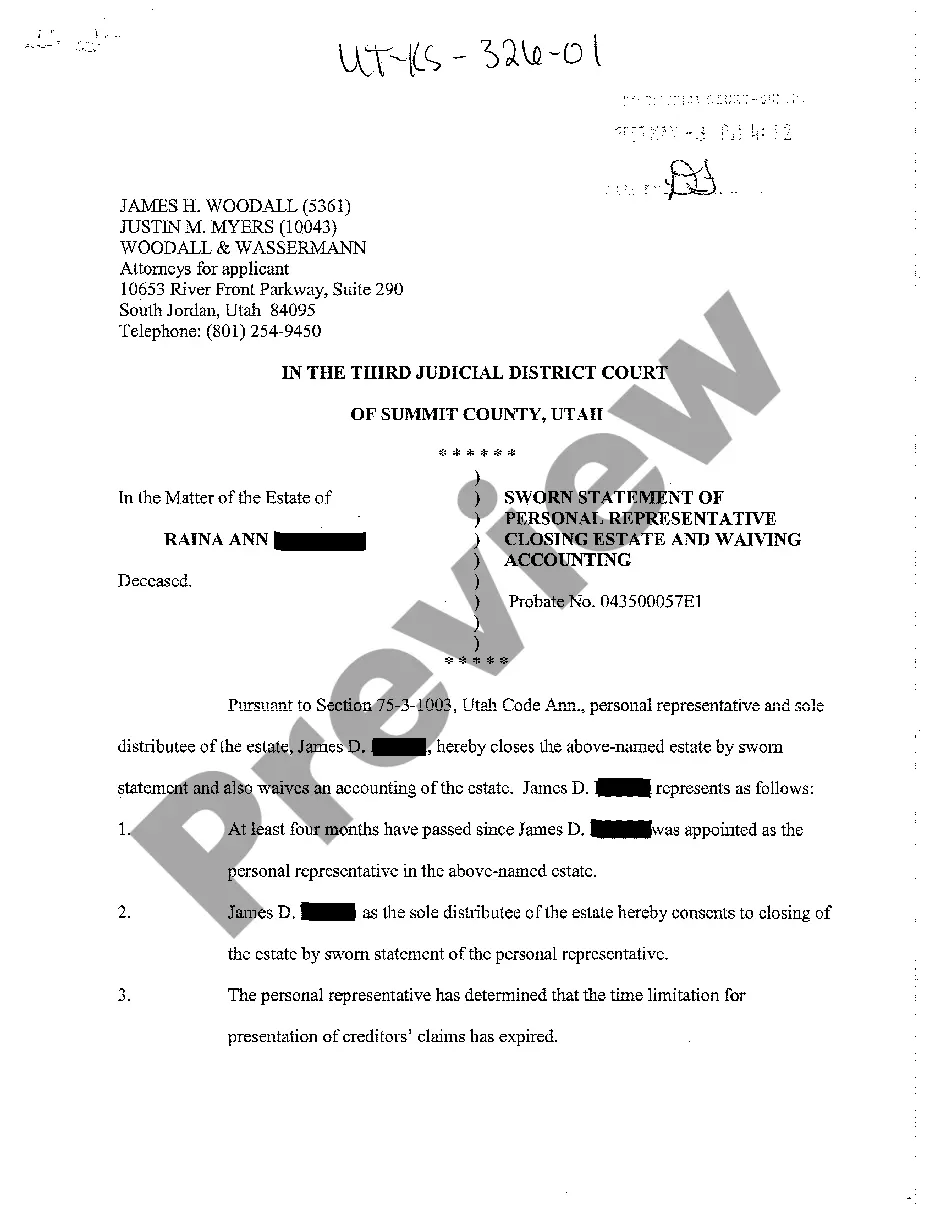

Utah Verified Statement of Personal Representative Closing Estate

Description

How to fill out Utah Verified Statement Of Personal Representative Closing Estate?

Among countless free and paid templates that you can get on the net, you can't be certain about their accuracy. For example, who created them or if they’re skilled enough to take care of what you need those to. Keep relaxed and utilize US Legal Forms! Find Utah Verified Statement of Personal Representative Closing Estate templates made by professional lawyers and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and after that paying them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are searching for. You'll also be able to access your earlier acquired documents in the My Forms menu.

If you’re using our service the first time, follow the tips listed below to get your Utah Verified Statement of Personal Representative Closing Estate quick:

- Make certain that the document you find is valid in the state where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another sample utilizing the Search field located in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you’ve signed up and paid for your subscription, you may use your Utah Verified Statement of Personal Representative Closing Estate as often as you need or for as long as it remains valid in your state. Edit it in your favored online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

As a fiduciary, a personal representative can be removed for waste, embezzlement, mismanagement, fraud, and for any other reason the court deems sufficient.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

However, if the other beneficiary is someone you do not know well, someone who you suspect will spend all the money right away, or someone who will not readily help you pay for a future bill, then you should keep the account open, perhaps until two years have passed since the date of death.

A personal representative or legal personal representative is the executor or administrator for the estate of a deceased person.If the deceased person died intestate, the personal representative will serve as the administrator of the intestate estate.

If you are named as an executor in the deceased's will, you must produce proof of your executor status and provide a certified copy of the death certificate before the bank will provide access to the account.Present either of these letters to the bank along with the death certificate to close the account.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.