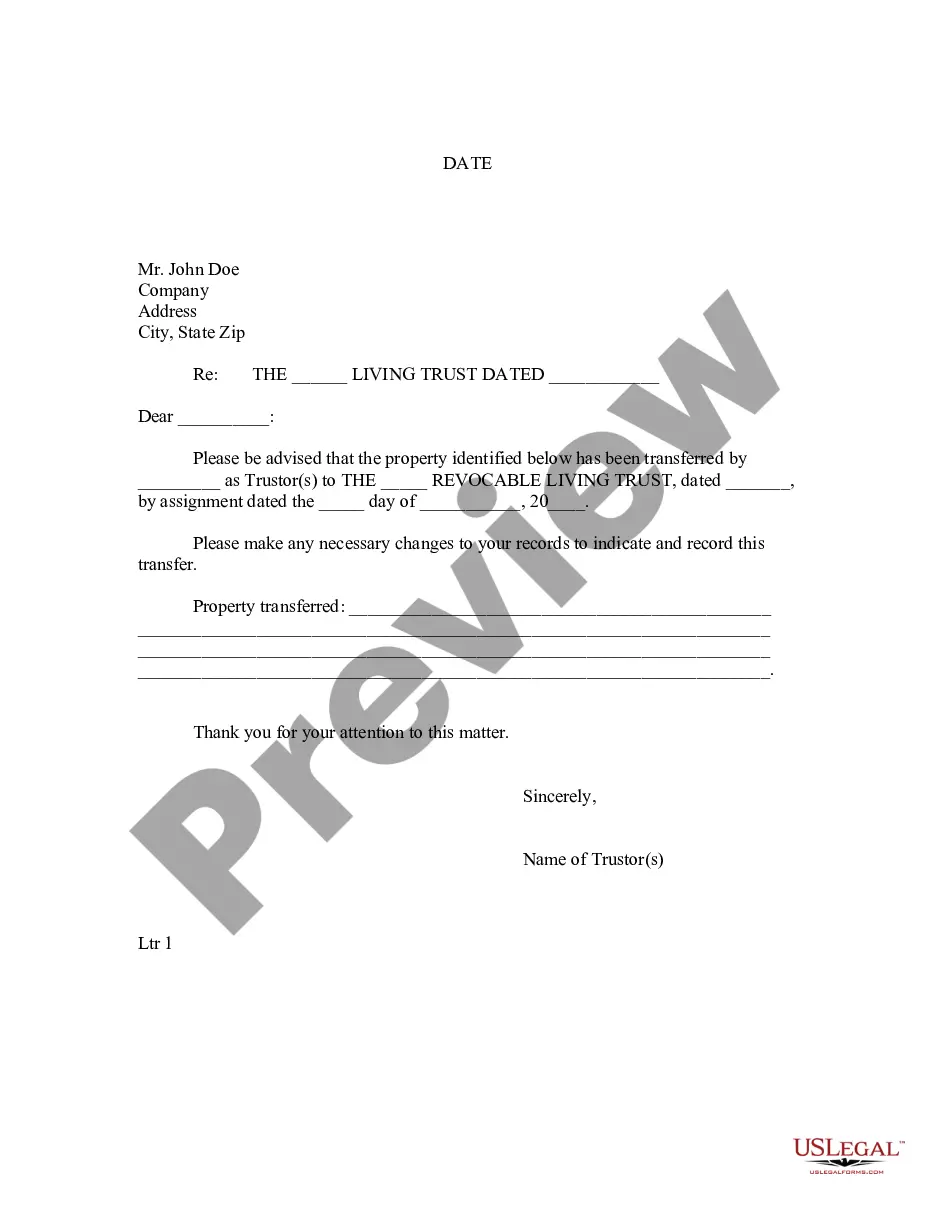

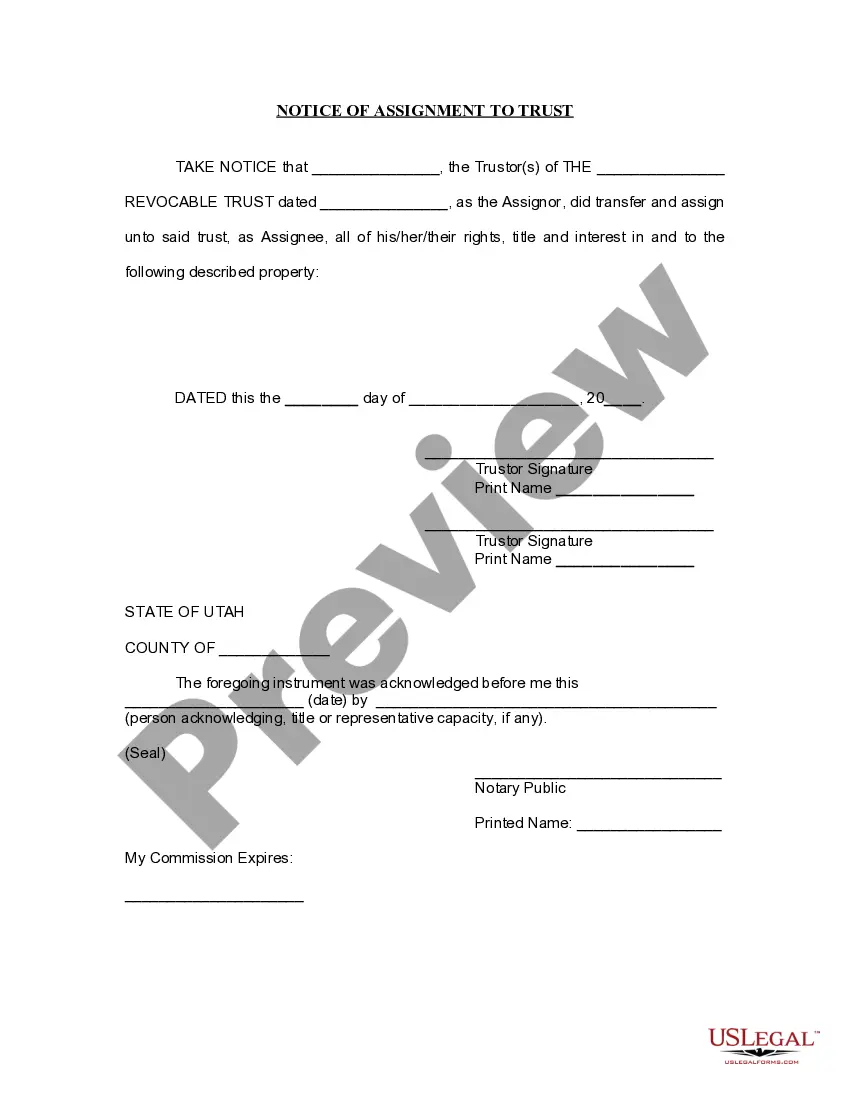

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Utah Notice of Assignment to Living Trust

Description

How to fill out Utah Notice Of Assignment To Living Trust?

Searching for a Utah Notice of Assignment to Living Trust on the internet can be stressful. All too often, you find documents which you believe are ok to use, but find out later they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you’re looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will immediately be added to the My Forms section. If you don’t have an account, you should sign up and select a subscription plan first.

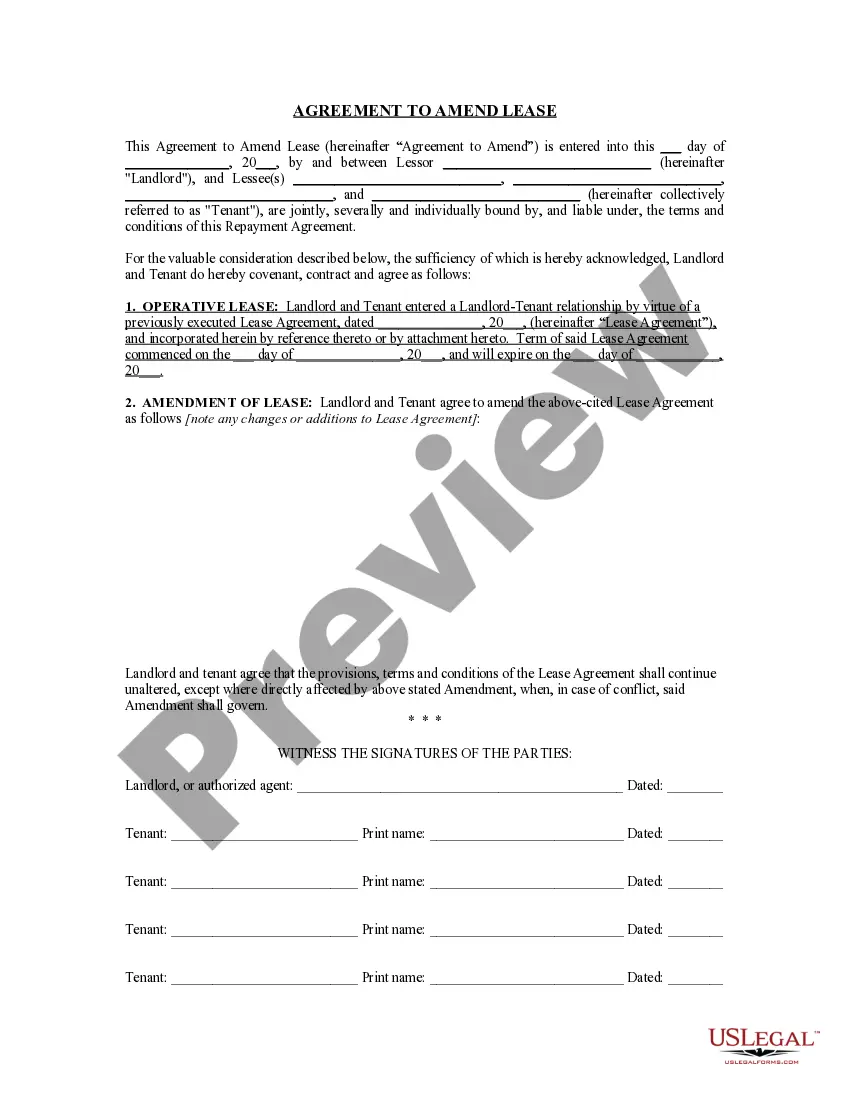

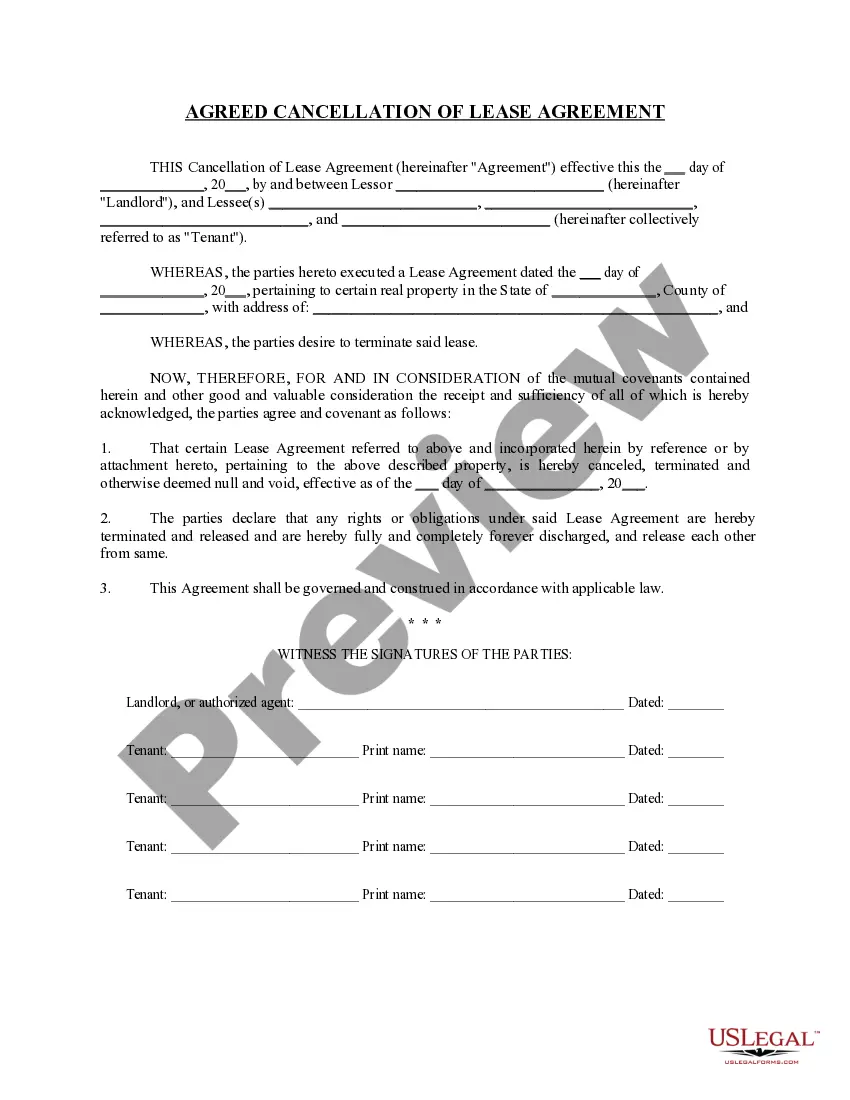

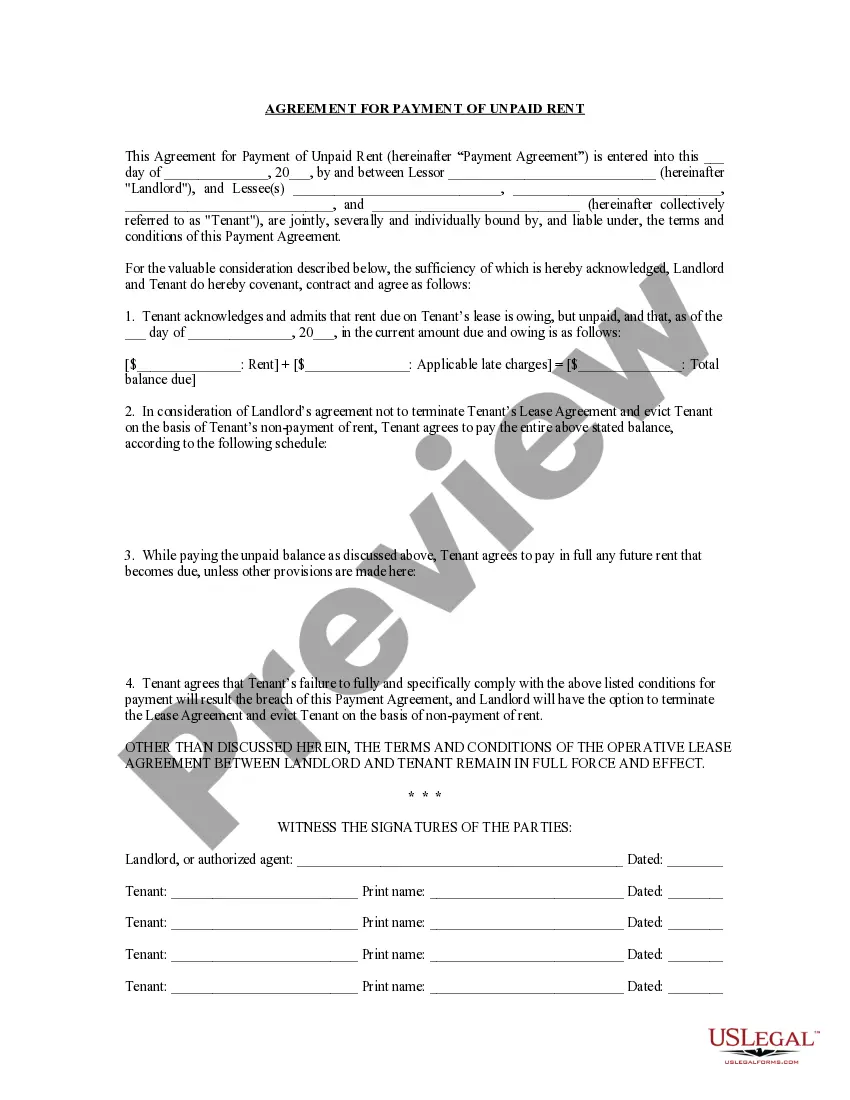

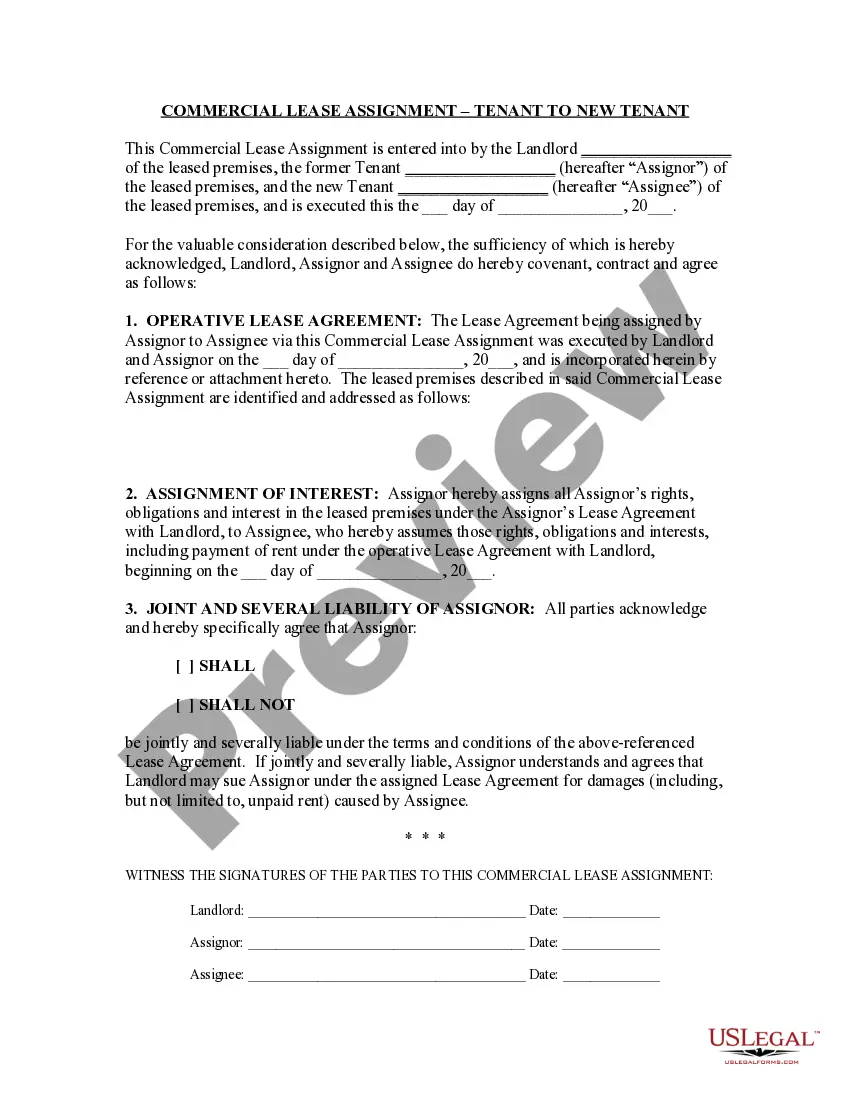

Follow the step-by-step guidelines below to download Utah Notice of Assignment to Living Trust from our website:

- Read the form description and hit Preview (if available) to verify whether the form meets your requirements or not.

- In case the form is not what you need, get others using the Search engine or the listed recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After downloading it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. Besides professionally drafted samples, customers may also be supported with step-by-step guidelines concerning how to find, download, and complete templates.

Form popularity

FAQ

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

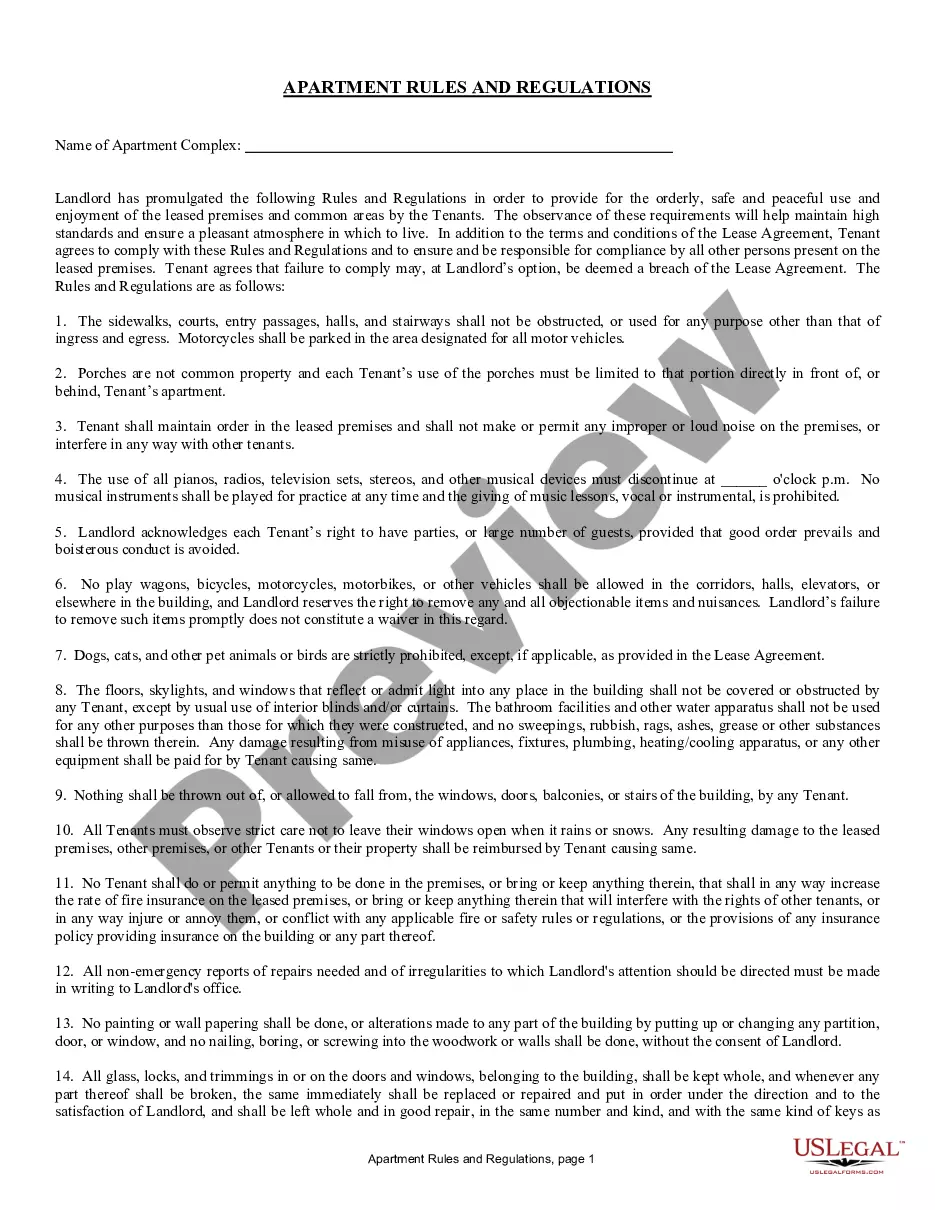

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

1Determine the Current Title and Vesting to Your Property.2Prepare a Deed.3Be Aware of Your Lender and Title Insurance.4Prepare a Preliminary Change of Ownership Report.5Execute Your Deed.6Record Your Deed.7Wait for the Deed to be Returned.8Keep the Property in the Trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

The trust in no way protects your assets, so that reasoning is simply false. You should put your vehicles into your trust in order to avoid probate. Only those assets held by the trust will avoid probate.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Usually, a trust prohibits beneficiaries from assigning their interest in the trust before distribution. The anti-assignment provision protects undistributed trust assets from claims by a beneficiary's creditors.