Quitclaim Deed for Mineral / Royalty Interest

Definition and meaning

A Quitclaim Deed for Mineral / Royalty Interest is a legal document used to transfer ownership rights to mineral resources or royalties associated with a specific property. This type of deed does not guarantee that the transferring party has valid ownership; it simply relinquishes any claim they may have to the interests being conveyed. It is commonly used in situations where the previous owner may not have a complete title or where the transaction is between acquaintances or family members, making the assurance of complete ownership less critical.

How to complete a form

Completing a Quitclaim Deed for Mineral / Royalty Interest involves several steps:

- Provide the state and county where the property is located.

- List the Quit Claiming Party's full name and their address.

- Indicate the effective date of the transfer.

- Describe the lands that are subject to the deed, including specific information about the mineral or royalty interests being conveyed.

- Sign the document in front of a notary public to validate the deed.

After filling out the form, ensure all parties involved understand their rights and responsibilities regarding the conveyed interests.

Who should use this form

This form is particularly beneficial for individuals or entities that:

- Want to transfer mineral or royalty interests without involving a formal sale.

- Are owners who wish to disclaim any claims to certain interests in a property.

- Need to clarify ownership issues among family members or business partners.

It's essential that users understand their ownership rights before utilizing this deed to avoid any future disputes.

Legal use and context

A Quitclaim Deed for Mineral / Royalty Interest is mostly used in real estate and mining transactions. Unlike a warranty deed, this form does not provide warranty of title, meaning it does not guarantee that the party transferring the deed holds any valid claim to the interests involved. It is frequently employed in informal transfers among friends or family, or to clarify ownership among co-owners of mineral rights. Users should consult with a legal professional to ensure that this deed meets their particular needs and complies with local laws.

What documents you may need alongside this one

When completing and filing a Quitclaim Deed for Mineral / Royalty Interest, you may require the following documents:

- Previous ownership documents that establish rights to the mineral interest.

- Property description documents, such as surveys or maps.

- Related deeds showing transfers of interests.

- Identification for all parties involved in the transaction.

Gathering these documents in advance ensures a smoother completion process.

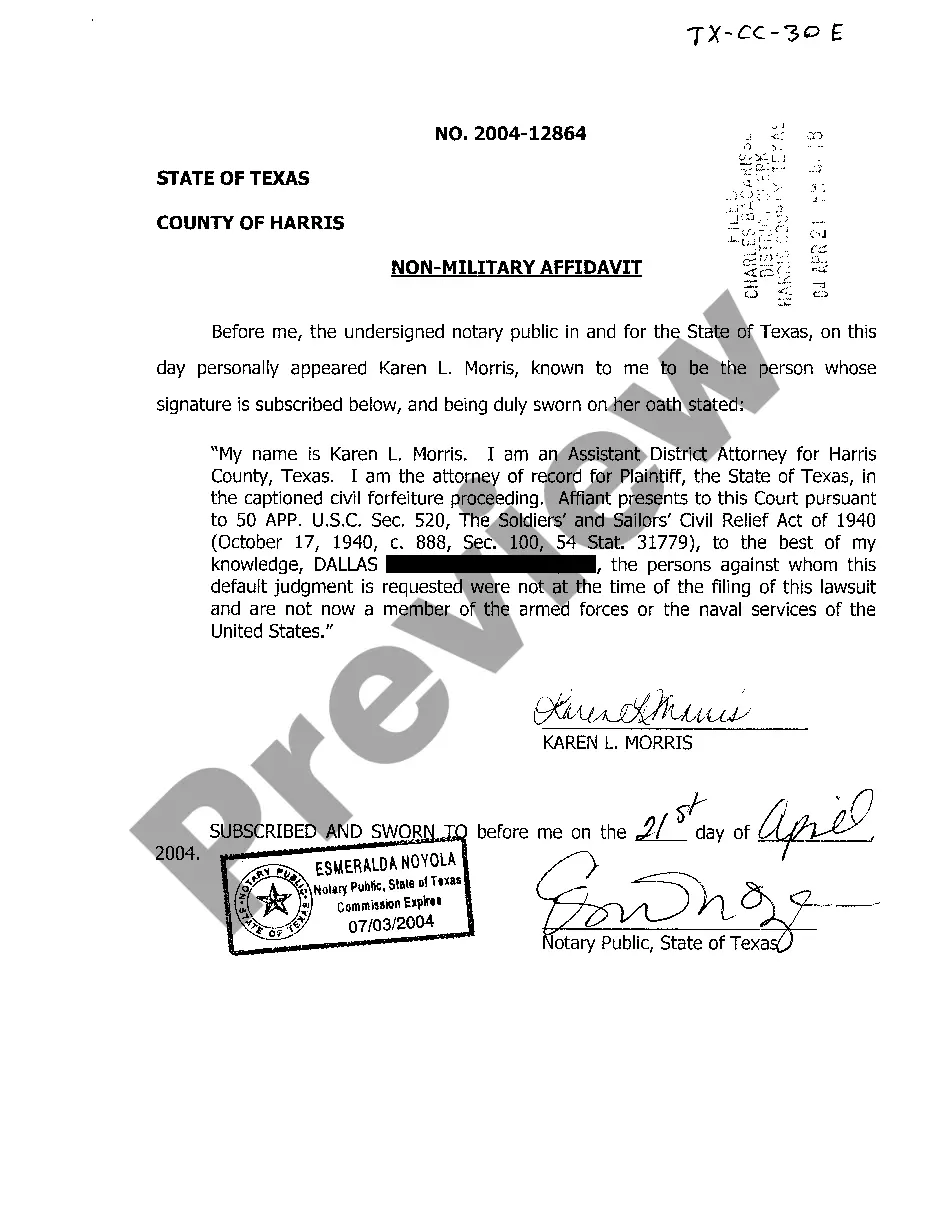

What to expect during notarization or witnessing

Notarization is a crucial step in validating a Quitclaim Deed for Mineral / Royalty Interest. During this process, you can expect the following:

- You will need to present valid identification to the notary public.

- All signers must be present for the deed to be notarized.

- The notary will complete the notarial certificate, which confirms the identity of the signers and affirms that the document was signed willingly.

Notarization helps prevent fraud and assures that the document is legally binding.

Key takeaways

Utilizing a Quitclaim Deed for Mineral / Royalty Interest can facilitate the smooth transfer of ownership rights. Here are the key points to remember:

- This deed provides no warranties on ownership.

- It is best used among familiar parties or in informal contexts.

- Proper documentation and notarization are necessary to ensure legality.

- Understanding ownership rights is crucial to avoid future disputes.

Using this deed correctly can save time and resources while clarifying mineral ownership interests.

Form popularity

FAQ

Quitclaim deeds do not rid the grantor of tax obligations.However, once a grantee accepts a clear title on the property, they inherit the responsibility of paying the newly acquired property taxes. The grantor no longer is obligated to pay future taxes on the property.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

A quitclaim deed transfers the owner's entire interest in the property to the person receiving the property but it only transfers what he actually owns, so if two people jointly own the property and one of them quitclaims his interest to his brother, he can only transfer his half of the ownership.

V. to transfer title (official ownership) to real property (or an interest in real property) from one (grantor) to another (grantee) by a written deed (or an equivalent document such as a judgment of distribution which conveys real property from an estate).

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A mineral deed form is a legal document, regarding the ownership of the minerals below the surface of the earth.A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

1. You're buying the least amount of protection of any deed. Also called a non-warranty deed, a quitclaim deed conveys whatever interest the grantor currently has in the property if any. The grantor only "remises, releases, and quitclaims" their interest in the property to the grantee.