Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Self-Employed Independent Contractor Employment Agreement - Commission For New Business?

Make use of the most comprehensive legal catalogue of forms. US Legal Forms is the best platform for getting updated Self-Employed Independent Contractor Employment Agreement - commission for new business templates. Our platform offers a huge number of legal forms drafted by licensed legal professionals and sorted by state.

To download a template from US Legal Forms, users simply need to sign up for an account first. If you are already registered on our platform, log in and select the template you need and purchase it. After buying forms, users can see them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the steps below:

- Check if the Form name you have found is state-specific and suits your requirements.

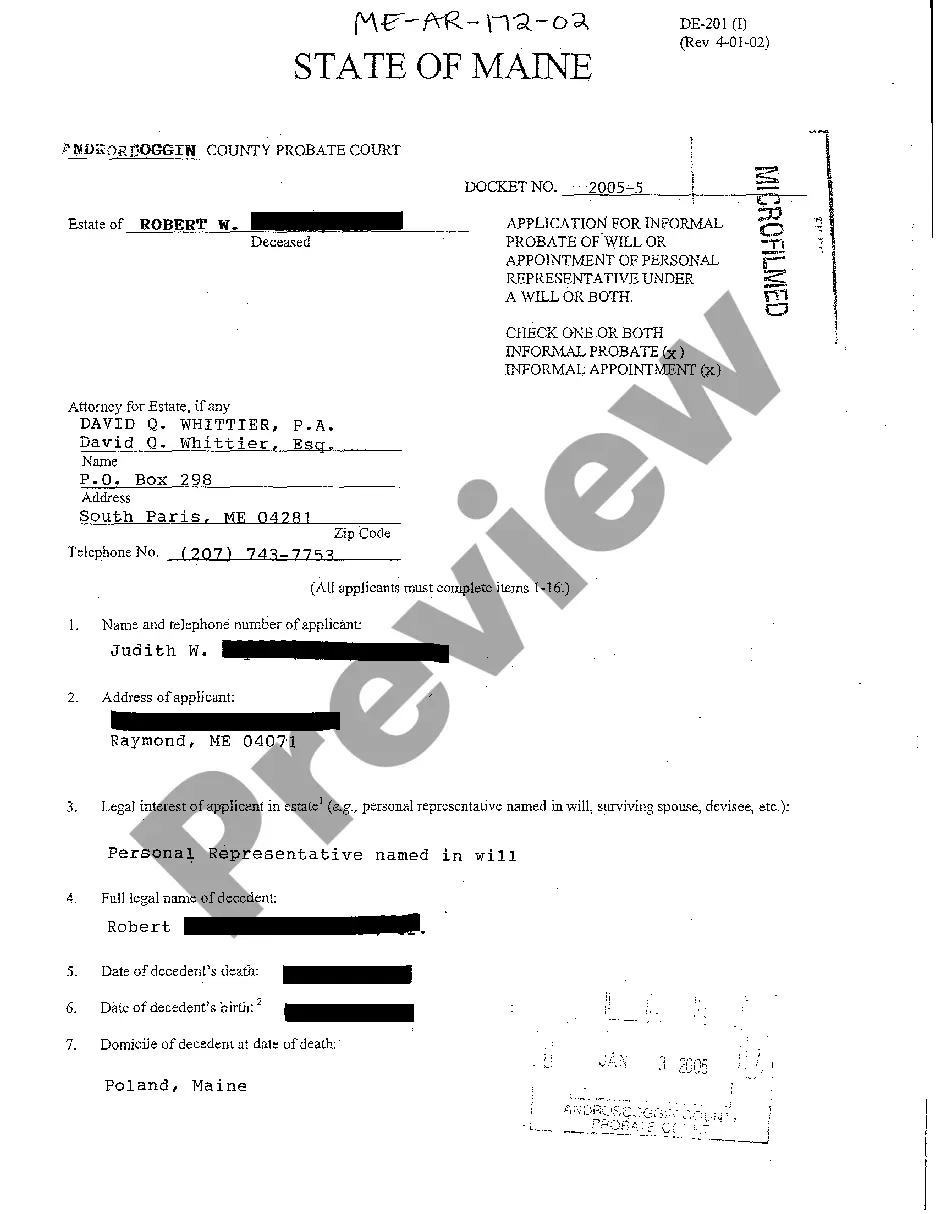

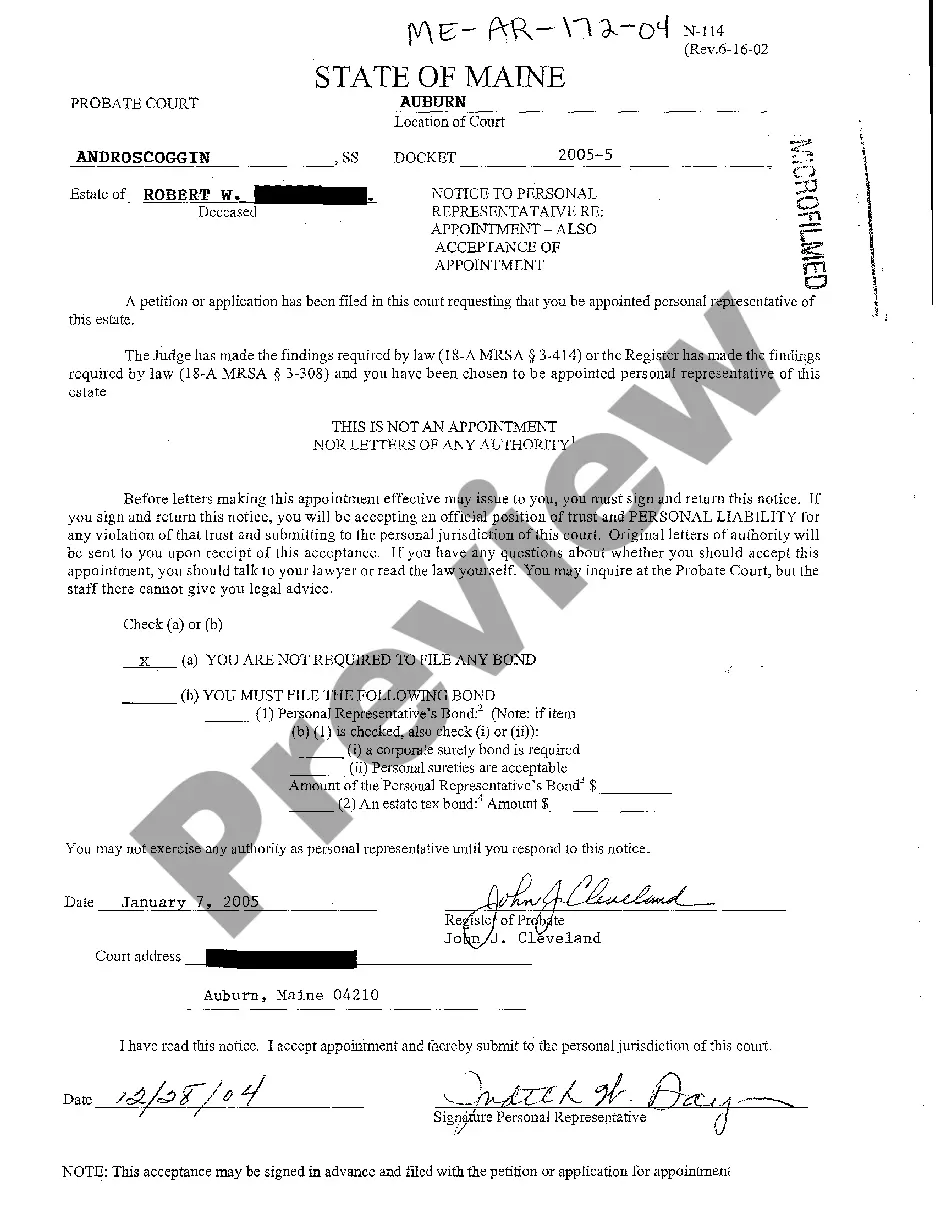

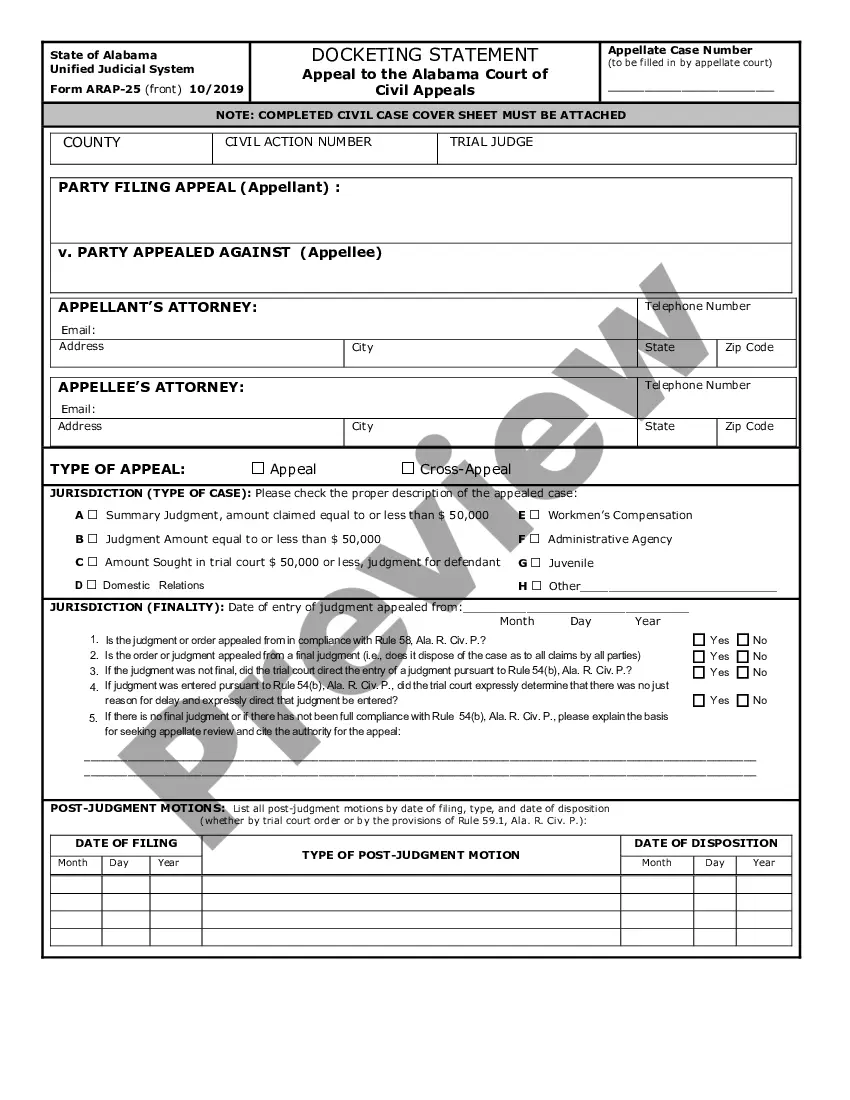

- In case the template has a Preview option, utilize it to check the sample.

- If the sample doesn’t suit you, make use of the search bar to find a better one.

- Hit Buy Now if the template corresponds to your needs.

- Select a pricing plan.

- Create a free account.

- Pay via PayPal or with the credit/credit card.

- Select a document format and download the sample.

- When it’s downloaded, print it and fill it out.

Save your effort and time using our platform to find, download, and fill in the Form name. Join a huge number of pleased customers who’re already using US Legal Forms!

Form popularity

FAQ

If you are an independent contractor working for a business with commission-based payment, the employer may not have to pay the minimum wage or overtime. However, a business that makes a commission agreement with an independent contractor is generally held to the agreement.

You must also include commissions as employee income on Form 941, your quarterly payroll tax report, and make periodic payments of these taxes to the IRS. Reporting Non-Employee Commissions.These workers are considered self-employed and the payments you give them are subject to self-employment taxes on these payments.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

Other Income Not Subject to Self Employment Tax Participation in a drug trial or clinical study that paid one time. Hobbies that include creation and patenting of inventions, when done occasionally. Occasional leasing of a commercial permit to another party with intention to return to using the permit when able.

You must also include commissions as employee income on Form 941, your quarterly payroll tax report, and make periodic payments of these taxes to the IRS. Reporting Non-Employee Commissions.These workers are considered self-employed and the payments you give them are subject to self-employment taxes on these payments.

As an employer, you are required to withhold taxes on commissions. You need to withhold payroll and federal income taxes. You withhold payroll taxes on commissions the same way you do for regular wages.The FICA tax rate is 7.65% (6.2% for Social Security and 1.45% for Medicare).

Self-employment tax is owed on your commission income only when you're an independent contractor.There's no self-employment tax owed on your commissions earned when you have employee status because your employer is responsible for withholding and paying Social Security and Medicare taxes.

All wages earned by an employee must be paid upon termination, and by definition, commissions are considered wages.A majority of states have wage payment laws that outline the specific requirements for the payment of commissions to terminated employees.

Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved. Responsibilities & Deliverables. Payment-Related Details. Confidentiality Clause. Contract Termination. Choice of Law.