Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building

Description

Key Concepts & Definitions

Real Estate Joint Venture Agreement: A legal arrangement where two or more parties pool their resources to undertake real estate development projects. This includes sharing capital, expertise, and sharing risks and rewards.

Financial Modeling: Used to project the monetary outcomes of a joint venture, often evaluating various scenarios to understand potential returns and risks.

Due Diligence: The process of investigating and evaluating a potential investment before proceeding with a transaction, crucial in any real estate joint venture.

Intellectual Property: While not typical in real estate, the design and unique construction methods can be considered as IP and might be shared within the JV.

Capital Markets: Play a role in funding real estate ventures through methods like equity or debt financing.

Step-by-Step Guide to Creating a Real Estate Joint Venture Agreement

- Identify a Partner: Choose a partner whose resources, goals, and expertise align with yours.

- Conduct Due Diligence: Thoroughly investigate the partner's financial standing and track record.

- Negotiate Terms: Include roles, capital contribution, profit sharing, and management responsibilities.

- Engage Legal Counsel: Involve attorneys to draft the agreement, ensuring adherence to state laws and that all aspects of the venture are clearly defined.

- Finalize Financial Modeling: Confirm financial projections and responsibilities are understood and agreed upon before signing.

- Execute and Monitor: Sign the agreement and continuously monitor the ventures progress and performance.

Risk Analysis

- Market Risk: The property market might not perform as expected, impacting venture returns.

- Financial Risk: Issues such as mismanagement of funds or inadequate capitalization can strain the venture.

- Operational Risk: Delays and unexpected operational challenges can alter timelines and budgets.

- Legal/Compliance Risk: Failing to comply with local real estate laws and regulations can result in legal penalties.

- Partnership Risk: Conflicts between partners may arise, potentially disrupting the venture.

Key Takeaways

- Ensure alignment of goals and thorough vetting of all partners before forming a joint venture.

- Legal and financial preparations are critical to navigate and mitigate potential risks effectively.

- Continuous management and open communication between partners are key for the success of any real estate joint venture.

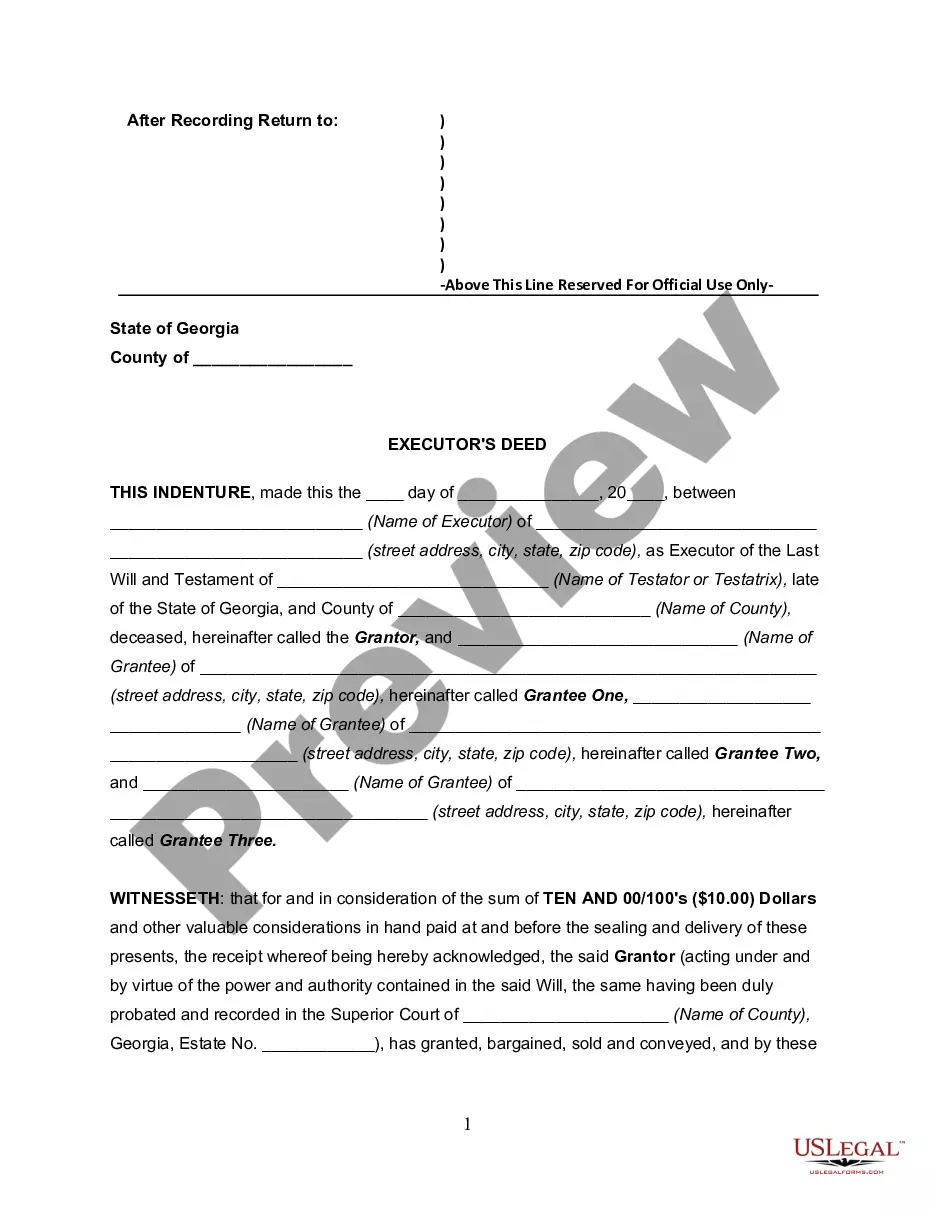

How to fill out Real Estate Joint Venture Agreement For The Purpose Of Repairing, Renovating And Selling A Building?

Use the most comprehensive legal library of forms. US Legal Forms is the best place for finding up-to-date Real Estate Joint Venture Agreement for the Purpose of Repairing, Renovating and Selling a Building templates. Our service provides a huge number of legal forms drafted by licensed lawyers and sorted by state.

To download a sample from US Legal Forms, users simply need to sign up for a free account first. If you are already registered on our platform, log in and select the template you are looking for and buy it. Right after buying templates, users can see them in the My Forms section.

To obtain a US Legal Forms subscription online, follow the steps listed below:

- Check if the Form name you have found is state-specific and suits your requirements.

- In case the template features a Preview option, use it to check the sample.

- In case the sample doesn’t suit you, utilize the search bar to find a better one.

- PressClick Buy Now if the template corresponds to your requirements.

- Select a pricing plan.

- Create your account.

- Pay with the help of PayPal or with yourr credit/visa or mastercard.

- Select a document format and download the template.

- After it’s downloaded, print it and fill it out.

Save your time and effort using our platform to find, download, and fill out the Form name. Join a huge number of delighted clients who’re already using US Legal Forms!

Form popularity

FAQ

There's no right or wrong way to split partnership profits, only what works for your business. You can decide to pay each partner a base salary and then split any remaining profits equally, or assign a percentage based on the time and resources each person contributes to the company.

The structure of the joint venture, e.g. whether it will be a separate business in its own right. the objectives of the joint venture. the financial contributions you will each make. whether you will transfer any assets or employees to the joint venture.

Know your partner. This is obvious. Know your partner's national culture. Decide on the respective roles in detail at the start. Discuss contingencies before the agreement is signed. Create a detailed joint venture agreement. Clear performance indicators. Establish an open dialogue. Keep good records.

A joint venture in real estate is two or more parties that combine resources for a specific development or investment.The responsibilities in a joint venture can be assigned in whatever way is needed for the particular project. The profits are also shared however the parties agree.

While signing a Joint Venture agreement, the following clauses must be properly examined such as: Object and scope of the Joint Venture; Equity participation by local and foreign investors and agreement to a future issue of capital; Management Committee; Financial arrangements; The composition of the board and

Choosing the right joint venture partner The ideal partner in a joint venture is one that has resources, skills and assets that complement your own. The joint venture has to work contractually, but there should also be a good fit between the cultures of the two organisations.

Joint ventures between two or more existing entities may take shape in different ways. The existing organizations may simply enter into an agreement to work together or pool resources for a specific purpose, or may opt to form a new entity for the purpose of conducting their joint business.

Complementary resources and capabilities. Unique competencies. Goal compatibility. Financial resources. Human capital. Organizational culture. Historical performance.

Joint venture are not required to file formal paperwork or documentation of status with state or federal governments. Instead, development of a joint venture is contractual and involves one business entity entering into a contract with another entity.