Sample Letter for Creditor Notification of Estate Opening

Description

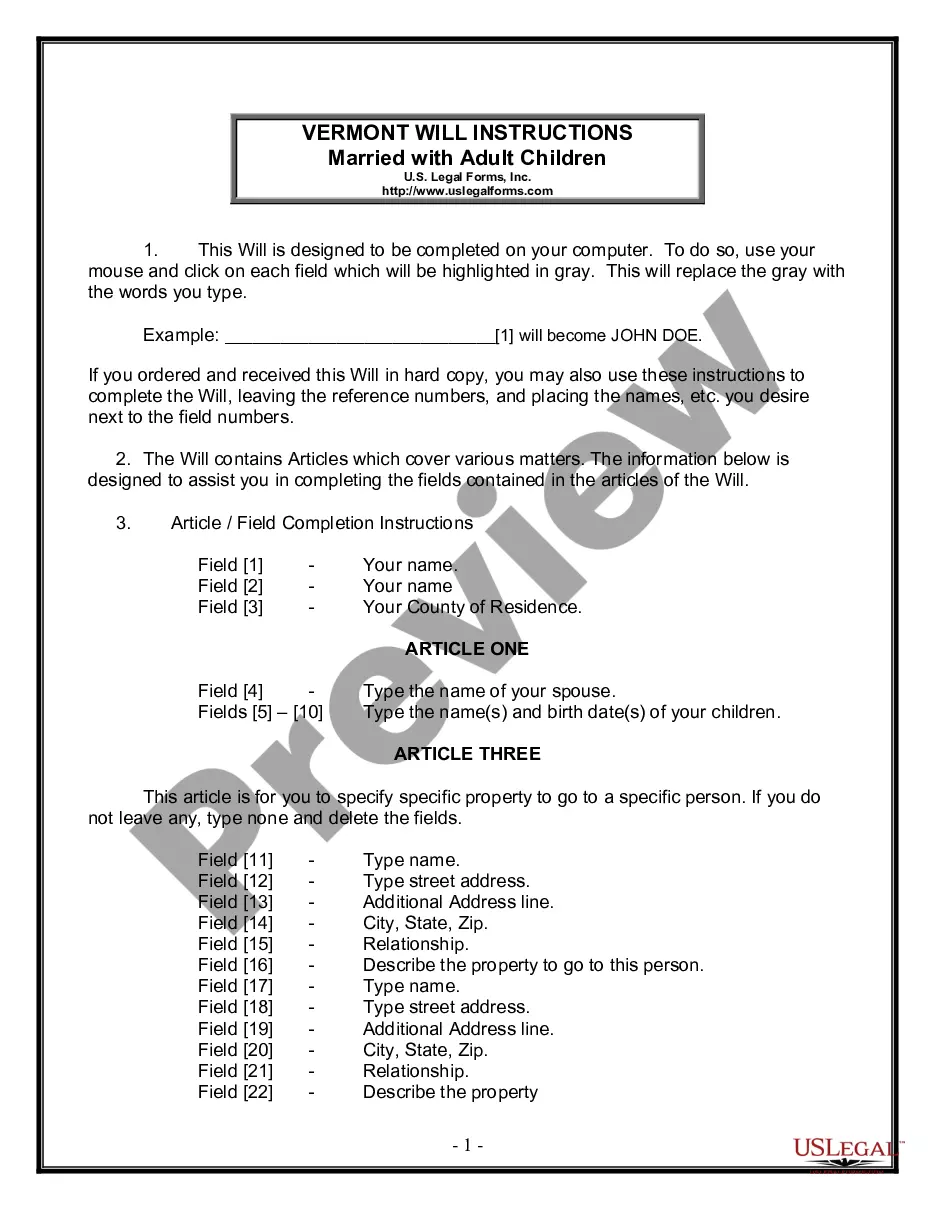

How to fill out Sample Letter For Creditor Notification Of Estate Opening?

Use US Legal Forms to get a printable Sample Letter for Creditor Notification of Estate Opening. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Our’s is the most extensive Forms catalogue on the web and provides reasonably priced and accurate templates for customers and attorneys, and SMBs. The documents are categorized into state-based categories and a few of them can be previewed prior to being downloaded.

To download templates, customers need to have a subscription and to log in to their account. Click Download next to any template you want and find it in My Forms.

For people who do not have a subscription, follow the tips below to quickly find and download Sample Letter for Creditor Notification of Estate Opening:

- Check out to ensure that you get the correct form in relation to the state it’s needed in.

- Review the document by reading the description and by using the Preview feature.

- Hit Buy Now if it is the template you need.

- Generate your account and pay via PayPal or by card|credit card.

- Download the template to the device and feel free to reuse it multiple times.

- Use the Search field if you want to find another document template.

US Legal Forms offers a large number of legal and tax templates and packages for business and personal needs, including Sample Letter for Creditor Notification of Estate Opening. More than three million users have already utilized our service successfully. Choose your subscription plan and obtain high-quality documents within a few clicks.

Form popularity

FAQ

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

Generally speaking, creditors try to collect on what's owed them by going after the estate of the decedent in a process called probate. However, there are instances where the surviving spouse (or other heir) may be legally responsible. Not all assets are counted as part of a person's estate for probate purposes.

A notice to creditors refers to a public notice that is addressed to potential creditors and debtors of an estate of a deceased individual. The notice is published by the estate executor in local and national newspapers with a national circulation for several weeks, depending on the estate laws of the state.

A notice to creditors is a public statement noting the death of an individual in order to alert potential creditors to the situation. Still published in local newspapers, the notice is filed by the estate's executor and meant to facilitate the probate proceedings.

Inform the creditor that the deceased passed away; reference the prior call you made. Ask the creditor to place a formal death notice on the deceased credit file and to close the account. Provide information about the decedent, such as his full name, address, Social Security number, birth date and account number.

How to Notify Creditors of Death. Once your debts have been established, your surviving family members or the executor of your estate will need to notify your creditors of your death. They can do this by sending a copy of your death certificate to each creditor.

If you or your loved one has completed a beneficiary form for each account such as your life insurance policy and 401(k) unsecured creditors typically cannot collect any money from those sources of funds.

Timespan for Creditors to Make Claim For unsecured debts, the time limit ranges from 3-6 months in most states. State laws require executors to post notice of the death, either in a newspaper or directly to known creditors to give them a chance to file a claim. No claims are accepted after the time frame has expired.

Mail the letter first class. You should send the letter first class, return receipt requested. The receipt will serve as proof that the creditor received the letter. Be sure to attach any supporting documentation, such as a copy of your credit report.