Agreement for Conditional Gifts

Definition and meaning

The Agreement for Conditional Gifts is a legal document that outlines the terms under which one party, referred to as the Donor, agrees to provide financial assistance or gifts to another party, known as the Donee. This agreement stipulates specific conditions that must be met in order for the gifts to continue. Typically, these conditions may include requirements related to the Donee's living arrangements, financial accountability, or educational progress.

Key components of the form

The Agreement for Conditional Gifts generally includes the following key components:

- Identification of Parties: Clearly identifies both the Donor and Donee, including their names and contact information.

- Gift Details: Specifies the nature and amount of the financial gifts, such as funds for rent, living expenses, or educational costs.

- Conditions: Outlines the specific conditions that the Donee must fulfill in order to receive the gifts.

- Duration: States the period during which the agreement is effective.

- Signatures: Requires signatures from both parties to validate the agreement.

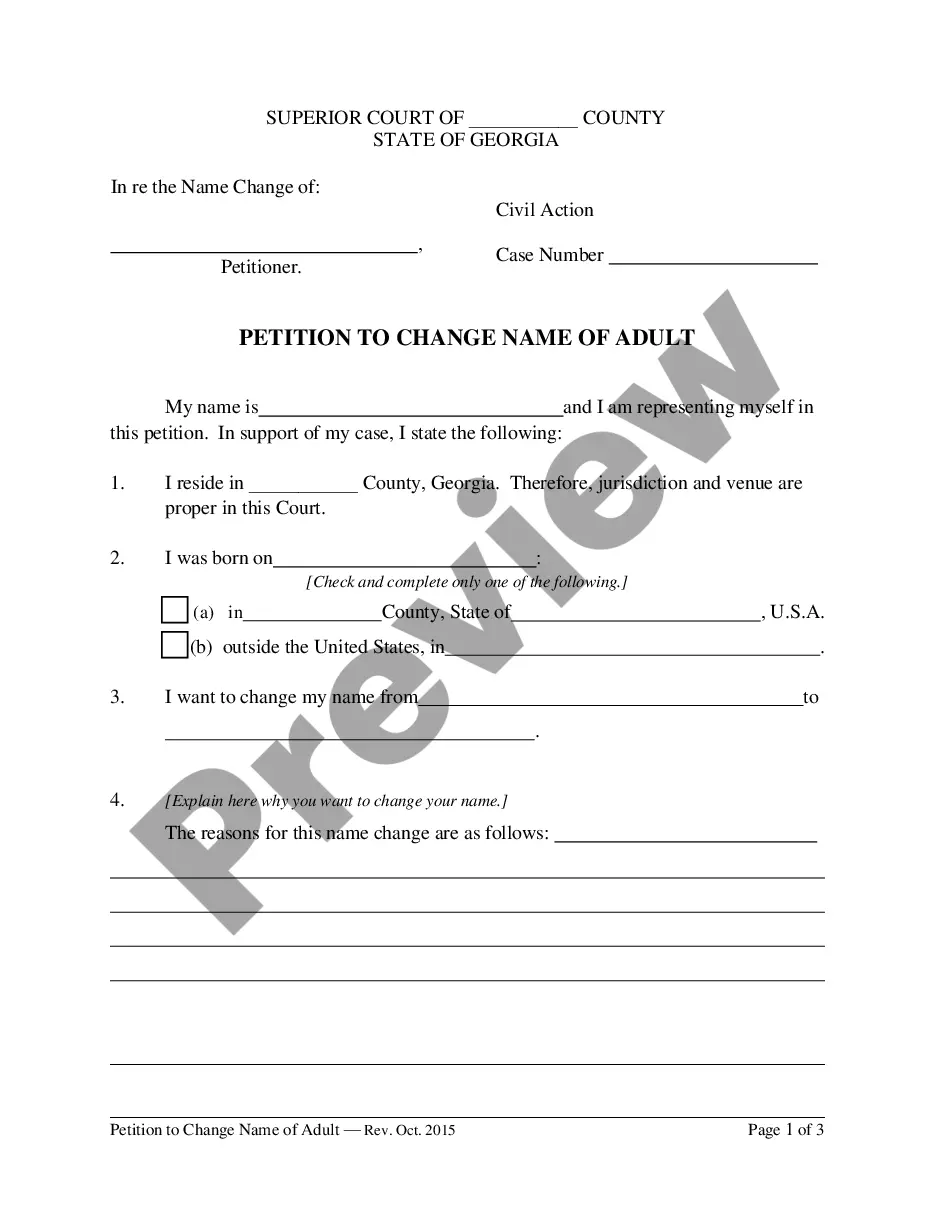

How to complete a form

To complete the Agreement for Conditional Gifts, follow these steps:

- Gather Information: Collect the necessary details about both the Donor and Donee, including their names, addresses, and any relevant financial information.

- Fill Out the Form: Complete the template by providing the required information. Be sure to specify the gifts, the conditions, and any other relevant details.

- Review the Conditions: Clearly state the conditions that must be met by the Donee to continue receiving gifts.

- Finalize the Agreement: Both parties should review the agreement thoroughly before signing it to ensure mutual understanding.

- Keep Copies: Once signed, each party should keep a copy for their records.

Benefits of using this form online

Utilizing the online Agreement for Conditional Gifts offers several advantages:

- Convenience: Access the form from anywhere at any time, saving time and effort.

- Instant Availability: Download and print the form immediately, eliminating delays associated with mail or in-person appointments.

- Professional Drafting: Forms drafted by licensed attorneys ensure that the legal requirements are met.

- Customizable: Tailor the template to your specific needs effortlessly.

Common mistakes to avoid when using this form

When completing the Agreement for Conditional Gifts, avoid these common errors:

- Incomplete Information: Ensure all required fields are filled out completely to avoid misunderstandings.

- Vague Conditions: Clearly define the conditions for receiving gifts to prevent future disputes.

- Lack of Signatures: Do not forget to include signatures from both parties, as this is crucial for legal validity.

- Ignoring State Regulations: Be mindful of any specific legal requirements that may vary by state.

Form popularity

FAQ

An unconditional gift is a gift that is given without any expectation of reciprocation or in expectation of anything in return. That is, there are no "conditions" on either the giving or the receiving of the gift.A "conditional gift" is one that is done in anticipation of something or in reciprocation of something.

A conditional gift is one which is based on some future event or action taking place. If the event doesn't occur, then the gift-giver has the right to get the gift back. Most courts classify engagement rings as a conditional gift and award the engagement ring to the giver in broken engagement cases.

Dead hand control is conditioning a bequest or devisement to a beneficiary, such that they will only receive the gift if they abide by the conditions of the gift.Sometimes it is to protect the beneficiaries from their own bad behavior or financial mismanagement.

A conditional gift is one that is subject to or dependent on a condition. A conditional gift can be revoked if the recipient does not fulfill the conditions attached to the gift. A gift is a conditional gift and it is not final until some future event occurs.

Gifts can definitely be conditional. A conditional gift is a present given to someone without any consideration in return but with a condition attached to it. A conditional gift is always subject to a condition co-existing with the gift.

In example 1, it is a unilateral contract, because the offeror is bargaining for a service (a ride to a destination). In example 2, it is a conditional gift.If that's his main purpose, as opposed to just being nice, its a contract.

Condition Precedent: A condition precedent is a condition that must occur before any gift is made. Condition Subsequent: A condition subsequent applies to gifts which are given without condition.

As the name suggests a conditional gift is a gift that has some condition attached to it in a Will. The condition can be framed in one of two ways: a condition precedent where an event must occur before the beneficiary can receive the gift; or.

Goals of your written gift agreement Set expectations and understanding between the donor and your organization to create a satisfactory experience. Clearly set forth the donor's intention. Include specific, realistic, or measurable guidelines or restrictions on the nonprofit's use of the gift.