Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status

Description

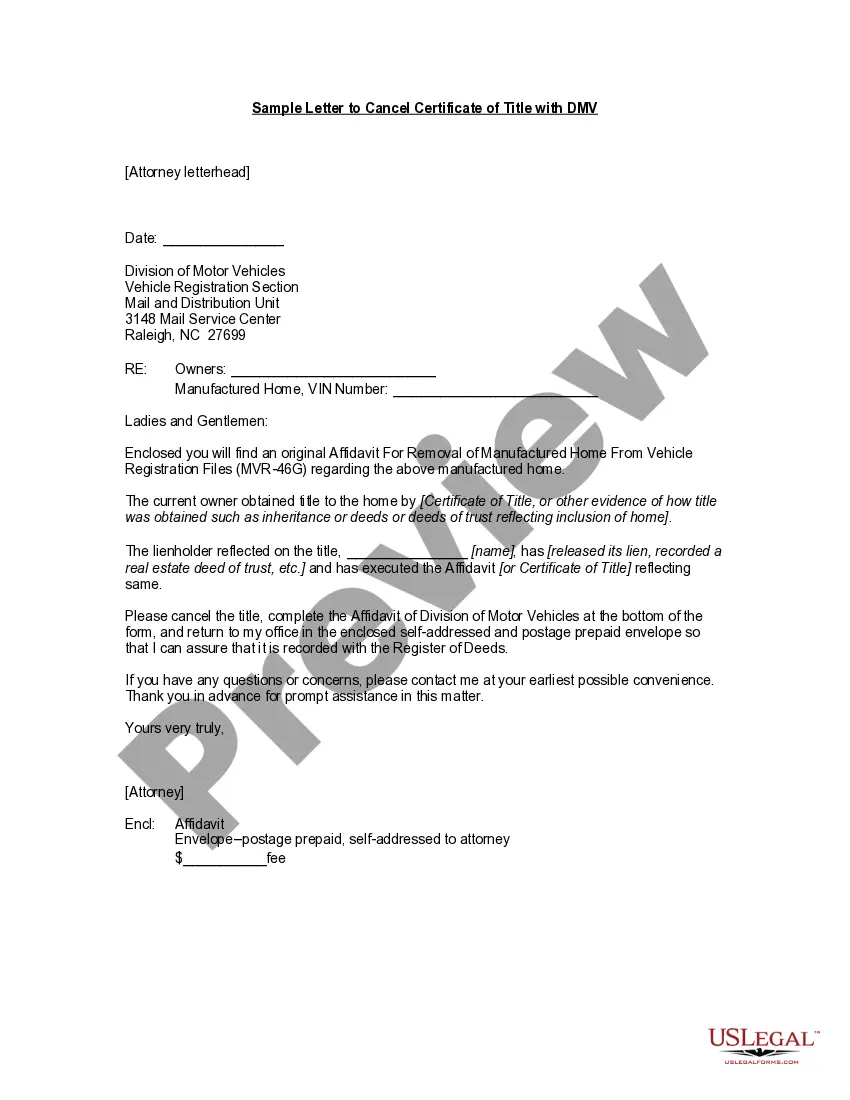

How to fill out Sample Letter For Notice Of Credit Limit - Conversion To C.O.D. Status?

Among numerous paid and free samples that you get online, you can't be certain about their accuracy. For example, who made them or if they’re skilled enough to take care of what you need those to. Keep relaxed and use US Legal Forms! Find Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status samples made by professional lawyers and get away from the high-priced and time-consuming procedure of looking for an lawyer and after that paying them to draft a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your previously saved templates in the My Forms menu.

If you’re making use of our service the very first time, follow the guidelines listed below to get your Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status quickly:

- Make sure that the document you see is valid in the state where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another sample utilizing the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and bought your subscription, you may use your Sample Letter for Notice of Credit Limit - Conversion to C.O.D. Status as often as you need or for as long as it continues to be active where you live. Revise it in your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

The average credit card limit in the UK is between £3,000 to A£4,000. If you want or need to get a premium credit card for a higher limit, you should check your credit score before applying and make sure it's very good.

Most credit experts recommend keeping this percentage at 30% or below. One important thing to consider is that when you request the increase in your credit limit, the issuer will be doing a hard credit inquiry, which will give you a short-term two to five-point credit score decrease.

Mention your reason for needing more credit. Tell the creditor how good your previous record has been. The tone of your letter should be formal, and the language should be unambiguous and objective. Get directly to the point and request the creditor an increase in your credit limit.

What's considered a "normal" credit limit in the U.S.? While limits may vary by age and location, on average Americans have a total credit limit of $22,751 across all their credit cards, according to the latest 2019 Experian data.

It's not typical for a credit card to have a $3,000 minimum credit limit, even when it comes to good credit. For example, cards like Discover it Cash Back and Citi Double Cash offer starting credit limits as low as $300 and $500, respectively. However, that's just the lowest amount you're guaranteed if approved.

You could get approved for a credit card with a $20,000 limit if you have excellent credit, a lot of income, and very little debt. But there are no credit cards with $20,000 limits guaranteed as a minimum.

If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.If you decide it's the right time to up your limit, either call customer service or request a credit limit increase online.

Your first credit limit may be as low as $100 if your first credit card is from a retail store, but you might be approved for a slightly larger credit limit up to $500 if your first credit card is issued by a bank or credit card company.

You can't exactly predict a credit limit, but you can look at averages. Most creditworthy applicants with stable incomes can expect credit card credit limits between $3,500 and $7,500. High-income applicants with excellent credit might expect a credit limit of up to or more than $10,000.