Definition and meaning

The Assignment of a Specified Amount of Wages is a legal document that allows an individual, referred to as the Assignor, to transfer a specific portion of their wages to another party, known as the Assignee. This document serves as a formal agreement indicating the Assignor's intent to assign a designated amount of their future earnings to the Assignee. Typically, this form is used to settle debts or obligations, such as loans or personal commitments.

Who should use this form

This form is suitable for anyone who needs to assign part of their wages, including:

- Individuals needing to pay off a debt

- Employees who want to allocate a portion of their salary for child support or alimony

- People who wish to settle outstanding medical bills or personal loans

It's important for users to understand their rights and the implications of such an assignment.

Key components of the form

The key components of the Assignment of a Specified Amount of Wages typically include:

- Identification of the Assignor: The person assigning their wages must be clearly identified with their name and address.

- Identification of the Assignee: The recipient of the assigned wages should also be specified.

- Amount Assigned: The specific dollar amount that is being assigned must be noted.

- Employer’s Information: The name and address of the Assignor's employer.

- Authorization of Payment: A clause authorizing the employer to pay the Assignee directly.

Each section of the form must be accurately completed to ensure its validity.

Common mistakes to avoid when using this form

To ensure the Assignment of a Specified Amount of Wages is effective, users should avoid the following common mistakes:

- Failing to specify the exact amount of wages being assigned.

- Not including the complete names and addresses of both the Assignor and Assignee.

- Ignoring to obtain signatures from both parties.

- Forgetting to notify the employer about the assignment.

Being diligent in completing the form can prevent future disputes and complications.

What documents you may need alongside this one

When using the Assignment of a Specified Amount of Wages, it may be beneficial to have the following documents ready:

- Proof of identity, such as a government-issued ID for both parties.

- Any related agreements that specify the debt or obligation being satisfied.

- Previous correspondence with the Assignee, if applicable.

- Pay stubs or documentation of wages to support the assigned amount.

Having these documents at hand can streamline the process and help validate the assignment.

Benefits of using this form online

Using the Assignment of a Specified Amount of Wages form online offers several advantages:

- Convenience: Users can complete the form from anywhere, at any time, which is beneficial for those with busy schedules.

- Accessibility: Online forms often come with guidance to help users fill them out correctly.

- Time-saving: Digital forms can be filled out and submitted faster than traditional paper forms.

- Immediate Submission: Users can directly send the completed form to the necessary parties without delay.

These benefits make using the form online a practical choice for many individuals.

Legal use and context

The Assignment of a Specified Amount of Wages is typically used in various legal contexts, including:

- Debt repayment arrangements

- Child support payments

- Loan agreements

Understanding the legal implications of this assignment can help users protect their rights and obligations relating to wage assignments.

Employ the most extensive legal library of forms. US Legal Forms is the perfect place for getting updated Assignment of a Specified Amount of Wages templates. Our platform offers a huge number of legal forms drafted by certified lawyers and categorized by state.

To obtain a template from US Legal Forms, users only need to sign up for a free account first. If you are already registered on our service, log in and choose the template you are looking for and purchase it. After purchasing forms, users can find them in the My Forms section.

To obtain a US Legal Forms subscription on-line, follow the guidelines below:

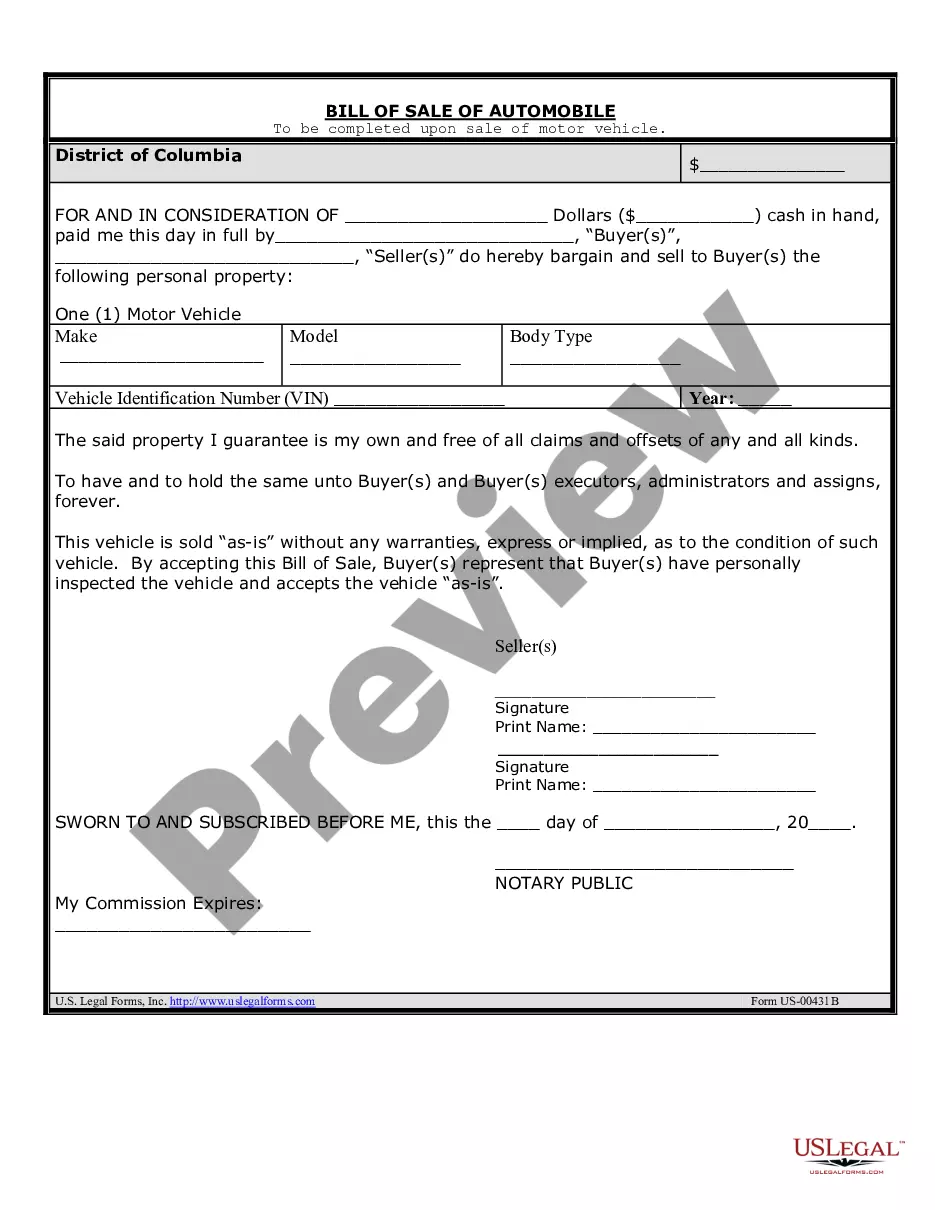

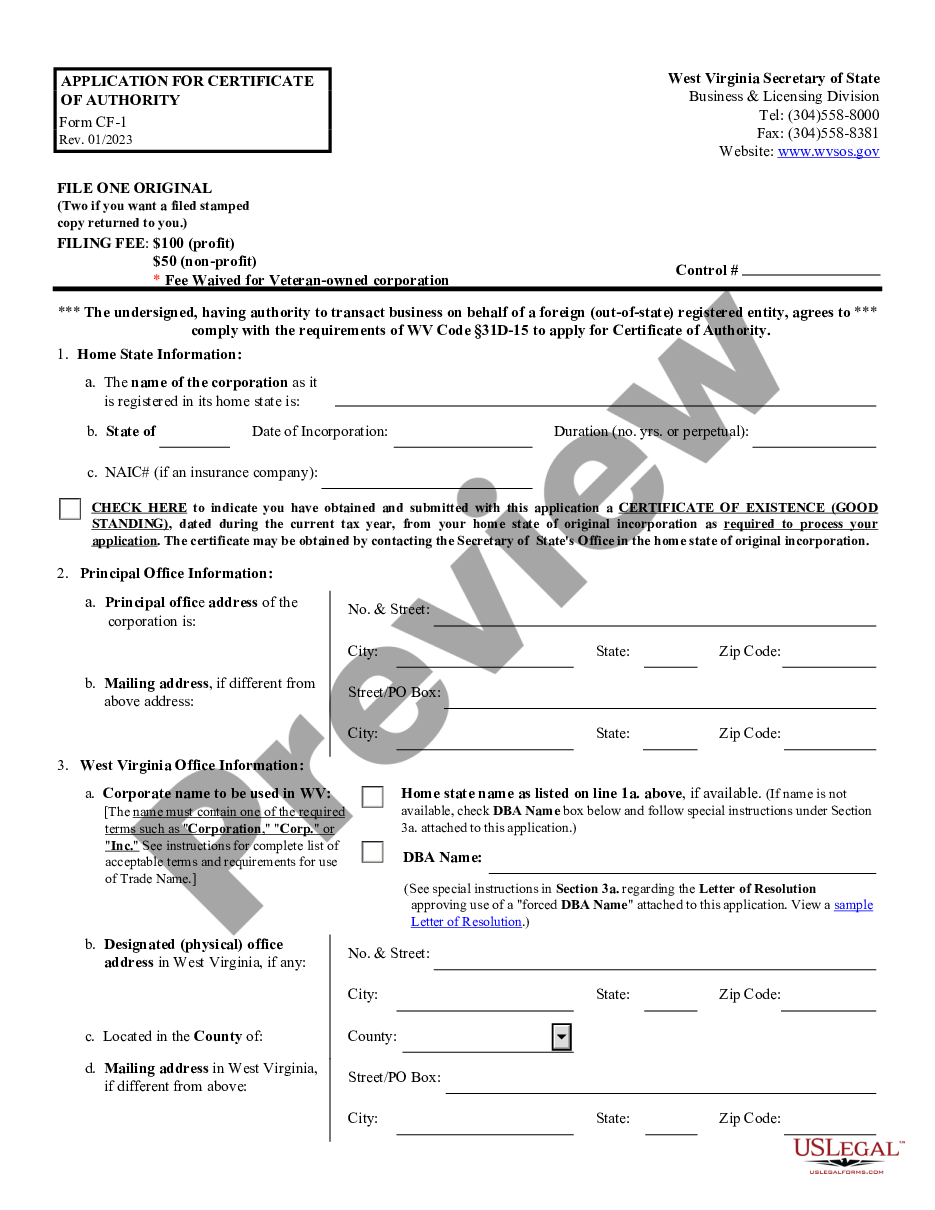

- Find out if the Form name you’ve found is state-specific and suits your needs.

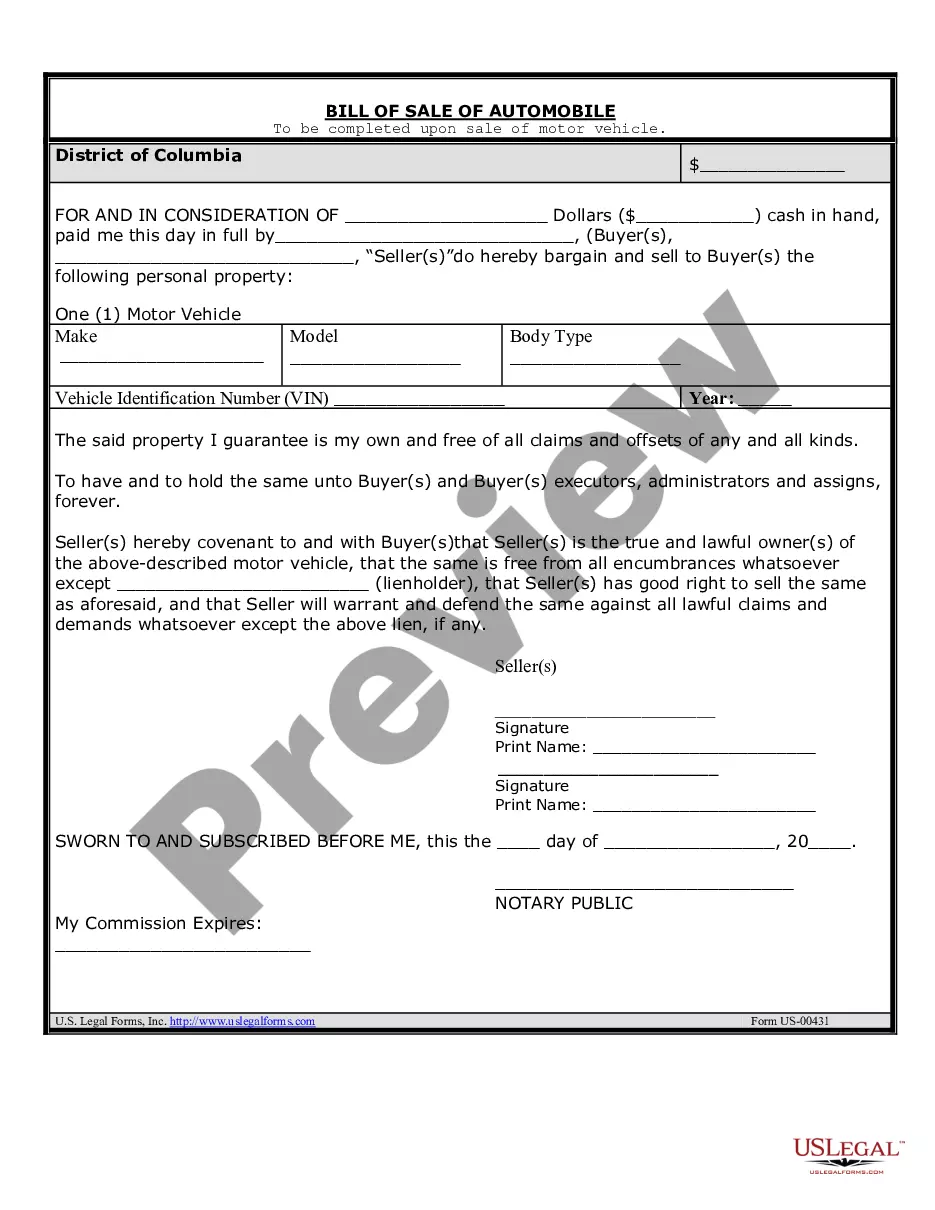

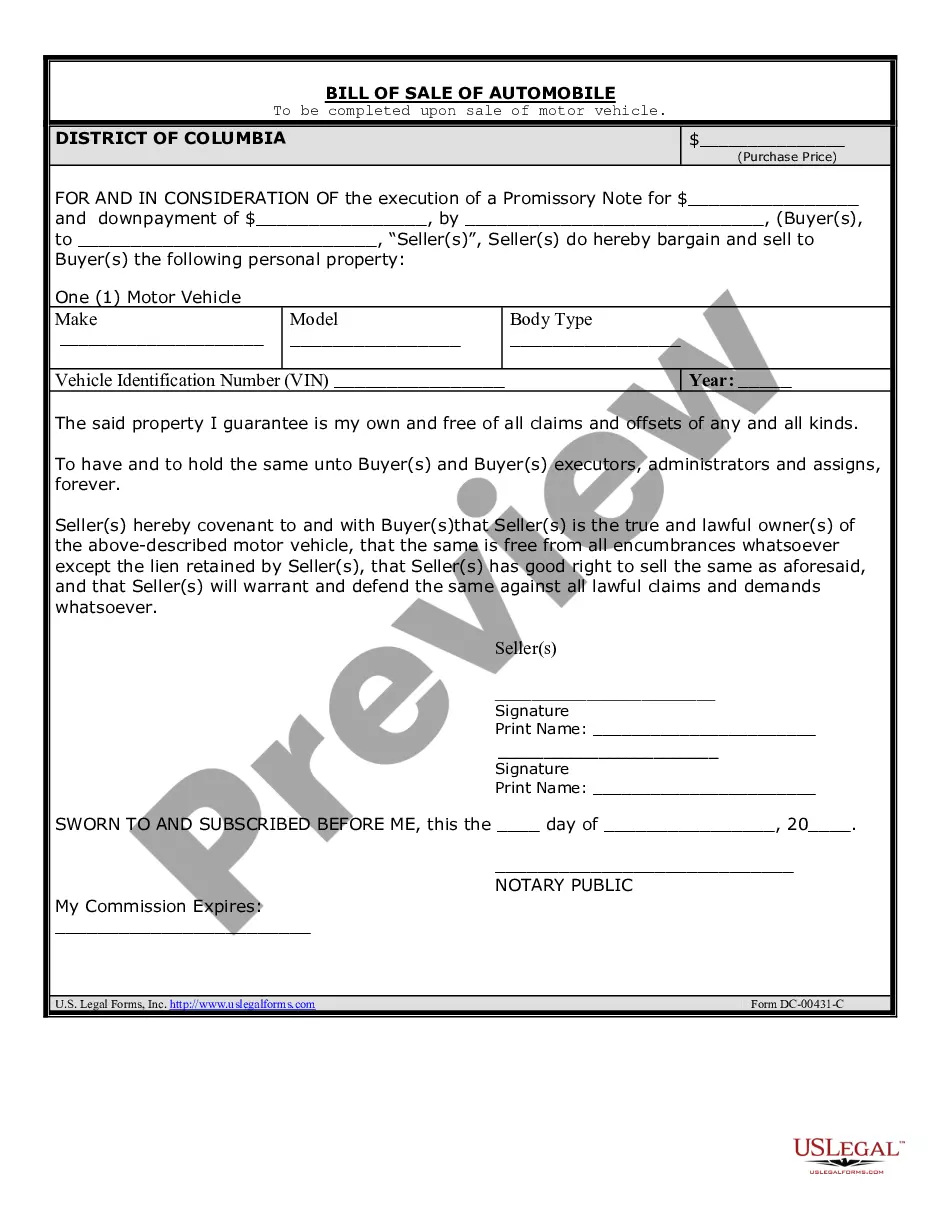

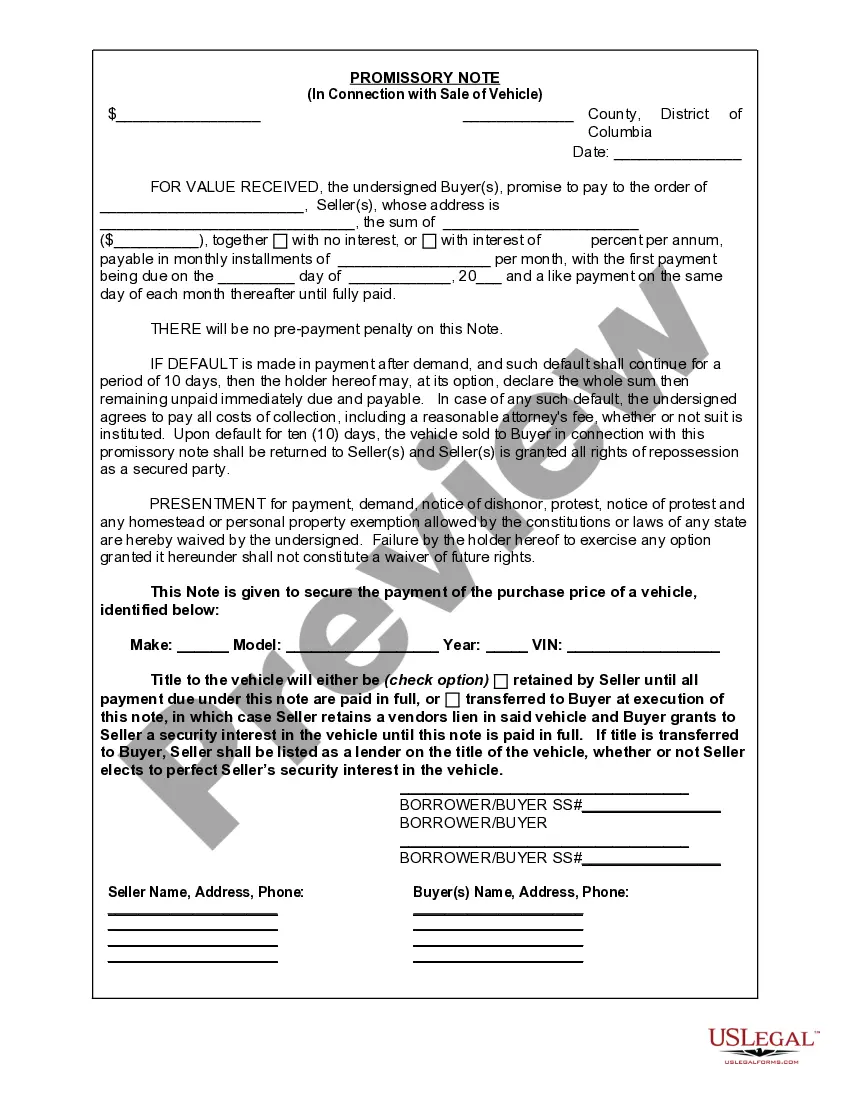

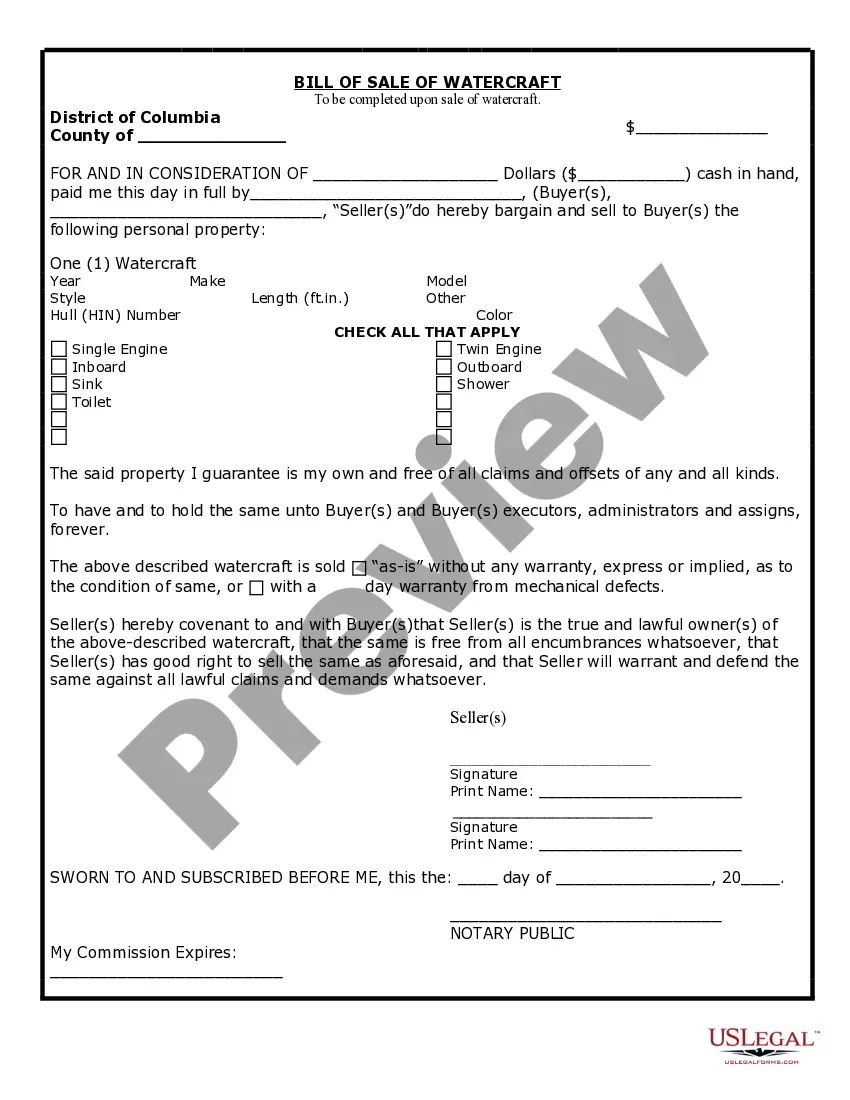

- If the form features a Preview function, use it to review the sample.

- If the template doesn’t suit you, utilize the search bar to find a better one.

- Hit Buy Now if the template meets your needs.

- Choose a pricing plan.

- Create an account.

- Pay with the help of PayPal or with yourr debit/bank card.

- Choose a document format and download the sample.

- After it’s downloaded, print it and fill it out.

Save your time and effort with the service to find, download, and fill in the Form name. Join a huge number of pleased customers who’re already using US Legal Forms!